Market Outlook: Q4 2024

As we approach year-end, digital assets are at a turning point. November’s elections could redefine regulation, while Ethereum's scaling solutions promise to revolutionize finance. Asset tokenization and decentralized networks stand ready to disrupt existing systems. A transformative year beckons.

To access the full report, click here

Recalibrating for the New Monetary Cycle

Our market outlook for digital assets anticipates continued influence from macroeconomic shifts and technological progress. We view the growing appetite for Bitcoin and Ether ETFs as a tipping point, positioning them as integral pieces of diversified portfolios. On the macro front, subsiding inflation and rate cuts are likely to support increased asset valuation and investor sentiment. We expect November's election to provide more clarity on industry regulation, ultimately creating both opportunities and challenges as a comprehensive framework eventually emerges. Technologically, Ethereum's Layer 2 solutions are revolutionizing transaction capabilities, cementing its leadership in DeFi and stablecoin markets.

Market Summary:

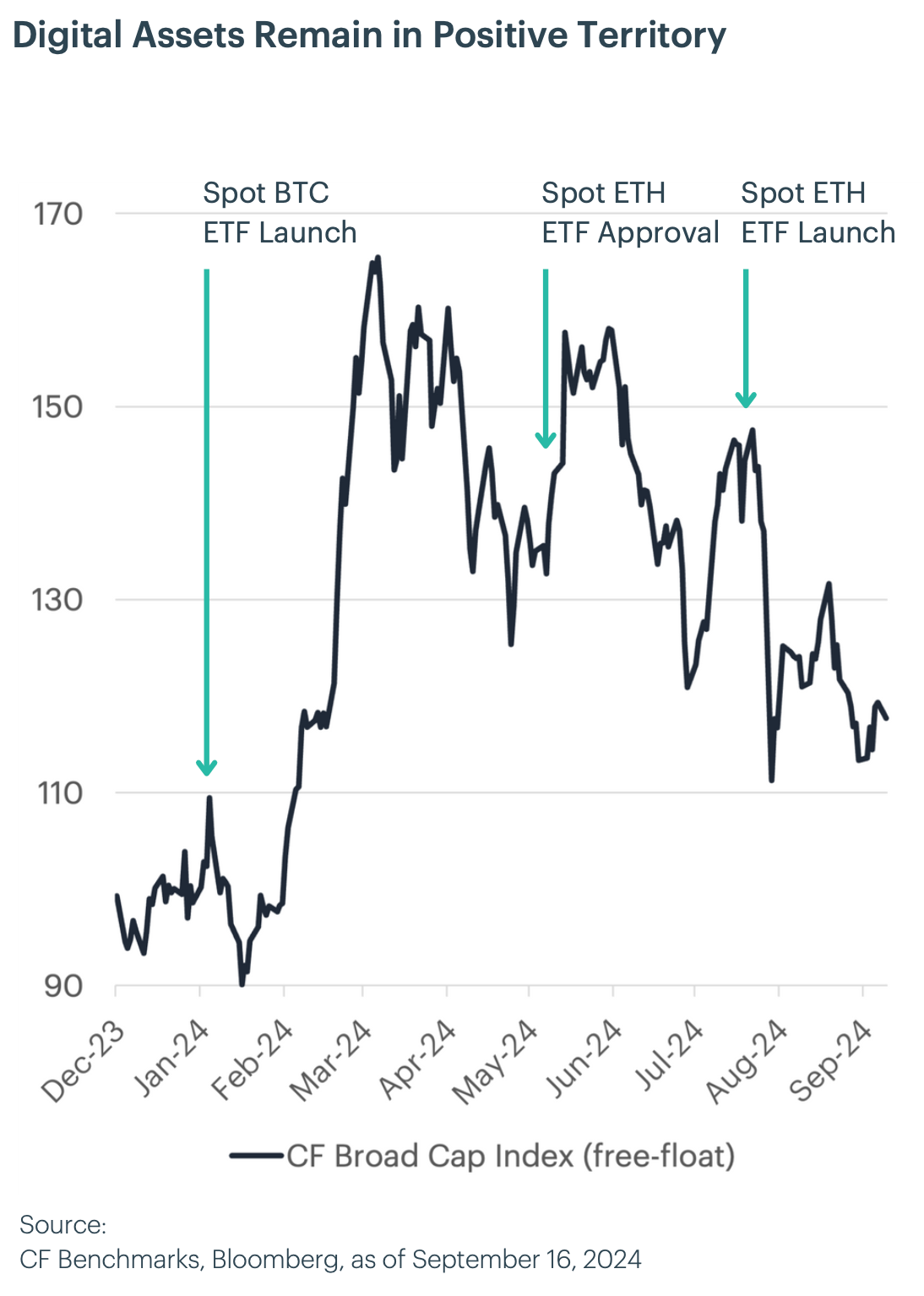

Digital assets have shown resilience and growth in 2024, marked by significant institutional adoption milestones. The launch of spot Bitcoin and Ether ETFs in the US has attracted substantial inflows, signaling mainstream acceptance. Macroeconomic factors, including inflation and interest rate changes, have influenced the market. The upcoming US elections and potential regulatory changes are drawing attention, with digital assets gaining advocates across the political spectrum.

Macro Backdrop:

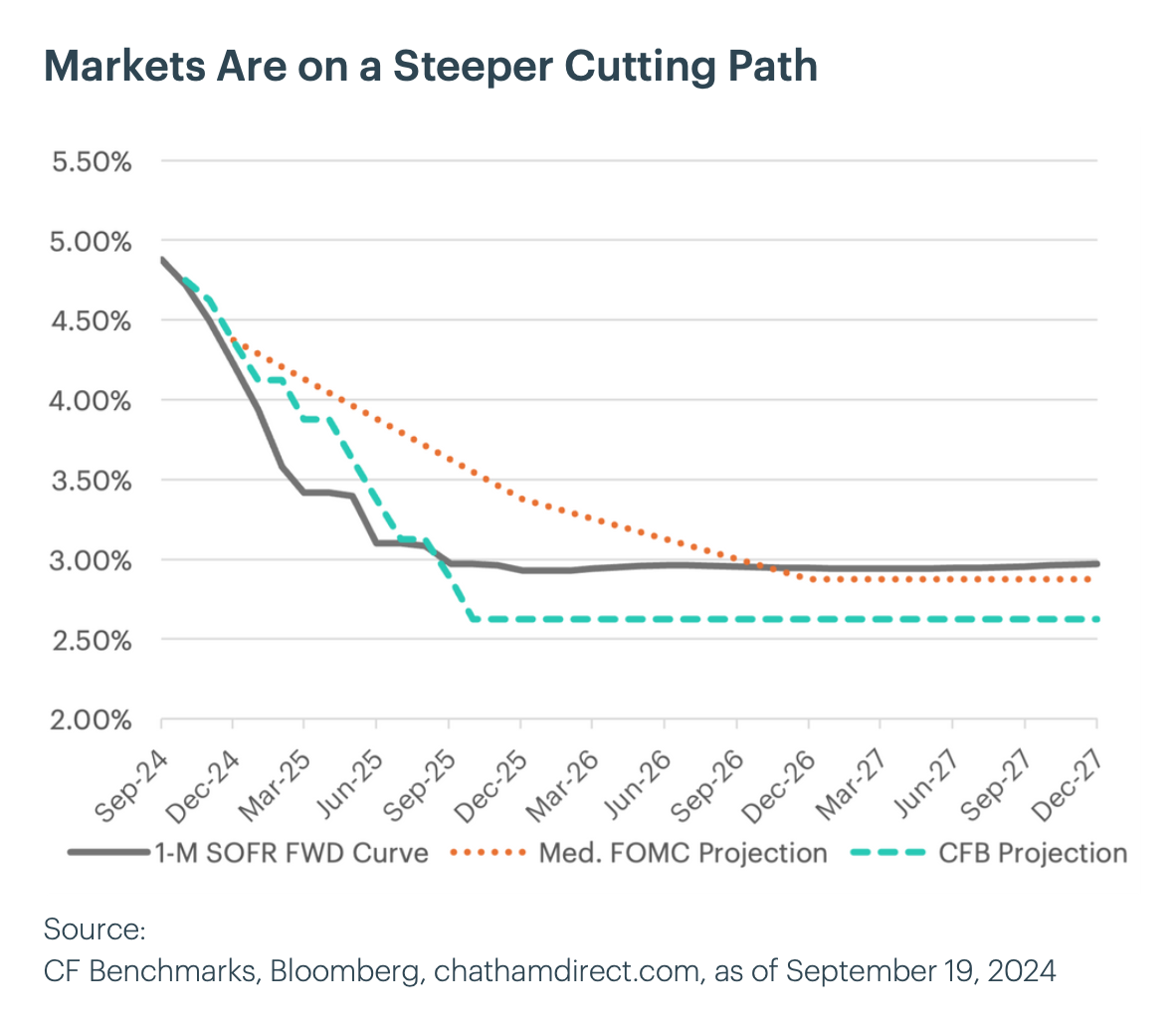

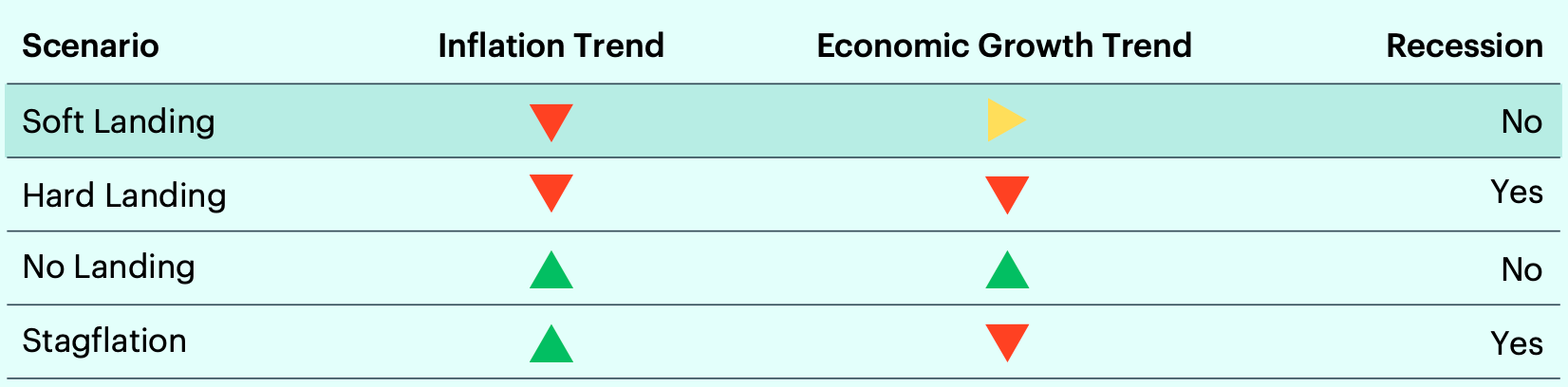

The Federal Reserve has begun cutting interest rates, with markets pricing in a more aggressive trajectory than official guidance. Global growth is projected to stabilize, with recession probabilities lower than at the start of the year. The US presidential election is too close to call, but regardless of outcome, it's seen as an opportunity for a more favorable regime change for the digital asset industry. Regulatory evolution is expected to be a critical inflection point for the sector. Furthermore, we are still anticipating a “soft landing” as our most probable outcome, with the scenarios and risks outlined below.

Secular Themes:

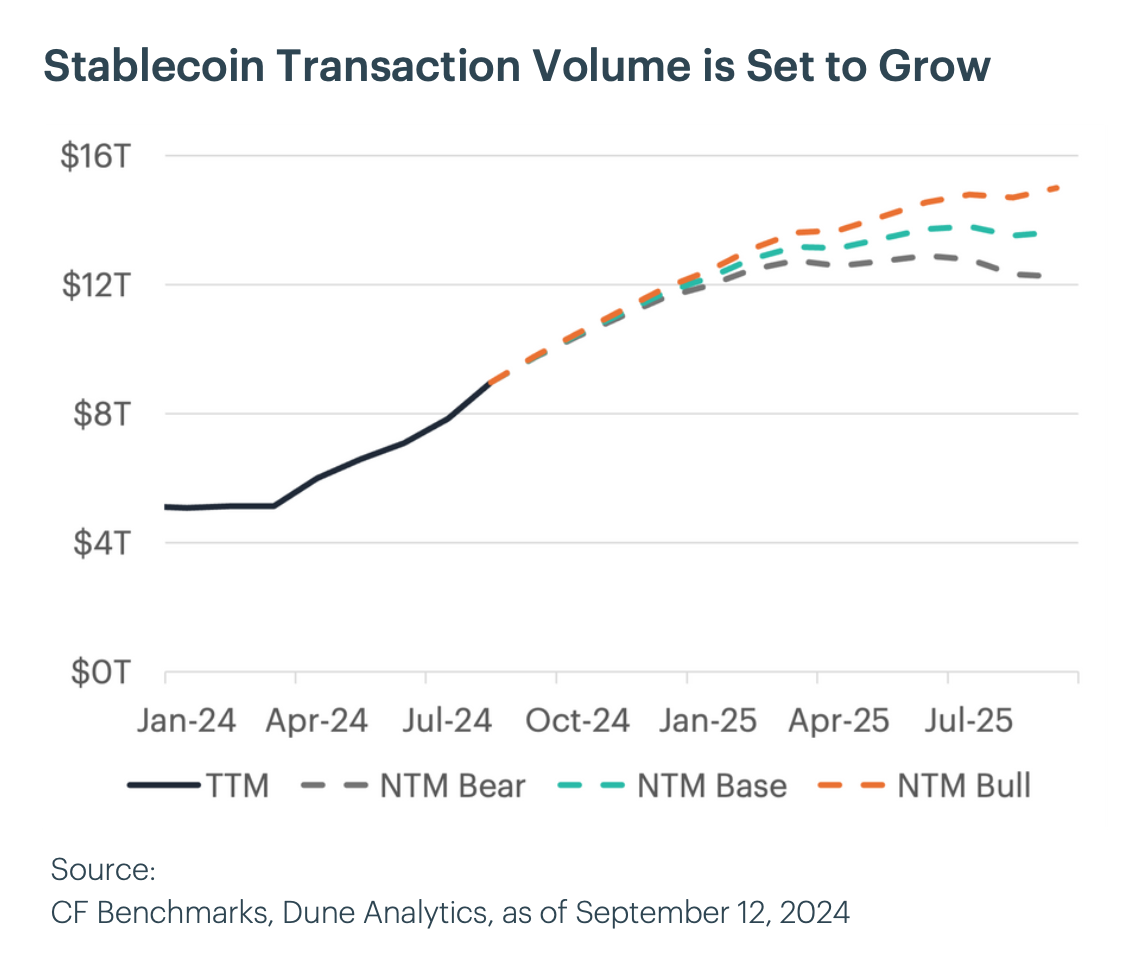

Ethereum's Layer 2 solutions are gaining traction, enhancing scalability while maintaining security and decentralization. Stablecoin adoption on Ethereum is growing rapidly, with the network processing nearly 40% of credit card network volumes. Asset tokenization is expanding beyond money market funds, potentially revolutionizing traditional finance. Decentralized Physical Infrastructure Networks (DePINs) are emerging as cost-effective alternatives to traditional cloud computing, particularly for GPU-intensive tasks like AI.

Asset Class Overview & Forecasts:

Analysts project positive returns across global equities, with Asian markets showing the highest expected gains. Interest rates are expected to decline in most major economies. Commodities show a mixed outlook. Currency forecasts suggest subtle shifts in global economic dynamics. GDP growth forecasts highlight divergent economic trajectories, with China maintaining higher growth and the US expected to moderate below trend.

To read the our full market outlook report, please click here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.