Weekly Index Highlights, October 7, 2024

For a quick breakdown of the performance of CFB’s key benchmark indices and reference rates for the period September 30 to October 6, 2024, explore our latest Weekly Index Highlights.

For a quick breakdown of the performance of CFB’s key benchmark indices and reference rates for the period September 30 to October 6, 2024, explore our latest Weekly Index Highlights.

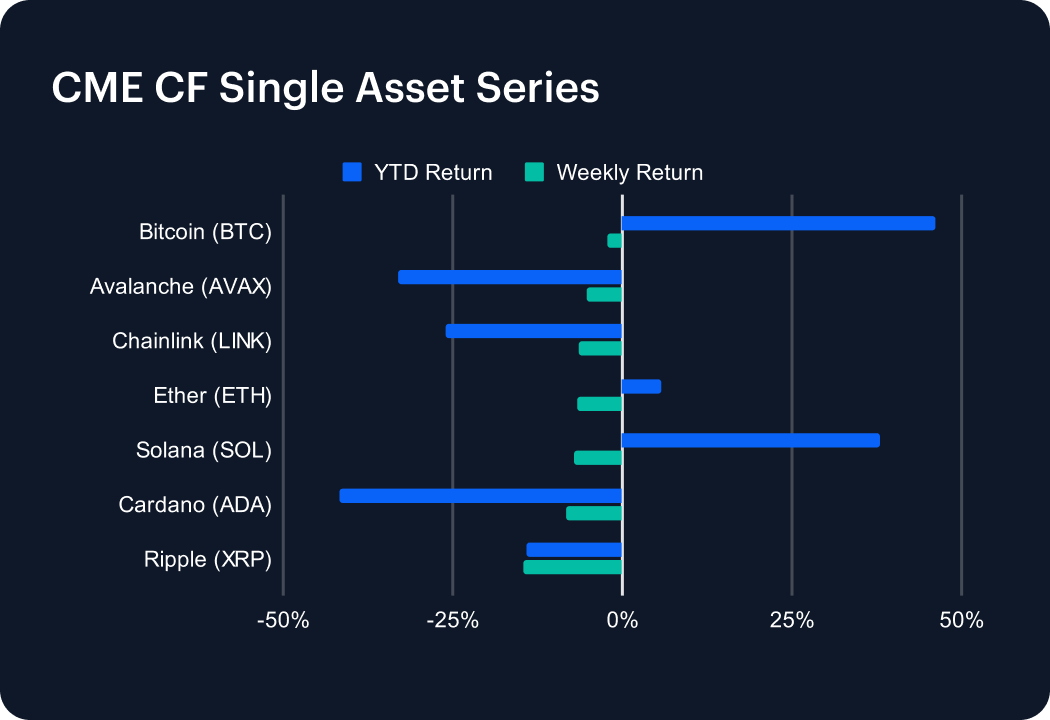

A weakening of large caps in the most recent week, following a spell of gains, left Bitcoin as relative outperformer with a -2.15% slip. Contrast that with the worst weekly underperformer, Ripple (XRP) -14.52%. Interestingly, XRP’s YTD return is now almost identical at -14.05%, underlining perceptions the token may be in the process of escaping a years-long cloud of uncertainty.

The broader snapshot also portrays a near unanimity of losses. Still, it’s worth noting pockets of mild intraweek advances had faded before the cut. Tell-tale relatively mild losses among dog-themed SHIB, -1.55%, WIF, -2.33%, and DOGE, -7.01%, helped minimise the Culture sub-category’s fall to -7.68% on average. But the -14.34% weekly loss by BONK, another meme token, among the deepest in any sub-category, shows differential sentiment isn’t running very deep.

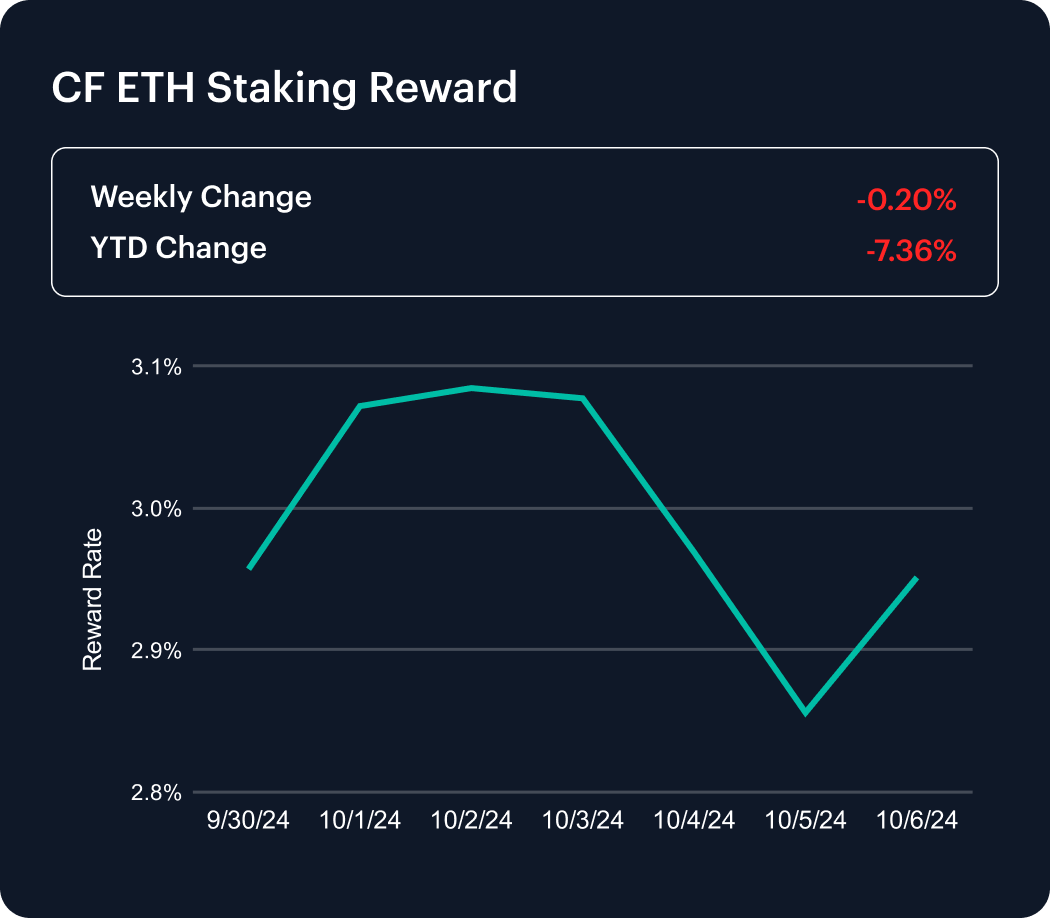

ETH staking rewards may be marginally trending lower over the short term given the weekly return change again edged lower at -0.2%, meaning ETH_SRR’s YTD return closed the week down -7.36%.

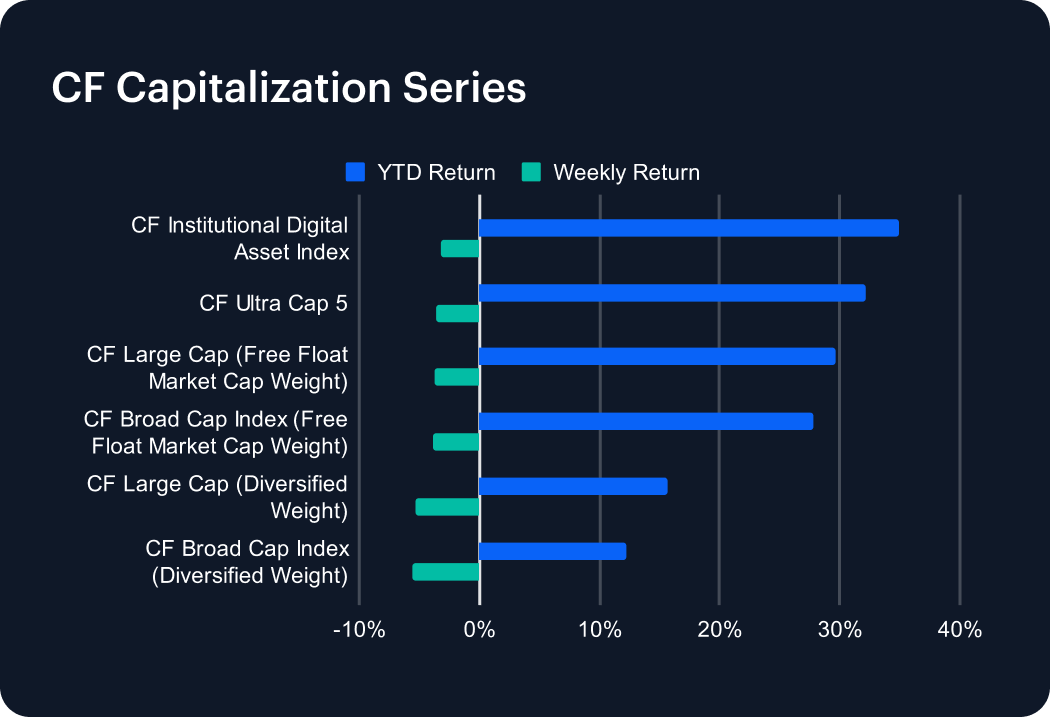

The generally weaker tone appears milder, viewed on the more aggregated basis shown by CF Capitalization Series indices. The influence of Bitcoin’s relatively firm week (-2.15%) is again evident in the narrow differential between the CF Ultra Cap 5’s -3.61% weekly decline, and the CF Broad Cap Index (Free Float Market Cap Weight), -3.83%. Note the biggest weekly faller in this series was CF Broad Cap Index (Diversified Weight), losing -5.56%.

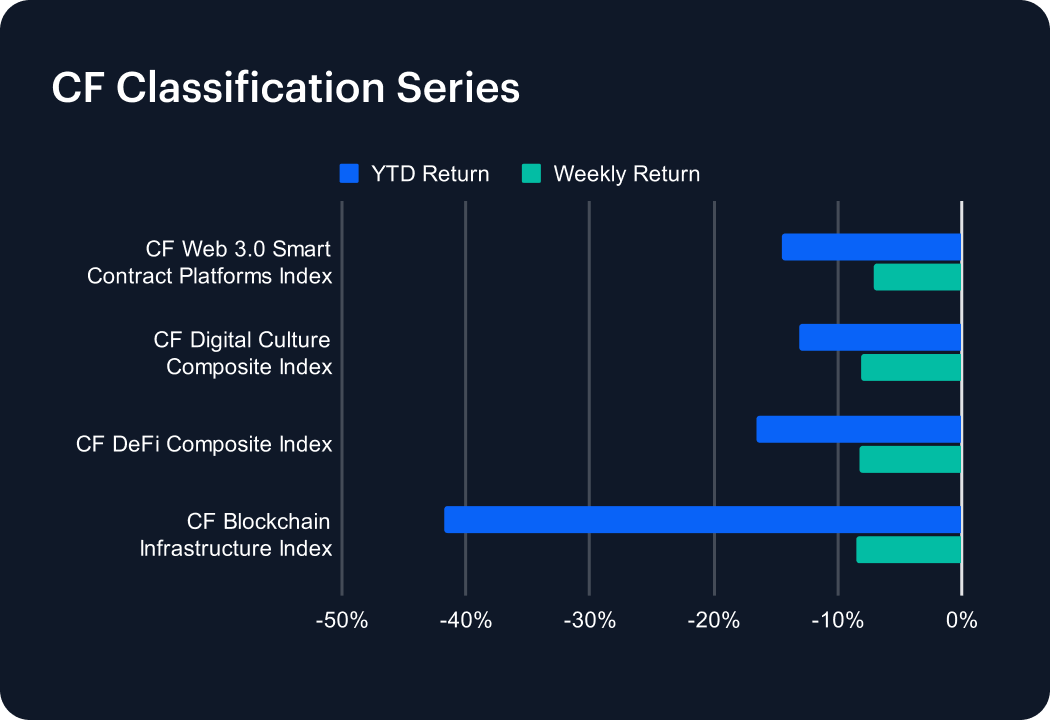

Here too, marginal differentials abound, posing the CF Web 3.0 Smart Contract Platforms Index’s relatively buffered -7.05% weekly return as notional at best, especially with series underperformer, the CF Blockchain Infrastructure Index falling only 1.41 percentage points more, with an -8.46% slide.

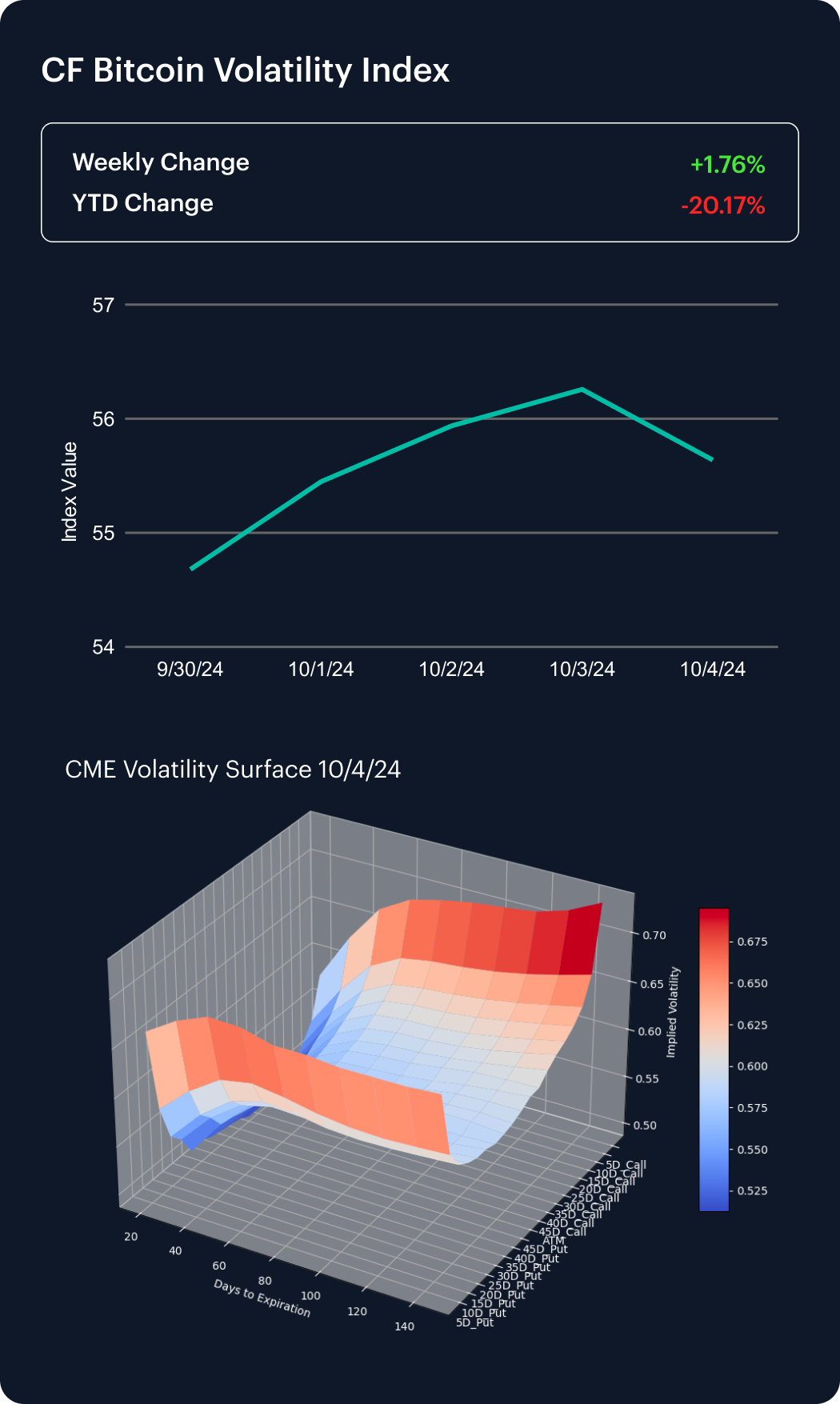

A second-straight weekly uptick of CME Bitcoin implied volatility, this time +1.76%, brought another incremental curtailment of BVXS’s YTD decline, leaving it to stand at a fall of -20.17%.

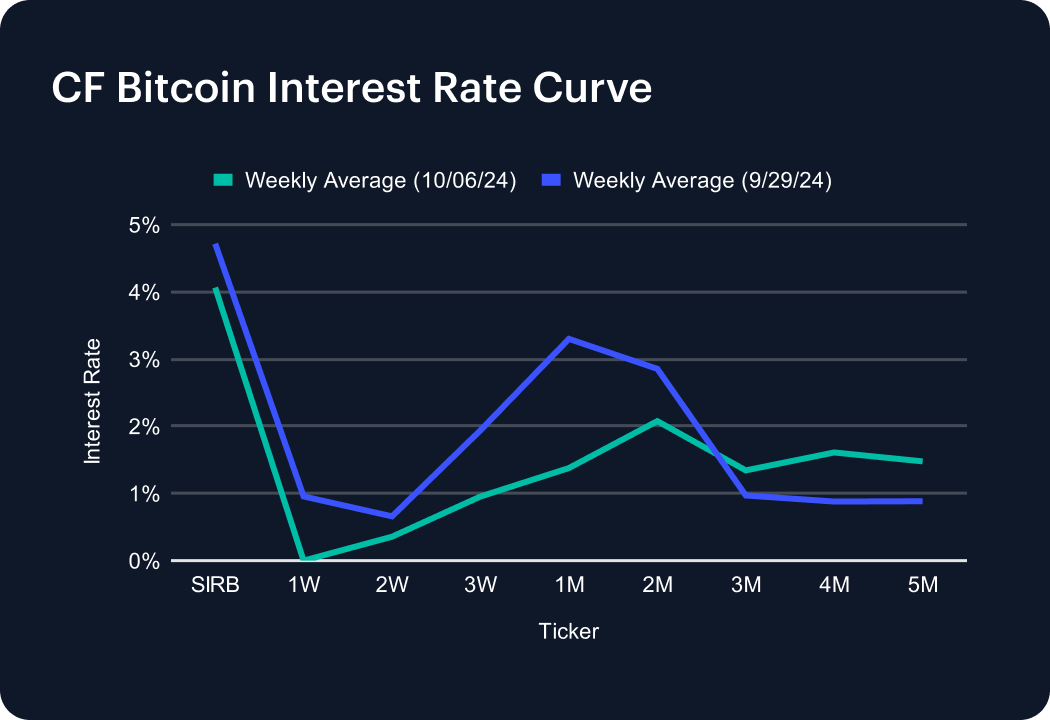

The shorter end’s long-standing flattening profile quickened over the most recent week, which notably ended with a benign U.S. monthly jobs report that triggered an advance by Treasury yields. CF BIRC’s 1-week tenor evaporated entirely to show a 0% reading from barely 0.01 of a basis point (bp) the week before. By marginal contrast, the longer end ticked higher, leaving the 5-month tenor to close at approximately 1.5 bp from 0.008% the previous week.

Index data based on CF Benchmarks Settlement Rates, published at 16:00 London Time

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.