The ‘Tricks’ behind a week of crypto ETF ‘Treats’

We tally the key crypto listings of the week, how they bypassed the hiatus, which funds are still waiting in the wings, and what these developments signal about the next wave of crypto ETF listings on Wall Street.

Bitwise’s BSOL staking ETF stands out in a week of sudden progression for regulated products

Surprising for some

The spate of U.S. digital asset ETF launches that emerged this week – a surprise for less attentive observers, given Washington’s ongoing administrative shutdown – is worth a closer look.

Here, we offer a tally of the key listings, how they bypassed the hiatus, which funds are still waiting in the wings, and what these developments likely signal about the next wave of crypto ETF listings on Wall Street.

GLS in Effect

What caught many market watchers off‐guard is that several products moved forward amid a partial U.S. government shutdown, during which SEC staff were largely furloughed.

For the SEC though, the government’s increasingly frequent impasses are set to have less of an impact on the process of certain securities approvals than they did in the past.

That’s chiefly because of the SEC enacting, in September, Generic Listing Standards (GLS) for commodity‐based trust shares (which include many spot‐crypto ETPs). Exchanges can now list qualifying crypto ETPs under a faster process rather than via the bespoke 19b‑4 filings of yore.

What is ‘Operation-of-Law’?

But that’s not all. Some of the new light-footed choreography by both regulator and regulated comes down to the vastly more accommodative regulatory atmosphere fostered by the Commission leadership installed under the administration that arrived in January.

Simultaneously, some issuers deployed the statutory “Operation‑of‑Law” route under Section 8(a) of the Securities Act of 1933. By this means, once a registration statement’s delaying amendment is withdrawn, and the required waiting period expires, the filing becomes effective unless the SEC issues a stop‐order.

In effect: approval can be triggered by silence. The shutdown meant fewer staff to push stop‐orders or force amendments, so some issuers capitalized.

This appears to be the strategy deployed by Canary Capital Group (for their HBR, LTCC ETFs) — using the same playbook as REX Osprey, which listed a raft of CF Benchmarks-powered ’40 Act funds over the summer.

Click below to read more about these.

Bitwise’s SOL Staking ETF stands out

Amid this week’s crypto ETP action, the Bitwise Solana Staking ETF (NYSE: BSOL) is the most significant milestone for several reasons.

- First U.S.-listed fully staking‑enabled Solana (SOL) ETF

- Targets 100% staking participation via institutional‑grade staking services (Bitwise OnChain Solutions in partnership with Helius Technologies)

- Solana price benchmark: the regulated CME CF Solana‑Dollar Reference Rate – New York Variant (SOLUSD_NY) from CF Benchmarks, the leading UK FCA authorized Benchmark Administrator, and world’s largest crypto index provider

- First live deployment of staking mechanics by a ’33 Act fund: SOL tokens are held in cold‑storage institutional custody; rewards are credited daily and reinvested into the fund via increasing the entitlement per unit; a “staking service fee” is charged and remaining rewards passed to investors

Click below to read more about the launch of Bitwise’s Solana Staking ETF (BSOL)

Grayscale “first’ evaporates

Grayscale Investments’ Solana ETF, ticker: GSOL, a conversion of its prior OTC Trust, saw its own listing on NYSE Arca, on October 29th. Grayscale, weeks before the listing was active, publicly claimed to be providing the first staking‐enabled Solana ETF.

For what it’s worth – and experience informs us that first-mover status can be worth a lot in terms of asset-gathering – the “first” staking‑Solana‑ETF label was effectively claimed by BSOL.

What to watch next

The slate of crypto ETF filings remains the most jam-packed it’s been at any time since the SEC began to permission such products. Many of these applications are at an advanced stage, suggesting they may list imminently (particularly those approaching the SEC’s now actively facilitated administrative cut-offs).

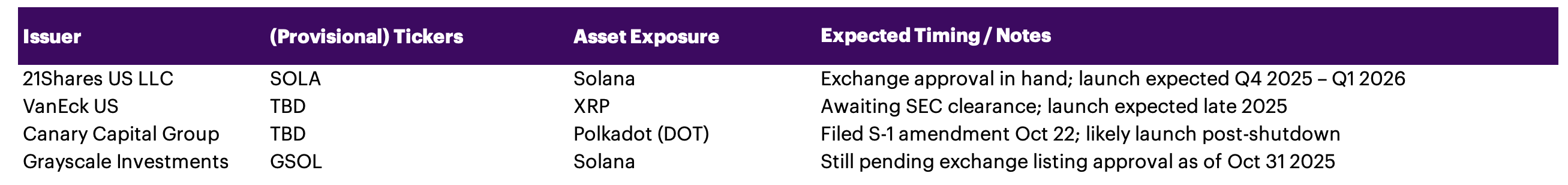

The profile emerging from a cursory scan of how the paperwork looked at the time of publication is summarized below.

- The backlog: estimates suggest ~90+ crypto‑ETPs are awaiting approval, giving clear runway for a second wave

- Solana: multiple applications still pending (estimated eight filings)

- XRP: seven ETF applications in the queue

- Issuers like 21Shares, VanEck, Canary Capital and others have recently amended S‑1s or filed 8‑A forms for listing‐ready positions

Further details are available in the table below – which does not purport to be an exhaustive list.

‘No Tricks’ takeaway: BSOL, CF Benchmarks in focus

As staking‑enabled altcoin ETFs unequivocally take root in the regulated crypto product landscape, pricing mechanisms for assets on a ‘standalone’ basis are as important as ever, with institutional investors requiring proven, failsafe assurances of accuracy, representativeness, and benchmark integrity.

For BSOL – referencing CF Benchmarks’ SOLUSD_NY – which this week kicked-off the era of staking ETFs proper, investors can track performance against the most trustable and most liquid external SOL reference methodology.

As more staking funds come to market, it is likely that those ETFs using proven providers, like BSOL – which gathered inflows of $153 million in its first two days of trading – will enjoy a greater implied tailwind of liquidity, governance, and trust, as competition for assets heats up.

Explore more

CME CF Solana-Dollar Reference Rate - New York Variant

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.