CF Benchmarks Recap - Issue 19

Tesla, driving a coach and horses through conventional notions of treasury management, was the main feature.

-

All the week's crypto breakthroughs... plus Tesla

-

Why it's time for CME Ether Futures

-

Hashdex Nasdaq Crypto Index ETF is a first

Tesla drives a packed week

As significant as this week was for conspicuous crypto junctures, it was still possible to overlook aspects of its importance. Below the headlines, understated developments were quite easily missed as keeping track becomes an issue; plus, dare we mention ethnocentrism? News that Mastercard will accept crypto payments, of BNY offering select crypto services, Kraken launching a venture fund and the CME’s new Ether Futures all vied for attention. Tesla, driving a coach and horses through conventional notions of treasury management, was the main feature. Its filing being in 10-K annual report format rather than the 8-K procedure for ‘significant corporate information’ plus TSLA’s statement that it was now at liberty to "acquire and hold digital assets from time to time or long-term" (and will probably accept payment in BTC) helped turbo charge the BTC price. Our regulated BRTI benchmark set a new record in the immediate aftermath, before a resurgent top on Friday at $48,905.08 (timestamp: 2021-02-12 00:20:38). Remarkably, the first multi-asset cryptocurrency ETF was also launched this week. (A ‘real’ ETF in the regulatory sense, not an ETP or trust). The news flew under the radar of many, possibly because of the vehicle’s Bermudan listing and Cayman domicile. Hashdex Nasdaq Crypto Index ETF will track our new Nasdaq Crypto Index benchmark and will be open to investors in Brazil. Finally, non-U.S. America stole another march as the week drew to a close, as Canada’s OSC approved the world’s first ever Bitcoin ETF.

From CME Ether Futures to Mastercard crypto payments

The CME launched its second crypto futures contract, this time on Ether, backed by CF Benchmarks’ Ether Reference Rate, with resounding first-day volume of 19,000 ETH, worth $33 million and an almost simultaneous inaugural block trade between BlockFi and CMT Digital. (More on page 2.) Adoption news was led by Bank of New York Mellon and Mastercard. The oldest U.S. lender’s offering is reportedly at an early stage, though appears aimed at asset management clients for now. The second-largest credit card issuer joins PayPal by permitting customer-to-merchant crypto payments, trumping its rival Visa.

OSC throws ETF gauntlet down to SEC

Canadian ETF firms and the Ontario Securities Commission have been on a mission of late to get the first ever open-ended Bitcoin ETF over the line and succeeded on Friday. Purpose Investments Inc. was “cleared by Canadian securities regulators to launch Purpose Bitcoin ETF” a ‘physical’-only security, without derivatives. Sparse details suggest preliminary moves but the news undoubtedly bodes well for four other applications to the OSC to launch open-ended Bitcoin ETFs all, again, curiously from Canadian firms, and all aiming to utilise either the BRR or BRTI benchmark.

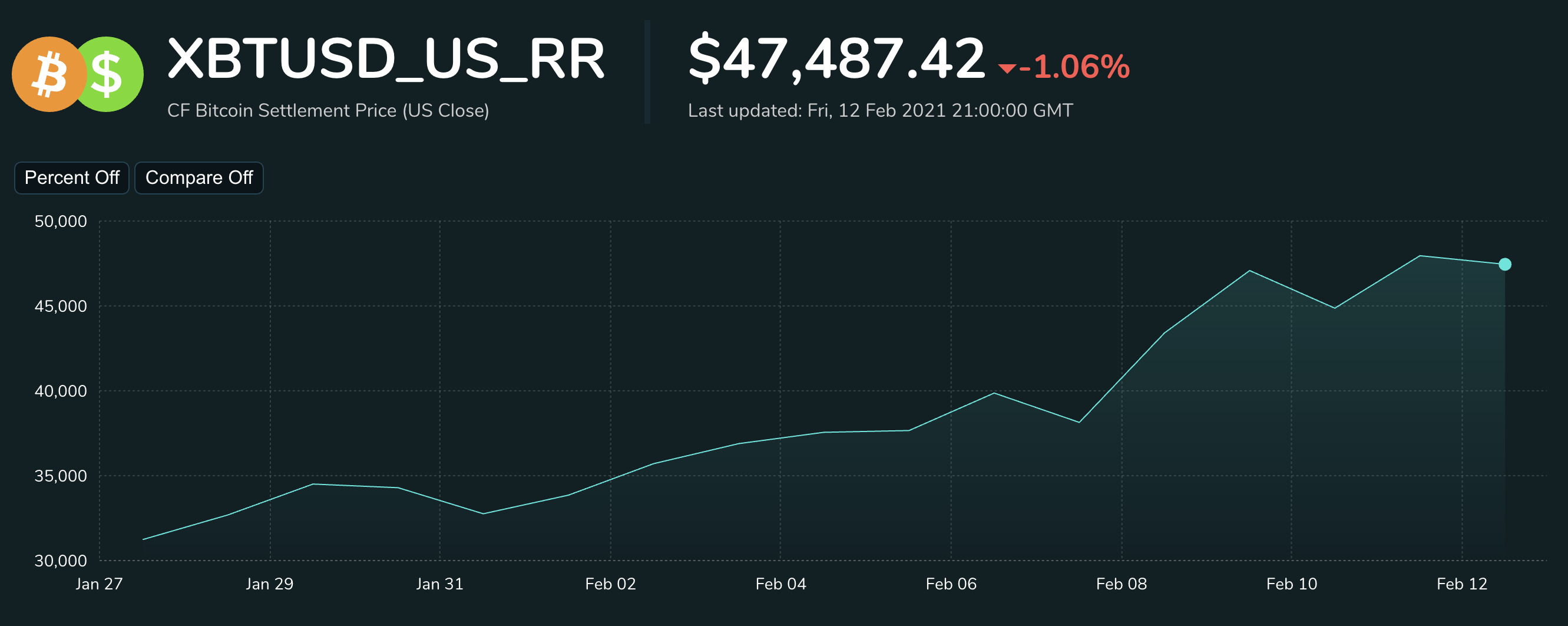

The Returns: A Bitcoin Benchmark for U.S. market hours

CF Benchmarks’ recent quantitative research confirmed the cogency of our existing Bitcoin Reference Rate using a 4pm London time as its reference window. Still, a settlement price with a ‘U.S. close’ has several advantages, hence this week’s launch. Despite its alternative reference time, its methodology, accuracy and integrity are identical.

Featured benchmarks: CME CF Ether-Dollar Reference Rate, Nasdaq Crypto Index Settlement

Why now, for CME Ether Futures?

No mistake

Though slightly diluted by the latest bout of shock-and-awe Bitcoin news, the CME Group’s Ether Futures launch is unlikely to end up as a historical footnote. For one thing, there’s every sign that the exchange expects Ether futures to play a role in the crypto ecosystem that’s just as significant as its well-established Bitcoin Futures, which began trading in December 2017. In fact, with Ether, the exchange followed its Bitcoin playbook almost down to the letter.

Like-for-like

As with Bitcoin, the CME evidently took pains to ensure its new ETH contract specifications matched contract specs of conventional assets as closely as possible. Key details of Ether Future specs include that it’s using the same contract unit integer as Bitcoin, though a different multiple: 50 Ether per ETH contract vs. 5 Bitcoins per BTC. Same for the permitted minimum price fluctuation, with BTC’s minimum of 5 per Bitcoin ($25) turning out to be a multiple of the one set for ETH (25 cents, i.e., $12.50 per contract).

The prescribed lowest price fluctuations for a CME crypto futures calendar spread (a type of hedged trade) is 1.00 per Bitcoin, meaning $5 a contract, whilst for ETH its 5 cents, which equates to $2.50 per contract.

So, apart from a utility motive in designating ETH contract details, with the exchange cognisant of Ether’s notionally lighter turnover relative to Bitcoin, there’s little doubt the CME has also tried to foster an air of familiarity for traders interested in its Ether futures.

Read the rest of this article on our website.

CF Benchmarks appointed Calculation Agent for Nasdaq Crypto Index (NCI)

Nasdaq, Inc. has launched the Nasdaq Crypto Index (NCI) with CF Benchmarks as Calculation Agent. The NCI is a benchmark index that has been designed to measure the performance of a significant portion of the digital asset market and to provide a benchmark for institutional investment in this new and emerging asset class. The Index is specifically designed to be dynamic in nature, broadly representative of the market, and readily trackable by investors. The first licensee of the index is digital asset manager Hashdex, whose Nasdaq Crypto Index ETF is listed for trading on the Bermuda Stock Exchange and will track the index.

The index is provided as both a once-a-day Settlement Price, published at 1500 New York Time 365 days a year and also as a per second real time index published 24/7, at www.cfbenchmarks.com/indices/nci. Nasdaq has appointed CF Benchmarks as calculation agent for both indices.

The rest of this announcement is available here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.