Market Recap: ETF Demand Surge Broadens Market Rally

Our market recap report offers a brief summary of the blockchain economic categories and their recent price performance amid a broader market landscape.

Key takeaways for the month:

- February was a milestone month for digital assets, with Bitcoin breaching $1.2 trillion in total market cap and prices hitting multi-year highs. This was driven by large fund flows into U.S.-based spot Bitcoin ETFs, which helped propel the CME CF Bitcoin Real-Time Index (BRTA Index) above $63,000 before settling in the $61-62K range. Ether also made significant gains and even managed to outpace its larger peer.

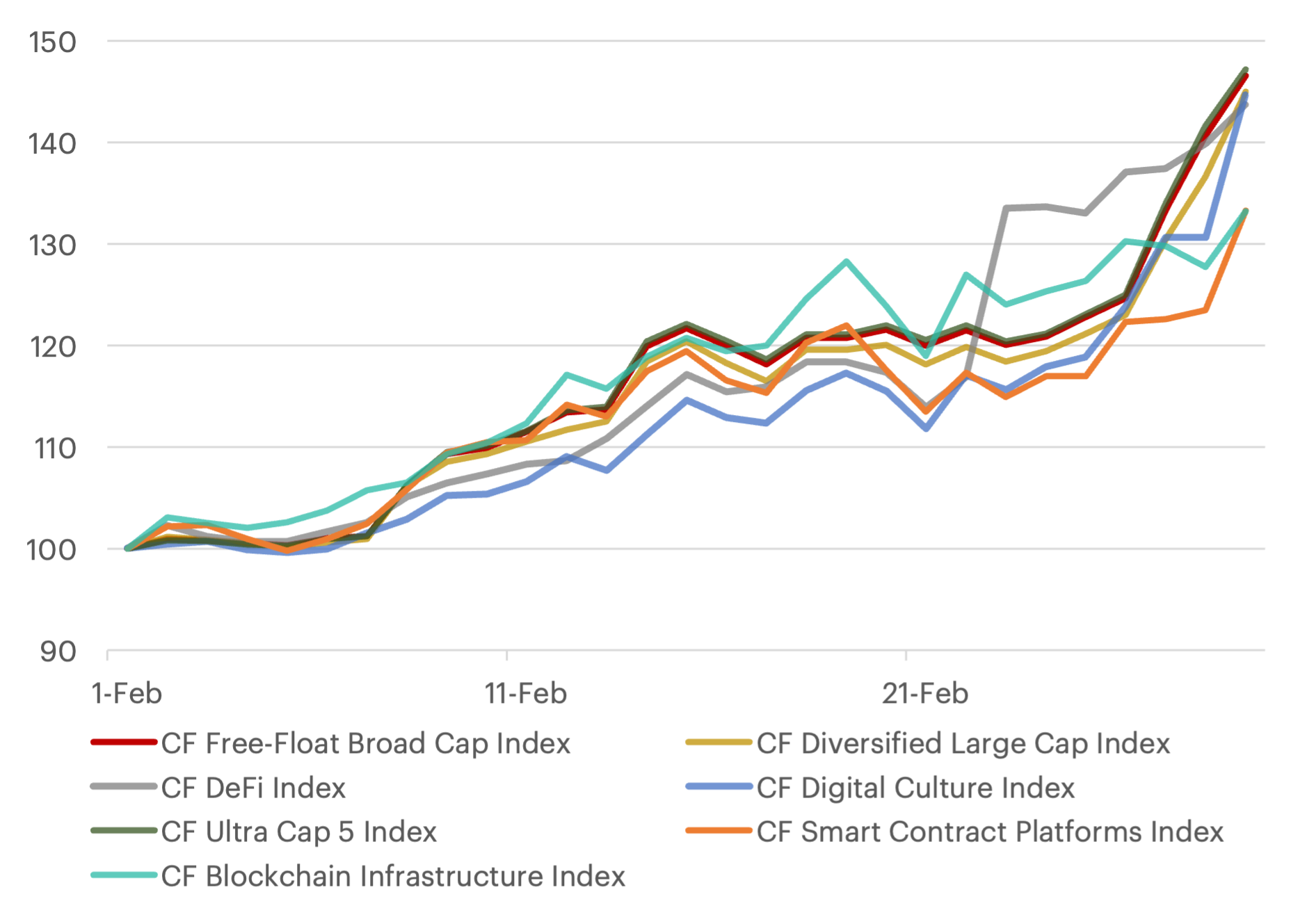

- Positive price momentum was ubiquitous across the market, with the CF Free-Float Broad Cap Index returning +46.5% and the CF Diversified Large Cap Index returning +44.9%. The Ultra Cap 5 Index, representing mega-cap cryptocurrencies, led the pack by rising over 47%.

- Open interest continued to increase for Bitcoin and Ether futures, while Ether futures on the CME reached an all-time high of 6,749 contracts.

- The DeFi space also witnessed substantial growth, with the total value locked (TVL) in DeFi protocols surging from $102 billion to over $162 billion, largely driven by an increase in liquid staking and lending activities.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.