CF Benchmarks Newsletter Issue 80

One way or another, quite remarkably, the crypto ETP class has continued to progressively evolve, despite political, geopolitical, and consequent market flux we’ve seen over the last several months. Those hard-won origins have come in handy.

- ETH ETFs in focus after mass options approval

- 3iQ, Evolve join first wave of North American SOL staking ETFs

- Our first Digital Asset Factor-based Market Review

Optionalized

Steady expansion of the crypto exchange-traded product class over the last year and a half, side by side with increasing availability and maturation of market structural, trading, liquidity, risk management, and other ancillary facilities that enable any listed product class to thrive, continues to look like the most promising vector for digital asset-TradFi convergence.

In fact, we’ve seen this process continue uninterrupted over the first quarter of the year – represented by crypto ETP filings progressing to active SEC review – even without a permanent chair of the Commission.

(That ‘open chair’ situation’s now been resolved; find colour on Paul Atkins’ confirmation below.)

One way or another, quite remarkably, the crypto ETP class has continued to progressively evolve, despite political, geopolitical, and consequent market flux we’ve seen over the last several months. Those hard-won origins have come in handy.

Either way, optimism that the range of digital assets permissible in the ETP wrapper (largely synonymous with the ‘ETF wrapper’) will keep expanding, regardless of broader conditions, seems uncontroversial.

For the latest incremental progression, further down, we note the coordinated introduction of options on a raft of Ether ETPs, with the SEC mass approving a raft of these instruments in one go in recent days.

North America's first Solana ETFs are Canadian

Adjacently though, first we’re delighted to welcome the launch this week, on Toronto’s TSX, of some of the first ever spot Solana (SOL) ETFs, by our key Canadian clients, 3iQ Corp and Evolve ETFs.

With over $1bn in fund assets under management late last year, 3iQ is Canada’s largest digital assets-only investment manager, and the first with that focus to become a registered IFM, as of 2018.

Having already listed North America's first staking ETF, 3iQ Ether Staking ETF, in 2023, the group has now deployed the same expertise for its latest project, by becoming one of the first issuers in the region to offer full exposure to the third-largest proof of stake (PoS) blockchain by market cap, with the 3iQ Solana Staking ETF (tickers: SOLQ.U, SOLQ).

The fund is available in a default U.S. dollar (USD) denominated series, under SOLQ.U, and a Canadian dollar (CAD) series as SOLQ; with both referring to the same CUSIP, because they’re the same underlying fund.

As we noted in our launch post (link below) SOLQ is also among the first Solana ETFs with exposure to SOL’s market price as well as, critically, network staking rewards from day one.

The fund's Solana benchmark is our regulated CME CF Solana-Dollar Reference Rate - New York Variant (SOLUSD_NY) enabling the most institutionally trusted, reliable and transparent SOL methodology, as well as facilitating potential liquidity and efficiency benefits from the primary CFTC-regulated contract market, CME’s Solana futures, settling to the same methodology.

Evolve's sixth crypto ETF

One of our first ever ETF clients, $7bn-plus AuM Evolve, has also opted to utilize our Solana benchmark methodology, this time integrating the regulated CME CF Solana-Dollar Reference Rate (SOLUSD_RR) into its latest fund, Evolve Solana ETF (tickers: SOLA, SOLA.U).

Evolve Solana ETF also provides direct, passive exposure to spot SOL, with Evolve stressing it is eschewing the use of derivatives within the fund.

The fund is available in both CAD units (ticker: SOLA) and USD units (SOLA.U) with both provided on an unhedged currency basis. Aside from currency denomination, both series are identical constituents of the same fund.

Meanwhile, the firm states that, subject to regulatory approval, the ETF intends to target staking of up to 50% of SOL holdings.

CFB-powered

SOLA is the latest in a lengthening list of CF Benchmarks-supported Evolve ETFs, including one of North America’s earliest Bitcoin ETFs, an Ether fund as well as the region’s first exchange traded BTC and ETH portfolio; plus leveraged Ether and Bitcoin fund alternatives. We’re proud to note that all the firm’s cryptocurrency vehicles utilize CF Benchmarks’ regulated pricing methodology for NAV calculation.

We wish both Evolve and 3iQ every success with their new funds and beyond.

Read across

Meanwhile, the Canadian SOL fund launches circumstantially echo the timeline of how crypto came to North American stock exchanges, more broadly.

The high probability that Canadian SOL funds will quickly establish themselves as part of Bay Street’s market ‘furniture’, could provide further unofficial checkboxes for U.S. regulators to tick, before going ahead with Wall St SOL ETFs, just as we saw with Canada’s BTC and ETH ETFs, which also preceded their U.S. counterparts.

Friction-free staking by Toronto’s funds would of course do no harm to staking ETF hopes south of the border either.

As we noted recently, the launch of CME Group Solana futures last month, opens a path for the SEC to expedite approval of SOL ETF filings, as the existence of the CFTC-regulated contract market satisfies one of the conditions in force when ETH and BTC funds were approved.

Canada’s successful SOL ETF debut offers the SEC further tacit encouragement, while turning up the regulatory disparity by another notch too.

SEC gives nod to Ether ETF options

The Commission first signally greenlighted Nasdaq’s proposed rule change on behalf of the largest new ETH fund listed last July, BlackRock’s iShares Ethereum Trust (ETHA), the NAV of which is based on our CME CF Ether-Dollar Reference Rate - New York Variant (ETHUSD_NY). The timing appeared significant, being reportedly the last possible day of a typical SEC review period.

Approval of options on the other ETH funds powered by ETHUSD_NY, Bitwise Ethereum ETF (ETHW), Franklin Ethereum ETF (EZET), and 21Shares Core Ethereum ETF (CETH), followed soon afterwards. Several other ETH fund options were also permissioned, strongly suggesting such approvals will be routinely accelerated going forward.

Levelled-up

Typical benefits brought by options becoming available on any exchange traded security should follow on from the new Ether ETF options, meaning ETH ETF market participants all just scored a level-up, with wider derivative-based trading strategies, risk-management, and liquidity facilities now available.

That’s just the start, of course. Exchange traded ETH ETF options are also likely to bring greater scope for structured product creation and enhanced price discovery potential - e.g., from creation of implied volatility surfaces. And both of these can feed back to increased efficiency across several of the advantages mentioned earlier.

Compression

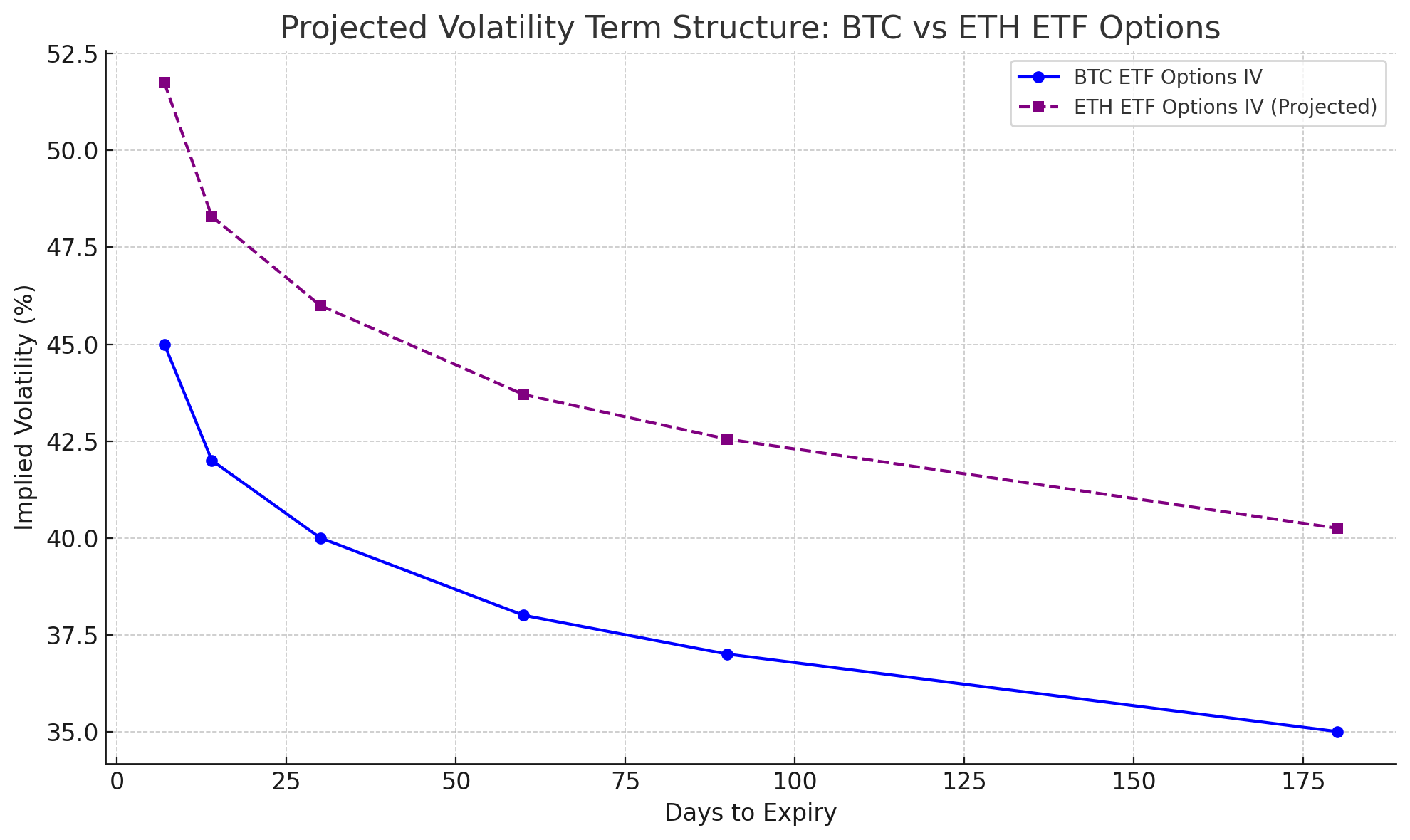

One intriguing speculation is that Ether’s widely cited historical implied volatility (IV) premium relative to Bitcoin (for front-month contracts, ~15%) could begin to compress with the advent of options on the second-largest cryptoasset’s ETFs; as its options market matures and liquidity improves.

Though BTC ETF volumes and flows dwarf ETH ETFs', the ETH options debut could still potentially bring one of the highest step changes in ETH option participation since CME ETH options launched in 2022.

Below, is an estimated Ether ETF option term structure (offered with strong caveats). It is based on public CME ETH option data, compared with the iShares Bitcoin Trust ETF (IBIT) options term structure. (These are end-of-day IVs for ATM options across standard expiries, smoothed and averaged from March–April 2025 data).

Cautious interpretation is advisable, but, if seen, IV compression could suggest further maturation of the overall ETH product market, reducing structural uncertainty, and bringing increased capital efficiency. That would imply a potential catalyst for higher institutional inflows, compounding downstream benefits from Ether ETF options: attraction of a broader capital base.

In turn, this could begin to address the sharp disparity between U.S. BTC and ETH ETF net assets: roughly 10:1, with Bitcoin total ETF AuM at roughly $100bn. How quickly that might occur though, is an open question.

Spotlight on Ethereum's Pectra upgrade

More by default than design, Ethereum threads are converging right now.

Despite a severe tariff-triggered beating in recent weeks – our CME CF Ether-Dollar Reference Rate (ETHUSD_RR) was down around 52% for the year-to-date at last check – the network has successfully completed several pivotal upgrades so far this year.

Now, following innovations packaged into Dencun, released mid-March, that could potentially slash transaction fees by as much as 99% on L2s like Arbitrum and Optimism, attention shifts to enhancement of staking mechanisms through improved user experiences engineered in the upcoming Pectra upgrade.

Currently slated for May 7th, as the Etherscan blog post linked above outlines, Pectra integrates radical sounding changes. These include a massive uplift of the effective balance limit per validator from 32 ETH to 2,048 ETH, while maintaining the 32 ETH minimum.

Primers

Before diving in for that deep read though, you might like to prime your understanding with two podcast clips below featuring the CF Benchmarks Research team, Research Analyst Mark Pilipczuk, and Head of Research, Gabe Selby CFA.

Mark opens the first clip by noting inclusion of staking in U.S. Ether ETFs could prove a key unlock of increased flows.

Gabe then outlines implications of another new Pectra facility: a shorter staking protocol-enforced waiting period before unstaked ETH is withdrawable, providing major participants (e.g., fiduciaries) with increased incentive to stake, and in higher amounts.

Clip from CFB Talks Digital Assets Episode 42

Then, for a pretty much complete summary of all key Pectra features, click below to play the second clip.

Clip from CFB Talks Digital Assets Episode 42

Atkins confirmed for SEC hot seat

Just as protracted as the wait for ETH ETF options, yet, in the end, almost as uncontroversial, was the completion of the appointment of Paul Atkins as the SEC's new chair.

Confirmed in a full Senate vote with a 52-44 split along party lines, the result almost certainly lays to rest contentions, raised at Senate Banking Committee confirmation hearings last month, over potential conflicts posed by certain lucrative (non-crypto) clients of Atkins, whilst he was chief executive of financial services consultancy Patomak Global Partners.

Front and centre from the perspective of crypto participants, Atkins becomes the second consecutive SEC chair with a storied pre-interest, and greater-than-average cognisance of digital assets, having been a member of advocacy group The Token Alliance as far back as 2017.

Long list

More substantively, whilst the SEC under acting chair Mark Uyeda made impressive headway in partially clearing a long list of high-stakes crypto decisions on the Commission’s docket – e.g., greenlighting Ether ETF options, slashing the huge backlog of litigation – many pressing issues remain. E.g., myriad ETF filings, in-kind create-redeem, staking, to name just a few proposed rule changes from self-regulatory organisations.

Meanwhile, the Commission is also widely expected to delve into its own toolbox of administrative discretion, calling for delicate balances to be struck in an environment where broader market volatility will almost certainly be a higher priority.

Introducing Quarterly Factor Reports

CF Benchmarks launched the first institutional-grade factor model for digital assets late last year.

This hard-won achievement followed what we believe to be the most extensive and transparent quantitative analysis of validated crypto data sources for the investigation of factors applicable to the digital asset class.

The findings were published in a white paper detailing our rationales and research methodology:

A Factor Model for Digital Assets

You can read a summary by clicking below.

As we noted in that explainer:

The extensive and increasing utilization of factors by institutions managing traditional assets suggests this investor cohort will seek to deploy factor-based strategies for the management of digital assets as well, particularly given the significant adoption of crypto by major financial firms seen in recent years.

From “CF Benchmarks introduces first Institutional-grade Factor Model for Digital Assets”, December 2024

To that end, pursuing our broad mission to further all facets of crypto adoption, particularly by institutions, our Head of Research, Gabe Selby, CFA, and Research Analyst Mark Pilipczuk, together with the lead quant behind our proprietary factor research, Senior Product Manager, Cristian Isac, have published CF Benchmarks’ inaugural quarterly crypto factors review.

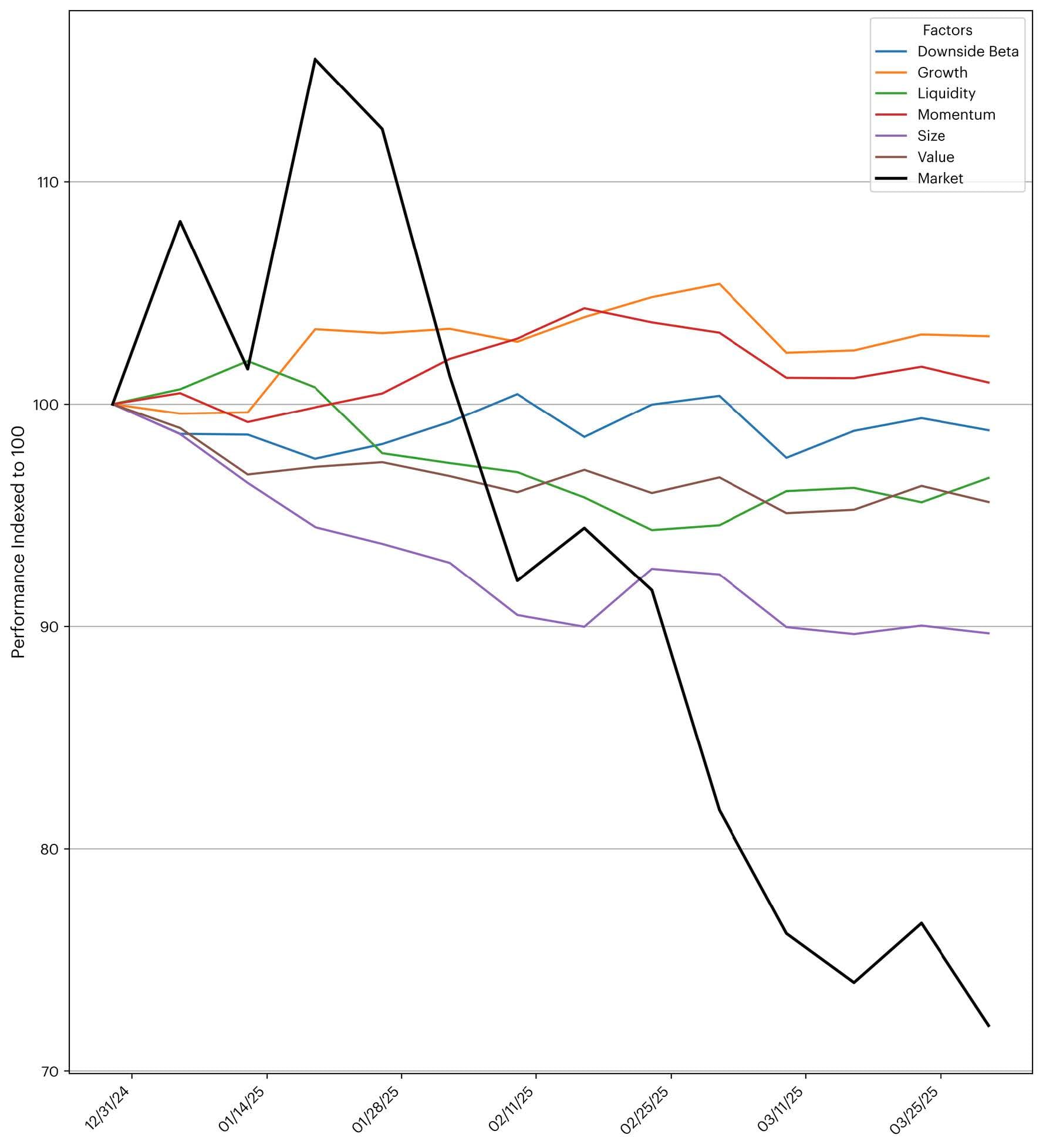

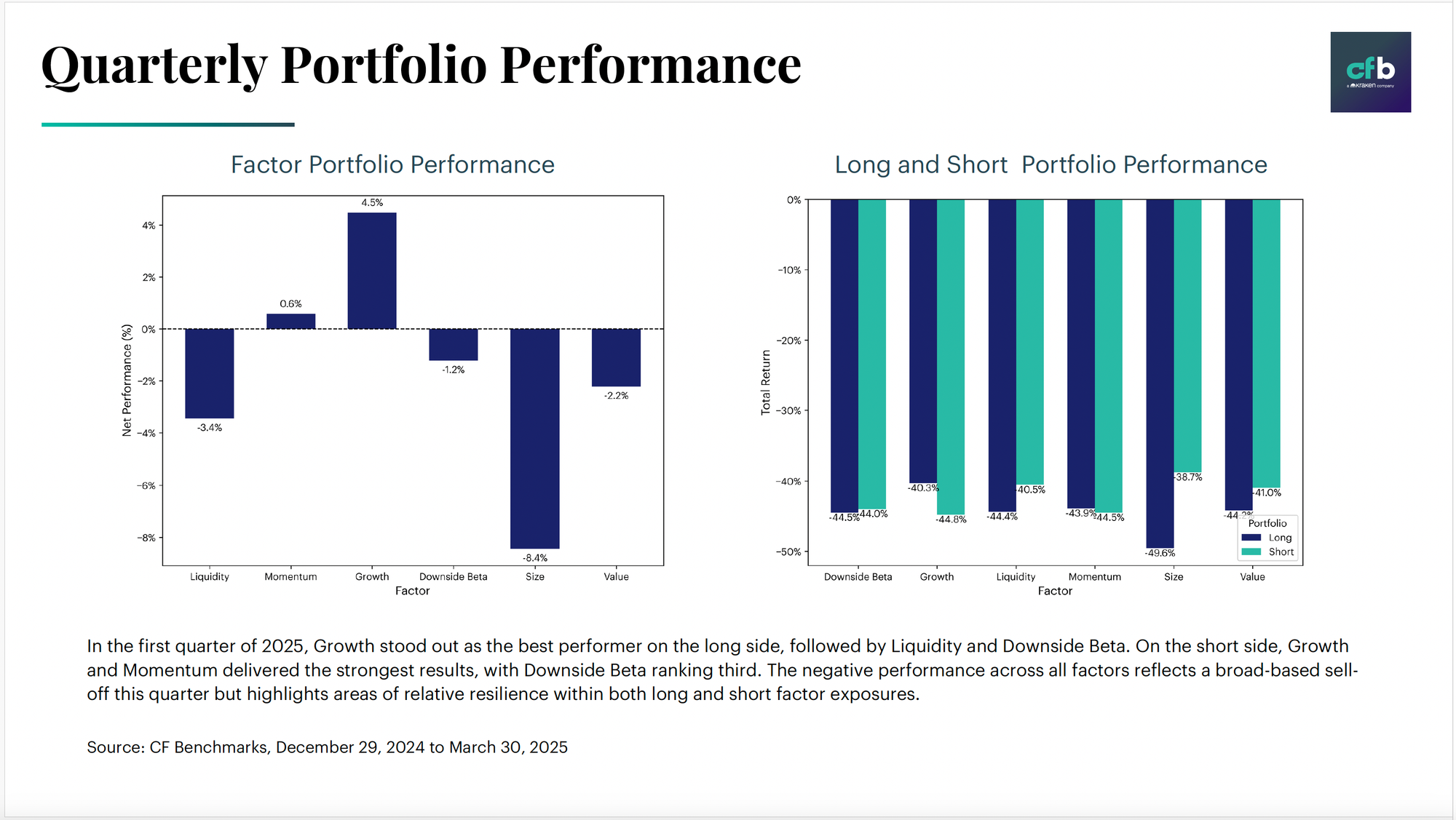

“Q1 2025: Quarterly Factor Review: Growth and Momentum Outperform in Turbulent Q1” provides a unique, comprehensive analysis of seven key risk factors—Market, Size, Value, Momentum, Growth, Downside Beta, and Liquidity—validated by CF Benchmarks, as a basis of cryptocurrency return variation.

As the researchers note in the report's introduction:

“Using both time-series (Fama-French) and cross-sectional (Fama-MacBeth) regression frameworks, the model analyzes on-chain and off-chain metrics like protocol fees, trading volume, and user activity. It shows strong explanatory power, particularly from Market, Growth, and Downside Beta”.

Key returns are summarized in the excerpted chart below, showing long/short factor and market performance, between December 29, 2024 and March 30, 2025.

With the quarter including a portion of the seismic volatility that would upend all asset classes in subsequent weeks, the report provides timely, exclusive and credible insights into the market characteristics shaping crypto prices during the observation period.

The slide below offers a more detailed insight into distinct factor portfolio returns, with growth continuing to eke out an outperformance in the quarter, suggesting a baseline to watch closely when further quarterly factor reports are released.

Furthermore, the report also examines the newly unearthed factors within the context of their respective long and short portfolio performance mapped extensively against CF Benchmarks’ CF Digital Asset Classification Structure (CF DACS) taxonomy of the investible digital asset universe.

This offers even deeper visibility into the source of return variations.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.