CF Benchmarks Newsletter - Issue 58

Outsize attention on the ambivalent Ripple ruling largely eclipsed important crypto ETF developments.

- Monochrome files to list first Bitcoin ETF on ASX

- SEC starts the clock on BTC ETF filings

- XRP soars but case continues

Partial

What is, apparently, the most important fragment of printed material of the past week for digital asset users and market participants, is pasted below:

Therefore, having considered the economic reality and totality of circumstances, the Court concludes that Ripple’s Other Distributions did not constitute the offer and sale of investment contracts.

It’s the third paragraph on page 27 of this court document, dated Thursday July 13th, issued by the Federal Court for the Southern District of New York (arguably the most pivotal for U.S. financial market matters) in a case brought by the SEC against Ripple Labs Inc., its CEO Bradley Garlinghouse, and its chair Christian Larsen.

This widely and closely watched case stems from charges levelled by the SEC in 2020 against Ripple Labs Inc. and the two executives, accusing them of raising “over $1.3 billion through an unregistered, ongoing digital asset securities offering.”

The market reaction was as exuberant as much of the social media commentary, sending the most liquid institutional Bitcoin price, our CME CF BRTI to fresh 2023 highs well into the $31k handle (See ‘Markets’ below, for details).

For XRP, native token of the Ripple chain (XRP/Ripple crash course here) a predictably more exponential surge, with our regulated, registered benchmark, CF Ripple-Dollar Spot Rate, 98.77% higher on its Wednesday close at one point.

Naturally, there are more than ample grounds for horses to be held, in terms of the most accurate interpretation of the ruling, therefore the precipitate price reaction will almost certainly need to be moderated - even more than the reflexive reversion that set in on the same day. In terms of a middle ground, for instance, the interpretation below is almost certain not to entirely prevail:

The sale of XRP on exchanges is NOT a security. Which means the sales of all cryptos on exchanges are NOT securities and @SECGov and @GaryGensler have NO jurisdiction over them. This is a watershed moment that relegates the SEC to TradFi and makes it a dinosaur regulator. Buh-bye pic.twitter.com/PRuumqQBEL

— Cameron Winklevoss (@cameron) July 13, 2023

Sticking points

There are several points on which the exuberance could turn out to be misguided, but the most obvious:

- It’s still worth noting that mechanically, the opinion refers only to XRP, though this will of course be argued for perhaps years to come

- The ruling itself invites further interpretation: that XRP is a security (according to the ‘Howey test’) when sold to institutional investors, but not when sold to individual consumers – in the guise of “programmatic investors”. I.e., the reasoning is that mass participants on exchanges and other platforms are conducting ‘blind transactions’

- The SEC said it was pleased the court found “XRP tokens were offered and sold…in violation of the securities laws”. It signalled it might appeal

- In any event, the case is set to continue: the partial ruling tends to obviate, if not dismiss discussion of XRP’s status as a security in relation to retail participants, but it expressly does not end discussion in relation to institutional sales. (Proceedings could be delayed if the SEC appeals)

Regardless, several exchanges, including Kraken, deemed the opinion as indicative enough to ‘get back into the water’, with resumption of XRP trading, having suspended transactions when the SEC opened its case.

ETF clock

Outsize attention on the ambivalent Ripple ruling largely eclipsed important crypto ETF developments.

Official consideration of applications to list investment companies, including ETFs, only typically begins once the SEC has acknowledged receipt of form 19b-4 (we explained the importance of this paperwork last week) —by publishing the application.

Well, for a swathe of high profile spot Bitcoin ETF filings posted last month, that has now happened. Including for the proposed vehicles that plan to utilize CME CF Bitcoin Reference Rate – New York Variant for NAV calculation – BlackRock’s iShares Bitcoin Trust, WisdomTree Bitcoin Trust, and Valkyrie Bitcoin Fund. (For further pointers, see this tweet from Bloomberg Intelligence ETF specialist James Seyffart.)

The key consequence of this is that the acknowledgement fires the starting gun on the first 45-day period that conventionally constitutes the SEC’s initial consideration. As we explained here, it could be the beginning of what turns out to be a protracted process for all applicants, that could last up to 240 days, or even longer, since proceedings are entirely at the commission’s discretion anyway.

Monochrome in pole for first ASX-listed BTC ETF

The path to an Australian cryptoasset fund listed on the country's principal exchange, the Australian Securities Exchange (ASX), is very likely to be more transparent than that of the U.S., given the definitive guidelines regulators there laid down together with codified rules around two years ago. As such, the only asset management firm officially acknowledged to be on that path, CF Benchmarks client, Monochrome Asset Management, which calculates the value of its Monochrome Bitcoin Trust with our CME CF BRR, is the sole firm in pole position to launch the first listed Bitcoin fund authorized by an Australian Financial Services Licence to offer retail investors direct and regulated exposure to cryptoassets. And Monochrome has now moved further forward on the grid, with an updated application to list Monochrome Bitcoin ETF (IBTC) on the ASX. There are no other applicants. This makes sense given that the group is the only firm currently authorized under Australia’s crypto product licensing rules.

Get the full background for Monochrome’s journey to this filing with our recent podcast episode featuring Monochrome CEO Jeff Yew.

Markets: XRP ignites field day for alts

A field day was triggered for alt coins on the premise that similar notions as the partial Ripple ruling might be applicable to other tokens implicitly or actually ensnared by the SEC’s categorization dragnet. The coins designated by market cap in our CF Cryptocurrency Ultra Cap 5 index (UC5) as distant 3rd and 4th, (after Ether), Solana and Cardano, jumped significantly. SOL rose more than 33% and ADA gained 22%. (For now, the recent market action does not appear to have been strong enough to alter UC5 constituents at the next rebalance, though that will of course be confirmed by our rules-based methodology in due course).

The ambivalence that seems to be one of the more honest reactions to the ruling is quite evident in the chart of crypto’s bellwether and dominant asset by market cap, Bitcoin, as represented by the most liquid institutional BTC price, CME CF Bitcoin Real Time Index (BRTI), charted below. Still, this inconclusiveness has been hanging in the air for quite a bit longer than the last few days, and the lack of decisive input from recent events is obviously due to BTC’s already settled official status as a non-security. Despite the frothy market and social reaction, the largest cryptoasset is only moderately moved, whilst what we’ve dubbed the “ETF barrier”, from around $30k-$31k has been tested for the umpteenth time and momentum has again been found wanting. The same conditionality that applied to this pattern of behaviour since it emerged in June continues to apply: repeated extrusions above obvious resistance pose risks to the market’s progress in the medium term.

Goal post

However, with so many attempts by price on the range, it makes sense to now ‘move the goal post’– meaning the line representing key resistance—to 2023’s new high of $31,815; implying a less problematic pace between intermediate support at $28,327 and that threshold. As well, the overall tone remains constructive. Short-term impetus maintains prices above the 20-day exponential moving average (EMA), and cyclical momentum is much more emphatic on the upside than on the downside (MACD indicator). The picture seems poised for a decisive move higher should the stimulus present itself.

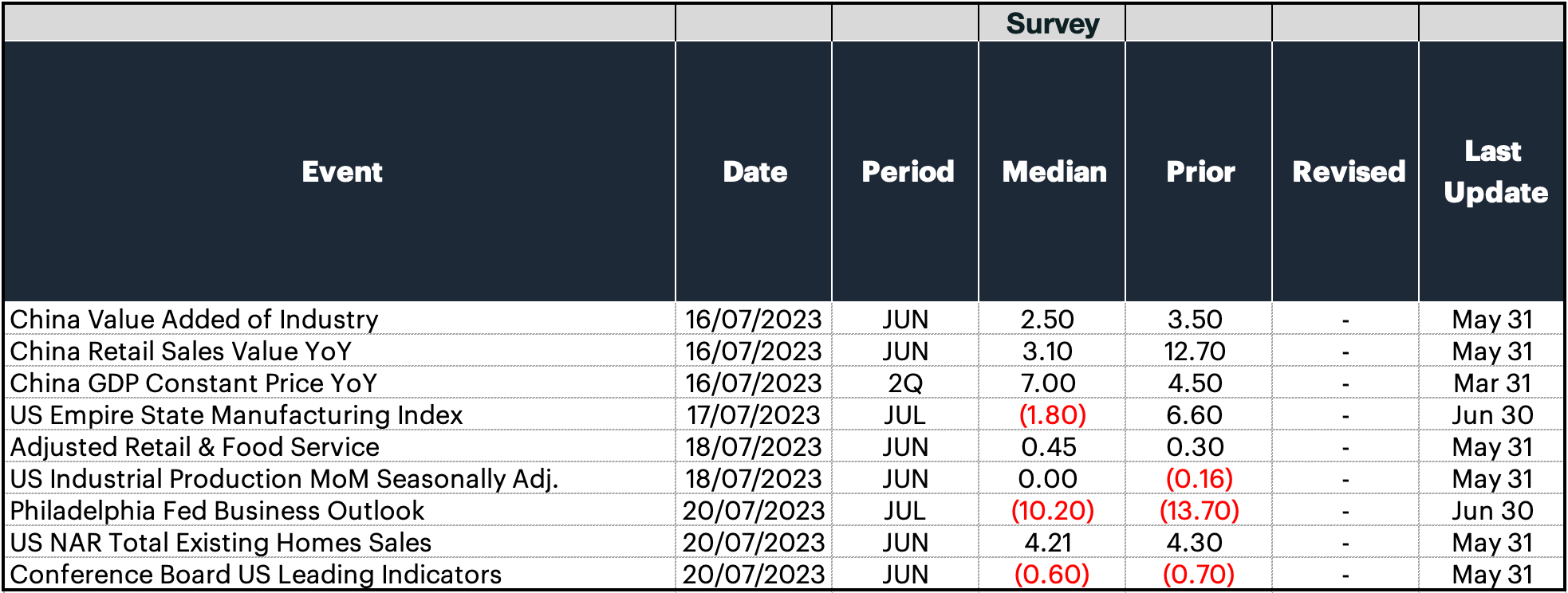

Macro Outlook

Last week’s inflation data surprised to the downside, with both headline and core consumer prices rising just 0.2% month over month in June. This latest reading set the year-over-year change to just 3% (vs. 4% prior) and 4.8% (vs. 5.3% prior), respectively. Producer prices also came in below expectations, with key categories signalling softer PCE inflation (the Fed's preferred measure) ahead. Taken together, this constructive data is likely to give the Fed more flexibility in pausing, or even ending future rate hikes after their July meeting.

This coming week's economic releases will add more color to the cyclical segments of the economy. New York State factory activity is expected to fall after a surprisingly strong showing in the June reading. Industrial production in June is expected to show that producers will likely continue to cautiously proceed in producing more inventories to avoid any potential supply gluts. Lastly, the Conference Board's measure of leading economic activity is expected to remain in contraction mode. Building permits have continued to help support the index, while consumer expectations remain broadly negative.

Gabe Selby

Featured benchmarks: CME CF Bitcoin Reference Rate • CME CF Ether-Dollar Reference Rate

CME ETH/BTC Ratio Futures set for launch

The CME’s newest derivative offering crypto exposure is set be launched in the coming weeks, and it represents something of a departure compared to digital asset contracts currently tradeable on the world’s largest derivatives exchange.

Pending regulatory approval, CME Ether/Bitcoin Ratio Futures will be available from July 31st. They are the first contracts of their kind offered by the marketplace, though a timely addition aimed at providing traders with a streamlined tool to express a view on the trajectory of the key differential between the two largest cryptoassets by market capitalization, whilst avoiding the need for a clear directional decision on one specific asset.

Like all CME crypto derivatives contracts, CME ETH/BTC Ratio Futures will settle to regulated CF Benchmarks pricing, in this case, both the CME CF Bitcoin Reference Rate and CME CF Ether-Dollar Reference Rate.

Some key advantages of the new contract:

- The ability to eliminate price slippage by execution of BTC and ETH futures spreads with enhanced efficiency via the pre-packaged effective spread within CME ETH/BTC Ratio Futures

- Execution of the common spread trade between Ether and Bitcoin on a transparent, regulated market, providing enhanced price discovery

- Increased matching opportunities: the ratio functionality provides an arbitrage between futures order books, enhancing liquidity and market efficiency

Read more about CME Ether/Bitcoin Ratio Futures

- Get details like contract specs, key features and settlement arrangements from the CME’s ETH/BTC Ratio Futures home page

- Read our introductory article: CME's new ETH/BTC Ratio is a future whose time has come

- Learn more with our research article: The ETH/BTC Ratio through time

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.