Weekly Index Highlights, April 14, 2025

The digital asset market rallied, led by diversified indices. The CF Large Cap Index rose 8.62%. Ether staking yields fell to 2.82%, Solana was up 6.94%, and Bitcoin’s implied volatility dropped, while realized volatility stayed steady.

Market Performance Update

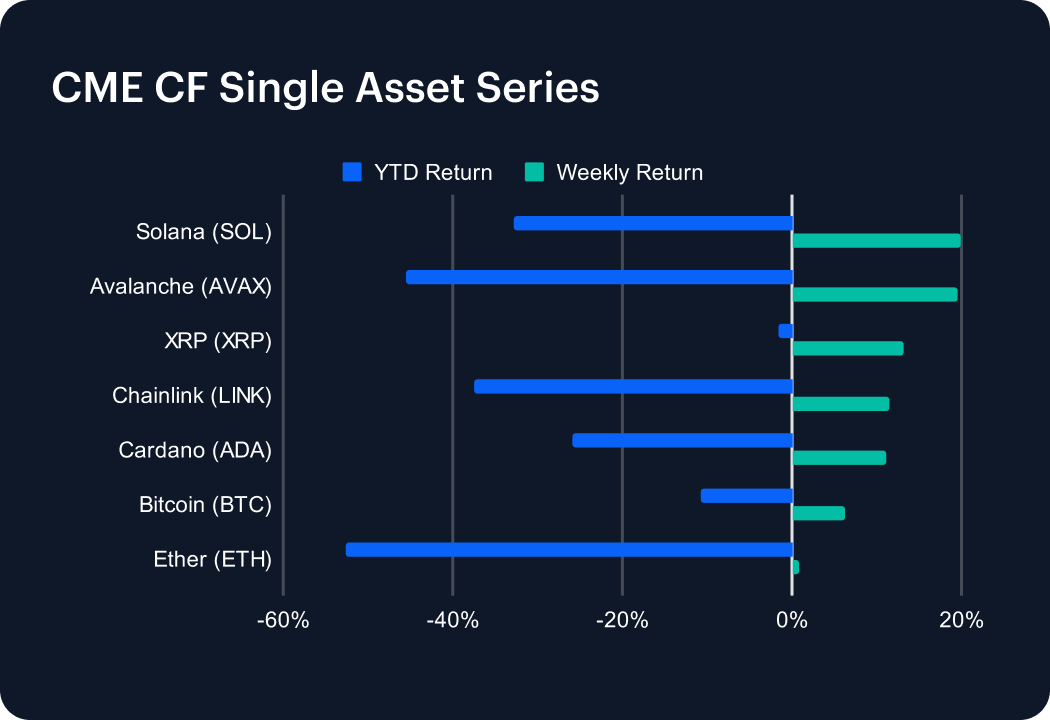

The digital asset market rebounded this week, marking a sharp shift in momentum as several major tokens posted double-digit gains. Solana (SOL) led the rally with a 19.87% weekly surge, trimming its year-to-date (YTD) loss to -32.73%. Avalanche (AVAX) followed closely, jumping 19.55% and improving its YTD return to -45.56%. XRP posted a strong 13.23% gain, nearly erasing its losses with a modest YTD dip of just -1.54%. Chainlink (LINK) and Cardano (ADA) climbed 11.48% and 11.05%, respectively. Bitcoin (BTC) showed continued resilience, rising 6.34% to bring its YTD performance to -10.76%. Ether (ETH), while still the worst performer YTD at -52.62%, managed a slight 0.77% gain.

Sector Analysis

Digital assets broadly rallied this week, with standout performances across several CF DACS sub-categories. In Culture, SUPER surged 35.41%, while WIF (+33.48%) and BONK (+28.56%) led a strong rebound in Meme Coins. The Computing segment saw explosive gains, with JASMY soaring 70.24%, HNT up 46.53%, and RENDER climbing 33.11%. Among Borrowing & Lending tokens, SPELL jumped 17.84% and ONDO rose 14.84%. In the Infrastructure sub-category, STX led Scaling with a 15.78% gain, while Identity token GAL added 12.75%. On the downside, EOS (-15.47%) and XTZ (-10.75%) dragged on the General Purpose Smart Contract Platforms, and PRIME (-8.57%) was a notable laggard in the Social segment. Overall, strength was broad-based, with the computing and Meme Coin segments standing out.

Staking Metrics

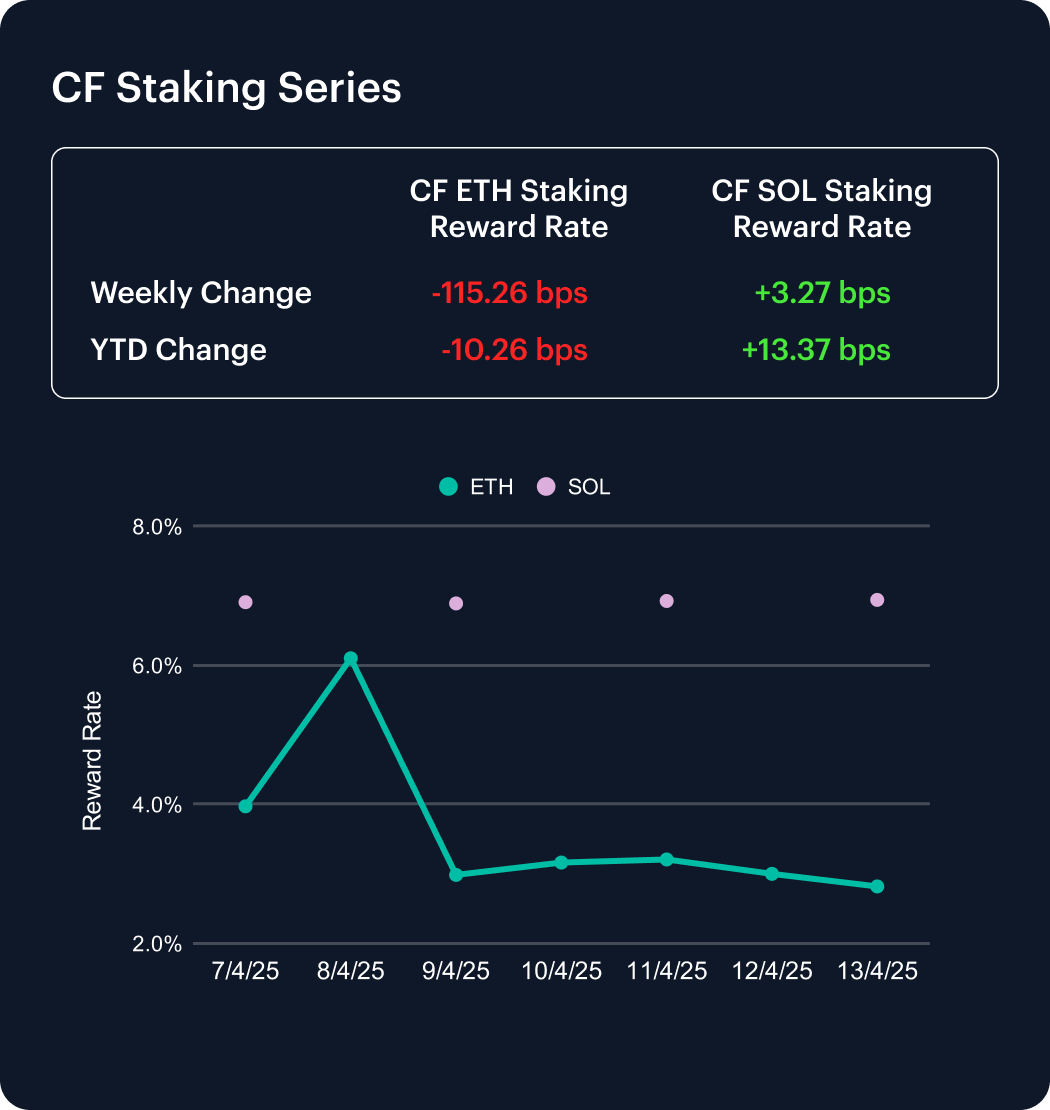

The CF Ether Staking Reward Rate Index (ETH_SRR) declined sharply this week, falling 115.26 basis points to 2.82%, a 29.01% weekly drop. Year-to-date, ETH_SRR is down 10.26 bps, reflecting a 3.51% cumulative decline, and reinforcing continued reward compression for Ethereum stakers.

In contrast, the CF SOL Staking Reward Rate Index (SOL_SRR) rose 3.27 bps to 6.94%, marking a 0.47% weekly gain. SOL_SRR is now up 13.37 bps in 2025, delivering a 1.96% YTD increase. This divergence highlights Solana’s growing staking rewards as Ethereum’s reward environment weakens, underscoring a broader shift in staking dynamics across networks.

Market Cap Index Performance

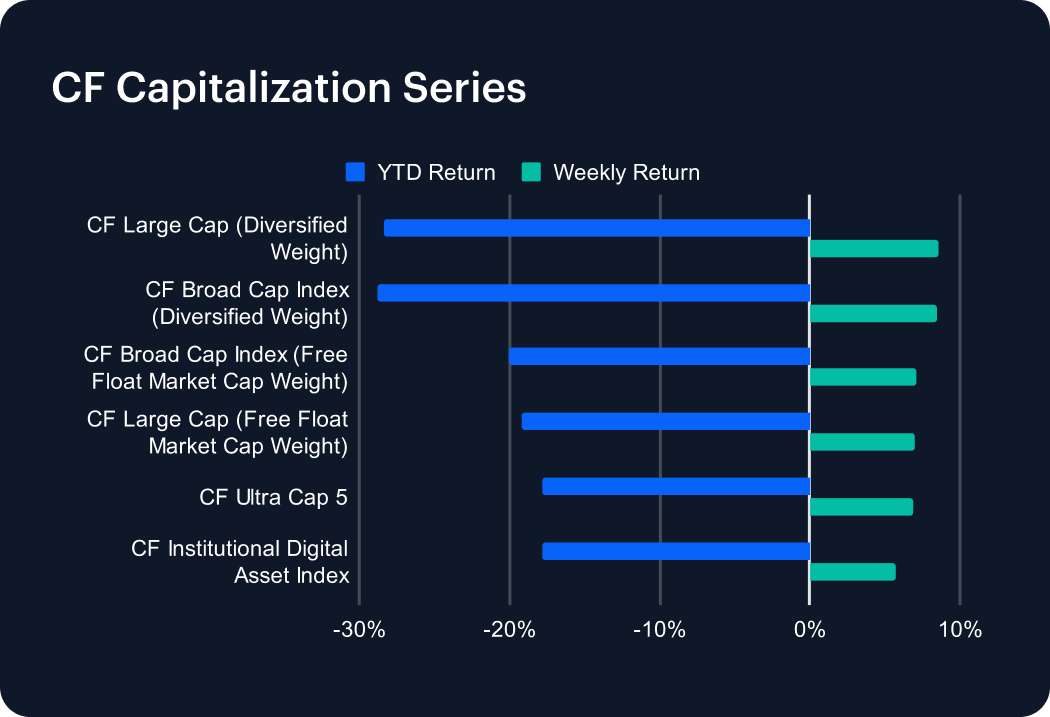

The CF Capitalization Series rebounded this week, posting solid gains across all indices. Diversified-weighted indices slightly outpaced their free-float market cap-weighted counterparts, reversing the recent trend of underperformance. The CF Large Cap Index (Diversified Weight) led the advance with an 8.62% weekly gain, trimming its year-to-date (YTD) loss to -28.37%. The CF Broad Cap Index (Diversified Weight) followed closely, rising 8.45% and easing its YTD decline to -28.80%. Among free-float market cap-weighted indices, the CF Broad Cap and CF Large Cap indices gained 7.07% and 7.02%, respectively. The CF Ultra Cap 5 advanced 6.85%, while the CF Institutional Digital Asset Index added 5.76%. The rally signals renewed risk appetite, particularly among small-cap tokens.

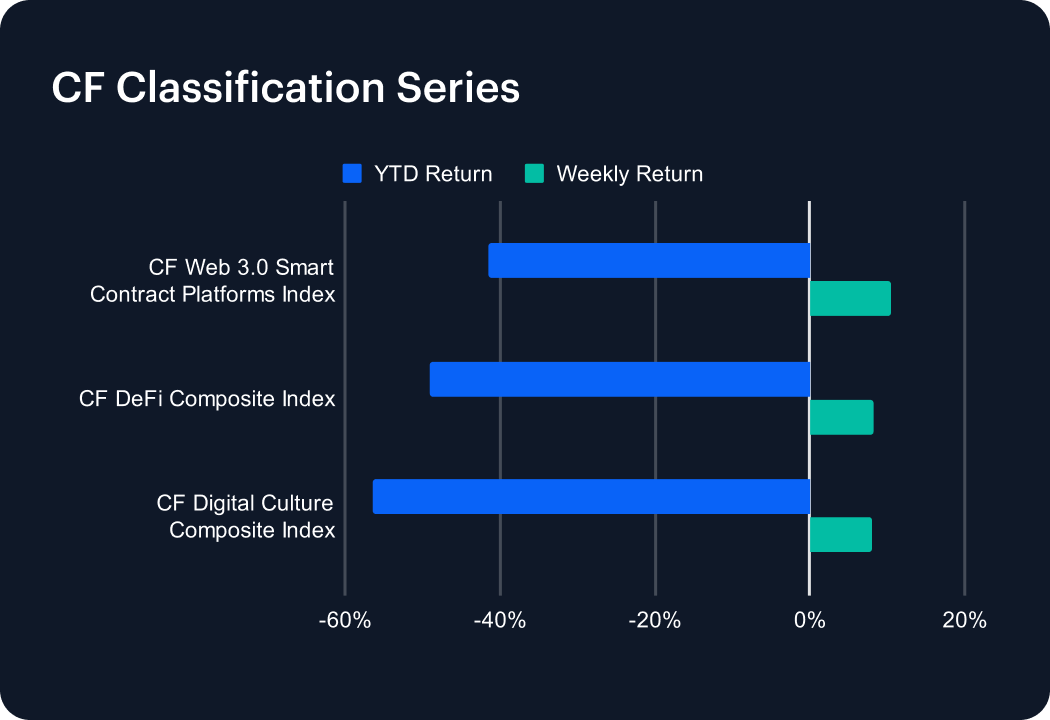

Classification Series Analysis

The CF Classification Series rebounded this week, as key digital asset verticals posted meaningful gains amid improving market sentiment. The CF Web 3.0 Smart Contract Platforms Index led the recovery with a 10.44% weekly gain, trimming its year-to-date (YTD) loss to -41.55%. The CF DeFi Composite Index followed, rising 8.27% and slightly reducing its YTD decline to -49.03%. Meanwhile, the CF Digital Culture Composite Index climbed 7.96%, though it remains the worst performer YTD at -56.38%. While these gains mark a positive shift, the deep cumulative losses across all three indices continue to highlight lingering investor caution around small-cap and thematic crypto segments. Broader risk appetite appears to be returning but remains selective.

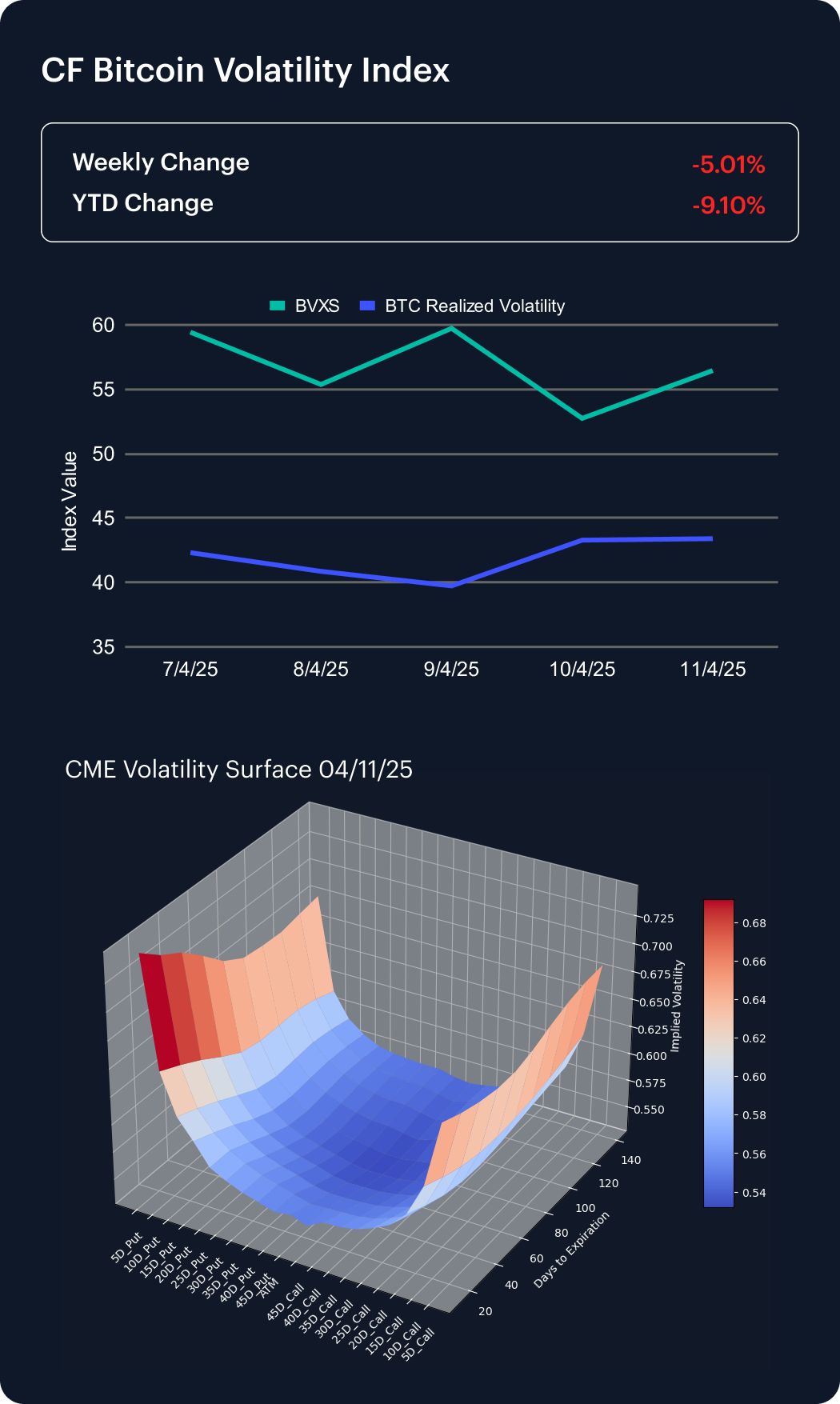

Volatility Analysis

The CF Bitcoin Volatility Index Settlement Rate (BVXS) declined 5.01% over the past week, settling at 56.45 and signaling a softening in implied volatility. Year-to-date, the index has fallen 9.10%, pointing to a broader decline in long-term volatility expectations. Realized volatility remained relatively steady, edging up from 42.31 to 43.40, indicating slight increases in short-term price swings.

According to CME Bitcoin Volatility Surface data, skew levels at the 10, 15, 20, and 25 delta points remain negative, reflecting continued demand for downside protection. However, skew did shift modestly more positive over the week, hinting at a slight easing in bearish sentiment. This suggests investors remain cautious, yet are growing less defensive as crypto volatility indicators begin to stabilize.

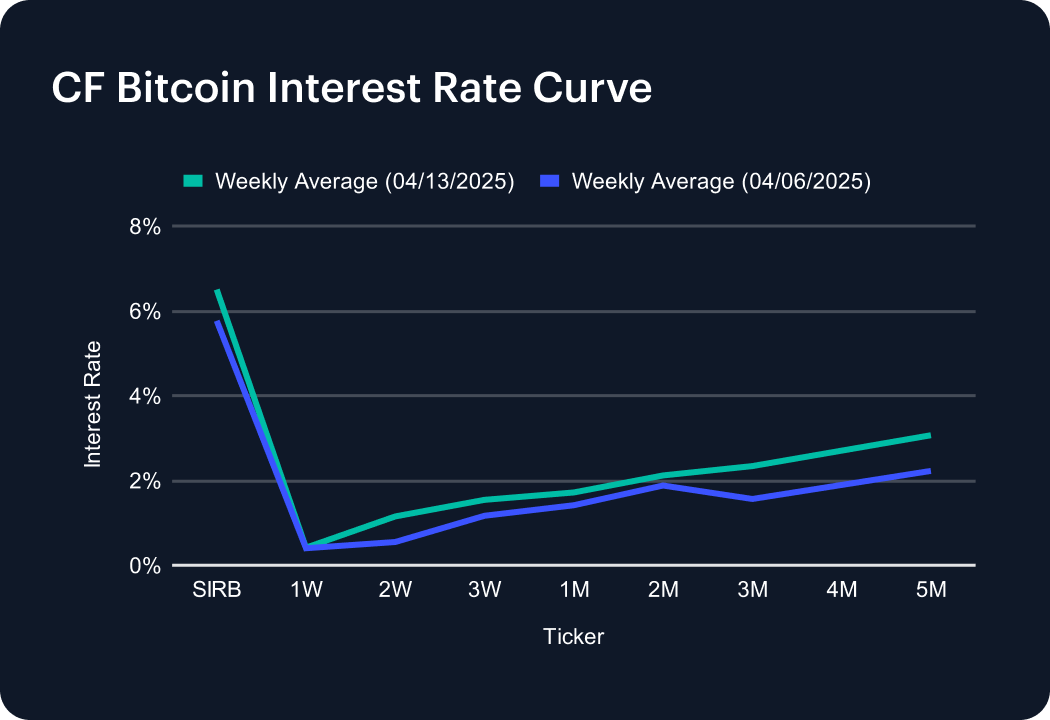

Interest Rate Analysis

The CF Bitcoin Interest Rate Curve shifted higher across all maturities this past week, led by notable gains in medium-term borrowing costs. The Short-Term Interest Rate Benchmark (SIRB) rose to 6.50% from 5.77%, indicating renewed demand for near-term liquidity. Short-dated tenors moved up modestly, with the 1-week rate at 0.41%, the 2-week at 1.15%, and the 3-week at 1.54%. Medium-term rates saw sharper increases—4-month and 5-month tenors climbed to 2.70% and 3.07%, respectively. The broad upward shift in the curve suggests rising demand for longer-term positioning, even as funding costs tick higher across durations, pointing to improving appetite for leverage and extended exposure.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.