UPDATED - CF Benchmarks Cryptocurrency Tax and Reporting Calendar

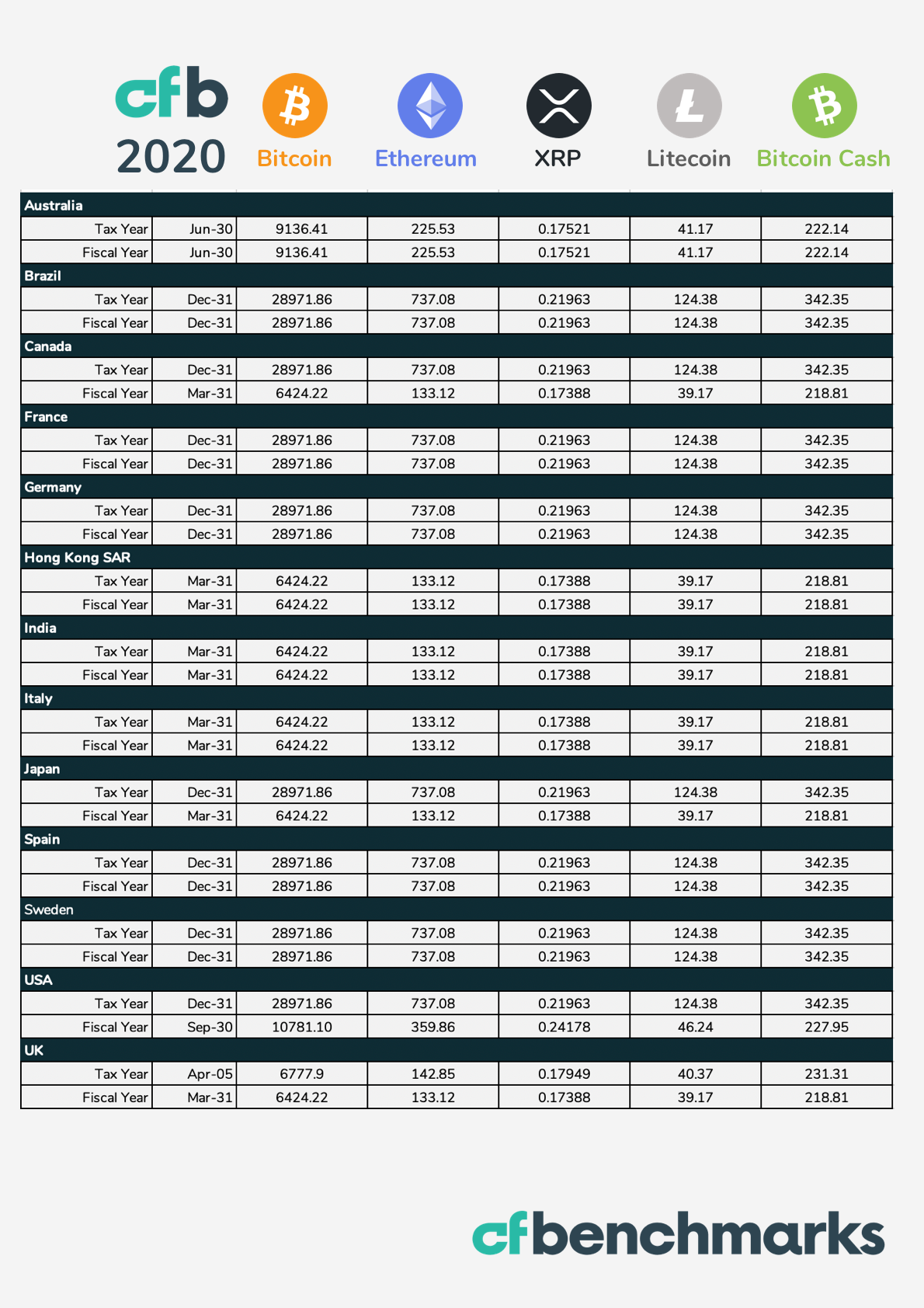

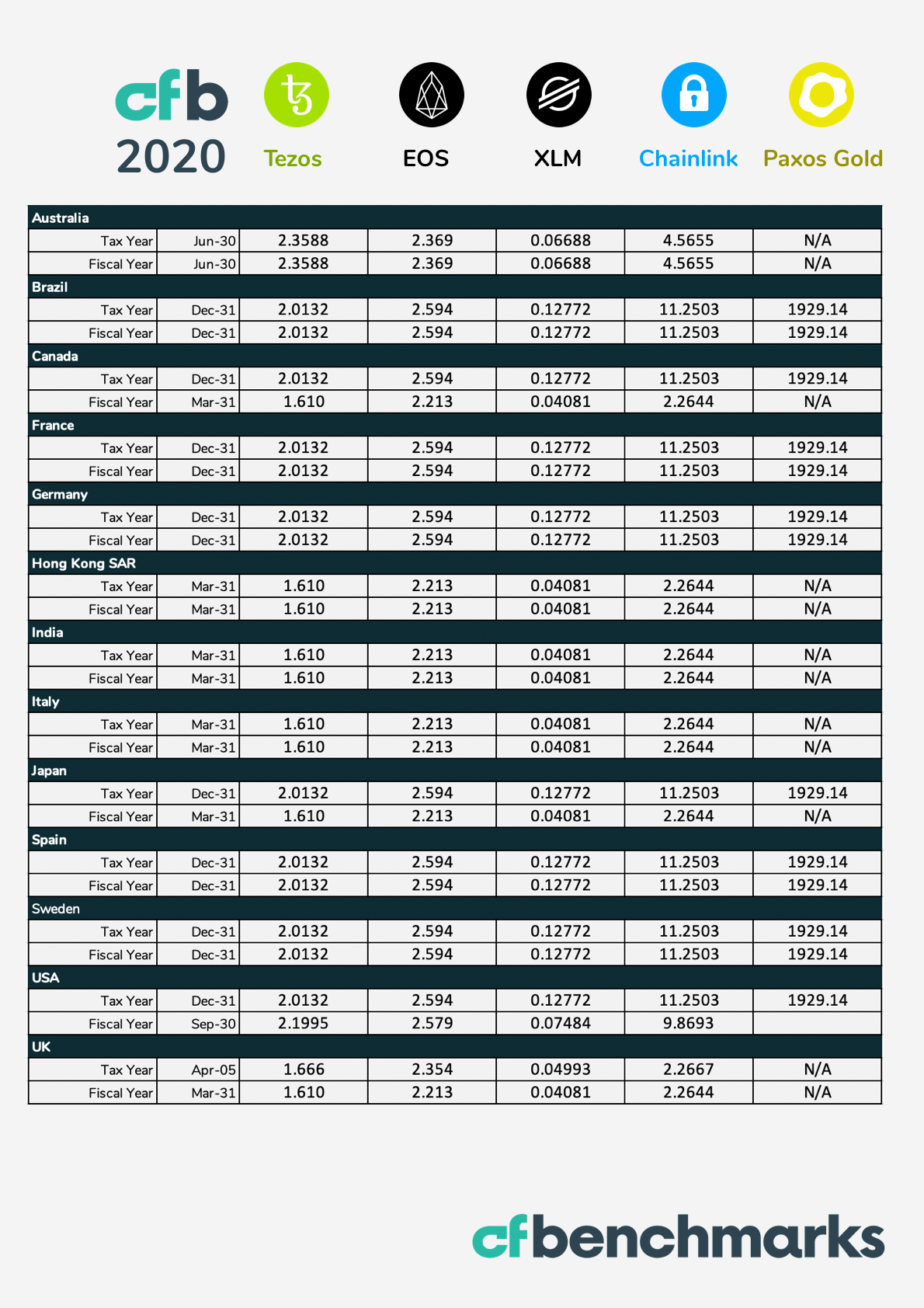

Our unique cryptocurrency reporting tool now includes the ill imprtant index values for December 31st 2020

How CF Benchmarks Cryptocurrency Price Indices can help you report the value of cryptocurrency holdings and earnings to tax authorities, auditors and other stakeholders that might scrutinise your valuations.

This is not and is not intended to be tax advice in any jurisdiction of the world. You should consult your own tax, legal and accounting advisors for any advice on tax matters.

The Problem of Accurate and Precise Valuation of Cryptocurrency Holdings

As anyone who owns or earns cryptocurrency through their work or business knows, there are severe frictions in reporting their value, such as in financial statements and tax returns. Auditors and tax authorities rightly wish to know that the pricing sources used for valuations are accurate, robust and representative. The distributed nature of cryptocurrency trading means there is no single recognised source for cryptocurrency pricing, for example, like there is for stocks, which can be priced according to the closing price on a stock exchange. Additionally, given the volatility of cryptocurrencies, pricing that is precise down to the second is imperative in order that accurate valuations can be measured at key reporting dates such as financial or tax year ends.

How CF Benchmarks helps solve the problem and how you can use our index pricing for your reporting

CF Benchmarks Real Time Indices and Spot Rates take order data from exchanges that meet our strict criteria, this ensures that the CF Benchmarks Cryptocurrency Price indices are calculated using data that is; free from manipulation, money laundering or criminal activity and is from liquid sources.

docs-cfbenchmarks.s3.amazonaws.com/CF+Constituent+Exchanges.pdf

CF Benchmarks Real Time Indices and Spot Rates are calculated using state-of-the-art, manipulation-resistant, published methodologies, with codified rules for dealing with erroneous, outlier and stale data to ensure they are accurate and robust.

docs-cfbenchmarks.s3.amazonaws.com/CME+CF+Real+Time+Indices+Methodology.pdf

docs-cfbenchmarks.s3.amazonaws.com/CF+Spot+Rate+Methodology+Guide.pdf

CF Benchmarks Real Time Indices and Spot Rates are recognised as Financial Benchmarks under EU BMR. CF Benchmarks operations, policies, processes and governance are regulated by the UK Financial Conduct Authority (FCA) - the primary regulator of financial firms in the UK. You can verify this on the FCA website where a register of authorised firms is hosted:

register.fca.org.uk/s/search?type=Companies&q=CF+Benchmarks

The CF Benchmarks Cryptocurrency Tax and Reporting Calendar

This simple and easy to use CF Benchmarks Cryptocurrency Tax & Reporting Calendar allows you to value cryptocurrency at the appropriate fiscal or tax year end. Simply multiply your holdings by the price shown on the relevant date. Should anyone question the appropriateness, validity or integrity of the data, download the relevant documents detailed in the FAQs on using CF Benchmarks Price Indices section and provide them to those that have asked the questions.

Dates & Times

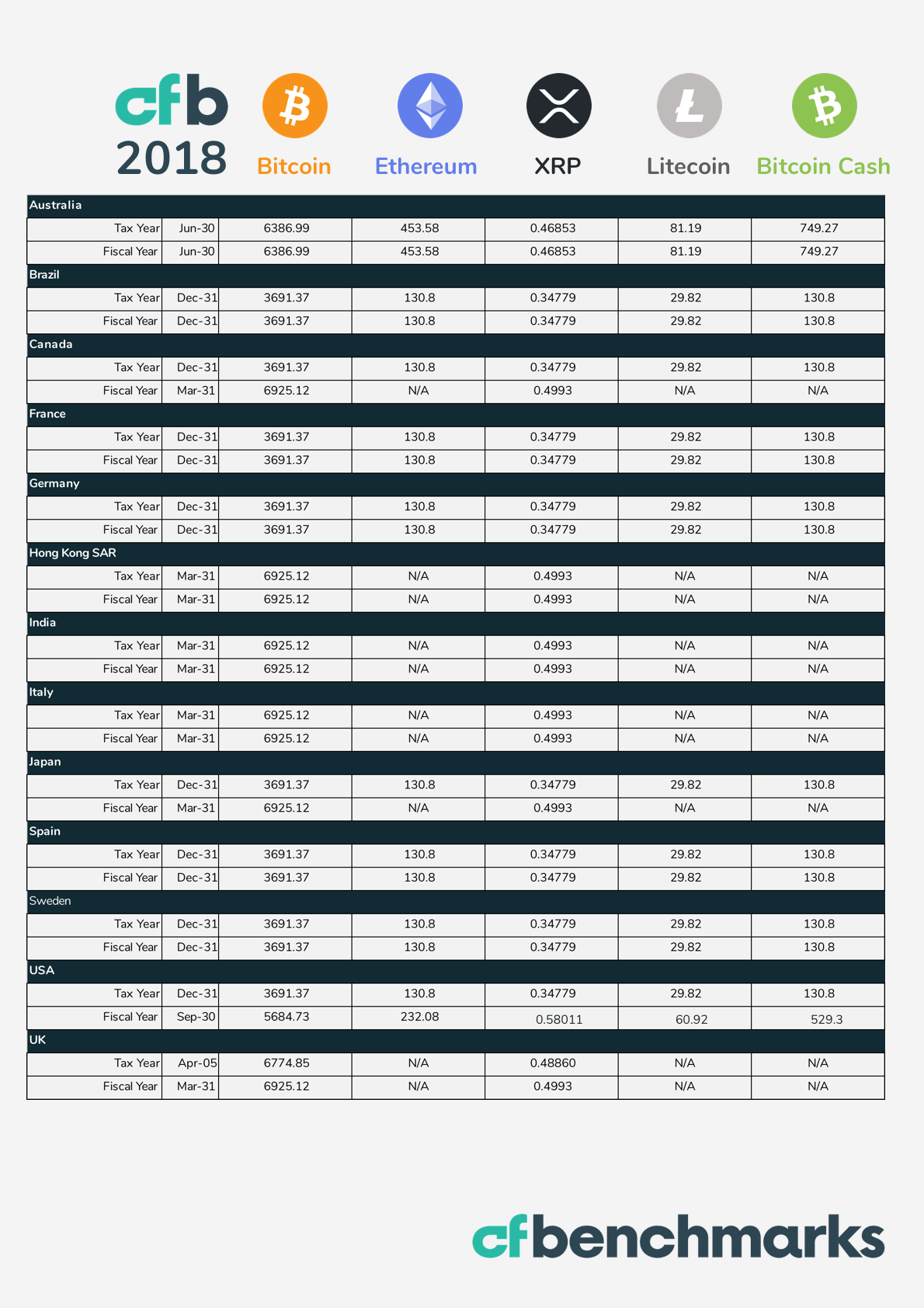

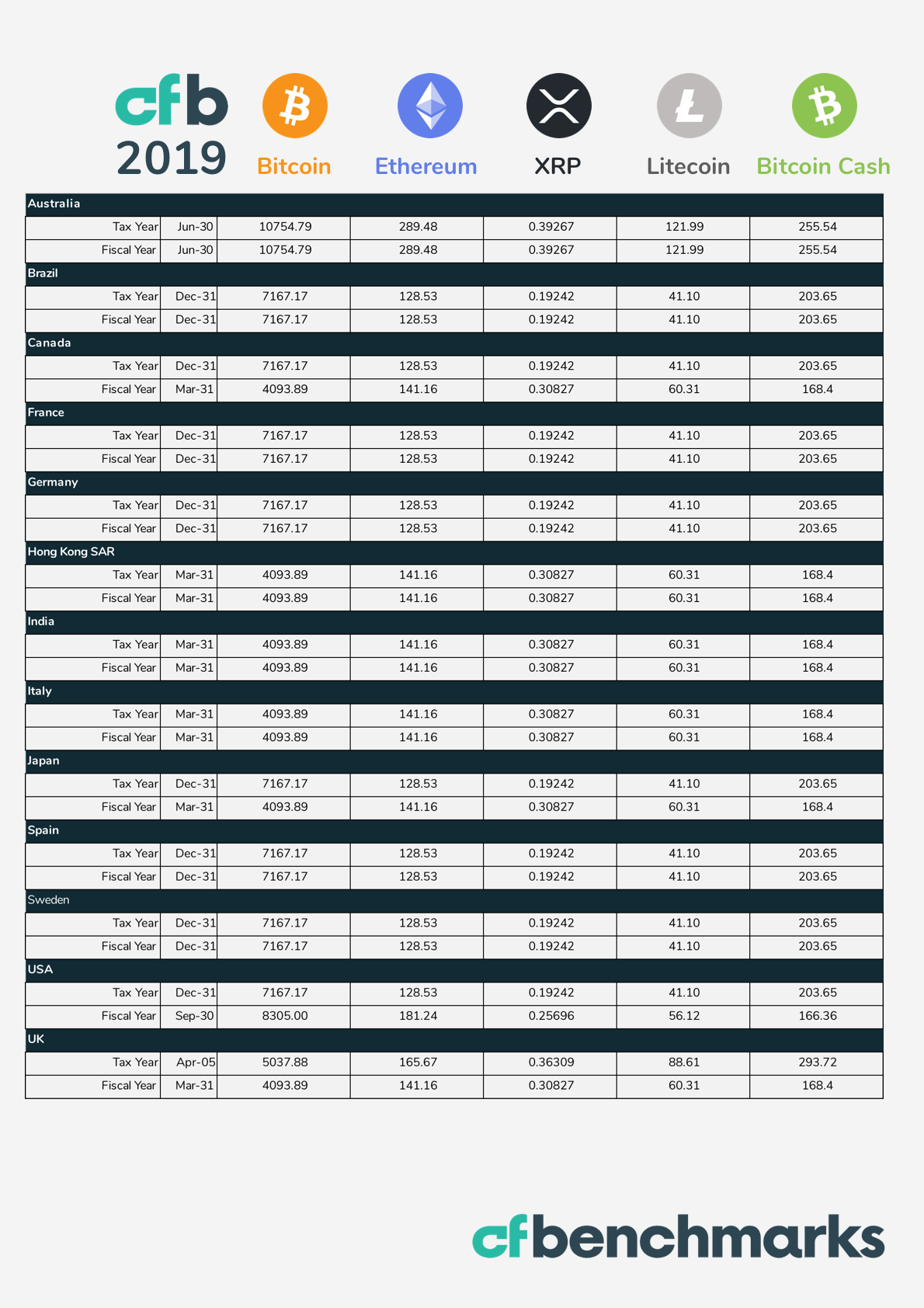

Note that the Tax & Reporting Calendar has been updated to include values for December 31st 2020 23:59:59 UTC for the countries and coins covered!

The calendar still covers the major economies of the world and their respective fiscal and tax year ends. These are also the most common dates for year ends around the world and they hopefully cover the country you are based in.

However, please note that we have not covered all the economies of the world. If you need to report for different dates, please let us know and we will try to respond with the relevant index values for those dates. We also recognise that companies in many countries have financial year end dates that are different from those shown in our calendar. if your company has a financial year end different from those listed in our calendar and you would like the benchmark price for the date that coincides with your financial year end or reporting period then please contact us at info@cfbenchmarks.com.

Because CF Benchmarks has been calculating price indices every second continuously for years, it has a deep and rich data history. Should you require higher volumes of data or data of greater granularity and resolution, such as to carry out SPEC-ID accounting: LIFO/FIFO/HIFO accounting of your cryptocurrency trading, please get in touch. We should be able to offer you a data package that enables you to do this and to justify your accounts to any third parties.

We have provided benchmark price values back to 2018 to assist users that may need to report in arrears or whose historic reporting is being audited.

This calendar will be updated in early April with values for through to March 31st 2020 23:59:59 UTC, please check back to this page again then.

Fiat Currencies

It was decided that the calendar would provide cryptocurrency values in US dollars only because that market is the most liquid one for such assets. If you need to report in a currency other than the US dollar, please translate the US dollar values we have published here into your local currency by using a widely accepted foreign exchange (FX) rate. Comprehensive and widely used foreign exchange rate sources include xe.com and oanda.com.

Cryptocurrency Assets

The calendar covers all assets for which CF Benchmarks had published benchmark price indices available at the time of publication. It is important to note that the benchmark prices contained in the The CF Benchmarks Cryptocurrency Tax and Reporting Calendar were published contemporaneously at the time and date shown. Prices were NOT back-tested or back-calculated. We continue to expand our range of supported cryptocurrency assets. If we currently do not support an asset that you need accurate pricing for, please subscribe to our newsletter to keep up to date on our index launches: blog.cfbenchmarks.com/#subscribe

THE CF BENCHMARKS CRYPTOCURRENCY TAX & REPORTING CALENDAR

FAQs on using CF Benchmarks Price Indices

If you are using the CF Benchmarks Indices values on the calendar for reporting purposes, you may find that third parties such as auditors, tax authorities or lawyers will ask you questions around the validity of using the CF Benchmark indices. Below are a series of common questions and answers plus supporting documentation that you may provide to anyone with questions about CF Benchmarks price indices.

How is the index value calculated?

The index is calculated as per the published methodology – available to download from the CF Benchmarks website: www.cfbenchmarks.com.

The data used to calculate the indices are sourced from exchanges that meet our strict published criteria that are also available for download from the CF Benchmarks website: www.cfbenchmarks.com

How do we know the methodology is suitable for applying to the valuation of cryptocurrencies?

CF Benchmarks is a registered Benchmark Administrator. As such, it is in compliance with EU BMR - see screenshot of the UK FCA Register to evidence this:

register.fca.org.uk/s/search?type=Companies&q=CF+Benchmarks

CF Benchmarks indices are used by many institutions – its Bitcoin Reference Rate is used to settle the Bitcoin-USD futures contract listed by CME Group:

www.cmegroup.com/trading/equity-index/us-index/bitcoin_contract_specifications.html

How do we know that the index is calculated according to the published methodology and that CF Benchmarks systems and processes are robust?

CF Benchmarks governance, operational, technology and compliance controls have been audited by Deloitte. The SOC1 audit report is publicly available by clicking the top right button marked “audit report” at www.cfbenchmarks.com.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.