Santa Claus Rally Stumbles on Fed Outlook

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Key takeaways for the month

- Monetary Uncertainty Pulls Bitcoin Back from New Highs: Bitcoin surged to a new record high, with our CME CF Bitcoin Real Time Index briefly breaching $108,000, fueled by $6.1 billion in crypto-related fund inflows and regulatory optimism. However, the Federal Reserve's more hawkish stance at its December meeting, signaling a slower path for future rate cuts, triggered a sell-off in risk assets, including digital assets. Despite heightened volatility, crypto fund flows remained resilient, most notably into Ether ETFs. Discussions continued surrounding a U.S. strategic Bitcoin reserve, which highlights the increasing institutional and governmental acceptance of Bitcoin as a long-term store of value.

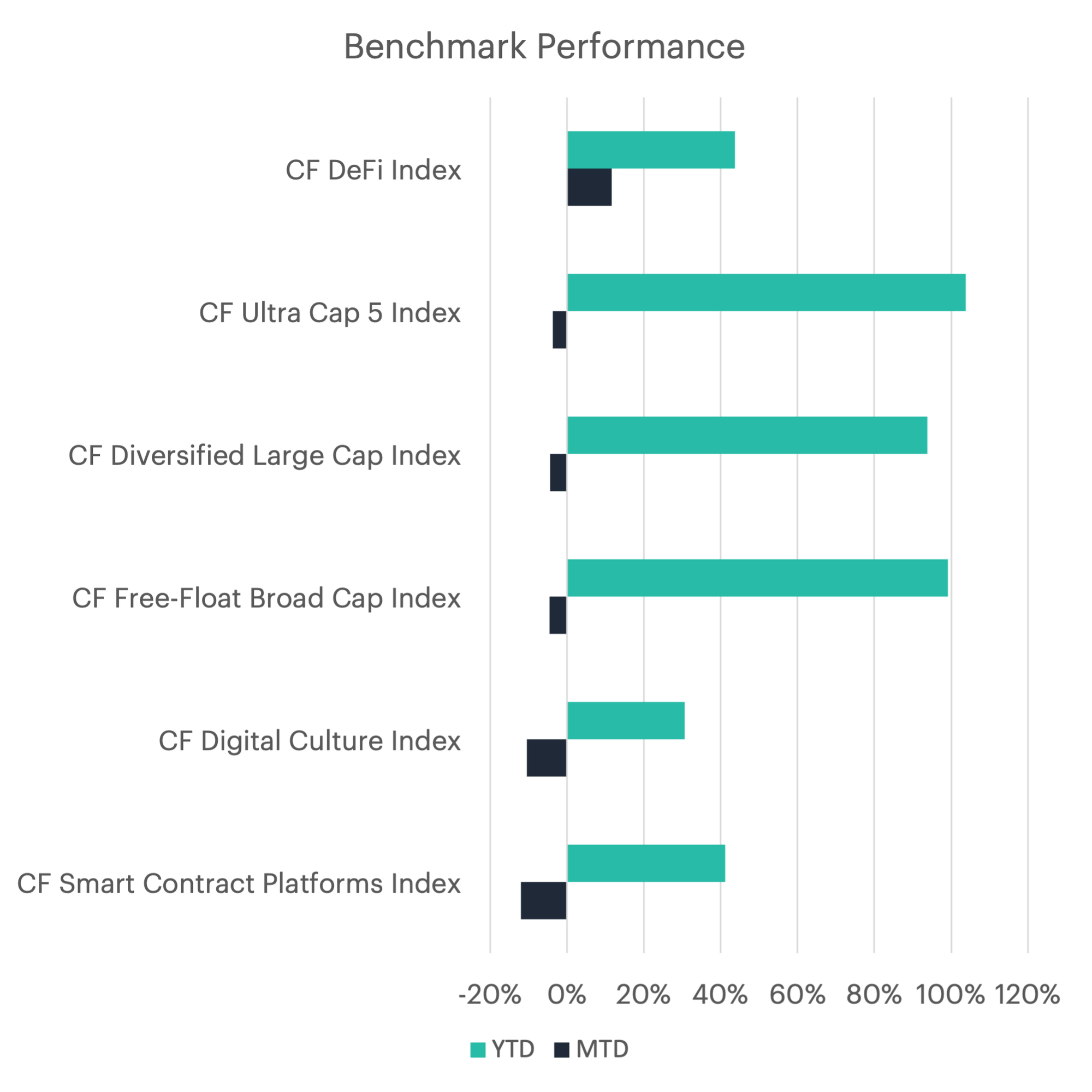

- DeFi Dominates in December: The CF DeFi Index emerged as the only index to finish the month in positive territory (+8.69%), rising as much as 38.6% mid-month before retracing lower. Conversely, the CF Blockchain Infrastructure Index and CF Digital Culture Index lagged, falling 17.1% and 14.8%, respectively, after sharp sell-offs in the latter half of the month. Year-to-date, the CF Ultra Cap 5 Index led with 103.79% growth, followed by the CF Free-Float Broad Cap Index (99.16%). The CF Digital Culture Index lagged, gaining just 30.61%.

- Synthetix and Hedera Rise on Innovation: Synthetix (SNX) led the gains with a 78.8% increase after launching multi-collateral perpetuals on Base, which boosted its TVL and DEX volumes. Hedera (HBAR) followed with a 57.5% gain, driven by a partnership with SpaceX for space data management and a collaboration with Chainlink to provide secure on-chain data feeds for DeFi developers. tellar (-36.8%) and Fantom (-36.4%) underperformed this month as investors shifted away from small-cap tokens following Bitcoin’s mid-month correction.

- Digital Asset Fund Flows Top $6 Billion, Ether Flows Set New Monthly Record: Fund flows into digital assets continued in December, with investors allocating over $6.1 billion. Ether saw record-breaking monthly fund flows, surpassing the $2 billion mark for the first time. From a regional perspective, fund inflows remained concentrated in North America ($6.0 billion), while the South America region saw investor demand recover modestly ($32 million).

- CME Ether Futures Surge to Record Highs: Total open interest in CME Ether futures continued to grow in December, increasing by nearly 40% from the previous month and reaching new all-time highs. Bitcoin futures open interest also hit record highs earlier in the month but ended December with a modest decline of 8.4%.

- PENGU Airdrop Fuels Sales Boom: Ethereum secured the top position on the NFT sales volume leaderboard, recording a 107% increase in volume. This surge was driven by heightened trading activity ahead of the highly anticipated PENGU airdrop, which led to an 85.4% rise in transaction counts. The Bitcoin network also saw impressive growth, with sales volumes increasing by 72.7% as the number of transactions surged by 112%. Meanwhile, Solana’s sales volume rose by 39.1%, accompanied by a 7.2% uptick in transaction count.

- Bitcoin Mining Revenues Hit Post-Halving Highs: Bitcoin’s price increase led to a 19.3% rise in mining revenues in December. Of the total miner rewards for the month, 2.7% came from fees, a decrease from 3.2% in November. Despite a continued decline in on-chain activity, the price gains boosted miners’ earnings to their highest levels since the April halving.

- Ethereum Fees Climb 6.7% as Network Throughput Gains Momentum: Total fees paid on the Ethereum network rose by 6.7% from the previous month, reaching $198.4 million. While total fees grew, the 10% decline in average fees per interaction suggests that the network’s throughput continues to grow.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.