CF Benchmarks Recap - Issue 29

For the last several months there’s really been only one game in the institutional crypto town, and it’s all about those steps to a potential first U.S. Bitcoin ETF

-

CF Benchmarks powers 2 of 3 Bitcoin ETFs under SEC review

-

WisdomTree launches Ethereum ETP on Xetra, SIX

-

Monthly benchmark returns in a nutshell

Non-random walk

For the last several months there’s really been only one game in the institutional crypto town, and it’s all about those steps to a potential first U.S. Bitcoin ETF (as explored in detail in this week’s Featured Benchmark). Many steps remain on that road, albeit outright setbacks have been few and far between lately. The SEC’s decision to extend the formal review period of VanEck’s VanEck Bitcoin Trust ETF – one of only three such applications under active review by the commission – was well within its routine remit and not necessarily disappointing. Steps supporting further normalisation of the institutional cryptoasset class were arguably more significant. Sample: 1. The European Investment Bank, the EU member state-owned public sector lender, announced an experimental issuance of €100m in two-year “digital bonds” registered on the Ethereum blockchain. 2. Institutional investment fund structures in Germany called Spezialfonds are now permitted to allocate up to 20% to crypto-assets, after a law passed in the Bundestag. 3. Widely owned video games publisher Nexon, became the latest global corporation to add Bitcoin to treasury. (Further progressive news in the sections below). Meanwhile, steady ‘NZIRP’ / asset purchase policy capped yields and the dollar whilst buoying stocks and other ‘risky assets’, like Bitcoin, propelling it back above $50k. In fact, BRTI’s weekly peak—$58,011.88—was in the closing minutes of the week; timestamp: 30/04/2021, 23:51 UTC, vs. the month’s $64,858.1 top on April 14th. ETHUSD_RTI continued its recent outperformance of the largest cryptoasset by capitalisation, continuing to define new Ether tops as May got underway, with $2,869.96, timestamp 01/05/2021, 05:32 UTC, vs. last month’s $2,799.68 high on the 29th.

WisdomTree floats Ethereum ETP

WisdomTree keeps busy whilst awaiting the outcome of its Bitcoin ETF filing, launching its second crypto product, Ethereum ETP (USD ticker: ETHW). Like its Bitcoin ETP, ETHW is listed on Switzerland’s SIX exchange and Deutsche Börse’s Xetra; has euro and U.S. dollar variants; is the only ETH ETP backed by a regulated benchmark (CME CF Ether-Dollar Reference Rate); and enjoys the highest institutional price liquidity given CME’s settlement of Ether contracts to the benchmark.

Funding and proceeds: Tesla, Paxos, Andreesen

Paxos, whose PAX Gold token is powered by CFB, completed a $300m Series D round. Proceeds will partly go toward onboarding up to 5 more clients as large as partner PayPal. Tesla booked $272m in proceeds from selling 10% of its $1.5bn February Bitcoin investment. VC Andreesen Horovitz aims to raise up to $1bn from its 3rd crypto-focused fund.

NYDIG, megabanks and megabank custodians

NYDIG has been sketched in as JPMorgan’s custodian in an actively managed Bitcoin fund. This follows Morgan Stanley’s disclosure of $29.4m from its own 2-week-old private Bitcoin fund, also custodied by NYDIG. US Bank (formerly US Bancorp) will service NYDIG’s own custody needs, as USB looks to catch-up with BoNY Mellon and State Street digital asset custody businesses.

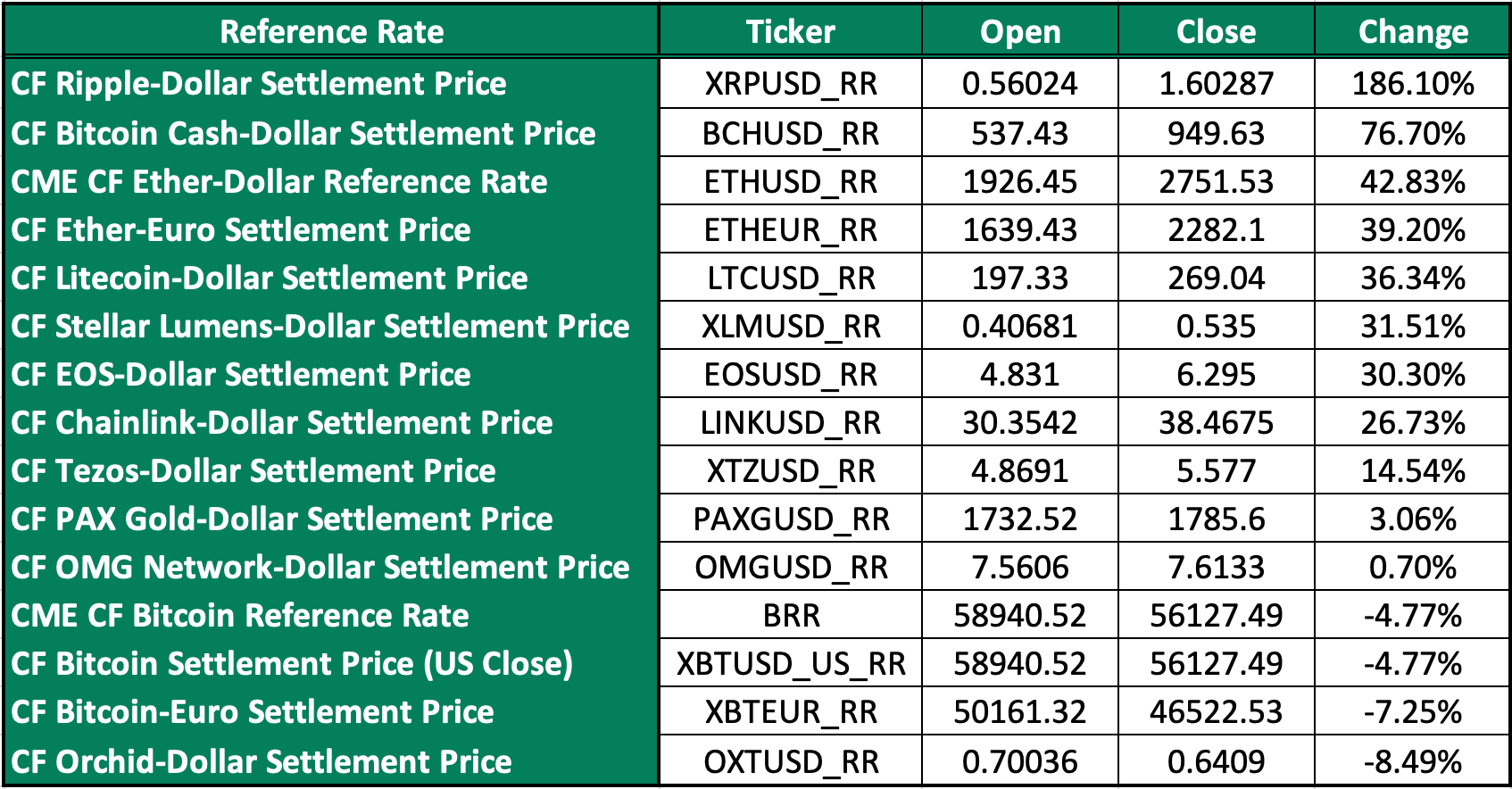

The Returns: Reference Rate monthly returns

The table below summarises monthly returns for all CF Benchmarks’ public Reference Rates, the once-a-day regulated benchmark indices that continue to bring rigorous standards of accuracy and integrity to numerous cryptoassets, including Bitcoin and Ether. The summary covers 1st April to 30th April with each asset and its total return ranked in order of performance. The month was most clearly notable for the negative performance of Bitcoin.

Featured benchmarks: CF Bitcoin Settlement Price (U.S. Close)

The CF Benchmarks-powered ETFs at the top of the SEC’s queue

With the SEC’s active review of WisdomTree Bitcoin Trust and Kryptoin Bitcoin ETF Trust well underway, a look at the firms behind the filings and what to watch for next

For years now the crypto space has demonstrated its ability to remain engaged with the dry, technical details of traditional markets regulation so long as the subject of the minutiae is the potential approval of a U.S. Bitcoin ETF.

And following numerous ultimately unsuccessful efforts to get a U.S. Bitcoin ETF over the line over the last five years or so, there’s once again been ample scope for geeking out on how fiat market regulation could soon impact cryptoassets with a brace of fresh ETF applications landing on the Securities and Exchange Commission’s desk this year. As of last week, the number of active applications for a U.S.-listed Bitcoin Exchange Traded Fund had reached nine.

Predictably, interest is most heightened in the handful of filings that the SEC has signalled it is actively reviewing. Formal acknowledgement that the Commission has begun a hands-on examination of a proposed security is typically conferred by a ‘Notice of Filing of a Proposed Rule Change’ (Here’s an example). These notices, again—typically—follow the submission of a form 19b-4 by the exchange on which the sponsor intends to list its ETF. (For both WisdomTree’s and Kryptoin’s ETF that would be the CBOE BZX Exchange).

Form 19b-4 is the official and legal document submitted by a ‘self-regulatory organisation’ (like an exchange) seeking permission to list an asset: quite logically, such requests are couched in the form of a ‘proposed rule change’.

Read the rest of this article on our blog.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.