ProShares’ Bitcoin ETF launch volumes crush expectations

With around $1bn in day-one volume, BITO approached the turnover dollar value of some of the most popular ETF launches ever

Investors cast aside futures fears and piled into the first U.S. Bitcoin ETF in near-record volumes

There's little doubt that the debut session of the first U.S. Bitcoin ETF, ProShares’ Bitcoin Strategy ETF (NYSE: BITO), was ‘well above average’.

With large swathes of Wall Street continuing to reserve judgement on crypto, and the launch ranking as one of the biggest tests of investor appetite for the cryptoasset class since Coinbase’s IPO in April, that’s an important judgement to reach.

What’s more, opinion on the merits of the ETF as a solution for greater accessibility to BTC—both within the institutional cryptoasset investment community and more broadly—was mixed in the run up. Misgivings about the shortcomings of futures-based investment products have also been widely aired. Whilst BITO invests in CME Bitcoin Futures that settle to the regulated CME CF Bitcoin Reference Rate (BRR), disappointment over the SEC’s preference for Bitcoin futures ETFs, has pivoted on inherent limitations of futures investment strategies—chiefly roll costs and contango.

Well, whilst a solid market debut doesn’t negate such concerns, it does provide a good answer to the question of how much aversion they exerted on a market that’s frequently evinced clear signs of crypto FOMO this year. For now, at least, the answer seems to be ‘not much’.

With a comfortably positive close and well over 20 million in first-day trading volume, BITO can certainly be said to have attracted more than ‘passing traffic’. At around $1bn in day-one volume, BITO approached the turnover dollar value of some of the most popular ETF launches ever, according to Markets Insider, which cited Bloomberg data.

Comparisons to routine ETF volumes are problematic given the first-day nature of the event, plus the lack of true market peers. The closest comparable assets may be the tranche of BTC ETFs launched in Canada earlier this year, though strictly speaking, their basis in spot Bitcoin should disqualify them. Furthermore, the dominance of U.S. financial markets is well represented in North American average trading volumes across the board.

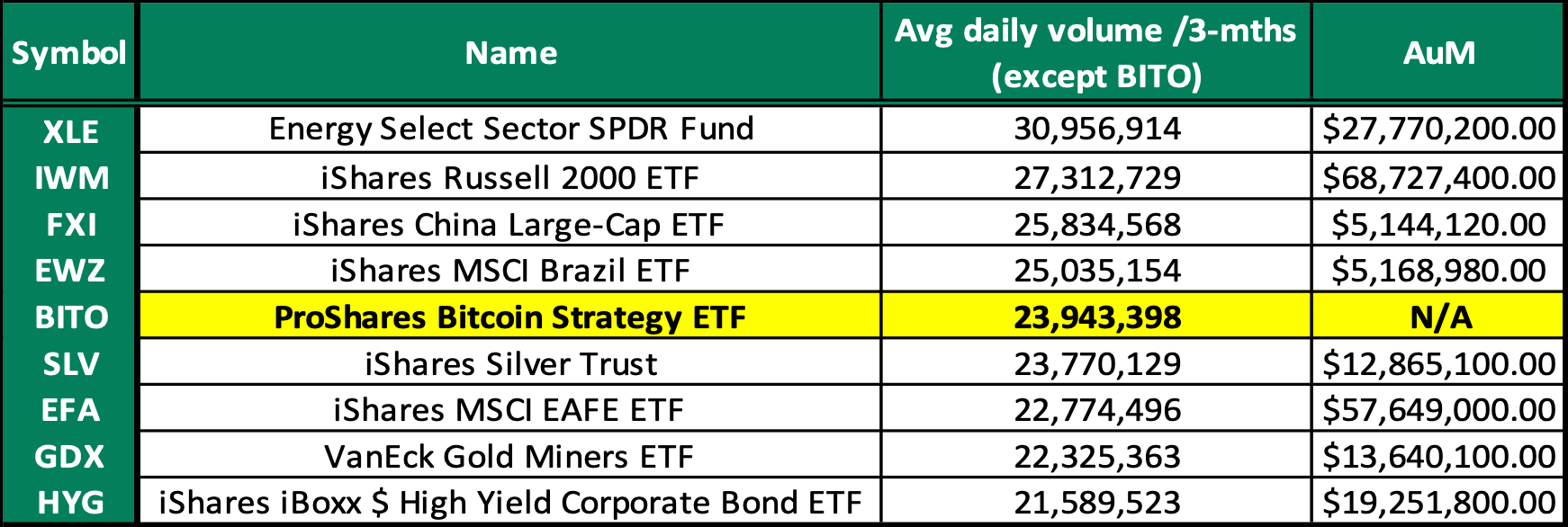

Still, a comparison of BITO’s first day volume to well-established equity sector ETFs with broadly similar average daily trading volumes (20-to-30 million shares) is thought provoking.

Figure 1 – BITO day-one volume vs. ETFs with average daily volume of 20–30 million shares per day

Meanwhile, BITO’s first official AuM disclosure will be instructive. Note that the ETF launched with seed capital of approximately $20m and reported net assets (including cash) of some $571m by the close of business on Tuesday.

On the basis of its first-day gross performance alone, it’s reasonable to conclude that initial investors in BITO have been comfortable with its value proposition as a means to gain exposure to BTC. That’s very probably due to a range of factors, including the familiarity, convenience and highly regulated nature of the ETF wrapper, as well as trust in the ProShares brand.

Extrapolating the value to investors of the end-to-end regulated nature of the CME Bitcoin Futures market—of which the BRR is an integral component—is less straightforward, though there’s abundant evidence that institutional participants demonstrate a clear preference for regulated Bitcoin futures venues vs. unregulated ones.

That characteristic bodes well for ProShares’ decision to deploy the BRR’s sister index, CF Bitcoin-Dollar US Settlement Price as Bitcoin Strategy ETF’s Performance Index. CF Bitcoin US differs from BRR solely in that it uses the BTC price calculated according to CF Benchmarks’ Benchmark Methodology at 4:00 PM EST, instead of the price at 4:00 PM London Time, per BRR. This makes CF Bitcoin-Dollar US Settlement Price the only regulated settlement price of Bitcoin for traditional U.S. market hours, and just like BRR, it’s backed by published research demonstrating its market integrity.

All told, the first U.S. Bitcoin ETF has shown evident first-day momentum on several key fronts and ticks the right boxes for continued institutional support.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.