CME‘s Bitcoin growth is a low-key big splash

It’s no surprise that corporate pressures and market tailwinds that have catalysed rising crypto demand, have helped contract volumes of CME’s dollar-settled futures in Bitcoin

Open interest in CME’s Bitcoin futures contract—defined by our CF Bitcoin Reference Rate—has risen 70% over a year

Big-growth, low-key

Eclipsed by news of PayPal’s massive Bitcoin capitulation, Square and Stoneridge’s outsize investments and, less positively, the OKEx freeze plus BitMEX arrests, some low-key Bitcoin developments have flown under the radar of late.

Whilst more ‘inside baseball’ in nature than, for instance, last week’s PayPal headlines, news about changes in the distribution of open interest in Bitcoin futures was nevertheless just as significant for the financial side of the crypto sphere as eye-catching developments were for the mass adoption narrative.

In the futures

Essentially, the low-key news concerns the chief derivative product of professional financial markets—futures contracts. Whilst cryptocurrencies have been a part of the enormous global futures market for about four years now, there are still perishingly few regulated crypto derivatives venues. Such services are critically important because it is problematic for institutional financial market participants to actively trade on unregulated exchanges. Given such restrictions, although crypto derivatives marketplaces have proliferated over the last few years, institutional participation has remained a small subset of the market.

And without the presence of the financial establishments of Wall Street, The City, Tokyo and beyond, crypto futures trading has largely been dominated by sophisticated though legally unfettered firms like OKEx and BitMEX. Though recently in the spotlight for less salubrious reasons, by dint of their first-mover advantage and aggressive market-share tactics, the pair for many years accounted for respectively around 30% and 60% of the crypto futures market. That left regulated exchanges, including the largest by trading volume and one of the oldest in the world, CME, trailing far behind.

In turn, relatively low activity by the established traditional trading industry has been emblematic of a key obstacle on the road towards widening crypto adoption.

CME interest advances

Well, 2020 has been a year of growing adoption on several fronts. It’s no surprise that corporate pressures and market tailwinds that have catalysed rising crypto demand, have helped contract volumes of CME’s dollar-settled futures in Bitcoin—the only crypto futures CME currently offers—advance to second place globally.

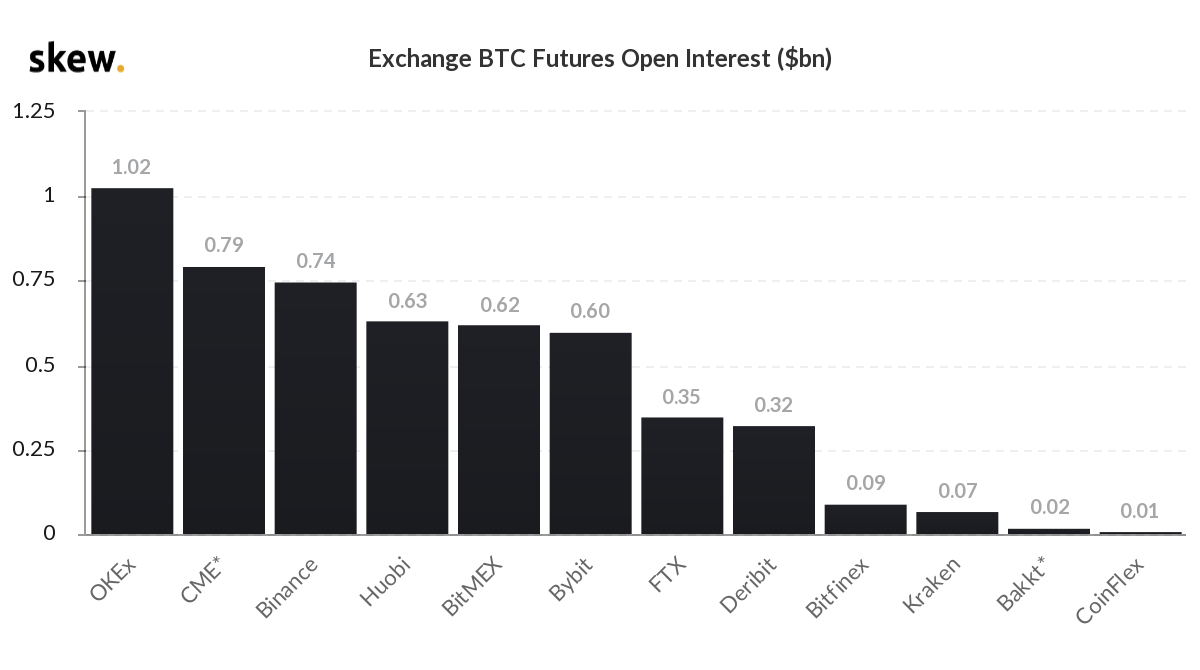

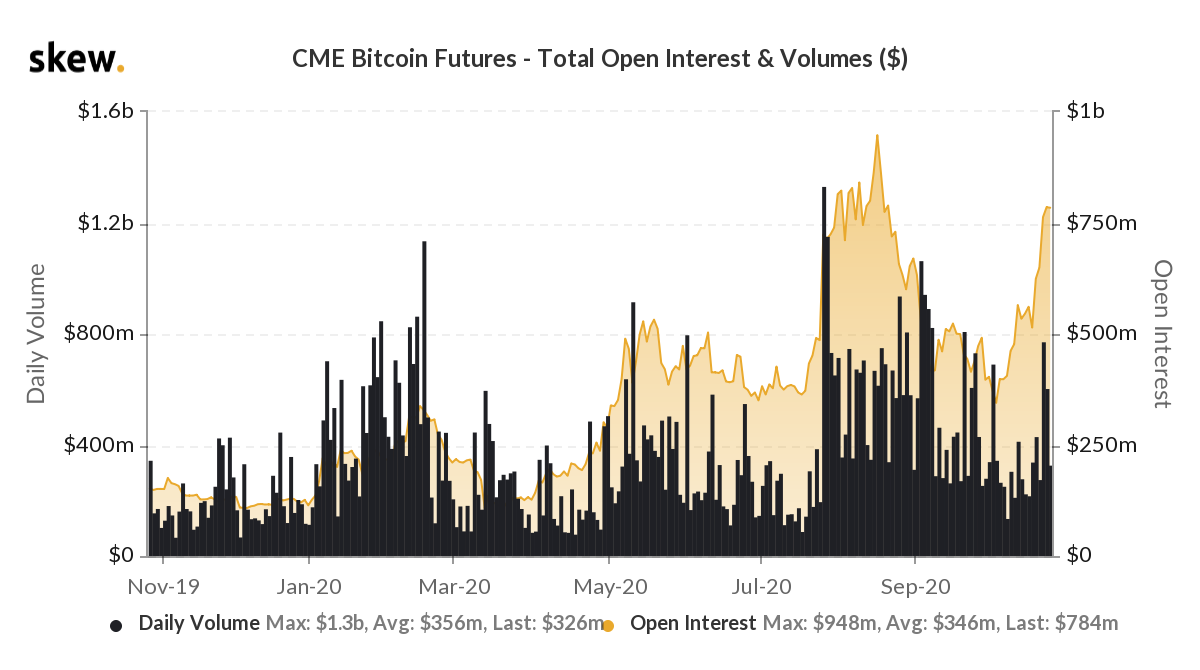

Data from skew.com charted below depict open interest in CME Bitcoin futures relative to the other leading crypto futures venues as it stood on Monday (Figure 1.) and the trend of CME’s futures trading volume and open interest over a year Figure 2.)

Figure 1. – Bitcoin Futures Open Interest – 26-10-2020 Source: skew.com

Source: skew.com

CME Bitcoin Futures – Total Open Interest/Volumes (U.S. dollars) 26-10-2019-26-10-2020 Source: skew.com

Source: skew.com

Leap year for Open Interest

According to these data, CME’s share of Bitcoin futures open interest—contracts opened but not yet traded (as distinct from historical trading volume)—has grown from around $460m to $784m, or about 70% over a year. That equates to CME jumping from 7th to second-largest major exchange in terms of open interest volume in the space of a year.

Tale of two Exes

That increase of market dominance has been punctuated by missteps in recent weeks by historical market leaders OKEx and BitMEX. It’s certainly true that futures volumes began to disperse well before these events, partly because the number of exchanges offering crypto derivatives has ballooned from 2-3 to more than a dozen in less than five years. Assuming the rate of CME open interest growth largely persists though, and unregulated venues continue to come unstuck and shed customers, CME becoming the top Bitcoin futures exchange in terms of open positions at some point, is not a punchy call.

Big splash, less flash

Clearly, the institutional adoption trend and regulated trading venues go hand in hand for obvious reasons. Furthermore, we’ve also observed recently, that open interest is very likely to be a better proxy of institutional demand than gross trading volume given that the former metric carries more weight in conveying how much traders trust a venue.

As such, while less flashy than PayPal’s crypto splash last week, booming CME open interest is just as critical a signifier of the momentum of crypto adoption. Furthermore, the fact that CME Bitcoin futures contracts are priced and settled with CF Benchmarks methodology and data, continues to underscore the importance of regulated prices as institutional crypto adoption gathers pace.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.