Keeping tabs on CF Benchmarks-supported U.S. Bitcoin ETF applications

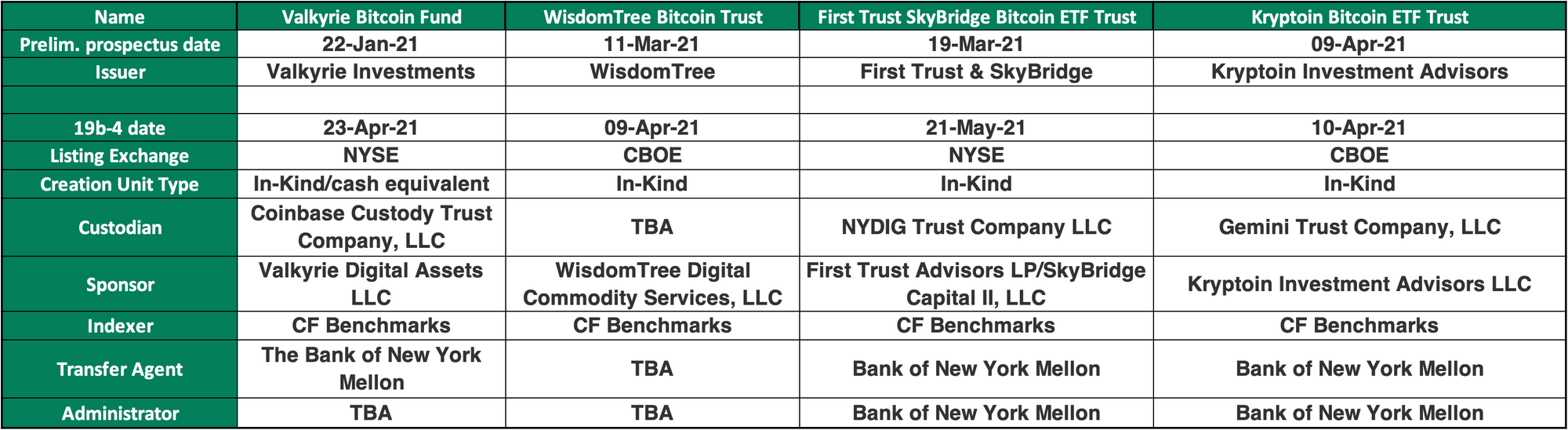

To help keep tabs on the CF Benchmarks-powered Bitcoin ETF applications so far, we’ve put together the table below.

All four CF Benchmarks-supported Bitcoin ETF plans are being actively considered by the SEC

For years, CF Benchmarks has been at the heart of crypto’s institutional adoption trend. Nowhere is this more visible right now than in the slow but sure mainstreaming of the crypto asset class as represented by the advent of cryptocurrency ETFs.

The first batch of BTC ETF applications landed on the SEC's desk some five years ago, though all those early bids were, frustratingly, rejected. Still, CF Benchmarks’ regulated methodologies have played an integral part in the long slog of convincing regulators and public opinion of the benefits to be had from wrapping cryptocurrencies into the tried, trusted and controlled structure of an ETF.

Despite the frustrations of applications past, being at the forefront of some of the most compelling ideas behind a potential crypto ETF back then appears to have paid off. Fast forward to 2021, and a new wave of U.S. applications looks more promising than the previous set, not least because a raft of crypto ETFs have now been approved by regulators in large economies around the world. Among these, CF Benchmarks indices support Evolve’s Bitcoin and Ether ETFs in Canada, QR Asset’s QBTC11 that’s set to launch in Brazil in June, as well as Hashdex Nasdaq Crypto Index ETF listed on the Bermuda Stock Exchange.

(It’s worth stressing that there is no certainty as to the outcome of any of the recent Bitcoin ETF applications filed to the SEC.)

Perhaps it should be little surprise that of 8 BTC applications filed to the SEC so far this year, four propose to deploy a CF Benchmarks index to calculate daily NAV. What’s more, as of Friday, the SEC had signalled that all four of these were under active review, with Anthony Scaramucci’s Skybridge Capital being the latest to receive the customary signal that the Commission had embarked upon a thorough, formal review of its filing.

As we explained a few weeks ago, the review process is pretty complicated and can take up to 240 days. Plus, the SEC is under no obligation to provide much info in between times.

So, to help keep tabs on the CF Benchmarks-powered applications so far, we’ve put together the table below. It contains the full set of entities involved in each application. There are some helpful links below the table to explain any terms that may be unfamiliar. We’ll update the table as new developments occur.

Key Terms

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.