Not quite a crypto cliff-hanger

Though a clear election end point may still be days away, as votes continue to be counted, wrangled over, and possibly even argued over in court, it’s clear that stocks and other risky assets—including crypto—are taking cues from clear probabilities and a handful of certainties in the bag so far.

Crypto markets are moving swiftly on

The fraught U.S. election still looks more like a cliff-hanger than a clean sweep, though a few market truisms appear to be applying to crypto in full effect.

- First and foremost, cryptocurrencies are maintaining the strong correlation with mainstream ‘risk assets’ that’s been in evidence for most of the year

- Secondly, yes markets prefer certainty to uncertainty and much uncertainty remains, but the preference should be seen in the round. Hint: it doesn’t just apply to the overall election result

- Leading on from the ‘uncertainty principle’, the next point to remember is that like it or not, if corporate America is a top priority for mainstream markets, by extension, the likely policy impact on U.S. businesses from the election is also a priority for major crypto markets too

Crypto is ‘risky assets’ too

On those bases, though a clear election end point may still be days away, as votes continue to be counted, wrangled over, and possibly even argued over in court, it’s clear that stocks and other risky assets—including crypto—are taking cues from clear probabilities and a handful of certainties in the bag so far.

- Senator Joe Biden’s electoral college vote vs. President Donald Trump’s stands at 238/213. That outcome has failed to live up to strongly optimistic hopes projected by Democrats of a ‘blue wave’

- Republicans are strongly indicated to maintain Senate majority control after winning the count for the upper house 53/47. A swifter resolution of stimulus talks—even if the size of the pandemic-related package remains uncertain—now looks to be on the cards. A GOP Senate win would also read-across to reduced chances that the Dems can trigger a much-dreaded rise in corporate taxation. Consequently, stock markets have rallied throughout the day

- On the policy and regulation front, from the specific perspective of the digital asset class, this election has been all but irrelevant. Only a handful of notable candidates made crypto-related comments, let-alone run on tickets that were in any way crypto-aware. So, the policy outlook is largely neutral for crypto regardless of who win

Known knowns and known unknowns

The above said, as this article went online live, voting trends were trimming the lack of clarity to an extent. Senator Joe Biden had notched up more votes than any other Presidential candidate in history, even if the path to an electoral college victory was more ambivalent.

He had also won the critical swing state of Wisconsin, though the President held four other swing states to Biden’s 3 swing wins. Even more speculatively, signs have been emerging that—not for the first time in recent history—Wall Street is beginning to veer away from its traditional Republican bias, implying that the controversies of Trump’s Presidency are taking a toll.

Volume sentiment

During pivotal geopolitical events like the current one, we have found that trading volumes at Constituent Exchanges from which CF Benchmarks derives prices for its FCA-authorised benchmark crypto indices provide clear insights into market sentiment.

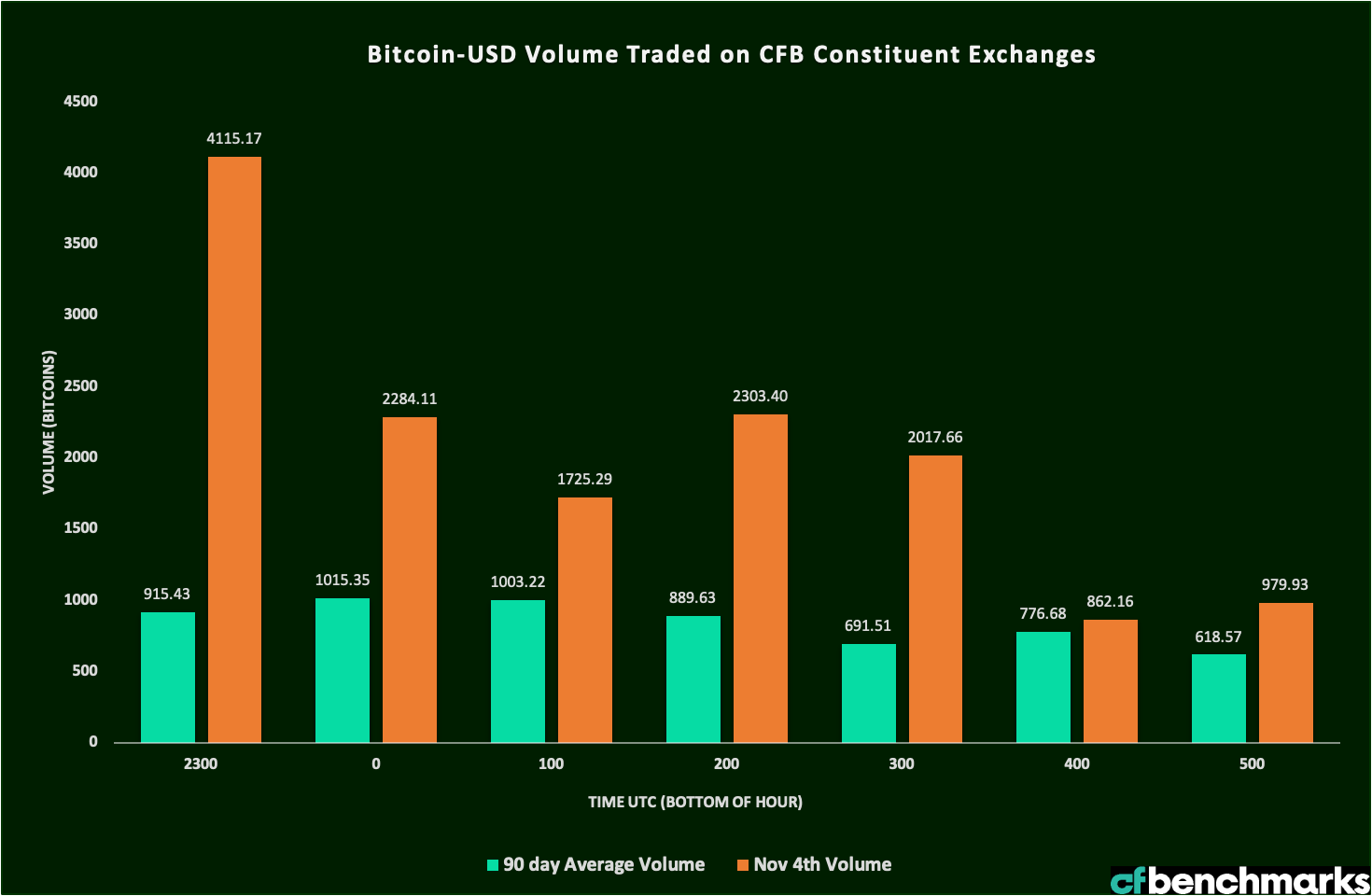

Charting volumes from late-night Tuesday UTC (when many large U.S. polling stations would close) through to the early hours of Wednesday, we can see (in Figure 1.) that the most remarkable volume in that time frame was during the trading hour of 23.00 UTC.

Figure 1. – BTC/USD volume from CF Benchmarks Constituent Exchanges - 23.00 UTC 03-11-2020 to 0500 UTC 04-11-2020 Source: CF Benchmarks

Source: CF Benchmarks

The surge in turnover was tantamount to 4.5 times the rolling 90-day average. It’s difficult to peg the jump to any clear cause. A barrage of tweets at that time from Donald Trump, perhaps? Or on the other side of the fence, possibly the emergence of news that there would be no quick, decisive win for the incumbent was the trigger. In any case, the expansion of turnover was not sustained in the hours that immediately followed.

Relatively steady volumes since the spike do not necessarily demonstrate that the crypto market has been less on tenterhooks than anyone else amid an election that remains too close to call approaching 24 hours since polls closed.

Suspense, but no crypto drama

However, the data also show that despite the suspense, crypto traders are neither particularly spooked nor particularly euphoric about the U.S. election so far. As we’ve seen, there are clear reasons to expect Bitcoin sentiment to remain unperturbed regardless of the eventual outcome. Crypto continues to track stock market relief that corporate America probably won’t face immediate challenges either way.

Note: The CME CF Bitcoin Real Time Rate (BRTI) is constituted of price data from 5 rigorously screened exchanges. The data are then subjected to multiple computations and tests to eliminate anomalies and potential manipulation before admitted to the index. The methodology is an obligation enforced by CF Benchmarks’ authorisation as an official Benchmark Administrator from the FCA. In other words, BRTI price and volume data really are standard benchmarks for crypto markets.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.