Market Recap: Fed Pivot DeFi(es) Historically Weak September

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Key takeaways for the month:

- Fed's Rate Cut Sparks Crypto Rally: All eyes were on the Federal Reserve, effectively splitting the month into two periods. Initially, markets were cautious due to signs of a softening labor market and slowing growth, aligning with September's historically weak performance for digital assets. Optimism surged when the Fed cut the benchmark rate by 50 basis points to 4.75–5.0%, emphasizing their "maximum employment" mandate while inflation trends back towards their 2% goal. The Fed's median projections now indicate that policy rates could eventually fall below 3% to mitigate economic risks. Bucking typical seasonal weakness, large-cap tokens like Bitcoin and Ether closed significantly higher than their early September lows. The historically challenging month saw a rebound in investor sentiment in the face of changing monetary policy.

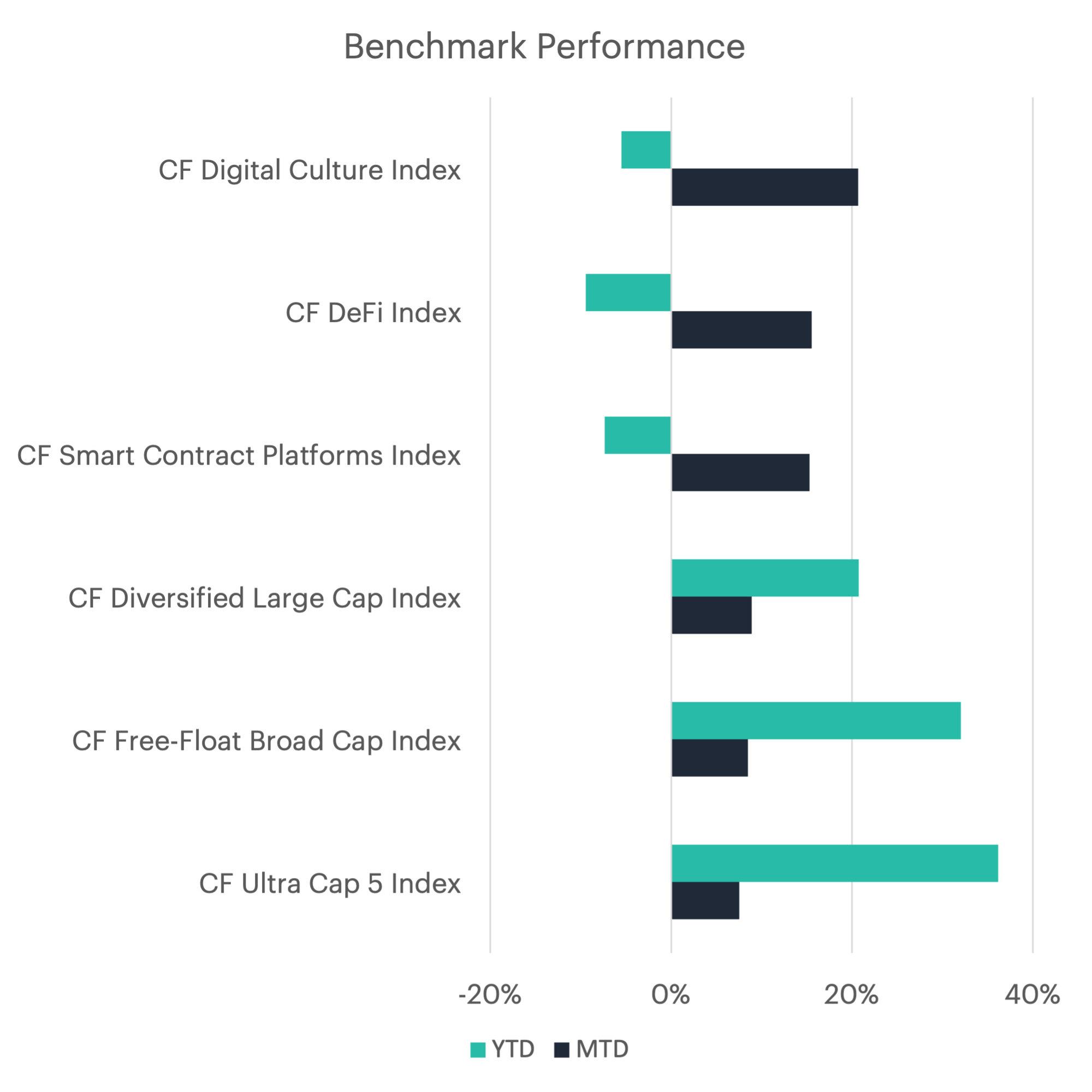

- Digital Culture Leads, Large Caps Lag: Our CF Digital Culture Index led performance, rising over 21.63%, and the CF Smart Contract Platforms Index followed closely, ending at 15.67%. Meanwhile, the CF Ultra Cap 5 Index and CF Free-Float Broad Cap Index lagged, finishing at 7.53% and 8.46%, respectively, indicating relatively slower price appreciation in large-cap cryptocurrencies.

- Fantom's Rebrand Fuels Surge: Fantom's FTM token (+67.6%) and ApeCoin's APE token (+28.8%) were the top performers in August. Fantom rebranded to Sonic Labs and launched the Sonic testnet, aiming to boost transaction speeds to 10,000 TPS, which garnered investor attention and contributed to a rise in the token's price. Maker's MKR token (-10.6%) and Polygon's MATIC token (-3.6%) were the month's bottom performers. Despite Polygon's token migration from MATIC to POL as part of the Polygon 2.0 upgrade, the network saw reduced user engagement and a drop in daily active addresses.

- Bitcoin Attracts $1.2B in Fund Inflows: Fund inflows rebounded in September, with Bitcoin accounting for $1.2 billion of the inflows, while Ether experienced slight outflows of $326 million. From a regional perspective, the majority of inflows were concentrated in North America ($926 million), while Europe saw $155 million in inflows, registering its highest level this year.

- Ethereum Fees Skyrocket 89%: In September, the Ethereum network saw total fees paid increase 89% from the prior month to $97.4M. The average fee per interaction with the Ethereum network increased by 418% over the period, indicating heightened competition for Ethereum’s limited block space. the Solana network saw total fees paid decrease 30.0% from the prior month to $29.9M. MEV made up approximately 60.4% of the total fees, reflecting a high demand for block space despite the overall decline in fee revenue, suggesting that competitive, value-extractive activities continue to drive network usage.

- BVX Reacts to Fed's 50 BPS Rate Cut: The CF Bitcoin Volatility Index (BVX) ranged from a low of 51.43 to a high of 61.39 over the most recent month. This period saw some extreme swings, with the index posting a negative 1.9-sigma move (as measured by our rolling 30-day z-score) after the market rallied in the week following the Federal Reserve's decision to reduce the benchmark interest rate by 50 bps.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.