CF Benchmarks Newsletter - Issue 63

'Liquidity drought’ or not, large institutions have embarked on a wave of plans to install the infrastructure for the mass adoption they’re clearly convinced is just downwind.

- CFB powers Franklin Templeton, Ark 21Shares into the ETF fray

- Just launched - CME CF BRR Asia-Pacific, Ultra Cap 5 - EUR

- Our unique Quarterly Attribution Reports enter Year Two

Drought?

Picking up the thread following typically subdued peak summer months in the northern hemisphere provides an immediate reminder that crypto has only ever worn traditional seasonal market patterns very loosely.

There’s been little that’s ‘typical’ about recent months—particularly for volumes. The severe diminishment of substantial counterparties since 2022, combined with exacerbating behavioural impact, helps account for crypto’s total market capitalization hovering at around $1 trillion for most of the year, halved from as much as $2.2 trillion in 2022.

The latter figure lays bare the enormous value destruction from the market peak of almost $3 trillion in November 2021. Against that backdrop, even the green shoots of a turnaround in participation will likely take longer than a few months to take hold.

In recent months we’ve continued to see the fallout from those counterparty implosions: like realised volatility on CME Bitcoin futures (powered by our BRR) falling to its tamest since the contracts began trading in 2017. That’s despite crypto open interest on the institutionally dominated venue reaching record highs in Q2. By August, monthly spot volumes across 32 exchanges tracked by The Block had drained to the lowest mark since October 2020.

Dry run

Could such deterioration soon expose asset-level liquidity issues at the margins? Participants are unlikely to experience liquidity impairments for the largest cryptocurrencies by market capitalization, i.e. those covered by our CF Ultra Cap 5 index. But blockchain data and research firm Glassnode concluded recently that “Volatility, liquidity, trade volumes and on-chain settlement volumes are at historical lows”, reinforcing “the probability that the market has entered a period of extreme apathy, exhaustion and arguably boredom”.

Own goals

Meanwhile, self-inflicted impacts at the bleeding edge of the digital asset space continue, with predictably exacerbating outcomes on the metrics measuring participants’ inclination to gain or maintain exposure.

As CF Benchmarks’ Lead Research Analyst, Gabe Selby, CFA notes in our recently released June-September Quarterly Attribution Report, a Z-Score analysis on the decline of Total Value Locked (TVL) in the wake of the late-July hack of the Curve Finance protocol, suggests:

“The recent impact has been in line with the prior shocks in the space that included the collapse of Terra-Luna, FTX, and April’s Beanstalk (flash loan exploit) and Venus (compromised private key) hacks.”

In other words, investors are showing few signs of habituation to these ‘own goals’, regardless of their seemingly interminable frequency. The suggestion is that risks to existing allocations from future big DeFi malfeasances could be comparable to what we've seen over the last couple of years. Unfortunately, that would underscore any tendency some participants might have to stay out of the market.

That said, Gabe does point out that DeFi TVL has stabilized in more recent weeks.

(Scroll down for our spotlight on the latest Quarterly Attribution Reports, or click here to read the compiled report).

Paradox

All the above said, as we saw throughout the summer, ‘liquidity drought’ or not, large institutions have embarked on a wave of plans to install the infrastructure for the mass adoption they’re clearly convinced is just downwind.

Together with the convergence towards a more constructive legislative and judicial sentiment, these factors continue to stand in stark contrast to uncertain market conditions.

The disparity may be down to several factors – some of which are less intentional than accidental. Still with so-called ‘Crypto Winter’ coming up to two years old, enterprises and institutions have had plenty of time to react to ‘cold feet’. Yet signs of institutional adoption and entrenchment keep coming.

We outline recent key institutional adoption developments below.

ETFs

- Many applications from the summer to list more ETFs investing in CME Ether Bitcoin and/or Futures, are coming to fruition at the time of writing - the most obvious counterpoint between market conditions and institutional behaviour.

- Each one of the latest raft of so-called ‘strategy ETFs’ will reference the price of either CME bitcoin or ether futures, or a combination of both. All such contracts settle to our regulated bitcoin or ether benchmarks.

- An even clearer contradiction has been the willingness of traditional investment management firms to join their digital asset-first counterparts in the push to bring the U.S.’s first spot crypto ETF into existence; against the SEC’s hyper-sceptical stance.

- Fresh filings have emerged in recent weeks, with two key citing a regulated CF Benchmarks index for net asset value calculation. This reinforces our view that the first spot digital asset ETF under the SEC’s purview will be powered by CFB’s manipulation-resistant and replicable benchmark methodology.

- (With 6 out of 9 bitcoin ETF filings currently on the SEC’s docket citing CME CF Bitcoin Reference Rate – New York Variant (BRRNY) this is hardly a punchy call.)

- Franklin Templeton, the veritable, $1.4 trillion AuM investment group (est. 1947) best known for serving relatively risk averse U.S. savers via fixed income mutual funds, is the latest firm of its kind to file a spot bitcoin ETF application. In line with the majority of spot crypto ETF filings in recent months the digital asset custodian proposed is Coinbase Custody. The ETF would be listed on Cboe BZX.

- Franklin Templeton selected the BRRNY for NAV calculation, joining other high profile BTC ETF applicants in the current round, BlackRock’s iShares, Bitwise, WisdomTree and Valkyrie, by opting for the U.S.-closing time variant of the most liquid institutional bitcoin price.

- Somewhat surprisingly, this isn’t the first Franklin Templeton move to embrace the blockchain economy: Franklin OnChain U.S. Government Money Fund (FOBXX) became “the first U.S.-registered mutual fund to use a public blockchain to process transactions and record share ownership” when FOBXX support was launched on Polygon in April. Similar access was later rolled out on the Stellar blockchain.

- ARK 21Shares is the first 2023 spot crypto ETF applicant to take the wave of optimism behind recent filings a step further: it has followed up its own bitcoin fund application with an filing to list the first U.S. spot Ether ETF.

- CF Benchmarks’ Lead Research Analyst, Gabe Selby, CFA describes the likely rationale succinctly in the June-September Quarterly Attribution Report (QAR):

“Bitcoin maximalists might not be the sole beneficiaries of a spot fund, as many foresee that Ether's substantial market size and decentralized network could potentially follow suit."

- The Ark 21Shares Ethereum ETF is also the first proposed fund under the mark of either issuer citing a CF Benchmarks pricing source: CME CF Ether-Dollar Reference Rate – New York Variant (ETHUSD_NY).

- Like it’s Bitcoin counterpart (BRRNY), ETHUSD_NY is designed to make the same regulated, registered benchmark methodology utilized by our flagship bitcoin index (BRR) available to institutional providers seeking to strike NAV (or other valuation or reference functions) at the traditional time within U.S. trading hours.

- ARK 21Shares’s move is signal in multiple ways. From CFB’s perspective, most importantly, it represents further vindication of our high-integrity methodology.

- It also shows more institutional providers are coming round to the idea that the documented track record, demonstrable manipulation resistance and transparency of our indices, gives crypto ETF applications an unmatched edge

- Just over a month on since Grayscale prevailed against the SEC, the importance of the case is still worth underlining. Not least because the clock is winding down on the SEC’s ability to request a rehearing: it had 45 days to do so from the publication of the District of Columbia Circuit Court of Appeals' ruling that the regulator’s rejection of GBTC's bid to convert into an ETF was unfounded. The decision has been well aired, so what may happen next is of most interest:

- The SEC has its work cut out to secure a rehearing by the same 3-judge panel that issued the ruling, or an en banc session - a hearing by all Court of Appeals Judges.

- The commission must state why “the case is of exceptional importance or cite precedent that is purported to be contrary to the panel judgment”, according to Latham & Watkins LLP. The firm cites several remedies the SEC can still pursue to prevent Grayscale from listing GBTC as an ETF.

- Therefore, despite the unequivocal tone of the ruling, which has stoked justifiable optimism at Grayscale and among crypto market participants more broadly, the sober assessment for now is that the development is an incremental step forward but not quite a watershed.

Legal & legislative

Against the backdrop of other favourable legal outcomes and promising legislative progress, the Grayscale ruling looks more indicative of changing attitudes in the official sector than on its own.

- Having signalled it would appeal the Ripple partial ruling, the SEC and Ripple Labs have been locked in a series of back-and-forth court filings, largely about the appropriateness of the SEC being granted a rehearing. The case is currently awaiting a decision on the SEC’s request, earlier this month, for an interlocutory appeal. In effect, disputes on legal minutiae are holding up substantive argument about Judge Analisa Torres’ initial ruling that XRP is only a security when sold to institutional participants. A conclusion seems months away. As things stand, the view that XRP’s classification as a security is legally problematic. But that's about it.

- A case in which the SEC was not a litigant, but which aired adjacent themes, was a win by Uniswap Labs in a class action brought by participants on the group's DEX. The traders argued Uniswap was liable for fraudulent transactions of alleged scam tokens on the protocol. A judge at the District Court - Southern District of New York disagreed.

“It defies logic that a drafter of computer code underlying a particular software platform could be liable under Section 29(b) [of the Securities Exchange Act] for a third-party’s misuse of that platform.” - Judge Katherine Polk Failla

- Implied endorsement of the principle that autonomous systems can't be liable shouldn’t be taken too far. The capacity of courts to reach such conclusions could be curtailed by future regulatory or legislative developments. Still, the ruling sets a precedent. Meanwhile, Judge Polk Failla is slated to hear the SEC’s case against Coinbase.

- Several legislative proposals on various aspects of crypto are making their way through the U.S. House, albeit circuitously.

- Long-delayed implementation of digital asset measures in The Infrastructure Investment and Jobs Act may be finally unsnarling after The Treasury in late August published “broker” definition proposals to allay concerns that some tax reporting obligations for certain participants were unworkable.

- The similarly contested Financial Innovation and Technology for the 21st Century Act (FIT) passed a key committee stage late in July. The Clarity for Payment Stablecoins Act advanced through The U.S. House Financial Services committee around the same time as FIT.

- All three proposals will almost certainly continue to face partisan obstacles that may delay or even ultimately kill them. Still, lawmakers have seldom been more engaged in fomenting digital asset legislation than now, laying the foundations for eventual clarity on several fronts.

Index Evolution: Launch of CF Ultra Cap 5 - EUR and CME CF BRR Asia Pacific

The recent evolution of two key CF Benchmarks pricing sources is also driven by adoptive convergence trends among institutional participants.

- The CF Ultra Cap 5 - EUR is the latest regulated, registered benchmark to join our CF Capitalization Series of portfolio indices, delivering digital asset market beta in a variety of tranches.

- It's a euro-denominated variant of CF Ultra Cap 5, the first gauge of market beta endogenous within the top 5 digital asset by market capitalization. (The base variant was incepted in 2018 and launched in 2020).

- Again, like UC5, UC5 - EUR is an FCA registered Benchmark, in accordance with both UK and EU Benchmarks Regulation frameworks.

- That’s a de facto assurance that both variants are fully representative of the markets they measure, and that they’re replicable and manipulation resistant.

Click the links to read more about the once-a-day CF Ultra Cap 5 EUR - Settlement Price, and the CF Ultra Cap 5 EUR - Spot Rate, which is published once a second.

- CME CF Bitcoin Reference Rate - Asia Pacific Variant (BRRAP) is among the latest reference rates to join the growing ranks of indices published under the auspices of our partnership with the CME Group.

- As its full name suggests, BRRAP is the latest variant of the most liquid institutional bitcoin price, our flagship CME CF Bitcoin Reference Rate (BRR).

- BRRAP is powered by an index methodology that’s identical to the one underlying the most demonstrably trusted price of bitcoin, BRR; except that the calculation window for BRRAP is 15:00-16:00 Hong Kong Time for publication at 16:00 Hong Kong, while the calculation window for BRR, best known for settling all CME bitcoin futures and options contracts since their inception, is 15:00-16:00 London Time, for publication at 16:00.

The availability of a BRR price synchronized with the traditional Hong Kong market close enables institutions to more easily utilize the most verifiably reliable and secure bitcoin pricing methodology closer to regional market hours, for settling derivative contracts, striking fund NAV, and other functions.

- The CME CF Ether-Dollar Reference Rate APAC (ETHUSD_AP) which was launched simultaneously with BRRAP, provides the same characteristics for participants looking to reference the most trusted Ether price around Asia-Pacific market hours.

Visit the BRRAP Index Page.

Read more about BRRAP and ETHUSD_AP on the CME Group website.

Macro Outlook

By Gabe Selby

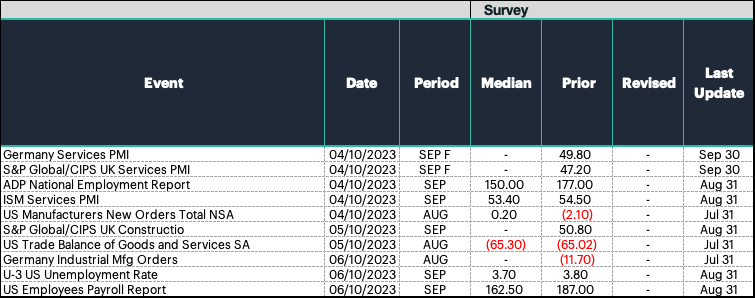

Plenty of potentially market-moving events and economic data remain ahead this week. Although a U.S. government shutdown was avoided almost at the last minute, market participants will continue to view forthcoming data points through the lens of the Fed's still uncertain rate-setting intentions, despite the recent pause in its historical hiking cycle. Meanwhile, with the recent increase in gasoline prices, the U.S. consumer's resilience may soon truly be put to the test.

To cap off the week, the latest employment report is expected to highlight the continued softening of the U.S. labor market. Economists surveyed anticipate job growth will decrease slightly to approximately 160k in September (down from 187k in August). Last month's upside surprise highlighted slowing wage growth along with an increase in labor-force participation, and while the trend of smaller monthly increases is expected to remain intact, current payroll levels are at risk, amid the Fed's goal of managing inflation at the expense of a robust labor market.

Featured utility: CF Digital Asset Classification Structure:

Quarterly Attribution Reports pass One Year Milestone

With the launch of regulated institutional cryptocurrency-related financial products now so frequent that such instruments are becoming increasingly mainstream, it’s all the more important for institutions to be apprised of accurate, detailed analyses of crypto market performance.

And because a quarterly cadence is in step with common rebalancing schedules of traditional investment vehicles, adopting the same frequency for digital asset market reviews is cogent: enabling efficiency, facilitating cross asset insights, and fostering an integrated approach to research overall.

CF Benchmarks’ Quarterly Attribution Reports (QARs), overseen by our Lead Research Analyst Gable Selby, CFA, are expressly designed to fill the shortfall of publicly available institutional-standard digital asset research.

Underpinned by the CF Digital Asset Classification Structure, QARs are still the only regular in-depth market analyses based on a transparent, comprehensive taxonomy of the blockchain economy, and designed and published by a regulated Benchmark Administrator.

Meanwhile, with QARs now having been published quarterly for a year, their utility for bringing the same analytical discipline to blockchain economic performance as is required by institutions participating in traditional markets, is demonstrably ever more unique.

Highlights from the latest QAR:

- With the free float market cap weighted variant of our CF Broad Cap Index still down over 60% from its all-time high in 2021 at the end or the review period, the differential versus traditional asset classes suggests crypto still has room for further upward retracement.

- Signs of a ‘change of regime’ in correlation terms between digital assets and traditional assets, like stocks: the average weekly correlation over the June-September rebalancing period between the CF Broad Cap Index (Free Float Market Cap Weight) and the Nasdaq 100 index stood at -0.02. That compares with an average weekly correlation of 0.41 over the prior rebalancing period.

- In keeping with the theme of this newsletter issue, open interest in the CME Group’s regulated cryptocurrency derivatives contracts continues to hold near all-time highs. Net speculative positioning in the same markets, as measured by CFTC data, persistently point to a different narrative than the one indicated by price performance alone.

Read on, watch on

- Click here to read the Compilation Quarterly Report for June-September 2023

- Links to individual QARs for all of our portfolio indices, including the CF Defi Composite Index, CF Digital Culture Composite Index and others, can be found here.

Catch the QAR edition of our CFB Talks Digital Assets podcast on Spotify

Or watch the episode below!

To get updated further about market trends in the final month of the quarter, be sure to read Gabe Selby’s September Monthly Report.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.