Weekly Index Highlights, October 14, 2024

Grab our latest Weekly Index Highlights for a quick overview of how digital assets performed during the week of October 7, to October 13, 2024, based on our key benchmark indices and reference rates.

Grab our latest Weekly Index Highlights for a quick overview of how digital assets performed during the week of October 7, to October 13, 2024, based on our key benchmark indices and reference rates.

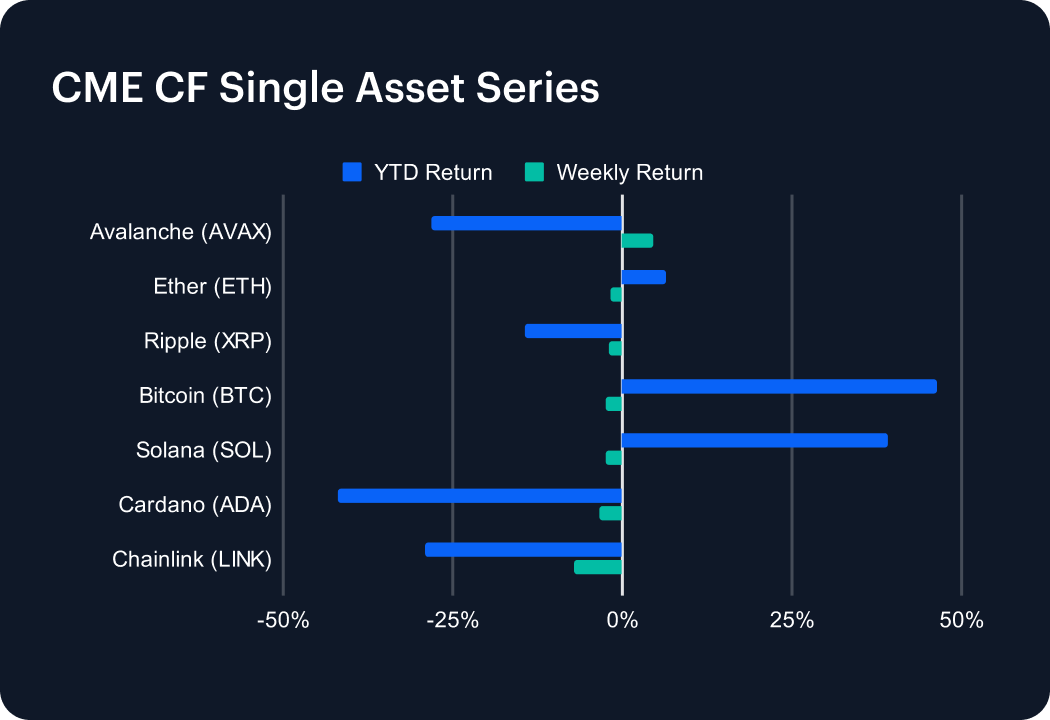

Pockets of modest outperformance emerge following another lacklustre week. Among CME CF Single Assets only Avalanche (AVAX) rose, +4.67%, amid news that the protocol’s foundation will repurchase a tranche of tokens.

Weekly gains across the investible digital asset universe, as portrayed by CF DACS, were only notionally thematic on the upside, whilst potential drivers were more evident on the downside. Uniswap (UNI), +6.48%, was among only two Finance sub-category gainers, with Kyber Network Crystal (KNC) managing just +0.95%. Meanwhile, SuperVerse’s (SUPER) +13.24% jump helps explain the Culture sub-category’s relative outperformance (-1.69%). Elsewhere, Chainlink (LINK), falling, -7.06%, led losses by all Utility tokens, for an average sub-category decline of -5.95%.

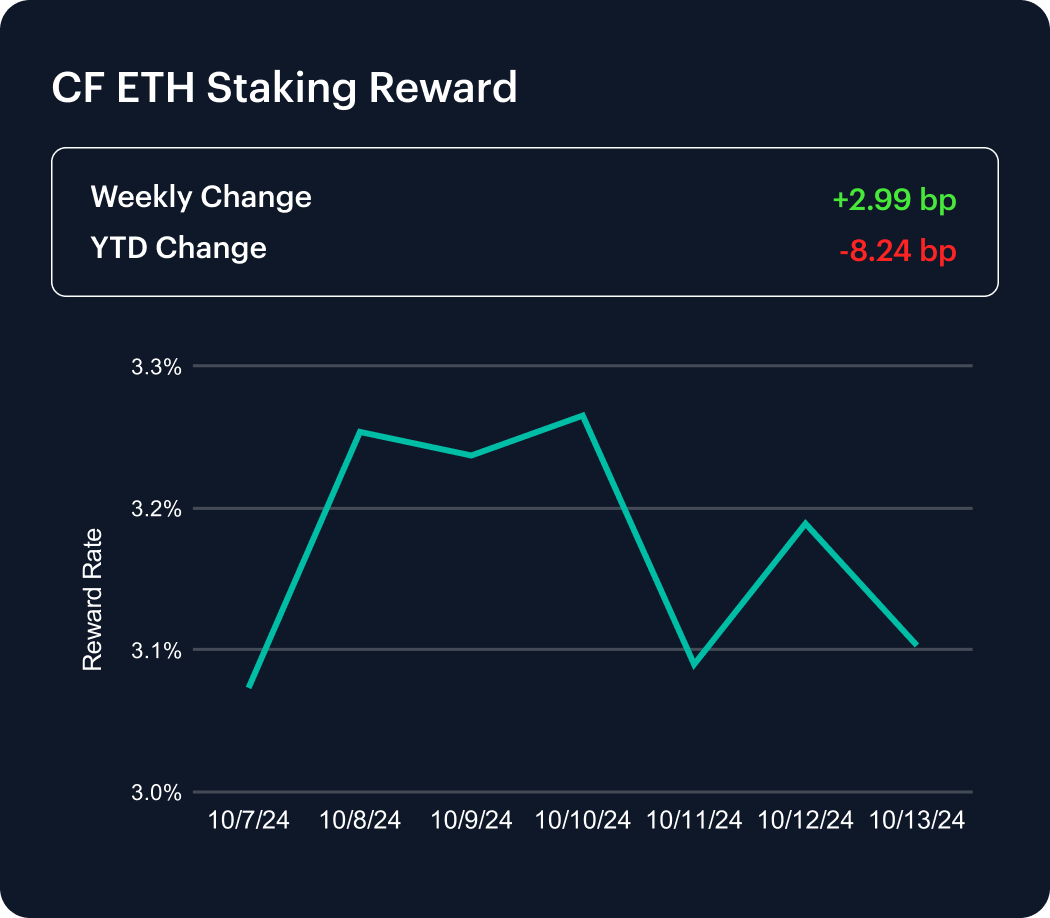

The weekly change of ETH staking rewards turned somewhat higher, +2.99 bp, after two straight negative weeks. The moderate upturn buffers the YTD decline, which now stands at -8.24 bp.

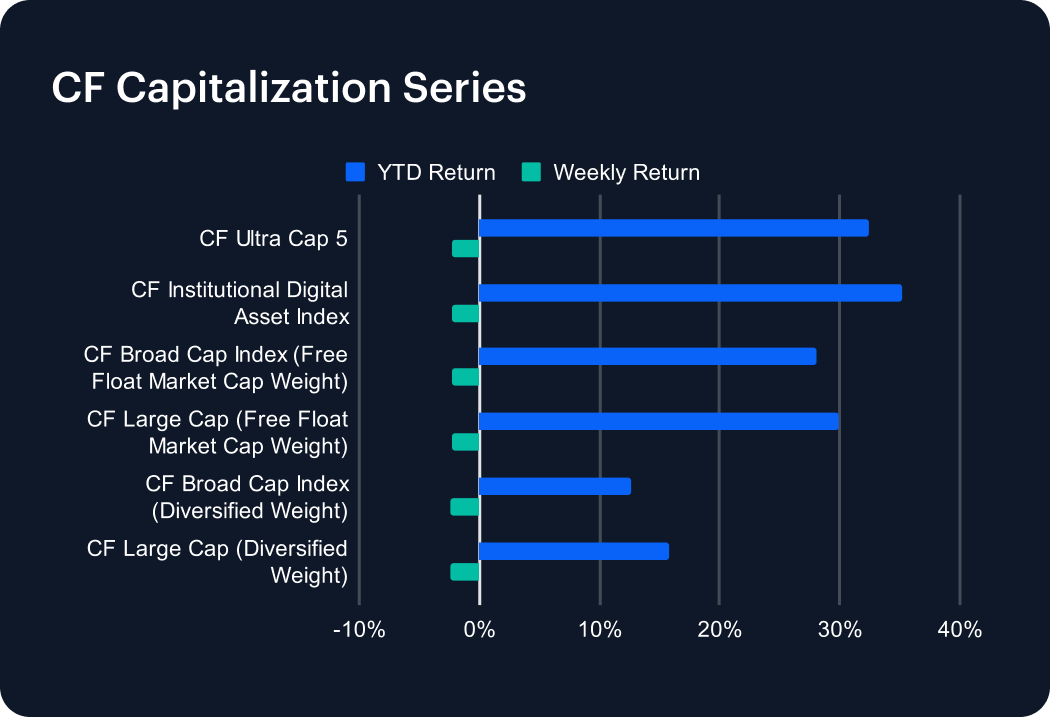

A week of relatively evenly distributed moderate declines across our suite of large and broad cap measures. The differential between the notional best and worst performers was tight, with the CF Ultra Cap 5 index falling -2.29%, while the CF Large Cap (Diversified Weight) index slipped by -2.44%.

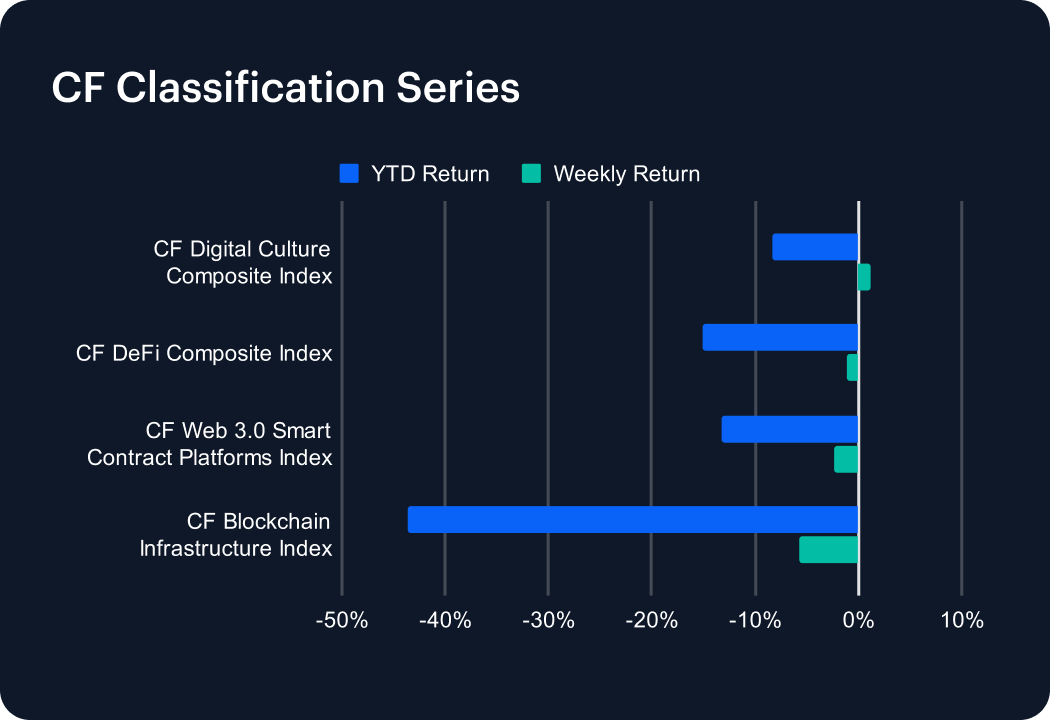

The primary driver of this week’s sole, slim, weekly ascent in this series, +1.23%, by the CF Digital Culture Composite Index, is given in the CF DACS section. As for the biggest underperformer, the title again belongs to the CF Blockchain Infrastructure Index, on both weekly and year-to-date bases; -5.80%, and -43.56%, respectively.

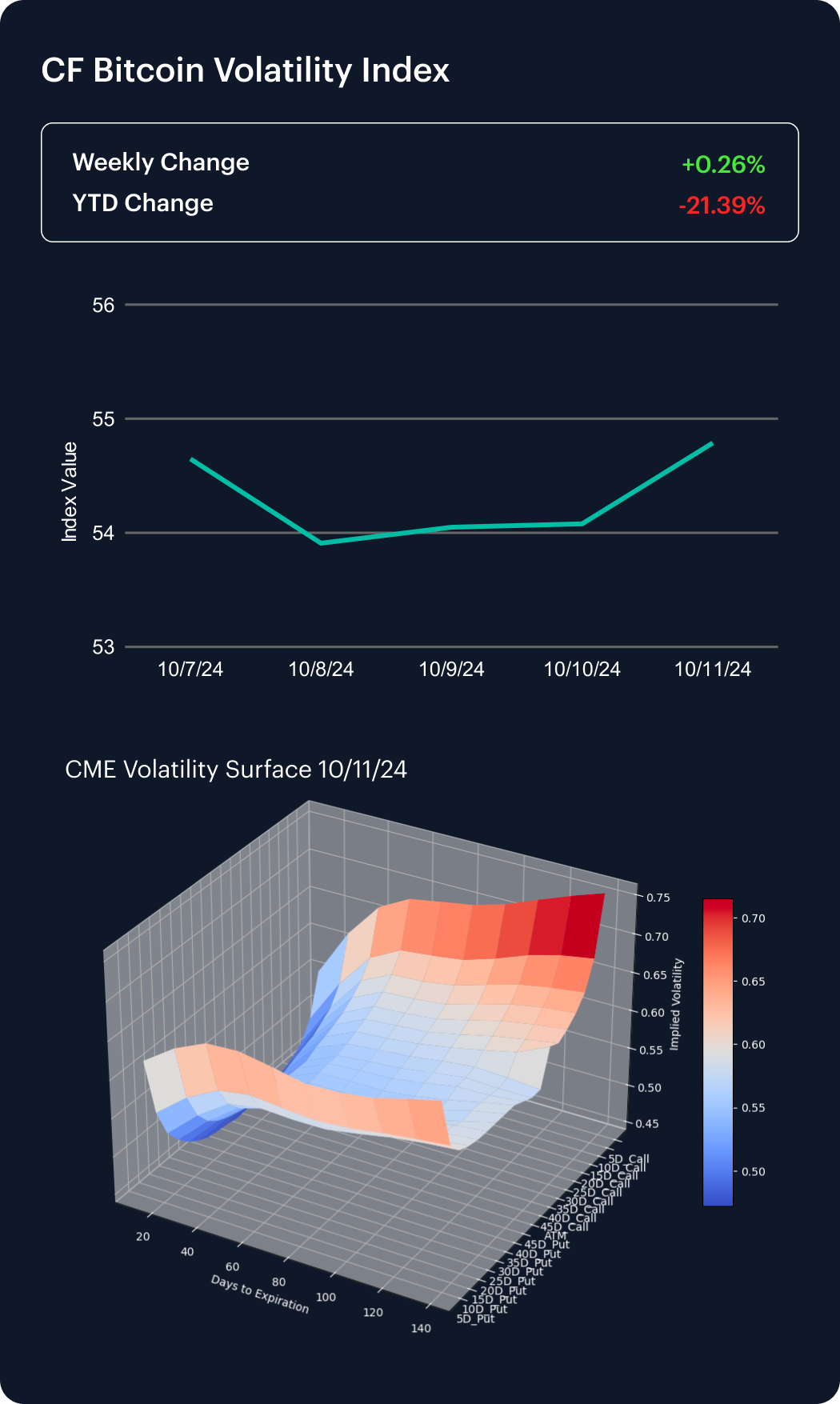

CME Bitcoin implied volatility continues to show signs of trending higher, after a third consecutive upward calibration of BVXS’s weekly change. However, any increase of volatility may be vulnerable to a reversal, given the rise was just +0.26% over the past week. That was too slight to prevent a small negative extension of the BVXS YTD change, which is now -21.39%.

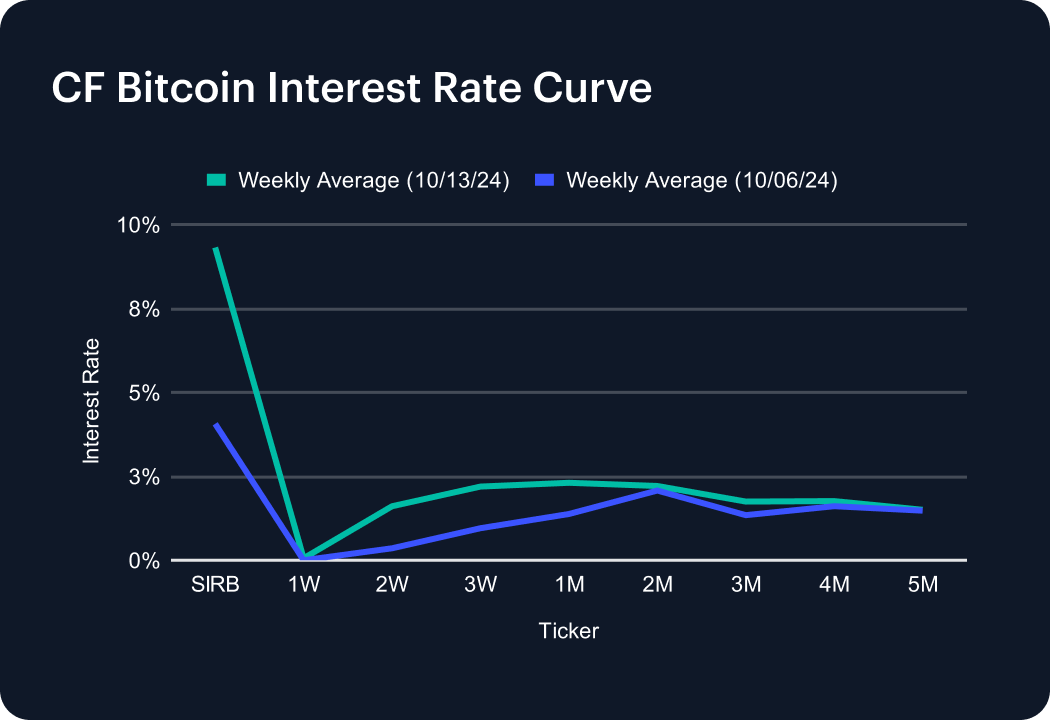

The week saw a return to the recent baseline of modest activity, with all rates ticking higher. That said, the zero 1-week tenor reading of the previous week was replaced by a similarly anaemic approximately 0.0006%. More practical indications include the following tenors: 2-week, up approximately 1.2 basis points (bp) to stand at 1.6 bp; 3-week, up ~1 bp to an average 2.2 bp; and 1-month, up less than 1 bp to stand around 2.3 bp.

Index data based on CF Benchmarks Settlement Rates, published at 16:00 London Time

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.