CF Benchmarks Quarterly Attribution Reports - September 2024

Thoroughly dissect and comprehend the performance of our flagship portfolio indices at the constituent, category, sub-category, and segment levels during the course of each portfolio rebalance period.

Crypto’s Crossroads: ETFs, Elections, and Economic Enigmas

Digital assets currently find themselves in a paradoxical environment, shaped by continued industry developments, macroeconomic factors, and the potential for a new regulatory regime. Despite progress in curbing inflation and a loosening labor market leading to declining interest rates, a risk-off sentiment has prevailed. Concurrently, institutional adoption reached a new milestone with the launch of spot Ether ETFs in the United States. These regulated products have attracted steady fund flows, highlighting robust interest in this emerging asset class, despite more muted price action. The success of these spot products has even spurred asset managers to explore future opportunities, evidenced by early applications for spot Solana ETFs submitted to the SEC.

Market volatility resurged in the latter half of the rebalance period, primarily triggered by the unwinding of the "Yen Carry Trade," dampening risk appetite across broader markets. On the monetary stage, Federal Reserve officials have led markets to the starting line of the next rate-cutting cycle. Jerome Powell's dovish performance at the August Jackson Hole Symposium helped mitigate some market losses. Crypto prices responded positively to these potential rate-cut signals, benefiting from their perceived inverse relationship with interest rates.

Attention has also pivoted towards the upcoming U.S. elections in November, with market participants carefully scrutinizing potential policy changes that might emerge from a new administration. Notably, former President Trump and various policymakers have endorsed Bitcoin as a potential strategic reserve asset for the U.S. Treasury, underscoring the growing influence of digital assets in the broader economic and political sphere. Digital assets have found advocates across the political spectrum, with pro-crypto Democrats calling for a "reset" with the industry after an adversarial past four years.

Key takeaways:

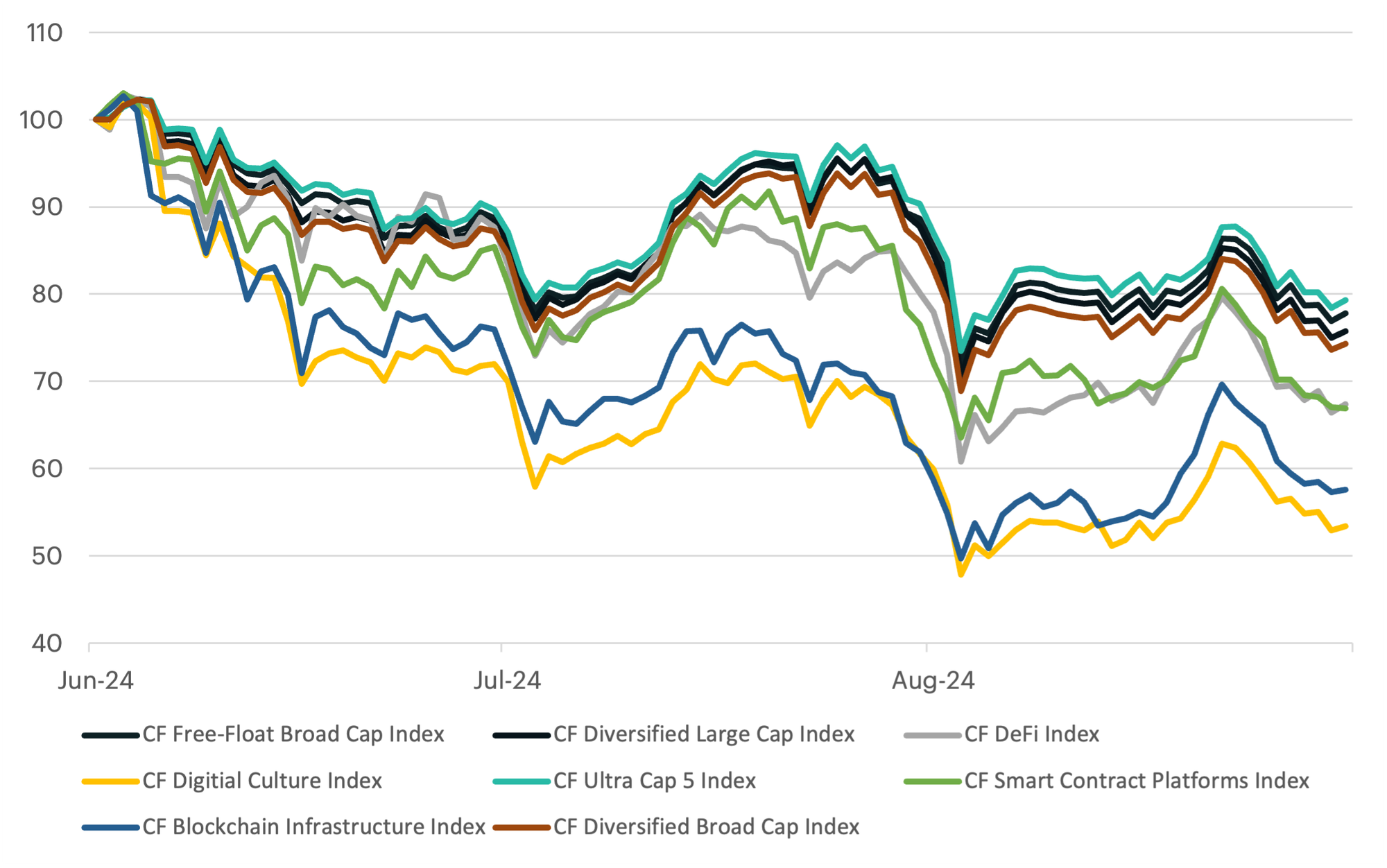

Ultra Caps Show Resilience as Culture Tokens Dive

- The period was characterized by heightened uncertainty, leading to turbulent market conditions and significant price volatility.

- Our CF Ultra Cap 5 Index and CF Free-Float Broad Cap Index showed resilience, declining 21.61% and 23.11% respectively. The CF Digital Culture Index and CF Blockchain Infrastructure Index underperformed significantly, falling 47.32% and 44.36% respectively.

Normalized Index Performance

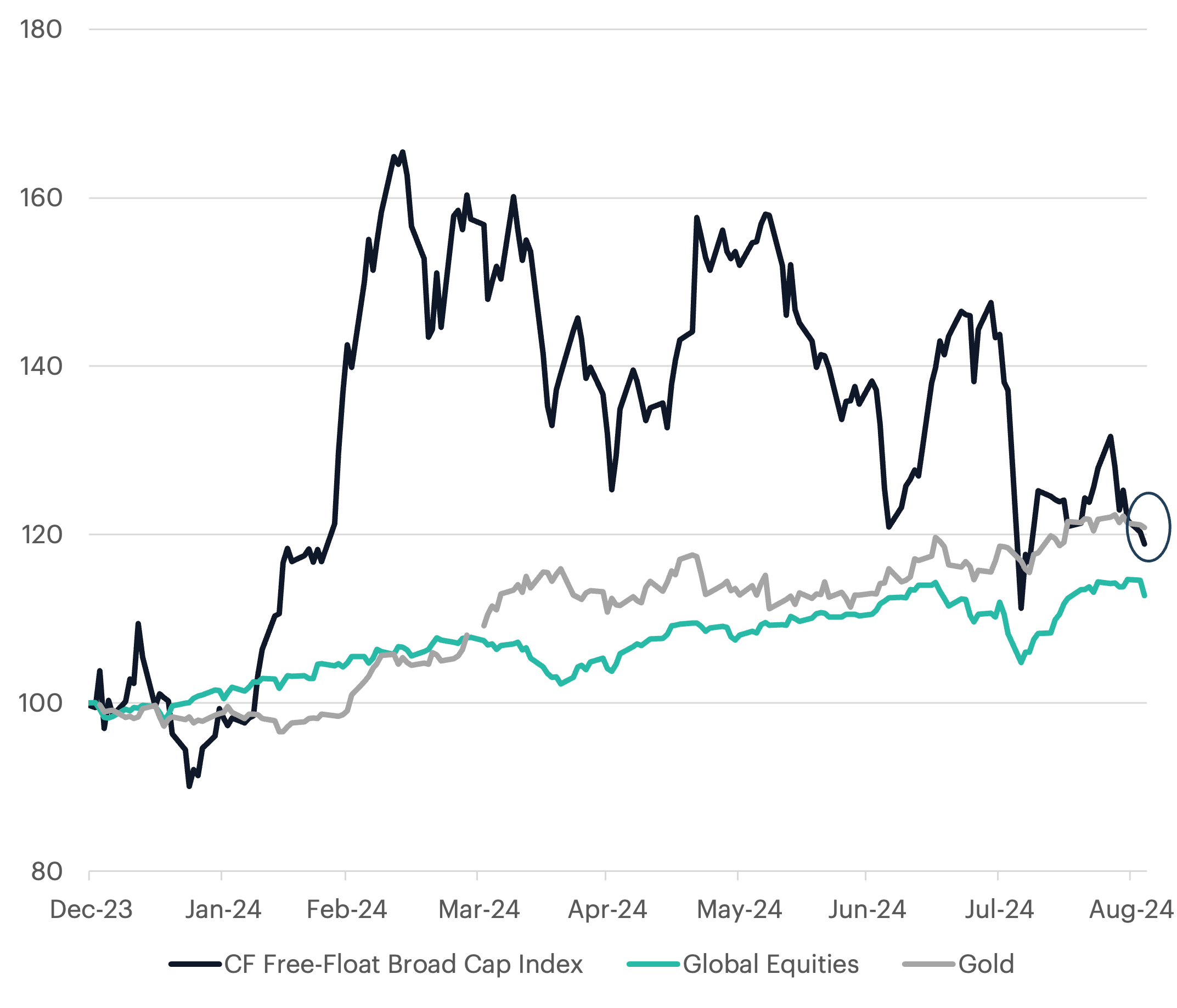

Gold Surpasses Crypto in Asset Class Race

- The cryptocurrency market, led by the CF Broad Cap Index, has recently been overtaken by gold, but digital assets still outperform global equities year-to-date.

- Uncertainty surrounding the upcoming U.S. election in November has market participants anticipating potential shifts in regulations, tax policies, and tariffs, which could impact both the digital asset industry and broader economic dynamics.

- Central banks' expected rate-cutting cycle could benefit both gold and cryptocurrencies, as lower interest rates often favor non-yielding assets, positioning digital assets for a potential rebound as market conditions evolve.

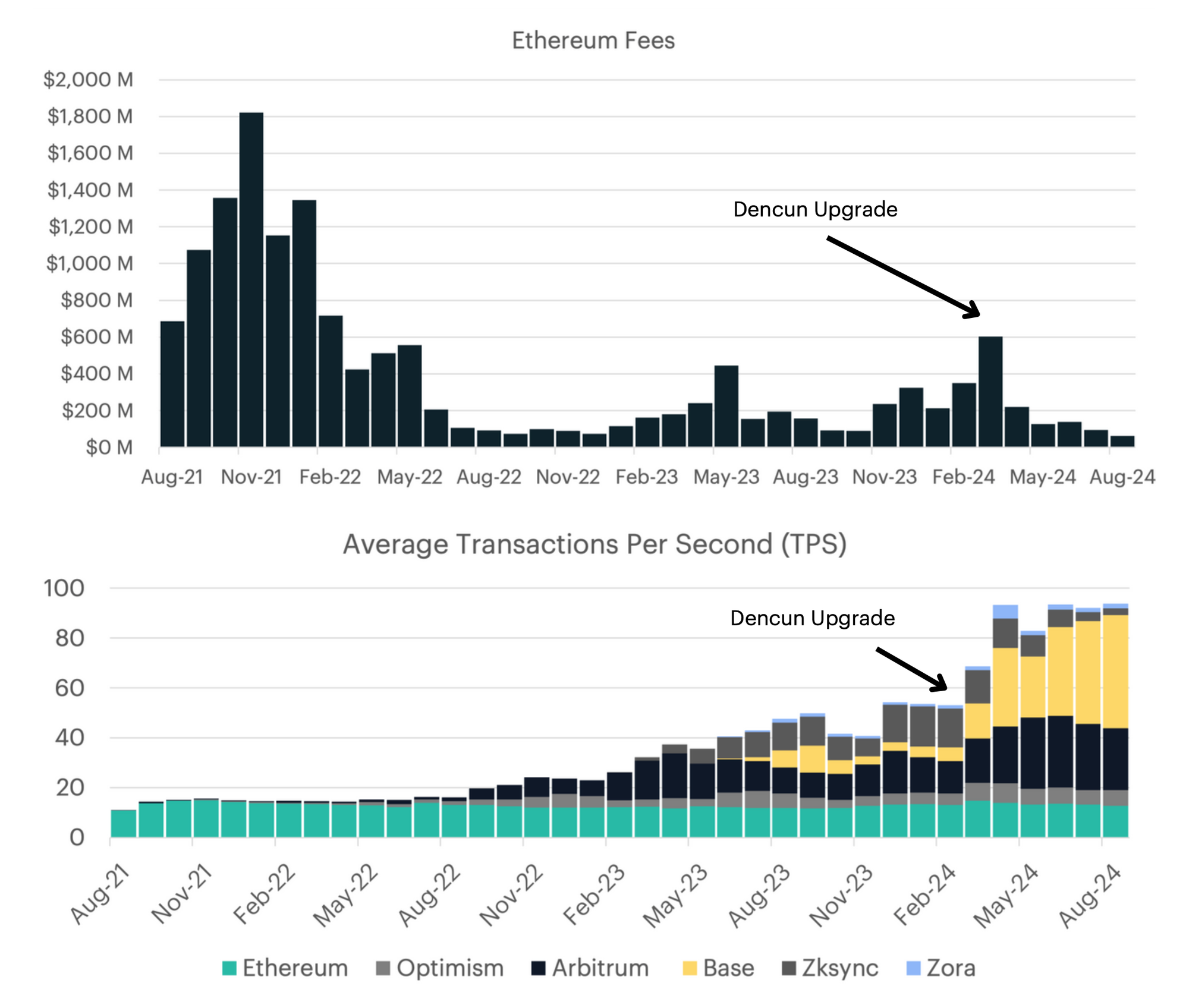

Dencun's Domino Effect

- Ethereum’s price has underperformed despite the launch of spot ETFs, with the March 2024 Dencun upgrade driving a shift towards Layer-2 (L2) networks like Optimism and Arbitrum, significantly boosting their transaction speeds and reducing costs.

- The L2 networks' success has led to a steep decline in fees on Ethereum’s main network, sparking competition among L2s to offer the lowest fees while sustaining high transaction throughput.

- Solana, contrasting with Ethereum's fee drop, has seen an increase in fee generation, highlighting a broader trend where scalability and cost-efficiency are becoming essential to the success of blockchain ecosystems.

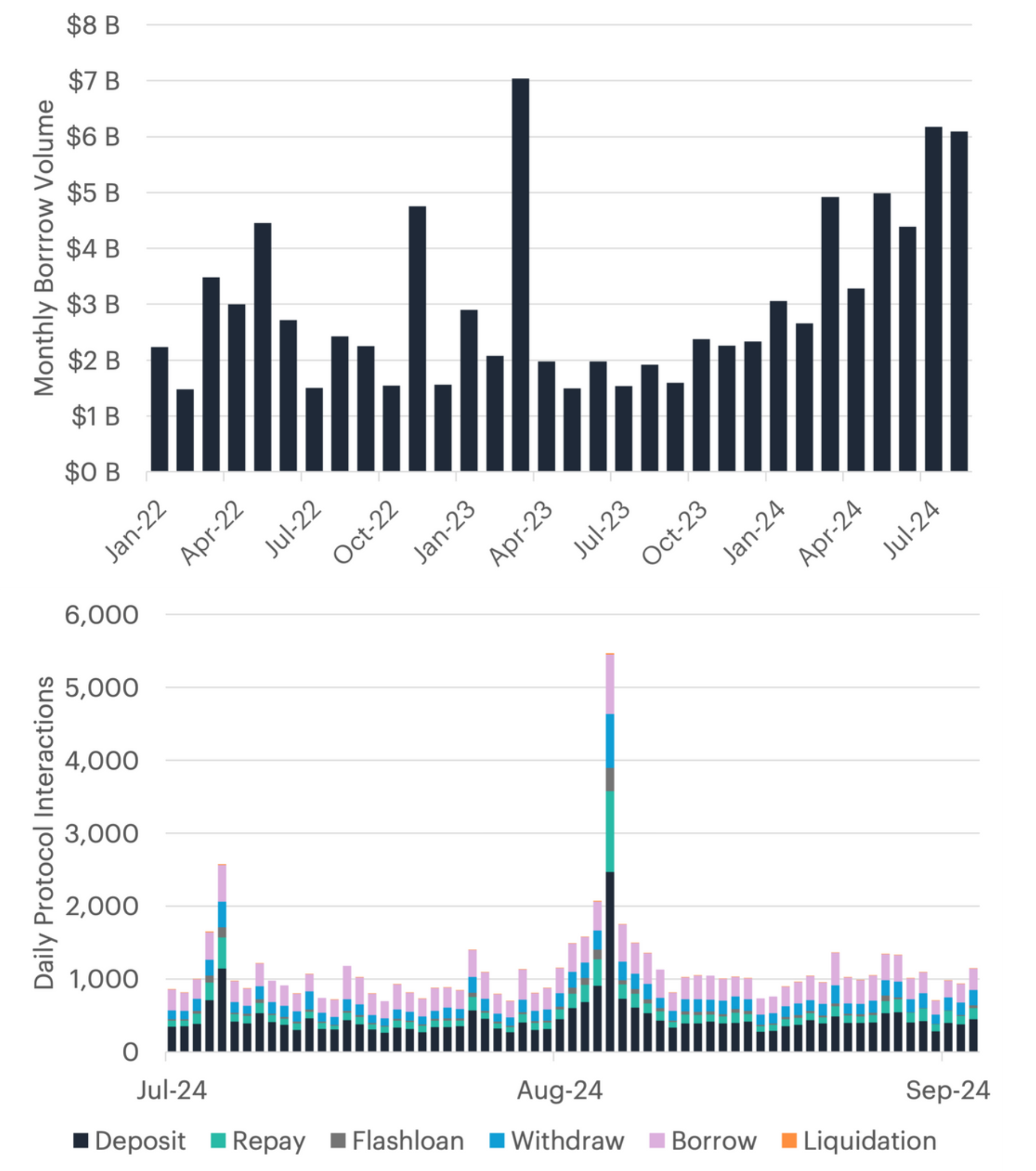

AAVE Sees Record Borrowing Activity

- Aave is a decentralized finance (DeFi) protocol on Ethereum that allows users to lend and borrow cryptocurrencies, offering both stable and variable interest rates, with features like "flash loans" and smart contract management for transparency and security.

- In July and August 2024, Aave saw borrowing volumes exceed $6 billion, the second-highest on record, alongside a surge in active users, surpassing the 2022 peak of 40,000 borrowers.

- During market sell-offs, particularly on August 5th, platform activity spiked, with 45% of users adding collateral, likely to avoid liquidations or to increase borrowing during the downturn, showcasing Aave's utility in volatile markets.

Solana's Scalability Powers User Surge

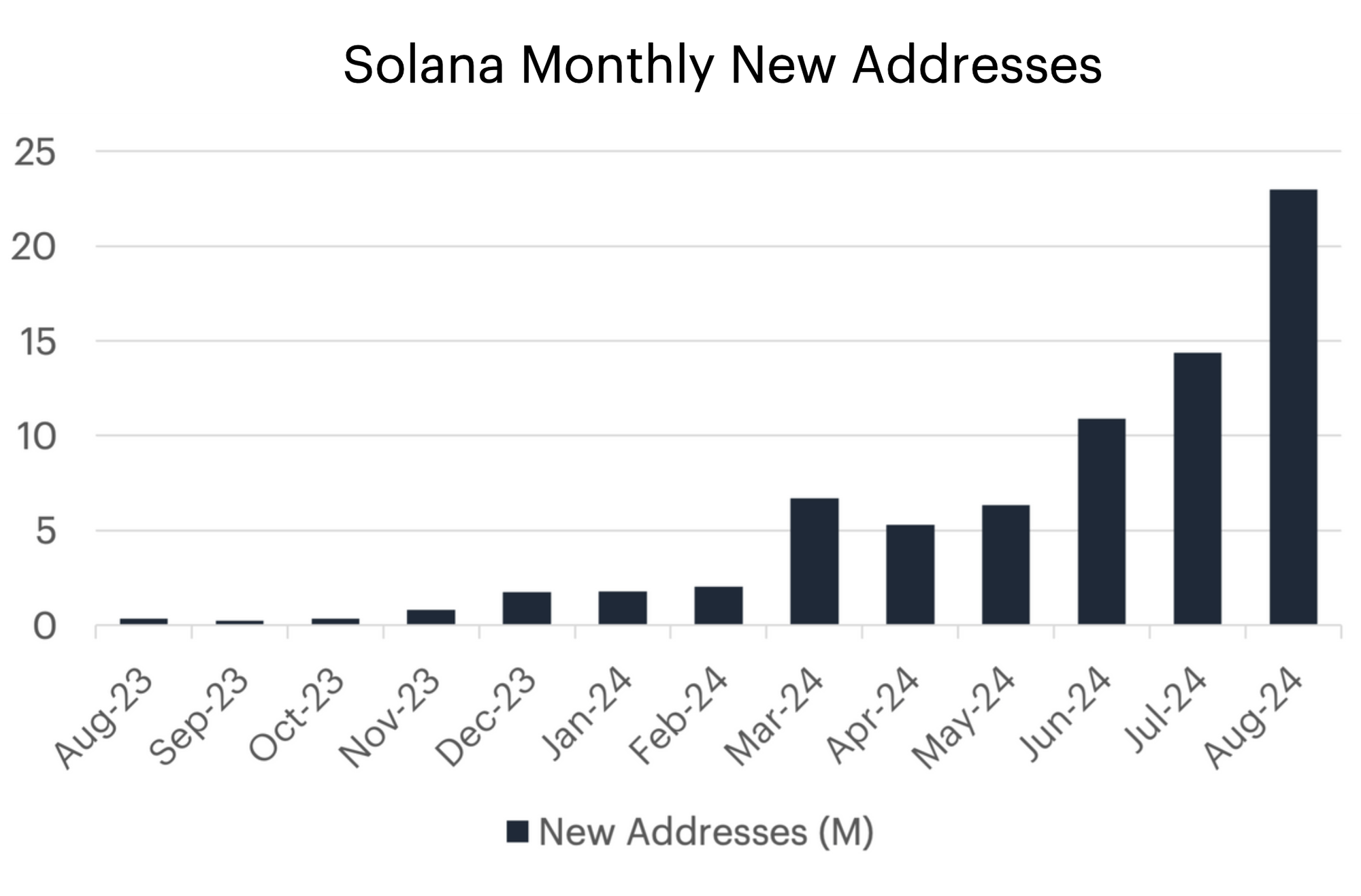

- Solana's SOL token experienced minimal decline during the quarter, with the network seeing significant growth in on-chain activity, surpassing 20 million new addresses and 1 billion transactions in August.

- Solana's unique Proof of History (PoH) consensus mechanism drives this growth, enabling fast and low-cost transactions, which contributed to decentralized exchange (DEX) volumes exceed $100 billion in July.

- Despite a 127% increase in transactions over the past year, Solana's average fees remain low at around 2 cents, maintaining strong demand for SOL to cover transaction fees and support network validation.

Helium’s Data Demand Drives Token Surge

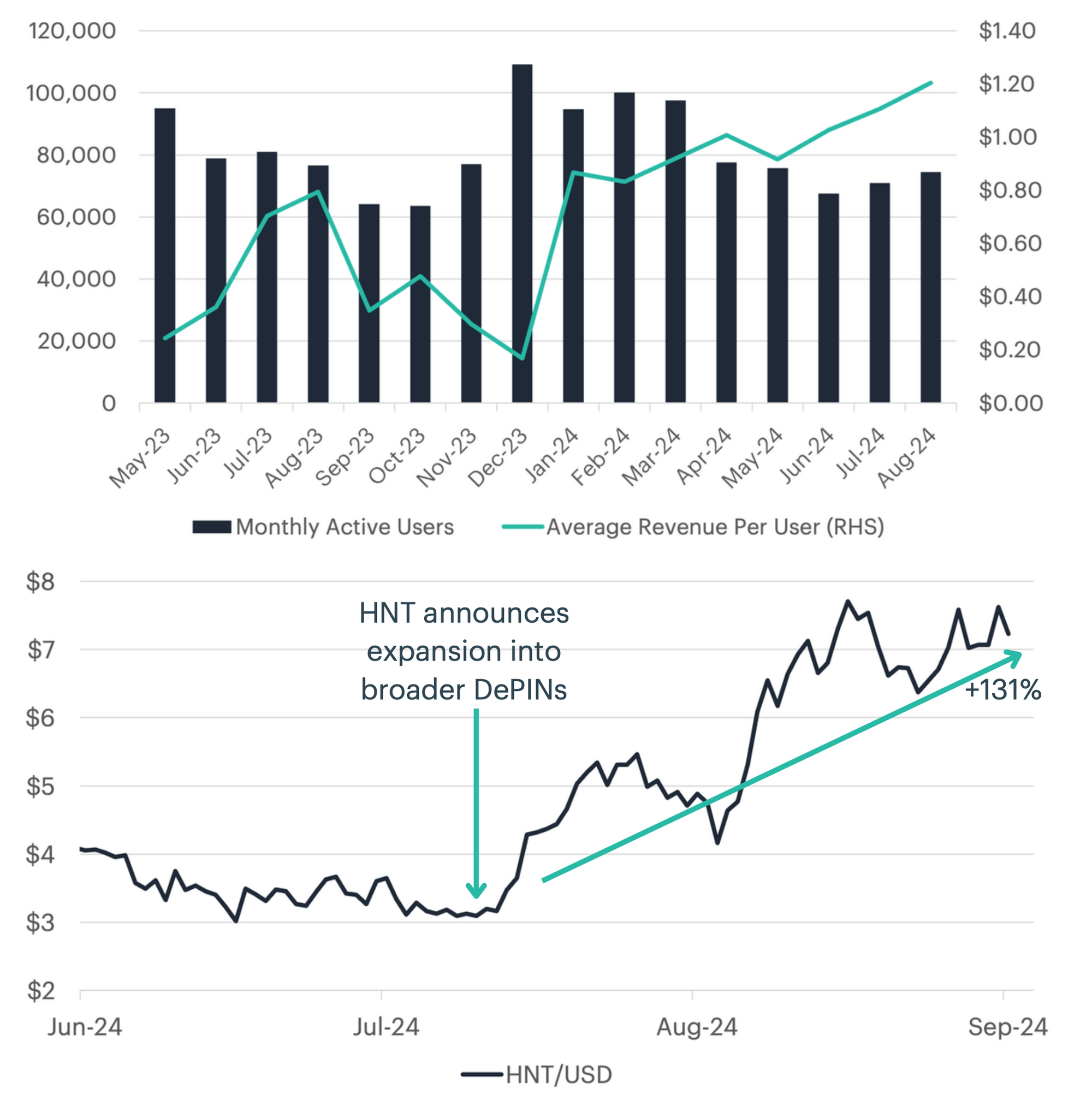

- Computing blockchains, like the Helium network, reward participants for maintaining decentralized physical infrastructure networks (DePINs), using Helium's native token (HNT) to pay for data transmission through Data Credits (DCs), which create deflationary pressure by reducing HNT’s supply.

- In 2024, despite a 32% decline in monthly active addresses, Helium experienced a 359% surge in total sign-ups and a 619% increase in average revenue per user, driven by rising demand for Data Credits as users consume more data.

- The Helium Foundation’s July announcement to expand its wireless network to broader DePINs, including compute, storage, energy, and mobility, led to a 131% rally in the HNT token, reflecting investor optimism over the network’s growth potential.

To read the full compilation report or a specific index's report, please click on the respective links below:

- Quarterly Attribution Report (PDF Version)

- CF Broad Cap Index Series

- CF Cryptocurrency Ultra Cap 5 Index

- CF Diversified Large Cap Index

- CF DeFi Composite Index

- CF Web 3.0 Smart Contract Platforms Index

- CF Digital Culture Composite Index

- CF Blockchain Infrastructure Index

Lastly, our Quarterly Attribution Reports are designed to help investors understand the performance of digital assets through a purpose-centric lens called the CF Digital Asset Classification Structure (CF DACS). To learn more about CF DACS, please utilize our interactive CF DACS Token Explorer.

Contact Us

Have a question or would like to chat? If so, please drop us a line to:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.