CME CF Solana-Dollar Reference Rate: a Primer for our latest Analysis

This primer is a 'quick start' guide to our CME CF Solana Dollar Reference Rate (SOLUSD_RR) Suitability Analysis.

This article is a companion to our recently published research paper:

'Suitability Analysis of the CME CF Solana-Dollar Reference Rate (SOLUSD_RR) as a Basis for Regulated Financial Products - March 2025 Update'

Click below to jump straight to the paper, or read on for a simplified summary.

For background, note the SOLUSD_RR paper is the latest in a long series of similar research papers. As a regulated Benchmark Administrator, CF Benchmarks undertakes a continuous programme of quantitative research into our Reference Rates, to ensure they continue to meet the 'Three Rs', essential for any benchmark registered under the UK Benchmarks Regulation (UK BMR) framework.

These 'Three Rs' stress that a benchmark must be:

- Representative of the underlying market;

- Resistant to manipulation, and;

- Replicable by market participants.

We call the research reports 'Suitability Analyses', because they're designed to demonstrate, quantitatively, the suitability of our benchmark indices for use in regulated financial products.

Each report is a fully fledged academic-standard research paper, providing a comprehensive analysis of our proprietary orderbook data over a specific observation period.

The analysis deploys classical empirical and statistical methods to test how robustly our indices meet the Three Rs.

This primer is intended as a 'quick start' guide for our latest analysis, focusing on the CME CF Solana Dollar Reference Rate (SOLUSD_RR).

Readers can follow along by navigating to the corresponding section of the full report from the links provided throughout.

Introduction

The Solana protocol emerged in response to common limitations faced by earlier crypto platforms, particularly Ethereum, offering substantial advancements, especially faster transaction speeds.

Due to its numerous superior technical features, Solana rapidly found appeal as a host for DeFi applications, and decentralized apps (DApps).

Solana's market-leading position

Solana boasts high usage, is a top-five blockchain by market capitalization, and holds a substantial Total Value Locked (TVL) of about $7 billion.

The CME CF Solana-Dollar Reference Rate

The CME CF Solana-Dollar Reference Rate is a once-a-day index price for Solana, denominated in U.S. dollars, and regulated under the UK Benchmarks Regulation (BMR) framework.

SOLUSD_RR methodology in a nutshell

Daily transactions from several reliable and liquid cryptocurrency exchanges (Constituent Exchanges) are captured over the specified observation period and aggregated as per below:

- A one-hour data window is split into 12 intervals of five minutes each

- A volume-weighted median price is computed for each partition

- The average of the 12 partition medians is calculated, and this is the robust daily benchmark price

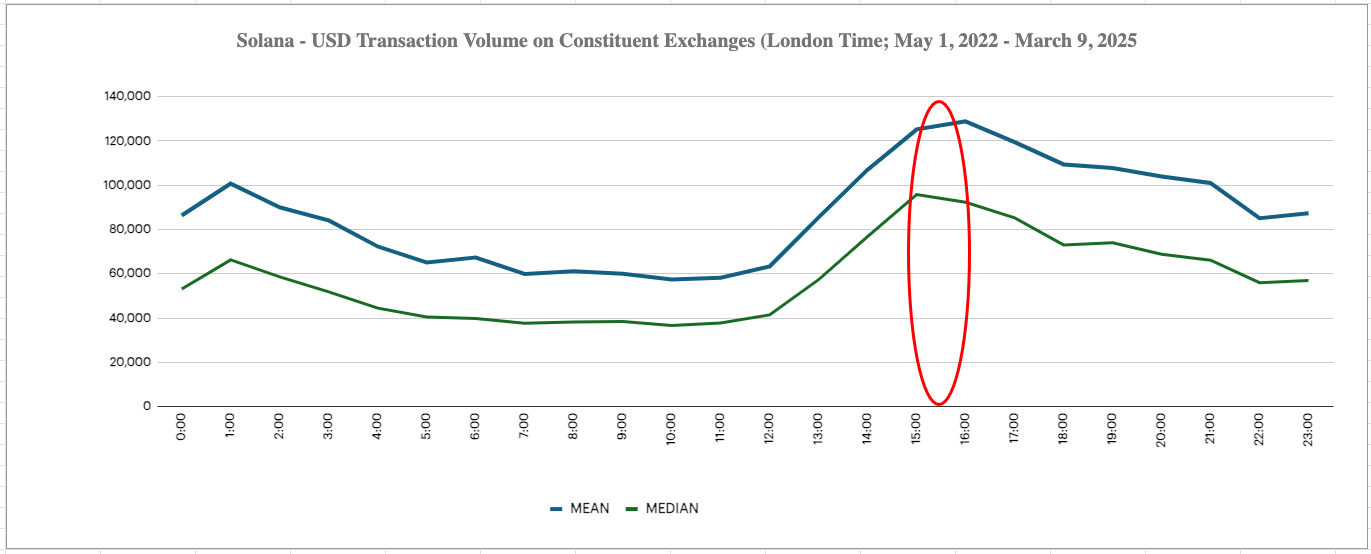

Why SOLUSD_RR is calculated at 4 PM London Time

The one-hour window of 15:00 to 16:00 London Time, coincides with peak traditional market liquidity, as well as peak SOLUSD_RR trading volume, as illustrated below.

How Representative is SOLUSD_RR of the Solana market?

Daily measurements of Solana transactions used for SOLUSD_RR calculation over the observation period, show the benchmark reliably reflects sufficient liquid trading volume to be representative of the broader SOL market. On average, data showed approximately 172,315 Solana ($11.6 million) were traded daily during the observation window.

SOLUSD_RR's Resistance to Manipulation

Here's a description of the multiple defensive design choices employed in the SOLUSD_RR methodology, to defray the risk of market manipulation:

- Partitioning calculation windows into smaller time units minimizes influence from large or anomalous trades

- Use of volume-weighted medians within each partition mitigates effects from unusual or extreme transaction prices

- Equal weighting of exchanges prevents dominant manipulation through targeting particular marketplaces

- Robust surveillance protocols automatically exclude suspicious data - and any such data that occur, trigger a thorough review process to maintain benchmark integrity

SOLUSD_RR's Replicability

An extended simulation was conducted to ascertain replicability. Thousands of institutional-scale trades per day of, on average, $2.08 million each, were executed consistently, with negligible slippage (typically below 0.10%, and in volatile conditions, still below 1.78%).

Conclusion

Drawing all strands together, the extensive analysis demonstrates SOLUSD_RR meets and exceeds the stringent regulatory and practical demands required of institutional financial products.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.