The CFB index behind BlackRock’s Bitcoin Private Trust

The availability of a choice of bitcoin indices published by CF Benchmarks, a tried and tested (and regulated) cryptocurrency Benchmark Administrator, undoubtedly helped give BlackRock the confidence to begin offering spot bitcoin exposure to institutional clients.

We explain why the CF Bitcoin NY TWAP's robust and GAAP-aligned methodology make it the best possible reference price for BlackRock's Bitcoin Private Trust, and an example of how high-quality services give major institutions the confidence to adopt crypto

Crypto adoption pre- and post-FTX

The latest implosion of a major crypto counterparty is roiling markets and once again stoking doubts about the investibility of the asset class and stability of the industry.

Still, it’s worth keeping in mind that the momentum of established institutions entering the digital asset space has only moderated slightly since the initial price downturn and industry turmoil began.

Fidelity Digital Assets’ (FDA) latest annual survey of institutional investors showed that whilst adoption slowed this year in the U.S. and Europe, it still rose by 9, and 11 percentage points respectively, to 42% and 67%. Meanwhile, despite a 3-point fall to 60%, Asia remained the region with the highest existing “adoption and perception” of digital assets.

These trends makes sense on an historic basis: if an asset class is generally regarded as viable, despite volatility, institutions don’t tend to flinch from investment during troubled times.

Incentive #1: regulatory clarity

Furthermore, as CF Benchmarks CEO Sui Chung pointed out earlier this week, the impact of crypto industry missteps like the FTX debacle could well accelerate the development of crypto-specific regulations that remove what institutional investors have indicated is a key barrier to entry: regulatory uncertainty.

Meanwhile, institutional attitudes to cryptoassets seem to be following a similar pattern, in general, to that seen for other risky assets that were once novel before eventually becoming ubiquitous (‘tech stocks’ seem a fair comparison).

Traditional institutions large and small have continued to steadily stream into the cryptoasset industry over the last several months, with Nasdaq, BNY Mellon, Citadel, JPMorgan and Fidelity itself among firms rolling out or extending crypto related products and services.

The pace may slow in the wake of FTX’s collapse, but it’s implausible to expect adoption to grind to a halt.

Incentive #2: quality ancillaries

Either way, because such institutions guard their reputation for market integrity, transparency and investor protection jealously, they continue to require the most watertight operational components available to ensure adherence to existing regulatory standards.

That’s proven to be the case for one of the largest institutions offering direct crypto exposure to institutional clients for the first time, BlackRock, with the launch of BlackRock Bitcoin Private Trust in August.

The availability of a choice of bitcoin indices published by CF Benchmarks, a tried and tested (and regulated) cryptocurrency Benchmark Administrator, undoubtedly helped give BlackRock the confidence to begin offering spot bitcoin exposure to institutional clients.

CF Bitcoin NY TWAP powers BlackRock Bitcoin Private Trust

It was from among these that BlackRock selected CF Benchmarks' CF Bitcoin NY TWAP, for calculating the NAV of BlackRock Bitcoin Private Trust.

The index is a once-a-day benchmark price of Bitcoin denominated in U.S. dollars, published at 16:00 New York time—synchronizing with the traditional U.S. market close.

As its name suggests, the index is in essence, a Time Weighted Average Price (TWAP) of the CME CF Bitcoin Reference Rate - New York Variant (BRRNY), but it is worth noting the calculation of CF Bitcoin NY TWAP applies additional refinements to the classical TWAP formula.

CF Bitcoin NY TWAP calculation details can be found on page 6 of its Methodology Guide.

The same CFB integrity by design

Most importantly, as a CF Benchmarks index, CF Bitcoin NY TWAP is subject to the same incorruptible, transparent standards and methodology that all CFB pricing sources are subject to, in order to promote the highest standards of market integrity, reliability and accuracy.

As the Methodology Guide shows, its calculation is “based on the Relevant Transactions of all Constituent Exchanges” that contribute to the index (page 5).

Those familiar with CFB’s Benchmark Methodology will know how integral Constituent Exchanges are to our anti-manipulation and pro-integrity safeguards.

In turn, a set of rules-based CF Constituent Exchange Criteria prescribe the highest possible standards for cryptocurrency exchange eligibility as the first line of defence for all indices published by CF Benchmarks.

Why CF Bitcoin TWAP?

To begin with, since the basic TWAP formula optimizes a trade’s average price while executing over a specified time period, it’s a given that TWAP strategies (usually algorithmically executed) are often utilized as an additional measure to minimize adverse price impacts (from the investor’s point of view) from working a large order in the open market.

Additionally, as the CF Bitcoin NY TWAP Index Page indicates, CF Bitcoin TWAP was also designed to help institutions resolve challenges related to GAAP conformance.

Detailing these challenges could extend the length of this article undesirably. As an alternative, anyone interested can read this succinct analysis by experts at PKF O’Connor, an accountancy firm, and XBTO, a specialist in commercial crypto-collateralized loans.

In thumbnail form, we can say funds investing in cryptoassets can encounter NAV calculation challenges not faced by funds investing in traditional assets.

The CF Bitcoin NY TWAP utilizes a TWAP strategy aligned with commonly deployed GAAP-compliant investment management practices, to ensure NAV calculation occurs at prices approximating as closely as possible to trade execution prices.

Any side effects?

Perhaps the most on-point question is whether an investment fund’s use of CF Bitcoin NY TWAP - in itself - could bring material differences in investment outcomes for investors, compared to investors in a fund using BRRNY.

Well, to begin with, given an understanding of TWAP mathematics, it should be clear that calculation of TWAP is irrelevant for price volatility.

And, in practice, it’s been observed that TWAPs generally demonstrate negligible-to-immaterial deviation from underlying prices, particularly on a long-term historical basis.

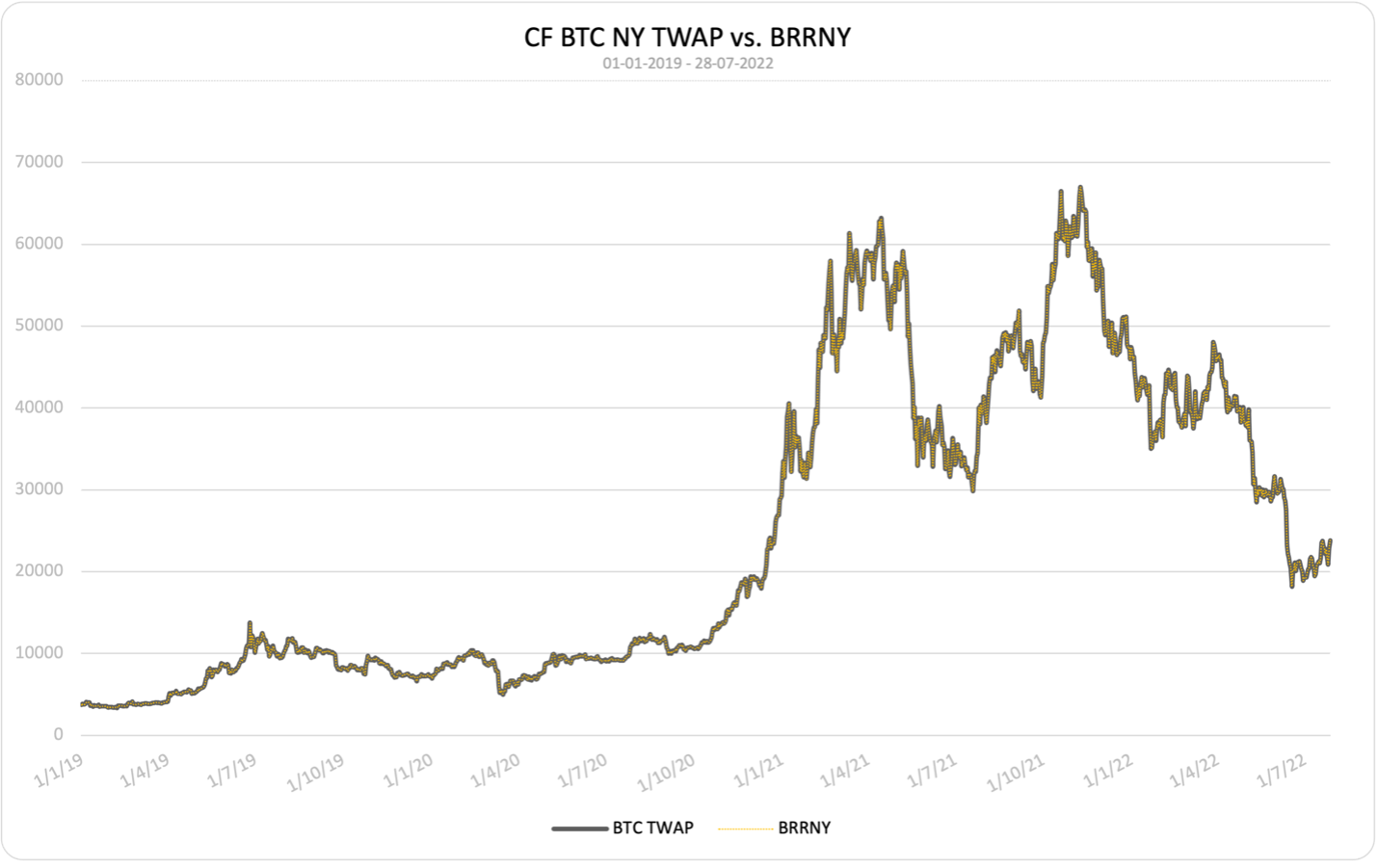

Data that currently exists for CF Bitcoin NY TWAP adheres to that observed norm – as illustrated below.

Tried and tested

For a ‘face value’ test, we can simply plot CF Bitcoin NY TWAP against CME CF Bitcoin Reference Rate - New York Variant, per below.

(Note the chart shows around two years and eight months of prices in both series preceding the announcement of BlackRock Private Bitcoin Trust.)

For a more precise determination of the ‘similarity’ of the two series, we can subject the same data to a t Test, with a null hypothesis (H0) that there is statistically significant deviation between the two series.

(In all honesty, this exercise is not particularly necessary to make the point, but for the sake of argument, we’ll do it anyway!)

The results of the analysis are summarised below.

Averages

| BTC TWAP | BRRNY | |

|---|---|---|

| Average | 23990.115 |

23990.85 |

t Test results

| Calculation | Outcome |

|---|---|

| t Stat | -0.00102 |

| p (two-tail) | 0.99919 |

| Alpha | α=0.005 |

| Source: CF Benchmarks |

The observed difference between the two series is vanishingly small, as expected. This strongly suggests no effect on investment outcomes relative to BRRNY, solely from use of CF BTC NY TWAP.

Summing up

- In summary, we’ve demonstrated that CF Bitcoin NY TWAP is possessed of the same qualities of market integrity, reliability, accuracy and transparency as its ‘underlying’ bitcoin price index, CME CF Bitcoin Reference Price – New York Variant

- Moreover, CF Bitcoin NY TWAP has the additional benefit of being closely aligned with commonly deployed GAAP-conformant investment practices, making it the ideal bitcoin reference price for a fund aiming to be GAAP compliant

- BlackRock’s decision to opt for CF Bitcoin NY TWAP to calculate the NAV of its BlackRock Private Bitcoin Trust looks even more cogent with these qualities in mind

Onwards

Meanwhile, the largest asset manager in the world is offering spot bitcoin exposure to institutional clients for the first time, underpinned by CF Bitcoin NY TWAP.

This spotlights the types of high-quality services that trusted and regulated institutions require in order order to provide exposure to digital assets with confidence.

Find out more about our suite of bitcoin reference indices by clicking the links below.

CME CF Bitcoin Reference Rate - New York Variant (BRRNY)

CME CF Bitcoin Reference Rate (BRR)

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.