CF Benchmarks Recap - Issue 36

Backed by the CME CF Bitcoin Reference Rate, QBTC11 joins the ranks of the most trustworthy, fully regulated crypto assets in the world, bringing the convenience of the simplified ETF wrapper to Brazilian investors.

-

QR Capital’s Bitcoin ETF launches in Brazil, backed by BRR

-

Despite volatility, funds barely trim huge 2-year BTC buys

-

The latest on CFB-powered U.S. Bitcoin ETF applications

Flash relapse

China’s ongoing clarification of its level of crypto tolerance has triggered more price drama. CME CF Bitcoin Real Time Index plumbed $28,824.36 on Tuesday at 13:55 UTC, challenging late January prices. Ether cratered in unison, taking CME CF Ether Dollar Real Time Index to $1,701.71; its cheapest since 29th March. The dominant coins were recouping by publication time though the hurdle back to perceived stability has obviously risen. Still, anecdotally, there’s been little perceptible slackening in the pace of institutional convergence. (For a selection of news, see below). That suggests a higher exponent of drama is required to stymie adoption and mainstreaming trends. Admittedly, the dearth of clarifying news on the most salient institutional banner—a U.S. ETF—hasn’t helped. The SEC pushed back two more closely watched decisions in recent days, including for Kryptoin, which plans to use one of our regulated benchmarks for NAV. As we’ve indicated several times in recent weeks though, including here, the plain truth is that no conclusions can be drawn from these extended reviews. Meanwhile, the quantified, documented integrity of the benchmark methodology that powers 4 of 8 applications under active SEC review, suggests continued optimism is far from misplaced. Find a short update on CFB-powered BTC ETF applications below.

QR Capital’s BRR-backed ETF launches in Brazil

Latin America’s crypto firsts continue. Following approval from Brazil’s CVM in March, QR Capital’s Bitcoin ETF began trading on Sao Paolo’s B3 exchange on Wednesday (ticker: QBTC11). Backed by the CME CF Bitcoin Reference Rate, QBTC11 joins the ranks of the most trustworthy, fully regulated crypto assets in the world, bringing the convenience of the simplified ETF wrapper to Brazilian investors for as little as 100 Brazilian lira. Following the launch of CF Benchmarks-calculated Hashdex Nasdaq Crypto ETF in Bermuda and El Salvador becoming first country to make Bitcoin legal tender (albeit controversially), adoption momentum has taken hold in Latin America, putting Brazil on par with Canada among the most advanced institutional crypto jurisdictions in the Americas, with fully regulated consumer access to Bitcoin.

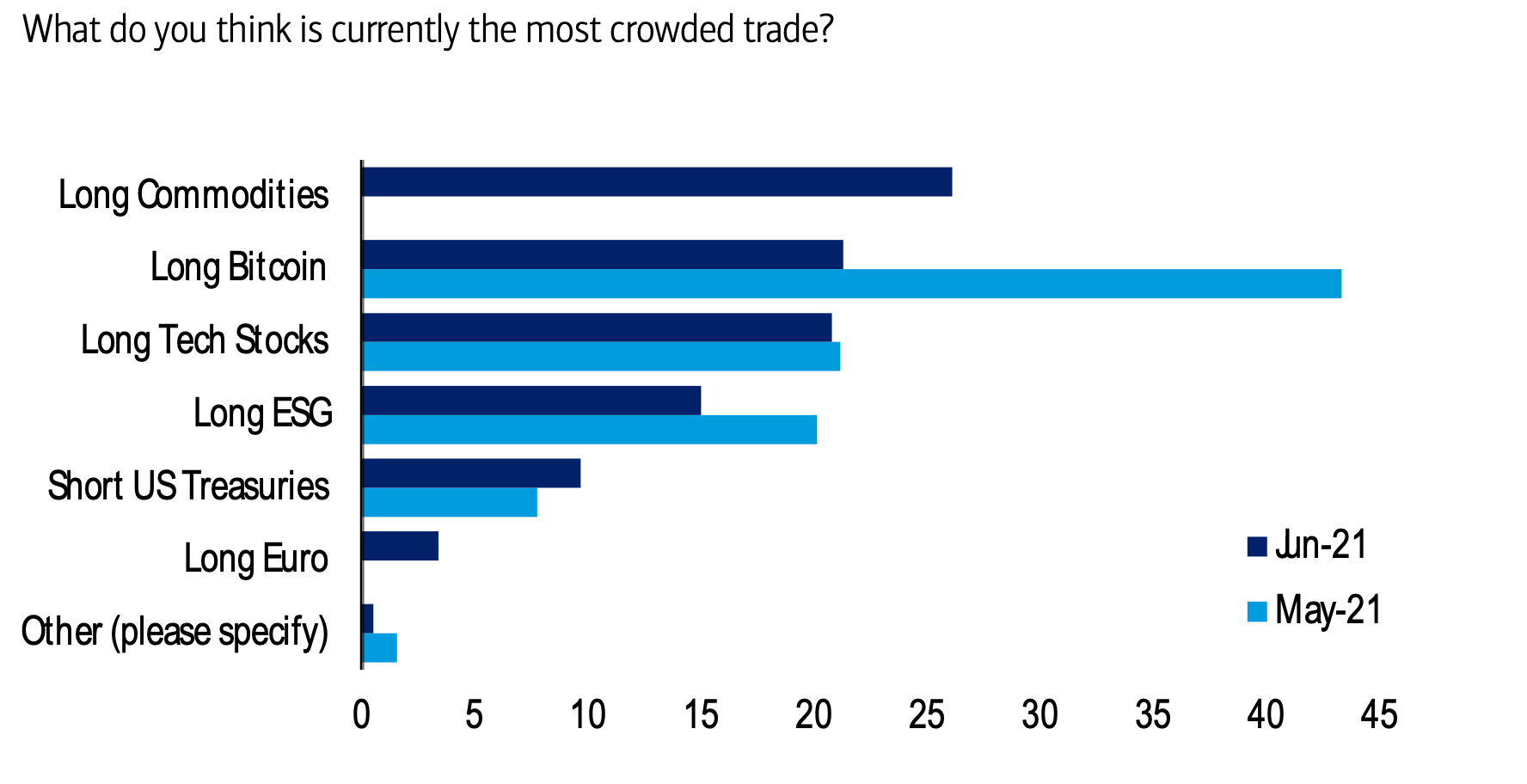

Funds, hedge funds turn ambivalent, though not antsy, on crypto

Surveys continue to paint an ambivalent, albeit promising, picture of institutional views on cryptoassets. 81% of the 200 fund managers polled mid-month for a regular Bank of America survey continue to view Bitcoin as a bubble. Even so, Bitcoins held by funds are up about 500,000 over two years, according to data collated by ByteTree Asset Management; even if that figure—tracking European ETPs and Canadian ETFs, plus some closed-ended U.S. funds—last stood at almost 783,000 vs. a peak of circa 790,000 in mid-May. Note the data are heavily skewed by Grayscale Bitcoin Trust, which accounts for some 654,000 of BTC tallied, underscoring that a granular view of institutional crypto sentiment isn’t possible yet. Meanwhile, a poll of 100 hedge fund CFOs by fund administrator Intertrust around the same time as the BofA survey showed they expect to increase cryptoassets allocations to 7.2% by 2026. As the FT points out, that could equate to $312bn worth of crypto bought over 5 years.

Source: BofA Global Fund Manager Survey

Source: BofA Global Fund Manager Survey

Featured benchmarks: CME CF Bitoin Reference Rate, CF Bitcoin-Dollar US Settlement Price

SEC rewinds more Bitcoin ETF reviews

Valkyrie and Kryptoin join WisdomTree with 45-day review extensions

The SEC’s latest delayed Bitcoin ETF decisions

- Late on Wednesday, Valkyrie’s Valkyrie Bitcoin Fund (which will use the CME CF Bitcoin Reference Rate to calculate NAV) became the latest crypto ETF filing to the SEC to have its decision date pushed back. The ‘notice of a proposed rule change’ that customarily kicked off the commission’s initial 45-day review period was published on 12th May, indicating 26th June as the previous decision deadline. The new deadline following the commission’s latest extension is designated as 10th August

- The commission extended its review period for Kryptoin’s Kryptoin Bitcoin ETF Trust (which will use the CF Bitcoin-Dollar US Settlement Price for NAV calculation) for 45 days on 9th June, following its acknowledgement of a ‘proposed rule change’ on 28th April. The 45-day review period extension began on 12th June, giving the SEC a new deadline of 27th July to decide on whether to approve or disapprove of the application

- For the second time, the SEC has extended its review period for VanEck’s VanEck Bitcoin Trust, having done so first in April, at that time giving itself 45 days ending on 17th June to come to a decision. The new 45-day review period should create a new deadline of 1st August, though that date wasn’t confirmed in the latest SEC notice on VanEck’s application.

The most interesting aspect of the document is that the SEC also used it to instigate a call for public comment, to “determine whether the proposed rule change should be approved or disapproved.” Whilst such calls are a routine measure in the commission’s toolbox when deciding on filings, they do indicate that the decision-making process is progressing to its next stage. Even so, as the notice points out, “Institution of (such) proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved.”

Read the full article on our blog.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.