Market Recap: Crypto Stabilizes with Robust ETF Demand & Public Policy Spotlight

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Key takeaways for the month:

- ETF Demand, Political Endorsements, and Macro Signals: Robust demand was observed for the anticipated launch of spot Ether ETFs, with over $1 billion in fund flows accumulating into the newly launched products. Concurrently, U.S. presidential candidates and policymakers have publicly advocated for Bitcoin to be adopted as a strategic reserve asset for the U.S. Treasury, reflecting the growing focus on digital assets in public policy. Meanwhile, cooling inflation and labor market data, coupled with recent Fed commentary, indicate potential interest rate cuts starting as early as September.

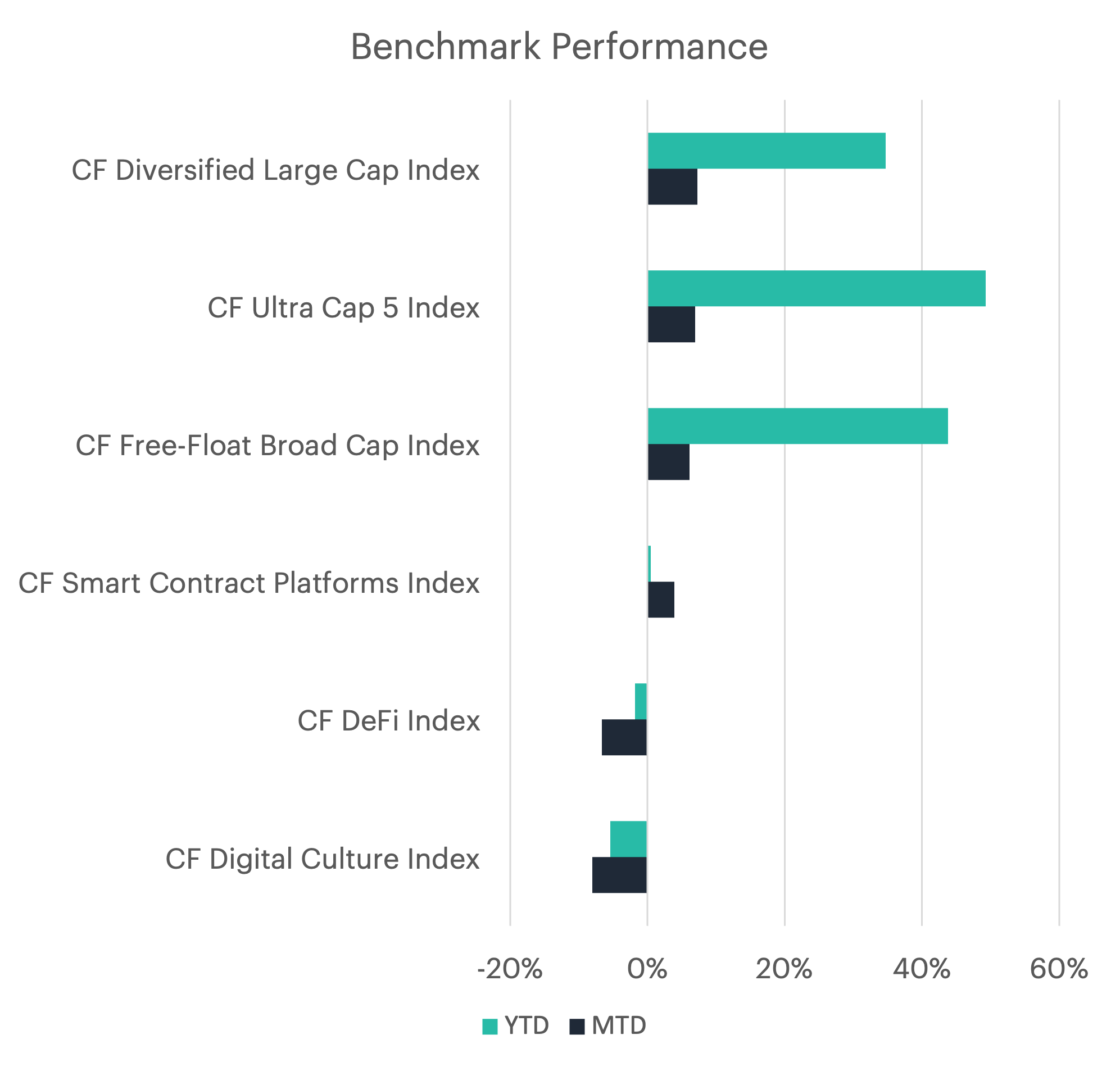

- Index Gains and Sectoral Shifts: Last month's portfolio index performance was broadly positive. The CF Free-Float Broad Cap Index, our broadest gauge of the institutionally investible market, recorded a 6.1% gain. Mega-cap tokens, represented by the CF Ultra Cap 5 Index, emerged as top performers, rising by 6.7%. The CF Diversified Large Cap Index led the pack with a 7.7% increase. In contrast, the CF Digital Culture Index continued to face challenges, declining by 6.7%, while the CF Blockchain Infrastructure Index lagged the rest with an 8.3% decline.

- July's Crypto Movers and Shakers: Ripple's XRP token (+31.6%) and Solana's SOL token (+17.3%) were the top performers in July. XRP surged on settlement hopes with the SEC after an amendment was filed in the SEC’s case against Binance. Solana saw record on-chain activity, surpassing Ethereum in daily fee revenue for the first time in late July. Fantom's FTM token (-28.2%) and Uniswap's UNI token (-21.8%) were the month's bottom performers. The Fantom foundation announced that it would be committing 200M FTM tokens, valued at $120M to fund strategic grants to developers creating apps on Fantom.

- Bitcoin's Dominance and Spot Ether Debut: Net monthly inflows continued in July, with Bitcoin accounting for $3,426 million in inflows. Following the launch of the spot ETFs, Ether saw $334 million in outflows. From a regional perspective, the majority of the inflows were concentrated in North America (+$3,021 million).

- Bitcoin's Mining Difficulty Hits All-Time-High: Bitcoin's network hash grew significantly in the past month, gaining 20.7% to reach 495 exahashes per second. The mining difficulty, which measures how hard it is to find a new block and thus adjusts to maintain a consistent block creation time, increased by 4.5% during the month. The next difficulty adjustment will likely be in the second week of August and is trending towards a 2.0% increase.

- Ethereum Fee Fluctuations and Network Activity: The Ethereum network saw total fees paid decrease 49% from the prior month to $66.2M. The average fee per interaction with the Ethereum network fell by 27.5% over the period, indicating that overall transaction volumes were down for the month.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.