Market Recap: Macro Influences Rekindle Market Uncertainty

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Key takeaways for the month:

- Yen Carry Trade Unwinds, Fed Pivots, and Crypto Adapts: Volatility returned for digital assets in August, driven by the unwinding of the "Yen Carry Trade," which negatively impacted risk appetite across the broader array of markets. Among other major macroeconomic factors, the Federal Reserve announced a dovish pivot at their annual Jackson Hole Symposium, which helped pare some of the earlier losses. Ether, while initially lagging, continued to see inflows into the newly launched U.S. spot ETFs, signaling long-term institutional interest despite a lower debut of inflows. Bitcoin prices also responded to these potential rate-cut signals, with Bitcoin benefiting from its perceived inverse relationship with interest rates.

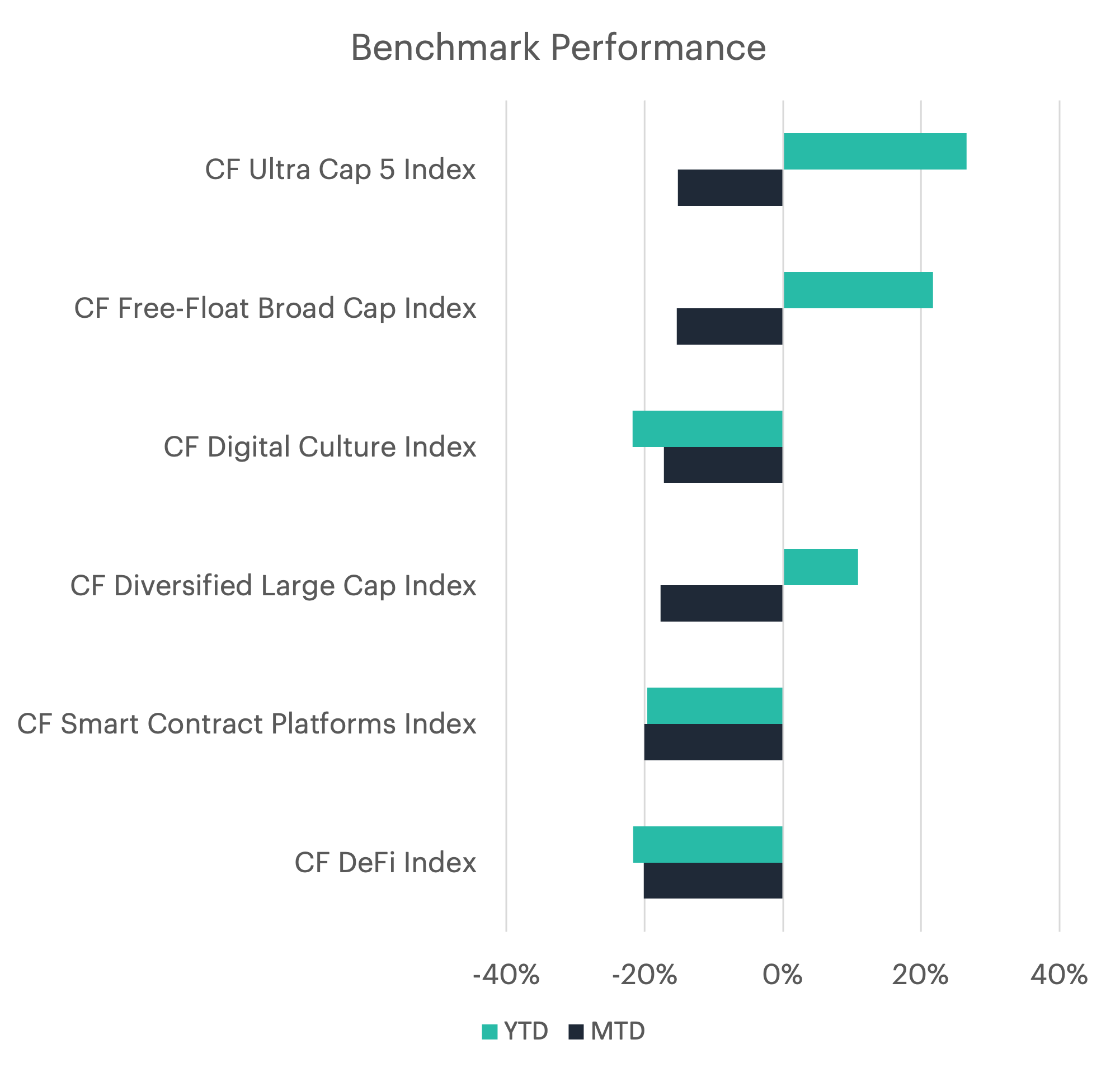

- Crypto Indices Face Headwinds: Our cryptocurrency indices displayed broadly negative performance, with the CF Free-Float Broad Cap Index falling over 15%. This decline was led by the CF Smart Contract Platforms Index and CF DeFi Index, falling over 18% and 20% respectively. Conversely, the CF Blockchain Infrastructure Index emerged as the relative leader by posting a sub-15% decline.

- Aave and Synthetix Shine Amidst Market Downturn: Aave's AAVE token (+20.6%) and Synthetix's SNX token (+11.5%) were the top performers in August. Aave reached a record 40,000 weekly borrowers in mid-August, surpassing its 2022 highs, driven by the launch of new lending markets on Base and Scroll. Maker's MKR token (-37.9%) and Cosmos's ATOM token (-23.2%) were the month's bottom performers. Maker rebranded to Sky ahead of the August launch of a new stablecoin, USDS, which includes a feature allowing Sky to remotely freeze assets, sparking backlash from the community.

- Long Positions Gain Ground in Futures Market: Net sentiment positioning in Bitcoin increased slightly in August, with long positions outpacing shorts. This resulted in net futures positioning on the CME increasing to -226 from -675 contracts. Total open interest for Bitcoin grew 3.6% from a month prior, while Ether saw a 17.5% increase.

- Fee Dynamics Reveal Declining Network Usage: In August, the Ethereum network saw total fees paid decrease 50% from the prior month to $51.6M. The average fee per interaction with the Ethereum network fell by 84.9% over the period, indicating that overall transaction volumes were up during the month. Meanwhile, the Solana network saw total fees paid decrease 38.4% from the prior month to $41.4M. MEV made up approximately 66.2% of the total fees, reflecting a high demand for block space despite the overall decline in fee revenue, suggesting that competitive, value-extractive activities continue to drive network usage.

- Ethereum Leads NFT Activity Despite Overall Market Cooldown: Ethereum has taken the top position on the NFT sales volume leaderboard in August, despite a 20.4% decrease in sales, as transaction counts fell by 10.1%. In addition, both Bitcoin and Solana saw declines in sales volume. Bitcoin's sales volume fell by 35.2% amid a 39% decrease in ordinals transactions. Meanwhile, Solana also saw a 35% decrease in sales as NFT demand cooled.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.