CF Benchmarks Quarterly Attribution Reports - December 2023

Thoroughly dissect and comprehend the performance of our flagship portfolio indices at the constituent, category, sub-category and segment levels.

Possible ETF Approval Sparks Year-End Rally as Ether Joins Approvals Queue

Despite the existing regulatory challenges and roadblocks that remain, institutional interest in digital assets has witnessed a swell in activity over recent months. Open interest on the Chicago Mercantile Exchange (CME) has risen - the total number of outstanding futures contracts for both Bitcoin and Ether has increased over 76% and 40% respectively since our last rebalance period, with the former surpassing its all-time high set back in June. Perhaps the largest contributing factor for this renewed interest is the potential of spot Exchange Traded Fund (ETF) products for the two largest tokens. Many investors also see the approval of spot ETFs as a major 'unlock' for the crypto industry. The ETF fund structure has grown exponentially since they were first introduced in the 1990s, breaching the $7tn level this past year in the U.S. Spot token ETFs would mark a major catalyst for adoption as retail investors would have access to the pure exposure of Bitcoin and Ether in a traditionally practical fund structure for the very first time. While many regulatory headwinds remain, the approvals of these spot ETFs could be seen as the very first steps in deconstructing these aforementioned challenges and hurdles that have plagued the digital asset class.

Over the last few months, several macroeconomic trends have impacted global markets. Inflation pressures have continued to steadily decline across the globe. With the latest data points coming in below expectations for both the U.S. and the Eurozone, this has allowed interest rate expectations for 2024 to shift in dovish manner. Some forecasters are now anticipating that the Federal Reserve could begin decreasing their benchmark rate as soon as March 2024. Furthermore, economic weakness, such as slowing job growth and cyclical demand, could give the central bank more slack in adjusting its tightening stance to the downside.

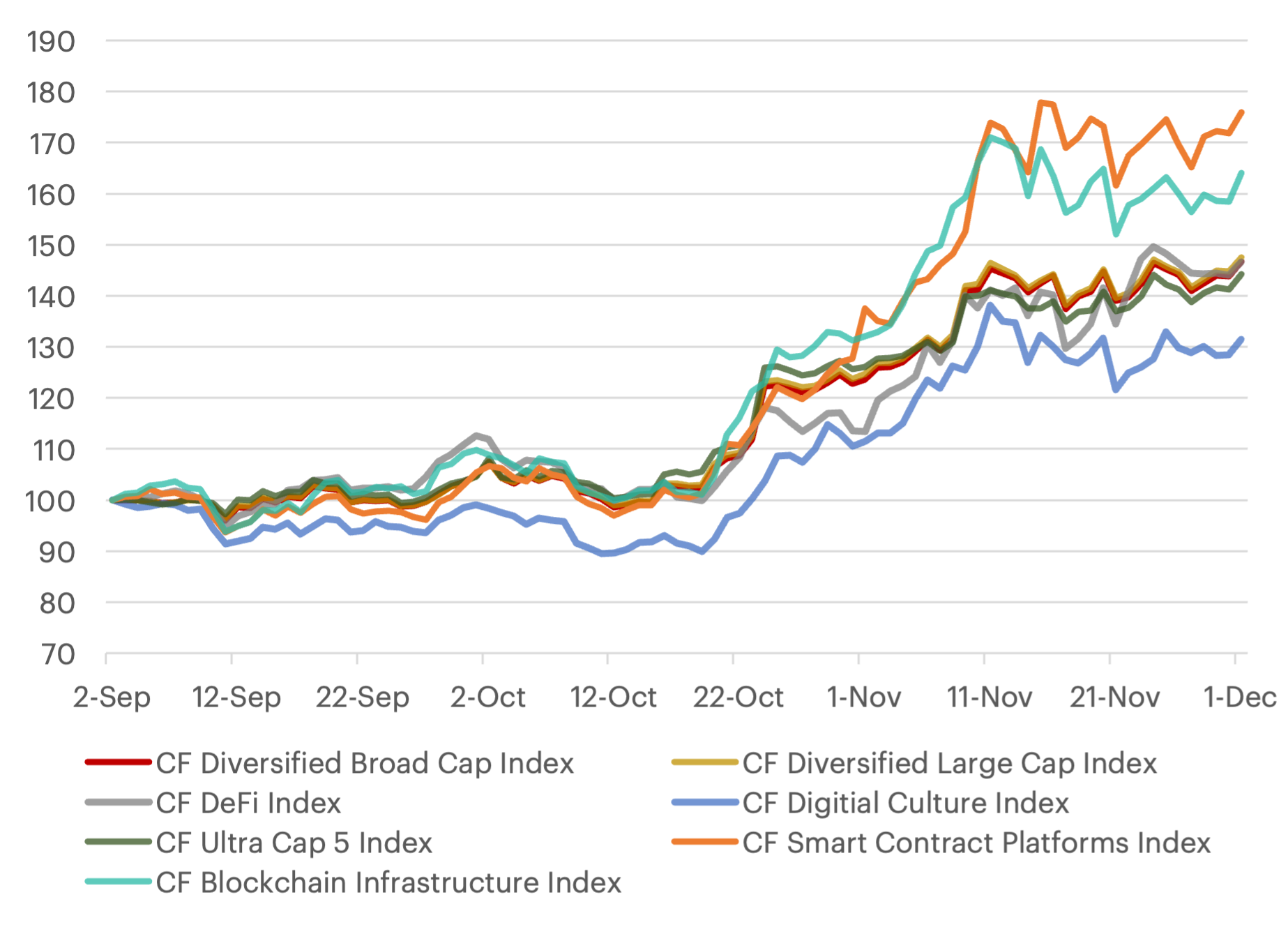

Given the current backdrop, investor sentiment has become more constructive for the digital asset class. All of our flagship portfolio indices posted strong performance over the last rebalance period, outperforming traditional risky assets, such as U.S. and global equity markets by a wide margin. The CF Web 3.0 Smart Contract Platforms Index led the pack, with the CF Blockchain Infrastructure Index coming in a close second. Both category indices outperformed the broader market (as measured by the CF Floating Broad Cap Index) by a significant margin. Lastly, the CF Digital Culture Composite Index continued to struggle, lagging behind the rest of the major portfolio indices for the second straight rebalance period.

Index Performance

To read the full compilation report or a specific index's report, please click on the respective links below:

- Quarterly Attribution Report (PDF Version)

- CF Broad Cap Index Series

- CF Cryptocurrency Ultra Cap 5 Index

- CF Diversified Large Cap Index

- CF DeFi Composite Index

- CF Web 3.0 Smart Contract Platforms Index

- CF Digital Culture Composite Index

- CF Blockchain Infrastructure Index

Lastly, our Quarterly Attribution Reports are designed to help investors understand the performance of digital assets through a purpose-centric lens called the CF Digital Asset Classification Structure (CF DACS). To learn more about CF DACS, please utilize our interactive CF DACS Token Explorer.

Contact Us

Have a question or would like to chat? If so, please drop us a line to:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.