Here’s how long we may wait for the new wave of US crypto ETFs

Will the SEC really soften its hardline stance on crypto ETFs as quickly as applicants expect?

The crypto ETF review process could now run on two tracks as a new regulatory regime begins

The ‘old doctrine’

Even before the re-election of Donald Trump as U.S. President, ETF issuers began telegraphing paperwork into the SEC proposing digital asset investment funds with, at the time, what seemed to be only moderate chances of securing regulatory approval.

Back then, these odds were judged against what we can call an unofficial ‘doctrine’, pieced together by investment firms and other participants – including CF Benchmarks – defining assets with the best chances of SEC approval for wrapping into ETFs.

After Trump went on to win, though, several more filings followed, suggesting increasing assurance among issuers.

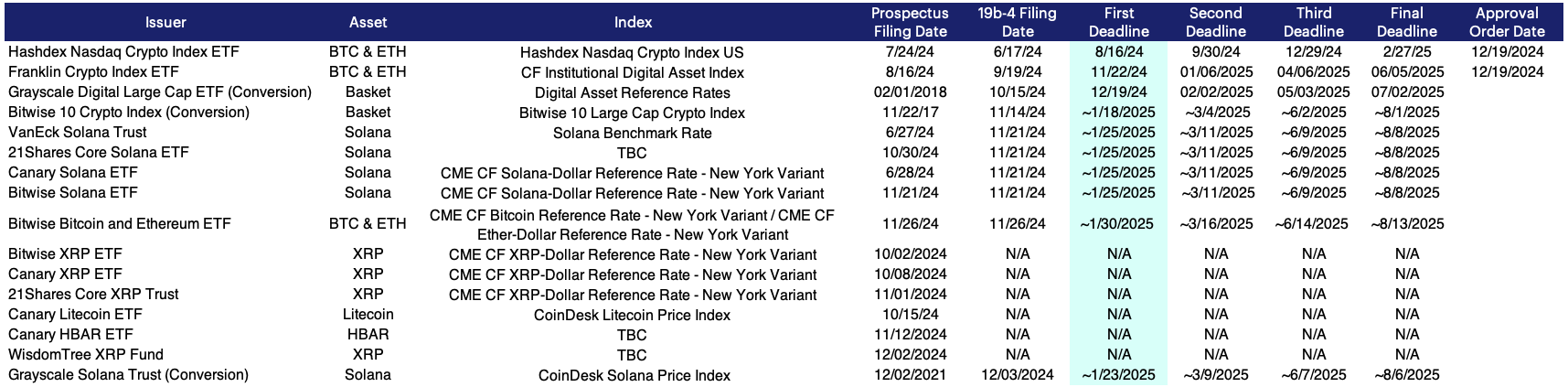

The list of crypto ETF filings is below, as of mid-December 2024; including two recently approved applications.

(Note 'N/A' indicates no form 19b-4 filed by the proposed listing exchange.)

New Chair

Now, with Gary Gensler set to depart as SEC chair in late January – most likely to be replaced by a known crypto proponent, former commissioner and staffer Paul Atkins – investment firms will almost certainly become even more confident of chances of regulatory approval for a wider array of crypto ETF assets beyond Bitcoin and Ether.

Still, there are quite a few counterbalancing points to consider.

Will the SEC really moderate its previous intractable interpretation of the Securities Act, with regards to crypto, as rapidly as many applicants seem to expect?

Though increasingly justified on the face of it, there’s still a risk the chances are being overestimated.

In this post, we’ll try to weigh how much of an improved probability of approval we should expect for recent crypto ETF filings, once the the upcoming change in the regulator’s leadership takes place.

It ought to go without saying that from this point on, you’re reading speculation, representing the author’s thoughts.

Inferred conditions

First, a reminder of the SEC’s ‘old doctrine’ for spot crypto exchange traded products, which is now widely expected to lapse.

It's important to understand it’s an inferred ‘doctrine’ which emerged mostly due to the bias for implied precedent and official opacity at the SEC under Gensler.

Likewise, this so-called old doctrine forms the basis of an inferred set of eligibility conditions for probable ETF approvability, formulated by various institutional crypto participants.

These conditions have been articulated several times by CF Benchmarks over the years, in numerous ETF applications we’ve assisted clients with.

Importantly, the conditions were in play when the SEC approved both the listing of the spot Bitcoin ETFs in January 2024, and eventually, the listing of spot Ether ETFs, around six months later, implying corroboration.

CF Benchmarks presented its reasoning to the Commission most recently in a Comment Letter submitted on behalf of Ether ETF applicants. The Commission took the unusual step of citing CF Benchmarks’ comments and data in its Ether ETF approval order.

Find the complete Comment Letter here, or read our explainer below.

We summarise the rationale below.

Ether ‘commodified’

Addressing one of the Commission’s longest-standing contentions - the assumption that most digital assets are unregistered securities - CF Benchmarks zeroed in on several pieces of regulatory evidence that tend to define Ether as a commodity, just like Bitcoin, which was already available via exchange traded products.

Firstly, we noted the existence of a Designated Contract Market (DCM) for Ether, consisting of commodity futures and options contracts, cleared by a Designated Clearing Organisation (DCO). For Ether, these were established by the existence of the CME Ether futures and options market (a DCM), cleared by CME Clearing (a DCO). This market was preceded of course by CME Bitcoin Futures and options.

Ether and Bitcoin de facto ‘classified’ by the CFTC as commodities circumvented the issue of their ETF shares being eligible for registration under the Securities Act (1933). As Bitcoin commodity trust shares, and Ether commodity trust shares, they’re just like shares in ETFs investing in commodities, like gold, silver, oil, etc.

It’s well known the SEC did not immediately acquiesce to the aptness of this evidence. Bitcoin ETFs were approved en masse in January 2024 only after the U.S. Court of Appeals ruled, in August 2023, the Commission failed to adequately explain why Grayscale’s application to convert GBTC to an ETF was rejected.

Safeguards

Next, we noted that key standards set out in Section 6(b)(5) of the ’34 Act, pertaining to prevention of market abuse, were met by ETH ETF listing exchanges.

Based on several ETF ‘disapproval’ orders, two clear requirements emerged as tests of whether the conditions were met.

- The existence of surveillance sharing agreements between listing exchanges and the crypto ‘market of significant size’ that was already subject to regulatory purview – for Ether, CME’s Ether futures market

- Demonstration by empirical analysis of a strong correlation between ETH price returns at major exchanges and CME ETH futures. The rationale being that any attempted manipulation of spot markets would show up in the futures market, and vice versa

Our Comment Letter included an analysis of order book data from CME CF Constituent Exchanges submitting prices to the CME CF Ether-Dollar Reference Rate (ETHUSD_RR).

Evidently, the commission acceded that both requirements were achieved.

The List

Finally, the Comment Letter noted the Commission’s tacit inverse categorisation of Ether, as something other than a security.

It was based on the omission – literally the lack of a mention of the term ‘Ether’ – from several high-profile SEC complaints against crypto trading platforms.

Crypto participants recall these cases only too well. Kraken, Coinbase, Binance, Bittrex and others were recipients of enforcement actions alleging unregistered securities offerings.

Collating these, the letter, submitted in March 2024 compiled a list of all tokens mentioned within the complaints.

- Solana (SOL)

- Cardano (ADA)

- Polygon (MATIC)

- Filecoin (FIL)

- The Sandbox (SAND)

- Axie Infinity (AXS)

- Chiliz (CHZ)

- Flow (FLOW)

- Internet Computer Protocol (ICP)

- NEAR (NEAR)

- Voyager (VGX)

- Dash (DASH)

- Nexo (NEXO)

Because all platforms the SEC complained about offered Ether trading, its omission from the list was a bit damning.

For Ether, exclusion seemed to indicate the Commission had less confidence in asserting it was a security.

(The same may potentially apply to other tokens; e.g., Bitcoin Cash, Litecoin and others.)

New Year, New SEC?

With that overview in hand, the key question for now is clearer: which conditions, if any, may now ease, or even lapse, under the expected new regulatory regime?

Part of the answer depends on Trump’s pick for new SEC chair Paul Atkins, and his stance to securities regulation, assuming he’s eventually appointed. (Confirmation hearings will likely start later in January.)

But even if we park, for the moment, consideration of how much the new chair may affect the crypto ETF outlook, a wholesale removal of the conditions described above seems questionable.

Especially conditions intended to ensure investor protection, orderly markets and market integrity; for example, surveillance sharing agreements (SSAs).

And if we accept surveillance SSAs will remain in place, that implies continuation of the phased process seen to date for the approval of crypto ETF assets.

On that basis, a DCM/DCO in the underlying asset would still need to be established first, before an ETF would be approvable.

New contracts needed

It’s worth noting that while the CF Benchmarks - CME Group partnership has continued to spin up UK FCA regulated crypto indices beyond Bitcoin and Ether – e.g., launching benchmarks for Solana, XRP, Litecoin and dozens more, CME Group hasn’t yet made any further crypto derivative contracts available to trade.

Under the ‘old doctrine’, that would suggest an indeterminate wait for almost all ETF filings in the table above, until such markets are opened, regardless of the SEC’s new stance.

Even longer for applications where there’s no CME CF index yet; e.g., Canary HBAR ETF.

FIT21: The New Rationale

Still, with 13 novel crypto ETF filings currently on the docket, it seems applicants have already decided approval odds for a wider array of assets have improved.

The question is, what rationales are now more plausible than before?

First, the obvious.

A streamlined workaround for the commodity-versus-security dilemma. Simply the establishment of a third category for digital assets to occupy.

Below is a comment from Ropes & Gray, the veritable U.S. corporate law firm, from a recent blog post: ‘A Second Trump Administration: Implications for Asset Managers’

“It is possible that the SEC could even go so far as to set up a novel regulatory framework for digital assets, perhaps working alongside the Commodity Futures Trading Commission,6 as envisioned by the Financial Innovation and Technology for the 21st Century Act,7 (FIT21) a 200-page bill that passed out of the House in May 2024 with some bipartisan support.”

In outline, FIT21 is has two main goals:

- To clarify and divide regulatory responsibility by classifying digital assets as “Restricted Digital Assets” – regulated by the SEC, or “Digital Commodities” regulated by the CFTC

- To oblige compliance with registration and disclosure requirements for a digital asset’s blockchain, underlying source code, transaction history, and economics

Designation as a Restricted Digital Asset (RDA) or Digital Commodity (DC) will be based on:

- Whether its blockchain is certified as a “decentralized system”. The underlying assumptions being:

- Highly decentralized protocols are probably DCs

- Centralized protocols are generally RDAs

- How the asset was acquired:

- If received by an unaffiliated/unrelated party by ‘end user distribution’, or purchased on a ‘digital commodity exchange’, the asset’s likely a DC

- Whether the asset holder is an affiliate of, or related to the issuer:

- Pre-certification assets held by affiliates/related parties are RDAs. Post-certification, assets held by affiliates and related parties are treated as DCs

- Assets held by issuers are treated as RDAs, before and after certification

These new designations don’t negate the SEC’s contention that many digital assets are securities, but they do help establish a constructive framework under which participants can transact or offer digital assets appropriately.

Two tracks

Still, the fate of FIT is difficult to predict. It appears to have bipartisan support. But the outline above shows how nuanced, complex, and far-reaching, it is.

There’s plenty of scope for further discussion and amendment to delay, or even prevent it becoming become law.

Crypto ETF filings on the table right now seem less likely to benefit from FIT.

In the meantime, it may be that rulemaking will still be the key way the SEC navigates filings through current regulations.

This implies a ‘two-track’ outlook for current filings and any that may be filed in coming months.

It follows that filings for ETFs which are similar to existing U.S.-listed crypto funds will have a faster path to approval. We outline our view of the prospects for live crypto filings below.

Solana

Unfortunately, the sizeable raft of Solana ETF filings could be destined for the ‘slower track’. That is despite the existence of two regulated Solana Reference Rates calculated and published by CF Benchmarks, in partnership with CME Group:

- CME CF Solana-Dollar Reference Rate (SOLUSD_RR)

- CME CF Solana-Dollar Reference Rate - New York Variant (SOLUSD_NY).

As we’ve seen, a regulated crypto Reference Rate to which CME Group can settle futures contracts has become, de facto, the first step toward ETPs providing exposure to that asset being approved.

Before any new regulatory regime kicks in, this ‘old doctrine’ pattern could remain the fastest path to market.

Regardless of regulatory changes or new rulemaking, a regulated Solana futures market might still be the the surest sign of a pending SOL ETF.

Conversely, SOL ETF applications face higher odds of protracted delays, and even rejection, so long as the ‘old doctrine’ remains in effect – and no Designated Contract Market in Solana exists.

Litecoin

Canary Capital’s Canary Litecoin ETF filing is in a similar position to the Solana filings, with one key difference.

Just like for Solana, a regulated Reference Rate is available for Litecoin (LTC), calculated and published by CF Benchmarks in partnership with CME Group:

CME CF Litecoin-Dollar Reference Rate (LTCUSD_RR).

If and when CME Group makes a contract settling to LTCUSD_RR available for trade, all else being equal, exchange traded Litecoin products could have a higher claim to approvability.

But Litecoin has another aspect in its favour.

Litecoin wasn’t on the ‘Old Doctrine’ list, suggesting a lower chance of SEC designation as a security. Litecoin was also specifically cited in a 2021 CFTC order as “encompassed within the broad definition of ‘commodity’”.

This means LTC could enjoy an administrative tailwind, maybe a higher probability of approval for ETF inclusion than other tokens.

Hedera

Canary Capital has also applied to list the Canary HBAR ETF, which would invest in Hedera (HBAR).

There’s no CME CF Reference Rate for HBAR yet. Therefore, this ETF looks like it will need regulatory changes, or specific rulemaking in order to be approved.

Most likely though, any approval process for this fund will probably be on the ‘slower track’.

XRP’s special case

Ripple’s XRP has also passed the first step on the road to becoming available via ETFs. CF Benchmarks publishes two XRP Reference Rates:

- CME CF XRP-Dollar Reference Rate (XRPUSD_RR)

- CME CF XRP-Dollar Reference Rate - New York Variant (XRPUSD_NY)

In theory, should CME Group list a futures contract settling to one of these benchmarks, XRP ETF filings could also tread the established path to approval.

Meanwhile, XRP’s connection to Ripple Labs lends itself neatly to the notional concept of ‘Restricted Digital Asset’ proposed by FIT21, and the potential path to approval within the ETF wrapper this implies.

For XRP the key question is, how soon will further steps to ETF approval occur, given the legal baggage hanging hanging over Ripple Labs?

In August, Ripple Labs was fined $125m in relation to primary market institutional sales of XRP. The SEC is currently appealing a 2023 partial ruling that programmatic sales of XRP to retail exchanges did not violate securities laws.

The change in regulatory temperature could mean Ripple prevails. However, for XRP, uncertainty is salient enough that counterparties are most likely to wait for the court outcome before doing anything.

January 15th, 2025, is the deadline by which the SEC must submit its opening brief. The appeals process would ordinarily be expected to continue till mid-2025.

The SEC could potentially abandon the appeal under new leadership, though that decision requires an agency vote. With signs that outgoing chair Gensler may have reshuffled the Enforcement Division in recent weeks, there are even more variables to consider.

Themes for an SEC Reboot

Finally, we look through other major regulatory themes relevant to all crypto ETFs that may be in focus after an SEC reboot.

In-kind

Progress is possible on the acceptability of in-kind creation and redemption of ETF shares. Creation and redemption units of U.S. Bitcoin and Ether ETF shares are currently structured in cash.

This methodology is widely recognised as less operationally, financially, and tax efficient, which is why most ETFs use in-kind create/redeem.

Regardless of why the SEC went this route (here’s one of the less conspiratorial takes from Bitcoin Magazine) this kink seems likely to be ironed out by SEC Rulemaking, No-Action Letters, or another form of administrative discretion.

The key point about such a pivot is that it could happen quite quickly.

Staking

The SEC indirectly made clear its disinclination to allow staking rewards in the U.S. Ether ETFs that listed in July 2024.

To be fair, staking rewards are broadly acknowledged as one of the least widely understood aspects of blockchain economics.

CF Benchmarks recently published the first comprehensive, public framework, for institutional quantification of and participation in Ethereum staking rewards (see below).

The framework promises to empower all types of counterparties to participate more confidently in staking. But the dispersion of such critical knowledge will take time.

The approval of staking rewards in U.S. Ether ETFs, and funds investing in other programmable protocols (e.g., Solana) seems less likely to be prioritized by the SEC.

DeFi

Similar thinking can be applied to proposed ETFs investing in DeFi protocols - if/when such filings appear. The nexus of permissionlessness, built-in opacity, enhanced risk of harm, and an even lower baseline of general knowledge, should mean the integration of DeFi remains a possibility for the long term only.

The takeaway

As shown above, the SEC will almost certainly continue to mandate that issuers and exchanges must instate measures ensuring the market integrity of crypto ETFs.

With CF Benchmarks’ regulated indices currently accounting for around 60% of crypto ETF Assets under Reference (AuR), our regulated Reference Rates remain the most institutionally trusted measures of blockchain economic reality, chiefly because of their unmatched track record of reliability and market integrity.

Regardless of the mid-to-long-term regulatory outlook for crypto ETFs, we expect our Reference Rates to remain the gold standard of crypto ETF net asset value (NAV) calculation, for issuers and regulators alike.

Read more about our regulated CME CF Reference Rates

Solana

XRP

All CME CF Cryptocurrency Pricing Products

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.