Tariff Tensions & Stagflation Signals Spark Sell-off

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Key takeaways for the month

- Macro Uncertainty Dampens Hopes: Digital assets continued to selloff amid escalating U.S. tariff tensions and weaker-than-expected macroeconomic data. Bitcoin ETFs recorded over $1.5bn billion in sustained outflows, reflecting waning investor confidence. The Federal Reserve held rates steady but revised its growth forecast downward and inflation expectations upward in its latest Summary of Economic Projections. Broader risk-off sentiment, paired with stagflation concerns, intensified volatility across cryptocurrencies, with altcoins and Ethereum ETFs also experiencing notable declines in capital inflows and price performance.

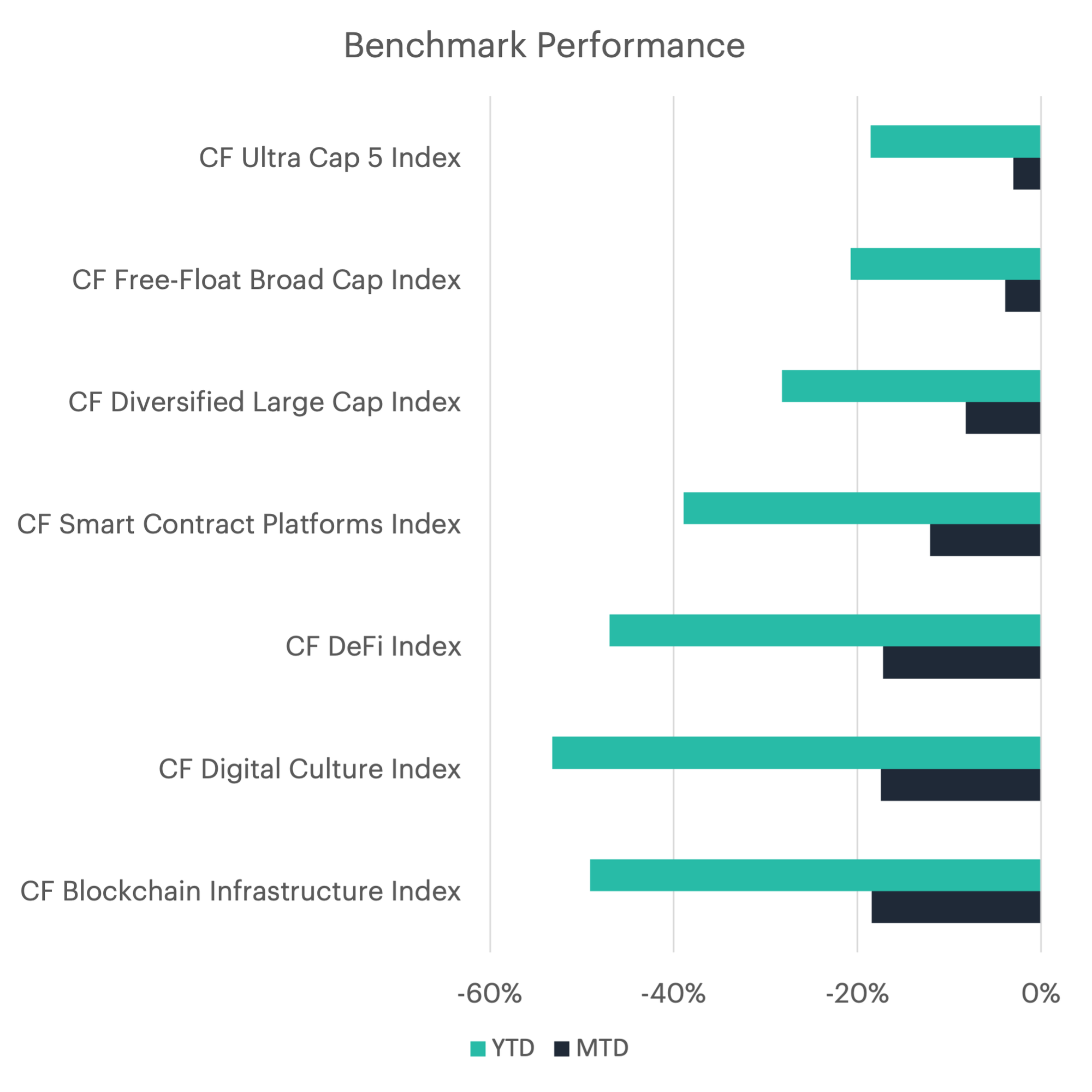

- Flight to Quality Helps Mega-Caps: Our CF Ultra Cap 5 Index led relative performance with a more modest decline of 3.02%, followed by the CF Free-Float Broad Cap Index at 3.88% and the CF Diversified Large Cap Index at 8.21%. In contrast, sector-specific indices posted steeper losses, with the CF DeFi Index down 17.22%, CF Digital Culture Index off 17.45%, and CF Blockchain Infrastructure Index trailing at 18.46%. Amid the uncertainty surrounding trade policy, investors clearly fled to the relative safety of larger-cap cryptocurrencies, abandoning riskier bets as macro concerns dominated overall market sentiment.

- CRV, EOS, & SNX DeFi Downturn: Curve DAO led performance with an 11.5% gain, buoyed by unanimous approval of multiple crvUSD minting markets. EOS followed with 9.4%, supported by critical security patch releases. Synthetix gained 4.4% after launching its innovative SNX-backed sUSD minting pool. Fantom (-29.1%), Algorand (-23.6%), and Stacks (-27.0%) led declines amid broad market weakness. Stacks underperformed following a thwarted GitHub supply chain attack, while Fantom and Litecoin saw sharp sell-offs absent any offsetting positive catalysts.

- Funds Face $1.6 Billion Exodus: March marked the second consecutive month of outflows from digital asset funds, with investors redeeming approximately $1.6 billion. Bitcoin accounted for $641 million of the outflows, while Ethereum also saw $388 million in redemptions. From a regional perspective, fund outflows were again concentrated in North America, which experienced a net outflow of approximately $1.55 billion. Meanwhile, Europe continued to attract capital, recording inflows of around $169 million for the month.

- Bitcoin Futures Sentiment Turns Positive Despite Declining Open Interest: Net sentiment positioning in Bitcoin improved in March, with long positions outpacing shorts. As a result, net futures positioning on the CME rose to 94 contracts, up from -57. Total open interest in CME Ether futures declined slightly in March, falling 6.4% from the previous month. Meanwhile, open interest in Bitcoin futures continued its downward trend, ending the month with a modest 9.4% decrease.

- Bitcoin Mining Hash Rate Stabilizes While Difficulty Continues to Rise: Bitcoin’s average monthly hash rate was relatively unchanged in March, declining by just 0.2% to 640 exahashes per second. Mining difficulty—which measures the computational effort required to mine a new block and adjusts to maintain consistent block creation times—increased by 2.8% over the month. The next difficulty adjustment is expected in the first week of April and is currently trending toward a 3.1% increase.

- Bitcoin Mining Revenue Dips as Transaction Fees and On-Chain Activity Decline: Bitcoin miners saw a 1.3% decline in mining revenue in March. Of the total rewards earned during the month, 1.2% came from transaction fees—down slightly from 1.3% in February. The overall drop in revenue was driven by a combination of Bitcoin’s declining price and reduced on-chain activity.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.