CF Benchmarks Newsletter Issue 81

We're enormously proud to win ETF.com's Index Provider of the Year Award!

- CME announces XRP futures, based on our XRPUSD_RR index

- CF Benchmarks Wins ETF.com's Index Provider of The Year Award

- Bitcoin volatility surges aren't what they used to be

Escape

Risky assets seem to be experiencing the latest in a long series of 'Great Escapes' they've experienced in recent years, even if it's acknowledged that the extent and duration of pain avoidance by geopolitically sensitive markets like stocks, is typically relative, conditional and ultimately unknowable.

Still, the focus in broader markets is very largely on their ongoing price upswing from lows since April 8th, the date when the earliest comments from closely followed analysts emerged, suggesting imminent moderation of ‘Liberation Day’ tariffs. (E.g., ex-JPMorgan strategist Marko Kolanovic, quoted by Bloomberg, here).

Relief, with a large side of uncertainty, lifted the S&P 500 almost 700 points, or around 14% from those lows, by early Friday.

For Bitcoin, an even more signal rebound. CME Bitcoin futures – which settle to the most institutionally adopted benchmark, CME CF Bitcoin Reference Rate (BRR) – had added back some $21,400, or about 28%; to perch within reach of the ‘psychological’ $100,000 barrier by mid-session on Friday.

Meanwhile, our Weekly Index Highlights, covering April 21st to 26th, depicted the continuing bounce of a clutch of large-cap tokens besides BTC, like Ether, Cardano, Chainlink, XRP, and others; with advances of approximately 5%-10% a piece.

Mild reaction

As well as the price revival though, discussion among digital asset practitioners is also coalescing around another observation, specifically about the focal asset, Bitcoin.

As early as April 7th, David Lawant, Head of Research at the leading digital assets-focused prime brokerage, FalconX, was struck by how relatively mild of a tariff impact Bitcoin was having:

“The price reaction in BTC has been mild compared to previous broad market sell-offs. Since the NY market close on Wednesday, BTC is down 8.4%, outperforming for the S&P 500 (-10.7%) and the Nasdaq (-11.4%).

Now compare that to major market drawdowns in recent years:

- At the peak of the Japanese Yen carry trade unwind in August 2024, BTC fell 13.5%, while the S&P 500 and Nasdaq declined 3.0% and 3.4%, respectively.

- During the regional banking crisis between March 09 and 10 2023, BTC dropped 8.9%, compared to 3.3% and 3.8% for the two equity indexes, although BTC rebounded by over 20% in the following session while the equity indexes stood flat.

- Going all the way back to the thick of COVID crash between March 11 and March 20, 2020, BTC sold off 25.2%, while the S&P 500 and Nasdaq fell 20.0% and 17.6%, respectively.”

Excerpt from “Signal versus Noise: What BTC’s Move Amid the Market Rout Reveals” – by David Lawant, Falcon X

Lawant qualifies these comments further in the clip from our CFB Talks Digital Assets podcast, below.

Clip from CFB Talks Digital Assets Episode 43

(Click below for a summary and links to the full show )

BVX shows the fade is on

Meanwhile, as our weekly update on the CF Bitcoin Volatility Index Settlement Rate (BVXS) notes, the gauge declined about 5.5% during the week ending April 27th; leaving the index down 20.84% for the year to date.

“This continued drop in implied volatility reflects a sustained easing in long-term market uncertainty. Meanwhile, realized volatility held steady, ticking slightly higher from 42.71 to 43.28, indicating stable short-term price movement with a modest increase in realized price swings.

CME Bitcoin Volatility Surface data shows positive skew persisting across the 10, 15, 20, and 25 delta points, alongside greater convexity in the curve this week. Additionally, there has been a notable rise in implied volatility for long-dated 5-delta calls, suggesting increasing investor interest in positioning for a significant move to the upside.”

From Weekly Index Highlights, April 28, 2025

(Note that BVX, a regulated benchmark, is the only true measure of CME Bitcoin implied volatility. Read more about it here.)

So, notwithstanding the tariff-triggered spike at the start of April, the commentary suggests the market has rapidly returned to a state that is structurally short of IV.

Historical context

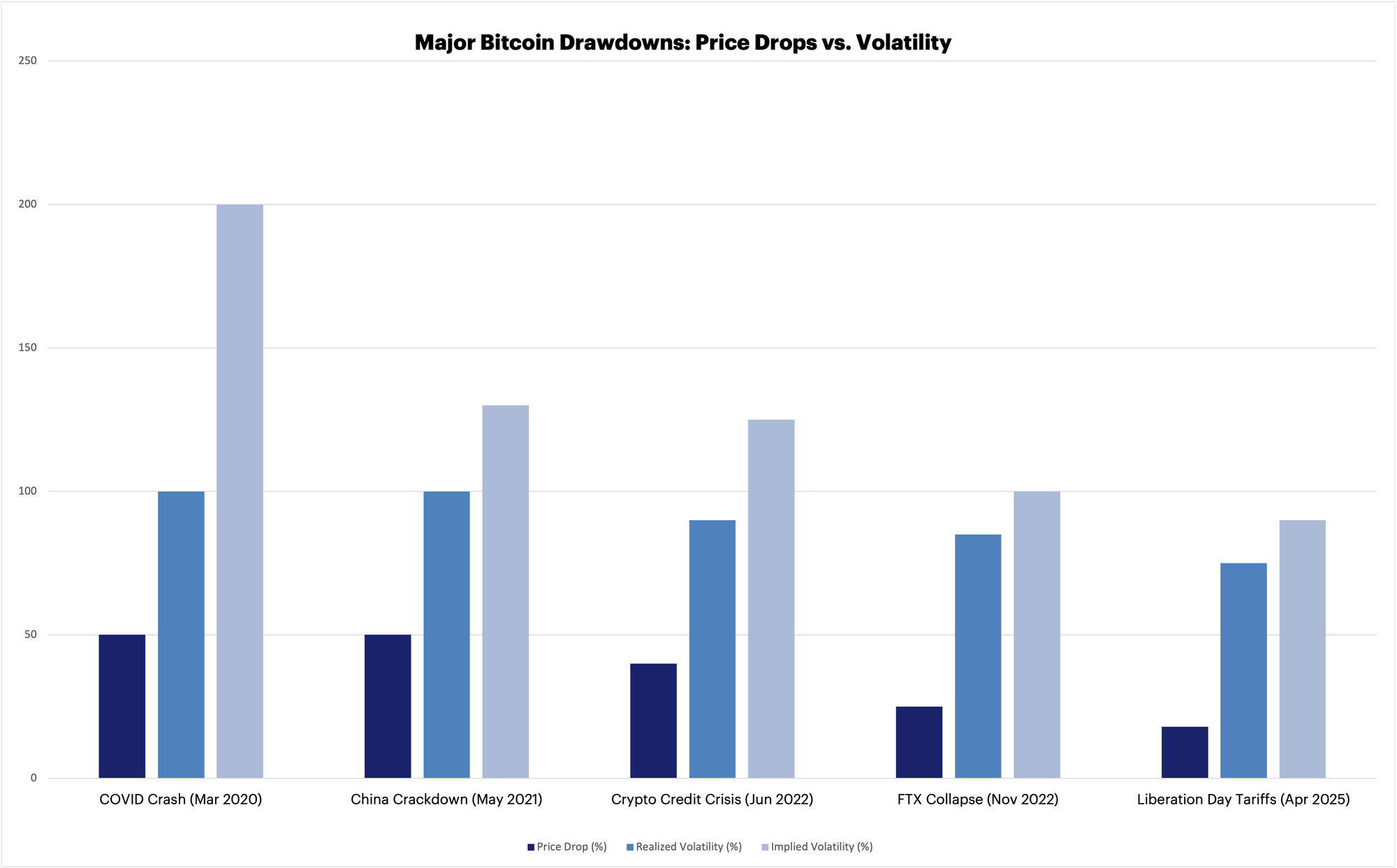

To get a sense of the wider historical picture, below we compare peak 7-day realized and implied volatility readings, observed over the various crises that have beset broader markets, and/or specifically the crypto market in recent years, beginning with 2020’s COVID crash, up to the recent ‘Liberation Day’ tumble.

It's immediately obvious that, as widely suspected, a moderate taming of Bitcoin’s typical volatility profile during market shocks appears to be underway.

The tempting wider takeaway is, as David Lawant alludes, that while Bitcoin volatility is still considered high in absolute terms, and clearly is, on average, relative to other key assets (BTC IV vs. VIX ‘crisis’ differential summarized here), the severity of that vol. might gradually be decreasing as the market matures. That maturation process includes the increasing availability of facilities, chiefly options and other derivatives, that enable participants to warehouse risk; as well as rising liquidity, diminishing information asymmetry and other evolutionary features.

No hard and fast conclusions here, though.

There'll be plenty of further instances, from moderate upsets to major cataclysms, during which these observations can be tested further.

ETF inflows resume

In the meantime, it doesn’t seem much of a stretch to place indications of Bitcoin's structural progression alongside other constructive market aspects, as contributing to the relative ‘standardization’ of spot crypto ETF flows since the funds were listed.

For colour, click below to hear a clip from an episode of Bloomberg’s Trillions podcast, where ETF analyst Eric Balchunas plays back a snippet of conversation with CF Benchmarks CEO, Sui Chung, recorded at the Exchange ETF conference in late-March.

De-escalation

So the absence of escalation, at the very least, for a lengthening spell, on the trade front, seems to have encouraged the resumption of crypto ETF allocations, after these had ground to a halt in initial reaction to the tariffs, and even sharply reversed on several subsequent days.

On aggregate $3.3bn flowed into U.S. spot Bitcoin ETFs in the last full week of April, the third largest weekly total since their inception around 16 months ago.

Underscoring the rebound, as our Head of Research Gabe Selby, CFA and Research Analyst Mark Pilipczuk note in their just-released Market Monthly Recap, April ended up being the first month in three where digital asset ETPs saw net inflows, with Bitcoin funds closing the month with $2.3bn more in assets.

(Click below for a summary of the Market Monthly and links to the full report.)

Ether's diffuse flows

On the other hand, U.S. Ether ETP assets continue to lag, amassing only $66m in April; well down from a $2.1bn rise in December, leaving total assets at $6.2bn, about half the $12bn recorded at the end of last year. Furthermore, despite the current improved backdrop, more than two thirds of ETH assets are now split between Grayscale’s ‘legacy’ ETHE (which converted from its prior OTC form last July) and BlackRock’s iShares Ethereum Trust ETF (ETHA), the largest new fund in terms of assets, of the four Wall Street Ether ETPs with NAVs based on our CME CF Ether Dollar-Reference Rate – New York Variant (ETHSUD_NY).

With ETHE holding $2.09bn as of the end of this week, versus ETHA’s $2.31bn, April’s distribution (almost identical to March’s) continues to underscore that demand for crypto exposure via the ETP structure, for now, is still dominated by BTC.

CME XRP futures set for May debut

That said, prospective crypto product issuers are sticking with the ‘venture’ footing they've been on over the last several months, as the regulatory reset continues to take shape.

For some vindication of this stance, look no further than the quickening cadence of new digital asset contracts being launched by CME Group, after the world’s leading derivatives marketplace announced it planned to launch XRP futures on May 19th. That will be just 2 months after the debut of SOL futures, powered by SOLUSD_RR, on the primary CFTC-regulated venue.

CME XRP futures will also be the latest contract settling to CF Benchmarks’ regulated benchmark methodology, this time in the shape of our XRPUSD RR index.

(Hit the link below for more details.)

As we've frequently noted, by default or design, the availability of CME futures in Bitcoin and Ether played an integral part in the eventual approval of U.S. ETPs investing in those assets. So CME’s announcement tends to improve the chances of XRP-related exchange listed products being approved in the relatively near term.

HashKey opens private XRP fund

Adjacently, XRP prospects have also advanced in Hong Kong in recent weeks. HashKey Capital, the crypto native investment manager, has announced an XRP private placement fund, with Ripple Labs, developer of the token, stepping in as an anchor investor.

HashKey was among the firms that listed Ether ETFs based on our CME CF Ether-Dollar Reference Rate – Asia Pacific Variant (ETHUSD_AP) last year. The group is adhering to our methodology for its latest fund, selecting the Asia-Pacific variant of our regulated XRP benchmark for NAV calculation.

The firm has made it known it intends to convert the tracker into an ETF, once approval by Hong Kong’s market regulator, SFC, is forthcoming.

CF Benchmarks wins Index Provider of The Year

We're enormously proud to win ETF.com's Index Provider of the Year Award!

ETF.com is one of the longest-established and most respected ETF websites, and has presented its annual award series, widely considered to be the de facto U.S. ETF industry awards, since 2013.

As such, it was a major honour to score a nomination; and a very welcome surprise to be recognized as the top index provider for the ETF industry in 2024.

It's worth emphasizing that although CF Benchmarks currently focuses on cryptocurrency benchmarks, this accolade is awarded in recognition of CF Benchmarks' excellence in the context of the entire ETF industry, not just pertaining to crypto ETFs.

Meanwhile, as the list of the other 2024 nominees below shows, all firms considered are reputable, leading companies, with one or two having been multibillion dollar revenue generators for years.

- Bloomberg Indices

- ICE Indices

- Nasdaq Indices

- MSCI

- CRSP

- Research Affiliates

It's all the more reason to reflect on the significance of this win, as CF Benchmarks continues to carve out a leading place at the epicenter of the fastest-growing new asset class.

CF Benchmarks CEO Sui Chung noted:

"Everyone at CFB is incredibly proud to receive this award, especially among such strong line-up of industry peers. Our mission has always been to build the foundation for a new generation of products that enable a broader swathe of investors to gain exposure to digitalassets. Tonight's win is the crowning achievement of almost a decade's work

This award is not just recognition of our efforts—it’s a clear signal of how crypto is becoming an increasingly mainstream asset that's increasingly being integrated closely into financial markets. It proves that crypto-native firms like ours can stand shoulder to shoulder with legacy TradFi giants—and win.”

ETF.com outlined its rationale for the award as follows:

"The award for Index Provider of the Year goes to CF Benchmarks. This provider significantly advanced cryptocurrency market infrastructure in 2024 by developing regulated, transparent, and reliable cryptocurrency indices, ensuring accurate and representative pricing."

Read more about ETF.com's Annual Awards here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.