Vote of Confidence: Bitcoin Rallies on Election Shifts

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Key takeaways for the month

- Fund Flows and Futures Drive Bitcoin Higher: Investors continued to focus on the upcoming U.S. presidential election, with former President Trump now holding a double-digit lead over Vice President Harris in decentralized prediction markets, although polling data still shows a much tighter race. This political backdrop, along with expectations of a potentially more accommodative regulatory framework and increased government spending, has been perceived positively for Bitcoin and the digital asset industry, contributing to the highest fund inflows ($5.4 billion) since February's spot Bitcoin ETF launch. Meanwhile, record-high CME futures open interest helped drive Bitcoin near its all-time high.

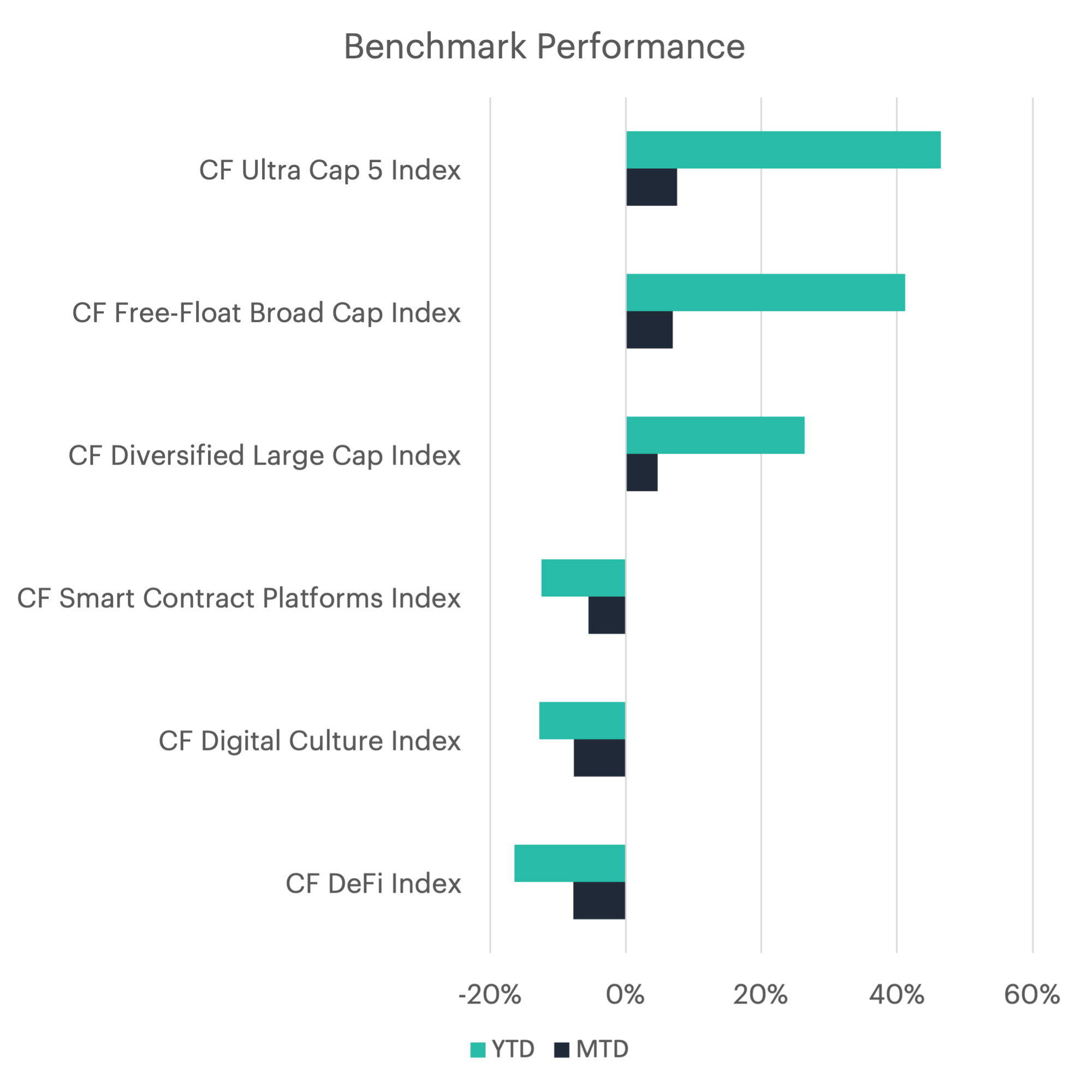

- Mixed Results Amid Narrow Market Breadth: Performance breadth remained narrow, with most asset pairs finishing the month in negative territory. The CF Ultra Cap 5 Index led, rising +7.55%, followed by the CF Free-Float Broad Cap Index at +6.90% and the CF Diversified Large Cap Index at +4.68%. Meanwhile, the CF Smart Contract Platforms Index declined -5.49%, while both the CF Digital Culture Index and CF DeFi Index saw similar losses of approximately -7.65% and -7.71% respectively, indicating notable underperformance in these areas of the cryptocurrency market.

- Meme Coins Lead While Smart Contract Platforms Lag: Dogecoin's DOGE token (+32.6%) and ApeCoin's APE token (+27.8%) were the top performers in October. DOGE surged on Musk-Trump campaign rumors, and APE rallied after a major cliff unlock of 15.6 million tokens, representing approximately 1.56% of total supply. Polygon's POL token (-20.9%) and Maker's MKR token (-19.9%) remained the worst performers. Both protocols experienced declining network activity, with notable drops in user engagement, transaction volume, and total deposit activity.

- Institutional Interest Continues to Strengthen: Bitcoin recorded its highest monthly fund flows since February's spot ETF launch, attracting $5.4 billion in inflows, while Ether recorded minor outflows of $35 million. Total open interest for CME Bitcoin futures grew 9.9% from the previous month, reaching new all-time highs, while Ether futures saw an 11.9% increase.

- Mining Revenue Tops $1B Post-Halving: An increase in both Bitcoin’s price and network fees contributed to a 25.6% growth in mining revenues in October. Of the miner rewards during the month, 4.6% came from fees, up from 1.7% in September. As on-chain activity rose in October, Bitcoin miners’ earnings exceeded $1 billion for the first time since the halving in April.

- Solana Fees Surge as Ethereum Cools: In October, total fees paid on the Solana network rose 256% from the previous month to $117.1 million. MEV accounted for approximately 69.3% of the total fees, reflecting high demand for block space and suggesting that competitive, value-extractive activities continue to drive network usage. Meanwhile, total fees paid on the Ethereum network decreased by 16.4% from the previous month to $103.2 million. The average fee per interaction with the network declined by 11%, indicating reduced competition for Ethereum’s limited block space.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.