CF Benchmarks Newsletter Issue 82

BlackRock's alternative tack to get In-Kind over the line | How the 'Retail' / 'Institutional' dichotomy is fracturing | CFB partners with Crypto Insights Group | Daily CFB data now available on X/Twitter

- BlackRock takes ETHA In-kind filing in hand

- Allocator platform Crypto Insights Group on-boards CFB

- Now on X/Twitter: Daily crypto index highlights, from CF Benchmarks

Cohorts

Periods of market turmoil – like the recent one that’s now largely receded – often bring to the fore the presumed split between behavioral profiles of the two key notional market cohorts, ‘retail’ and ‘institutional’, as participants attempt to gauge how entrenched sentiment may be and, consequently, how long volatility may remain elevated.

As noted in the prior edition though, Bitcoin volatility, at least, isn’t necessarily behaving in quite the same way as it has historically.

One possible reason why, is that those traditional pillars of ‘retail’ and ‘institutional’ might be beginning to fade, or merge.

Democratization

Beyond the most facile ‘democratization’ of markets based on falling information asymmetry over the past couple decades, the proliferation of institutional-grade facilities that non-corporate participants now have at their disposal, is one concrete example of how the demarcation is blurring.

And now, through platforms like Robinhood, Interactive Brokers, and others, individual traders can deploy an array of facilities and access specialized information – like algorithmic trading systems, so-called Level 2 data, structured products and more – previously only available to large counterparties.

Crossover

The ‘insto’–retail distinction has been particularly questionable, in principle, in the digital asset realm. On the blockchain, wallets are objectively just addresses, and identification, strictly speaking, can only be inferred.

And while permeation of institutional vs. retail behavior certainly looks to be happening bidirectionally, the most consequential impacts appear to be where institutional participation is converging with retail activity.

Think of prime brokerages like FalconX, and platforms like Anchorage and Copper, providing crossover services used by crypto-native HNW individuals and family offices, blurring categories.

From CEX to DEX

Meanwhile, the trend of rising institutional capital being deployed on centralized exchanges, AKA CEXs, and decentralized exchanges, AKA DEXs – both historically dominated by retail flows – has in fact been well established for years.

For instance, Chainalysis calculated that at the peak of the FTX collapse, in late 2022, 68% of the spike in fund withdrawals from CEXs was attributable to institutional transfers. That compared with just 34% during the sharp Bitcoin price reversal of December 2017, following the major bull run of the preceding months.

As for DEXs, up to date evidence is shown by the EY Parthenon/Coinbase 2025 Institutional Investor Digital Assets Survey (PDF) published in March. The results contradict the longstanding and widely held assumption that institutions steer particularly clear of DeFi protocols, DEXs and other dApps, with the percentage of investors saying they would engage with DeFi within the next two years indicated to be 75%, more than triple the 24% already doing so.

One takeaway

One key takeaway is that while the crypto times are currently ‘a changing’, far more visibly than at any other juncture in the asset class’s history, particularly on the regulatory front, encouraging participants to react in kind, behavioral trends appeared to have begun to shift quite a while ago. And that’s likely to have important consequences.

For one, as noted earlier, Bitcoin’s volatility profile seems to be evolving. If confirmed, that would underscore that assumptions about how crypto markets may behave, at least based on participant cohorts, is due for a revision.

Beyond Delta, with CME Group's Brian Burke, CFA

This theme came up in a recent episode of the CFB Talks Digital Assets podcast, in which we were fortunate enough to host CME Group’s, Brian Burke, CFA, Senior Director of Equity Products, who also oversees crypto options.

In the audio clip below, Burke suggests that with multiple means of structuring and executing derivative trades, enabling myriad ways of positioning with regards to risk, available to both CME’s institutional clients as well as its rapidly growing base of retail clients, the notion of a general split down behavioral lines is too simplistic.

Burke’s CFBTDA appearance, the first from a representative of CF Benchmarks’ earliest and longest standing institutional partner, CME Group, was timely.

It comes after the recent launch of CME Solana futures, and ahead of the imminent debut of CME XRP futures trading.

Brian acknowledges within the wide-ranging conversation that the cadence of CME’s new product launches has picked up of late, considering the more accommodating regulatory environment, as well as the increasing maturity of the crypto market, and improving educational distribution of digital asset participants.

Scroll to the end of this edition for an episode summary, and links to the full show.

On your way there, be sure to check out news of CFB’s just-launched X/Twitter bot; our exciting new partnership with asset allocators’ platform Crypto Insights Group, an article by our Head of Compliance, Alice Kane on a recent EU decision that could limit access to regulated crypto benchmarks, and a lot more.

BlackRock opts for different kind of in-kind filing

As has been well aired around here over the last several months, the ongoing regulatory reset at the SEC has yielded several concrete steps forward, particularly on the legal front, and chiefly for crypto platforms. From the perspective of CF Benchmarks' key watchpoints though, as the provider of the benchmark methodology powering the largest proportion of U.S. crypto ETP assets under reference, more patience is required.

Reviews extended

One less than encouraging development was confirmed in recent weeks, with the extension of the Commission’s review of a host of proposed rule changes – ETF filings – though rather than these being fresh requests for permission to list new crypto assets, they were applications to amend existing products.

Specifically, the SEC signalled delays of filings aimed at enabling staking within Ether ETFs, and to permit ‘in-kind’ redemptions of Bitcoin ETF units.

Review extensions are not rejections, of course. Still, the emergence of this upset with regards to the filing for a couple of high profile Ether funds by NYSE Arca, obviously casts a shadow on similar applications by other exchanges on behalf of funds listed on their venues.

Likewise, with reviews of Cboe BZW’s rule change applications for in-kind redemptions on behalf of the WisdomTree and VanEck Bitcoin funds also extended, the SEC’s consideration of Nasdaq’s filing in January on behalf of BlackRock’s iShares Bitcoin Trust (IBIT) (one of the BRRNY Six) will almost certainly be delayed too.

BlackRock re-files ETHA S-1

Meanwhile, the most recent application of this type, relating to BlackRock’s iShares Ethereum Trust (ETHA) looks set for a similar arc. (Note this is another fund supported by a CFB index, in this case ETHUSD_NY).

What’s different about that filing, though, is that BlackRock has opted to submit it in the form of a ‘post effective’ amendment S-1, essentially an amended registration statement for a security that’s already trading.

All other crypto in-kind filings (and those seeking to add staking to their funds) have, as noted above, been tabled by exchanges in the form of proposed rule changes.

S-1 amendments for listed ETFs aren’t unheard of, though they are unusual. While we’re short of scope here to explore BlackRock’s motivations for taking this approach, interpreting the move as anticipatory is a line of least resistance.

Note that Nasdaq has yet to file a 19-b4 seeking permission for in-kind redemption of ETHA.

Assuming the current atmosphere of progressive regulatory momentum will spur the SEC to a relatively quick - and positive - conclusion of its assessment of crypto ETF redemptions; an amended ETHA S-1 in hand could enable a smooth transition for that fund.

In any case, the normal review period for all types of registration statements, amendments or initial, is 30 days (as opposed to 45 days for rule changes). This means the outcome of the SEC’s initial determination will be known from around the first week of June.

CFB indices land on Crypto Insights Group platform

New Partnership

CF Benchmarks is excited to announce the launch of a partnership with Crypto Insights Group Corp., (CIG) the unique digital assets-focused data, analytics, and market intelligence platform for institutional allocators, investment managers, and capital markets services providers.

Starting with our CF Institutional Digital Asset Index (IDAX) and CF Large Cap Index, CIG has begun to roll-out access to CFB’s key measures of investible crypto market beta to users of its platform.

Meet Crypto Insights Group

Crypto Insights Group (CIG) is a leading alternatives data provider focused on delivering tools to digital asset fund managers and institutional allocators. CIG is dedicated to bridging the gap between traditional finance and the rapidly emerging digital asset class.

By providing a sophisticated Institutional Allocator Portal, CIG empowers fund managers and allocators with the ability to streamline the identification, diligence, and monitoring of the asset class.

CIG's platform includes a comprehensive suite of data management tools, analytics, benchmarking and research reports covering the investment landscape. CIG is backed by some of the most well-known funds and angels in the industry.

Click below to read the complete launch post.

The most trusted crypto indices are now on X/ Twitter

Key CF Benchmarks indices and index data are now being published daily on X (formerly known as Twitter).

If you're not already following CF Benchmarks, you're seriously missing out, but there's now an added reason to ensure that you do.

We've now begun to publish the daily settlement prices of some of our most high-profile indices, together with key details, and graphics.

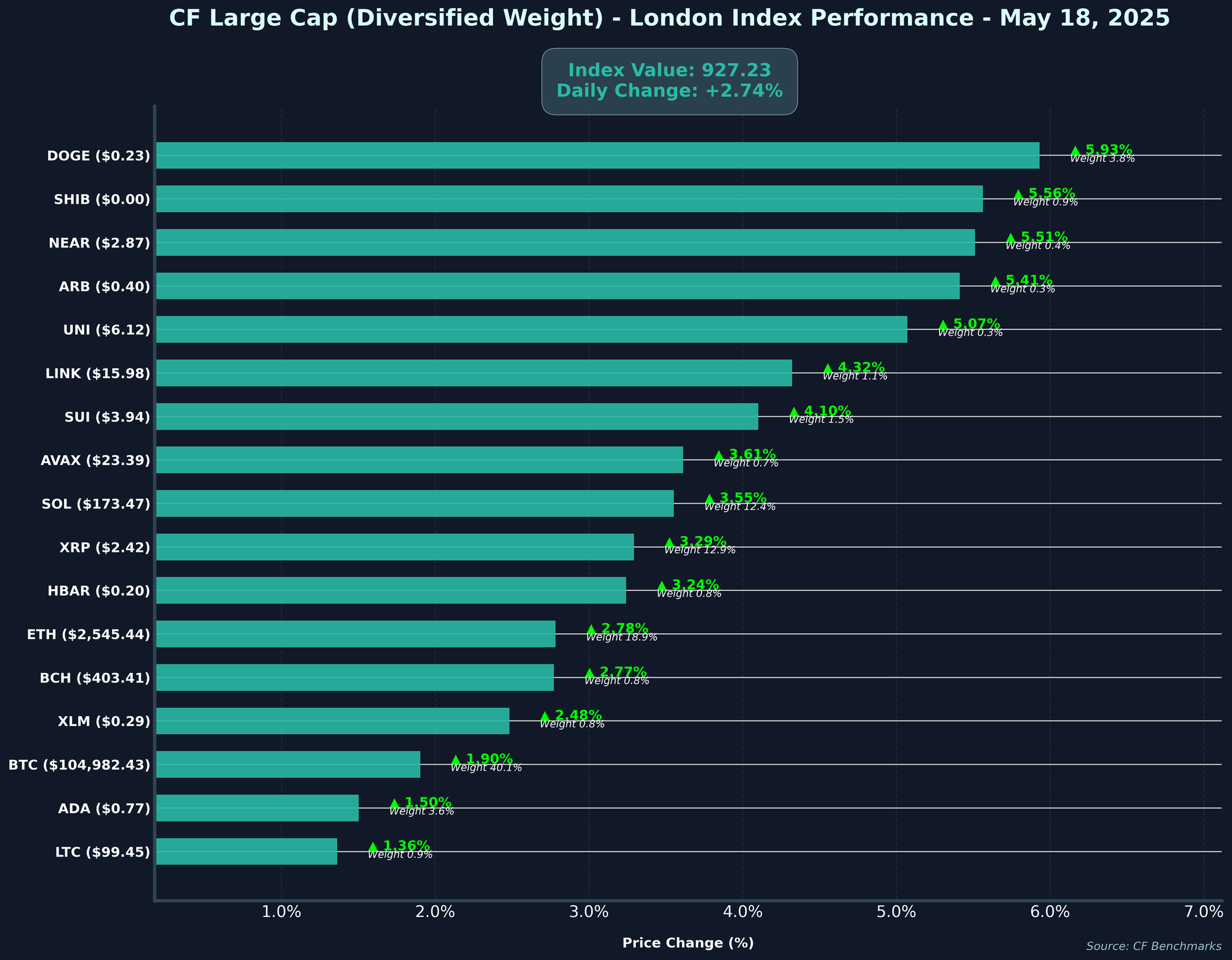

For instance the image below shows the daily change of constituents of our CF Large Cap (Diversified Weight) - London Index, together with the 4 PM London Time index price.

We plan to publish these snapshots daily - meaning our proven, transparent, and high-integrity measures of crypto market beta are now fully available and accessible to all.

Click below to find the latest update and to follow CF Benchmarks now.

📊 CF Institutional Digital Asset Index - US Performance - 2025-05-18

— CF Benchmarks (@CFBenchmarks) May 18, 2025

💰 Index Value: $12,978.88(+0.96%)#Crypto #CryptoIndex #CFBenchmarks #CryptoMarkets

Not investment advice. Past performance is not indicative of future results. pic.twitter.com/z2punp6spn

CF Benchmarks offers unique regulatory status and global reach after EU decision on 'non-significant' benchmarks

By Alise Kane, Head of Compliance, CF Benchmarks

UK FCA maintains crypto benchmark framework after EU change

The European Union has formally approved a significant shift in its regulatory framework for financial benchmarks, a pivotal conclusion to a nearly decade-long debate over the scope of oversight required for benchmark administrators.

With the Council of the European Union’s green light for the partial relaxation of licensing requirements, particularly the removal of the need for administrators of “non-significant” benchmarks (the category all crypto indices fall under) to register; institutions entering the digital asset space may be faced with a dearth of regulated benchmarks. (Here is a link to the minutes of the final reading of the amendment in the European Parliament, confirming its approval.)

This regulatory evolution comes at a time when crypto markets are rapidly expanding across the globe. As new digital asset financial products proliferate and institutional adoption gathers pace, the need for regulated, transparent benchmarks of these assets has never been more important. Fortunately for the digital asset product market, CF Benchmarks is a UK FCA regulated Benchmark Administrator, and the UK has confirmed it will maintain the current regulatory framework for Financial Benchmarks. This means financial institutions can continue to enjoy the support of regulated indices from CF Benchmarks.

Below, we will explore key benefits from the unique combination of CF Benchmarks’ regulatory status in the UK, and its global market coverage, highlighting why financial institutions such as BlackRock, CME Group, ChinaAMC and others, continue to choose CF Benchmarks' FCA regulated indices to power their digital asset products.

Click below to read the complete article

CFB Talks Digital Assets Episode 44: What's next for CME Group in crypto, after Bitcoin, Ether, Solana and XRP?

With a notional $1 trillion-plus in CME Group Bitcoin and Ether futures settled by CF Benchmarks indices since these contracts launched, our partnership is one of the most pivotal in crypto.

Meanwhile, after the Solana futures debut in March, and with the launch of XRP futures coming next week, the leading derivatives marketplace continues to play a critical and growing role in the evolution of the digital asset class.

It's why we're stoked to welcome Brian Burke, CFA, senior director overseeing crypto options at CME, as our extra special guest on the CFB Talks Digital Assets podcast!

Join us for an exclusive look inside crypto's biggest regulated marketplace, where both institutional and retail participation are accelerating.

A few of the many enlightening talking points:

- 'Crypto VIX Futures'? - With global market volatility in the news, how close are we to CME Bitcoin volatility futures?

- Quicker Roadmap - how increasing regulatory clarity, rising market maturity, and falling information asymmetry are driving a faster cadence of crypto derivative launches - and what to expect next

- Solana Surprise - SOL futures volumes and open interest are outpacing expectations: what's behind the momentum?

- 'Proto Perps' imminent - With smaller contract sizes and super-long dated expiries, how upcoming Spot Quoted Futures (SQF) can fill the retail gap even more - and why institutional players are interested too

Dive in now for a revealing conversation, on the oldest derivatives venue's enduring place in the newest asset class!

Spotify

Apple Podcasts

YouTube (audio)

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.