Weekly Index Highlights, October 21, 2024

Get a quick grasp of a busy week for digital assets, with our Weekly Index Highlights for October 14, to October 20, 2024, based on CF Benchmarks’ key indices and reference rates.

Get a quick grasp of a busy week for digital assets, with our Weekly Index Highlights for October 14, to October 20, 2024, based on CF Benchmarks’ key indices and reference rates.

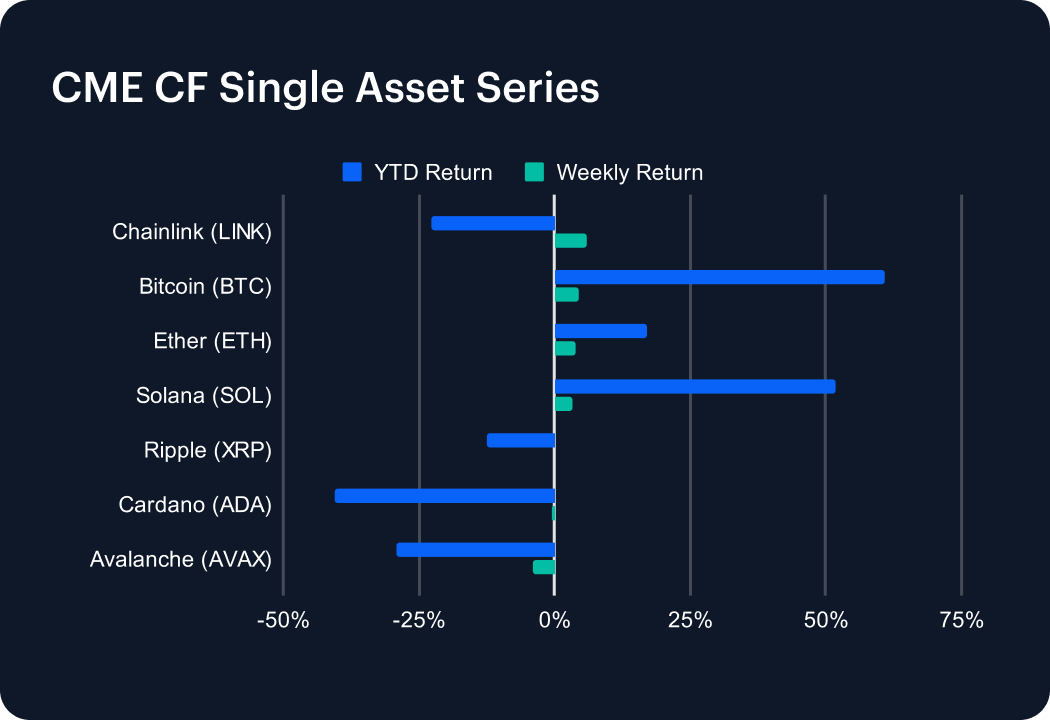

Prices closed firmer in the most recent week as participants appeared to become incrementally more certain of widely preferred outcomes on the political and macro fronts. Still, definitive weekly gains among CME CF Single Asset series indices notably excluded Ripple (XRP), which ticked just +0.09% higher, Cardano (ADA), which edged down -0.43%, and Avalanche (AVAX) which retreated -4.09%.

The Culture sub-category was the unequivocal weekly leader, propelled +9.39% on average by ApeCoin’s (APE) parabolic +98.01% surge, amid the launch of the ApeChain mainnet on Sunday. DOGE was lifted +21.50% by an influential backer’s comments. A Gaming segment theme was also evident: Axie Infinity (AXS) +7.78%, GALA +6.80%, IMX +3.84%, and SUPER +3.40%. Finally, ChainLink’s (LINK) +6.02% increase, and Ethereum Name Service (ENS), and Filecoin (FIL), rising respectively +6.57%, and +5.74%, indicated a Utility rebound; +2.57% on average.

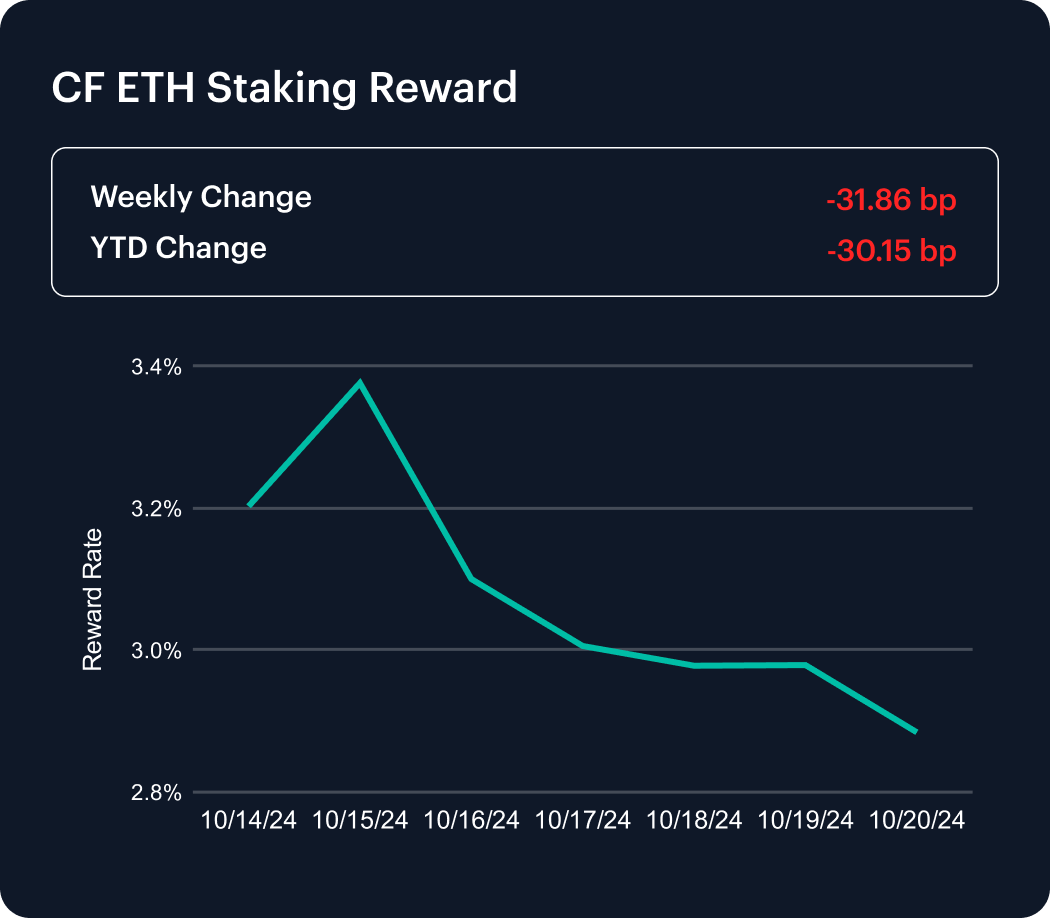

The overall softening trend of ETH staking rewards appears to be continuing. ETH_SRR’s weekly change has reverted to incremental declines, falling -31.86 bp in the most recent week, leaving the YTD change at -30.15 bp.

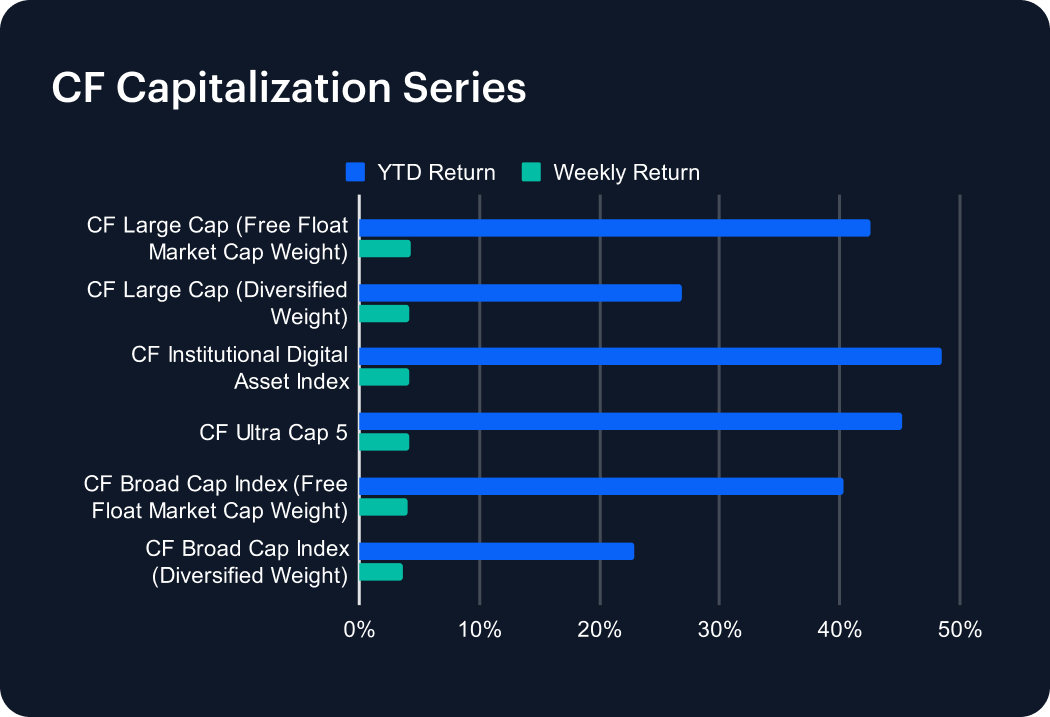

All indices in this series rose quite uniformly. A slight differentiation between the weekly return of the CF Large Cap (Free Float Market Cap Weight) index, +4.27%, and the CF Broad Cap Index (Diversified Weight), +3.66%, potentially suggests mega caps were moderately more favoured.

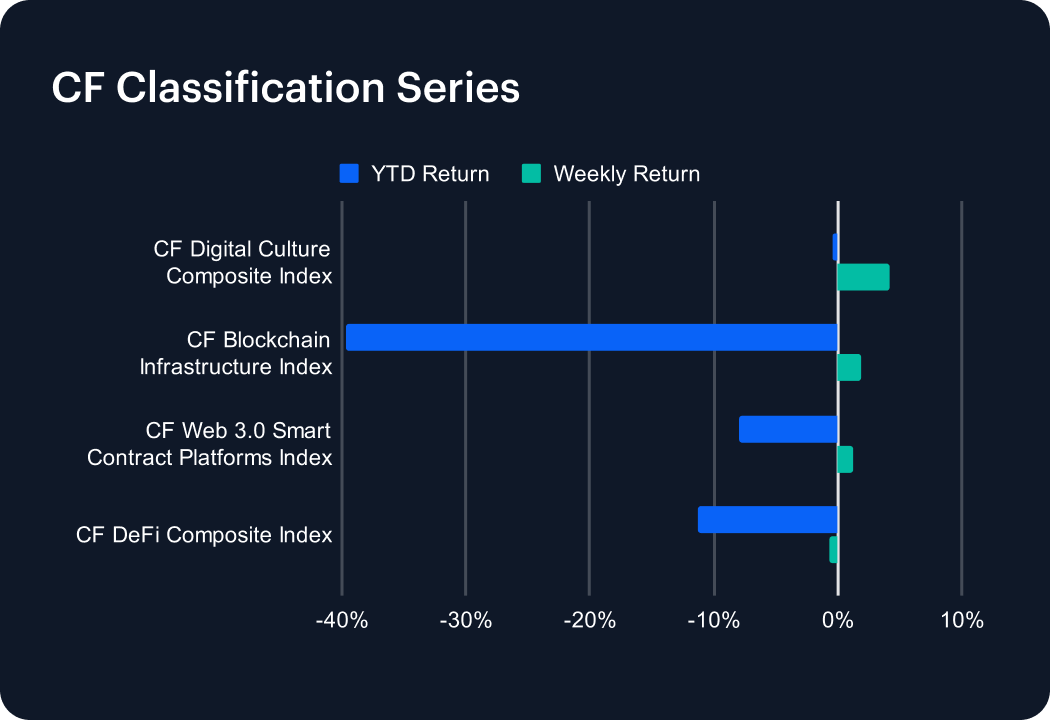

The ongoing strength of broadly culturally oriented protocols remains evident, as detailed in the CF DACS section. This enabled the CF Digital Culture Composite Index to outperform over the week, rising +4.21%, and trimming its year-to-date (YTD) decline to -0.43%, the shallowest YTD fall of the series.

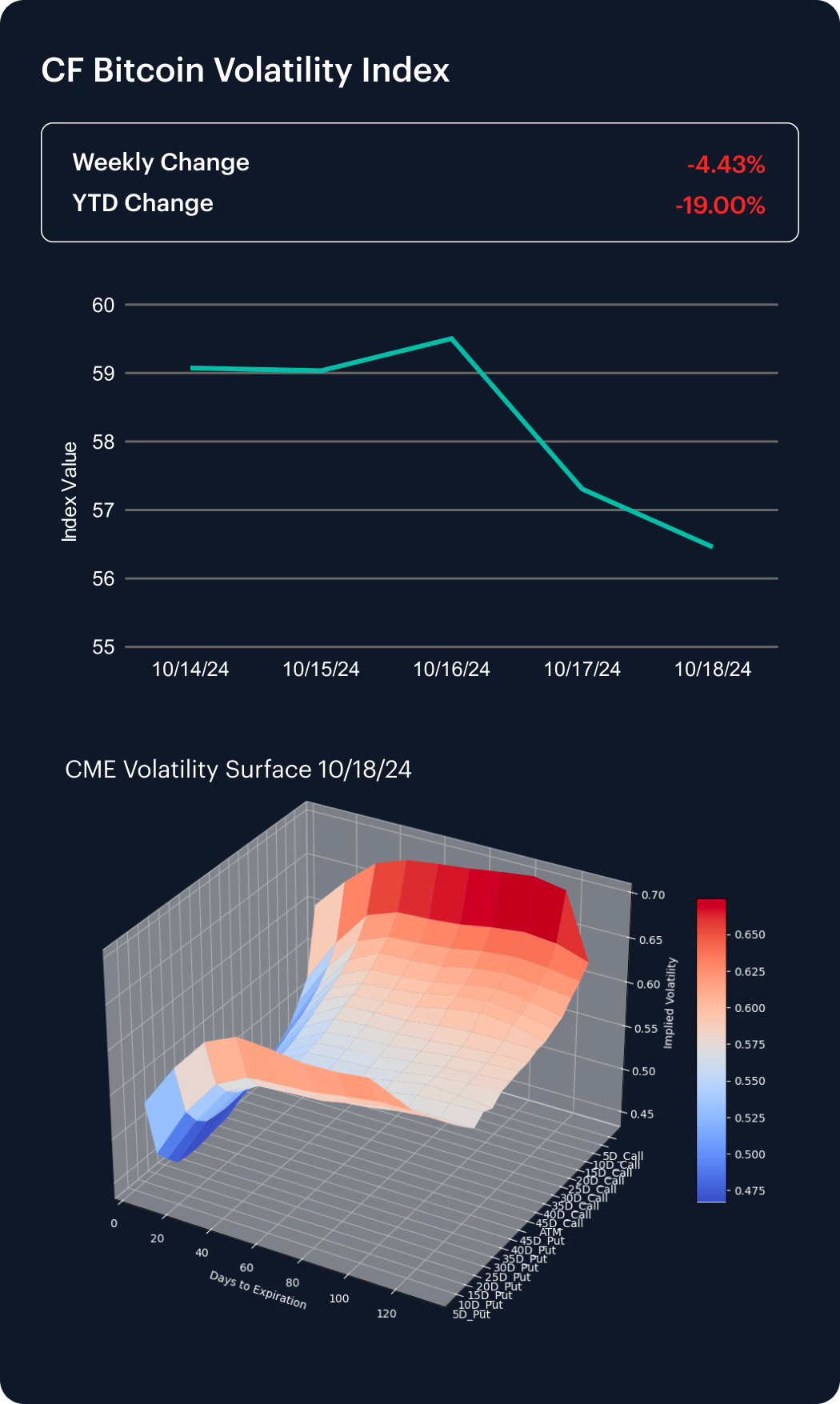

CME Bitcoin implied volatility accordingly dispersed due to the firm week for prices. BVXS’s -4.43% weekly decline extended its YTD fall to -19.00%.

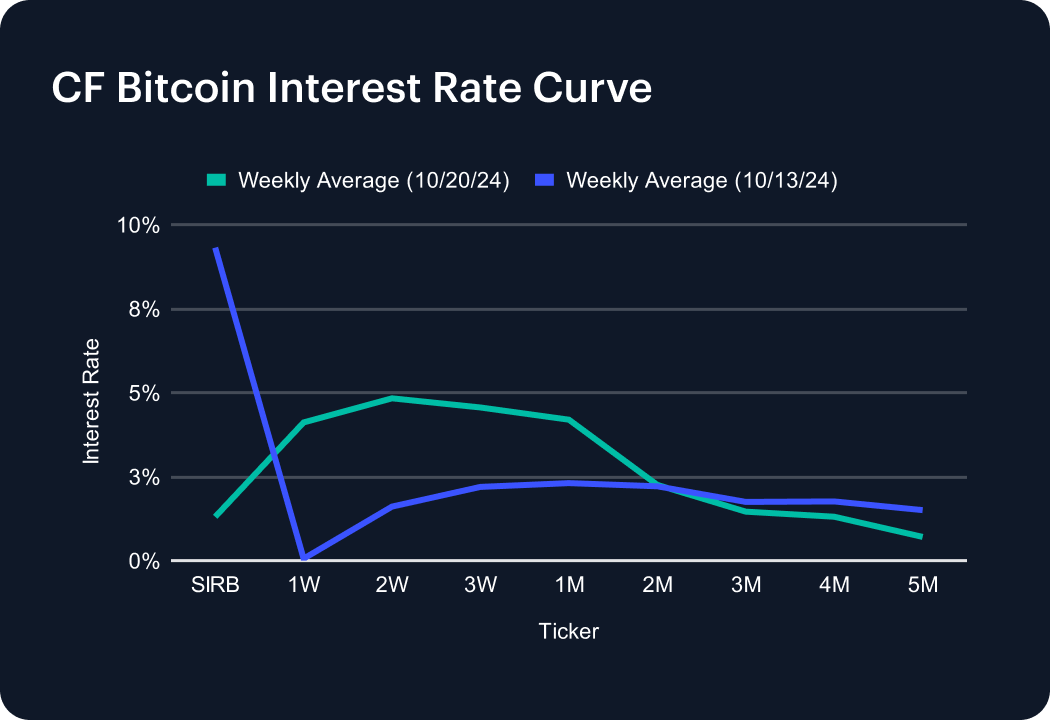

Not a great deal of movement over the week for average Bitcoin interest rates, though with the 1-week tenor rising approximately 4 bp from fractionally above zero the prior week, marginal activity looks to have been sustained across the curve. Meanwhile, the medium-to-long end is notably flattening, as 3-month, 4-month, and 5-month rates coalesce towards 1 basis point.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.