CF Benchmarks Newsletter - Issue 59

Among on-chain metrics, Bitcoin’s hashrate stands out as continuing to relay the robustness of demand for the network’s functionality and by default, adoption.

- FalconX launches derivatives powered by regulated CFB indices

- All recent spot Bitcoin ETF filings are now 'live' applications

- Bitcoin heads lower under $30k

Hot rate

Apparently, summer lulls do still exist in crypto. As we explain below, prices of the heaviest digital assets closed definitively lower in the past week as momentum from almost a month of news-driven sentiment (ETFs, XRP) meets dwindling interest, signified by dollar exchange traded volumes from key venues hugging weekly levels close to the lowest seen for two years, and realised volatility, in terms of technical chart measures like Bollinger Bands, compressing to their tightest in around six months.

Still, regardless of the palpable dip in market participation, structural and institutional developments remain active. Among on-chain metrics, Bitcoin’s hashrate stands out as continuing to relay the robustness of demand for the network’s functionality and by default, adoption. Although only a deduced measure, the length of the current advance in aggregate computational power, around a year, which included the depths of so-called ‘crypto winter’, during which the hashrate has risen some 97%, should be an accurate proxy of blockchain economic health, reflected in the willingness of miners to continue investing in processing power.

'Live' ETF filings

In the physical world, broad institutional adoption as represented by a potential U.S.-listed crypto exchange traded fund remains a long-range prospect, but the recent raft of proposals (that we've covered extensively) could still be said to have reached an important stage in recent days, with six of the eight known applications having been officially accepted for consideration by the SEC. Whilst it has zero bearing on whether or not any of the applications will ultimately make it, the date on which the commission accepts filings for review can be used to determine when it might publish approval or rejection decisions. Given that there are now several filings, including four citing our regulated CME CF Bitcoin Reference Rate – New York Variant for NAV calculation, we've compiled a comprehensive summary of all filings, including key details like the index ETFs intend to use, their proposed listing exchange, and potential dates when the SEC could provide updates. Scroll down for an excerpt or click here to go to the article.

'FIT' for the 21st Century

Elsewhere in the U.S. official sector, the emergence in recent days of a crypto oversight bill, fostered by House Republicans, could go some way to clarifying rules for providers and establishing clearer crypto-specific consumer protections. Perhaps predictably, the ‘Financial Innovation and Technology for the 21st Century Act’, is not without already obvious potential issues that belie its comprehensive intent, and it seems to have little chance of becoming law in its current form. Still, the indication of continuing impetus to create a more cogent legislative infrastructure for crypto will be interpreted positively by institutions.

Ripple pushback

Meanwhile, one of the ongoing high profile litigations that's one consequence of the legislative gap also saw fresh developments. As we predicted last week, following the New York District Court’s partial ruling that XRP was not a security under certain circumstances, the SEC tabled fresh documents to the court containing a rebuttal and quite clearly indicating it would appeal:

(Ripple Labs) “…creates an artificial distinction between the expectations of sophisticated institutional and retail investors” … a distinction that would turn the Howey Test “on its head” if allowed to stand.

Nasdaq 'remains committed'

Nasdaq Inc. announcing it will no longer pursue plans to launch a crypto custody business could also be seen as the latest illustration of real-world impacts from the U.S’s hazardously unresolved rules for certain types of digital asset businesses. “We remain committed to supporting the evolution of the digital asset ecosystem in a variety of ways,” the exchange operator’s CEO said.

SocGen gets fully licensed

A general counterpoint was adoption news in France, where Société Générale became the first firm to receive a recently instituted full crypto services license from the main securities regulator, AMF. SocGen’s unit, SG Forge can now offer services, such as custody, trading and sales. The license is also notable because it strongly contrasts with a regime where digital asset services providers are already required to be registered, but with rules, oversight and governance expectations much more stringent for fully licensed entity.

FalconX launch

One pro-adoption development CF Benchmarks is excited to be a part of was also announced last week. It's the launch by leading CFTC-regulated swaps dealer and prime brokerage FalconX, of a suite of crypto derivates that settle to our regulated benchmarks. The initiative makes a variety of derivatives strategies for gaining digital asset exposure in a regulated environment available to U.S. institutional and capital markets participants for the first time. The announcement is excerpted below.

Markets: Slow Motion

The slow-motion retreat of Ether and Bitcoin highlighted above didn’t immediately drag all boats lower as alts continued a recent light phase of divergence from the highest capitalized assets. Still, it’s clear the fade is in for many alts too. XRP remained 50% higher by the weekend against its pre-ruling launch point vs. almost 100% higher at one point. Solana, which had surged almost 50% over two days was recently 'just' 15% above July 13th lows. Despite most alts depending on Ethereum for their existence, few benefits for ETH prices have been apparent in recent days as the most ubiquitous blockchain’s token, like Bitcoin, faced its own 'round number' reckoning, in its case $2,000. The most trusted Ether streaming price, our CME CF Ether-Dollar Real-Time Index, has resumed a string of lower closing lows as it digs deeper into the $18k handle, with potential to see the closest major pivot in the current cycle around $1,763.

As for the OG asset, measured by the dominant institutional gauge, CME CF Bitcoin Real-Time Index, as widely observed in recent weeks, multiple instances of unwillingness to cross $30k-$31k make it easier to predict some commitment in the current trend dip. This view is backed by the evaporation of day-to-day support, signalled by prices sinking beneath the 20-day EMA. The next most widely watched region is set to be $28,327, where the most recent updraft commenced following the confirmed breach of that prior resistance in July. It looks to be an obvious place to speculate the existence of retail orders, though an obvious place for opportunistic stop hunting too. That said, the relatively soft BTC volumes and dwindled volatility we mentioned earlier imply continued drifts rather than dramatic falls in the near term.

Macro Outlook

By Gabe Selby

The U.S. consumer has shown remarkable resilience throughout the pandemic recovery, even in the face of higher inflation. However, the latest retail sales report for June revealed a clear deceleration in demand, which is likely to have knock-on effects on disinflationary trends in the coming months. Additionally, the June Industrial Production report indicated concerns among factory producers regarding replenishing excess inventory due to softer demand.

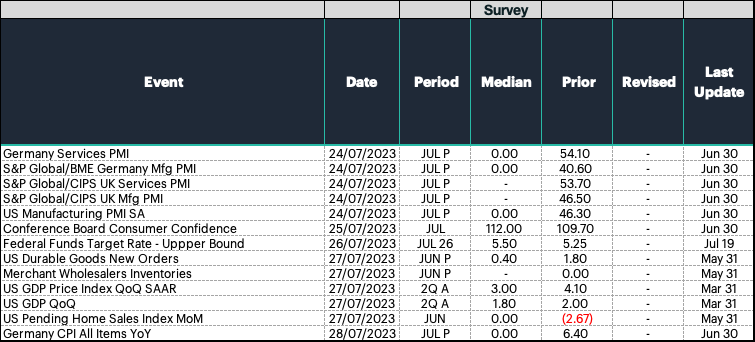

Investors and market participants will closely focus on Wednesday's FOMC rate decision. Currently, there is a market expectation of over a 90% chance of another 25 bps hike during the July meeting. However, the consistent trend of weaker-than-expected inflation prints is likely to strengthen the view that the central bank may have reached the terminal rate for this historic hiking cycle.

Featured benchmarks: CME CF Bitcoin Reference Rate • CME CF Ether-Dollar

FalconX launches Suite of Institutional Crypto Derivatives Powered by CF Benchmarks

FalconX partners with CF Benchmarks to offer trading of a broad range of cryptocurrency derivatives in a regulated environment

London, 18 July 2023 - Falcon X, the digital assets prime brokerage for the world’s leading institutions, is releasing the only crypto derivatives suite offered by a CFTC-regulated swaps dealer.

These contracts are settled against indices administered by CF Benchmarks, the FCA regulated cryptocurrency index provider.

The contracts offer regulated access to the crypto derivatives market, via swaps, options and non-deliverable forwards (NDFs) that settle to single asset reference rates provided by CF Benchmarks.

- The contracts provide exposure to Bitcoin settled against the CME CF Bitcoin Reference Rate, and to Ether settled against the CME CF Ether-Dollar Reference Rate

- FalconX is also offering a range of derivatives products settled against other regulated CF Benchmarks single asset reference rates, so clients can gain exposure to leading cryptocurrencies beyond Bitcoin and Ether

Read the rest of this announcement on our website

Featured benchmarks: CME CF Bitcoin Reference Rate - New York Variant

Keeping track of U.S. Bitcoin ETF applications - 2023 Edition

This could take some time: key details of the current crop of U.S. spot Bitcoin ETF applications, plus possible decision dates, all in one place

The wait

The race among asset managers to list the first U.S. spot Bitcoin ETF is ongoing. But with several applications already filed, including many by firms that have filed previously rejected applications, progress has moved firmly into the waiting phase. As we’ve often stated, this could last several months.

With 8 such applications now on the SEC’s desk though, keeping track of the timing of the commission’s potential decision-making process—which is already pretty convoluted and conditional, as we detailed here—can be extra challenging.

The cream of the crop

As we’ve also indicated previously, the SEC has once again signalled the importance of its long-held prerequisite of extraordinary regulatory look-through for any potential crypto ETF’s market operations, both in principle as well as regarding the specific mechanism—known as a Surveillance Sharing Agreement (SSA).

By extension, as the preeminent regulated cryptocurrency Benchmark Administrator, CF Benchmarks reasons that the commission will demonstrate its preference for the greatest possible visibility into the market participation of the Bitcoin ETF that is ultimately approved for listing.

Logically, that should mean applicants proposing to use CF Benchmarks’ regulated CME CF Bitcoin Reference Rate – New York Variant (BRRNY) as NAV calculation index, would enjoy an implicit additional advantage over ETF filers citing other indices.

Read the rest of this article, including the summary table of all filings on our website

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.