CF Benchmarks Newsletter - Issue 76

Despite the deluge of crypto ETF applications landing at the SEC throughout January, one of the most consequential filings wasn’t a request for permission to launch a fund.

- Bitcoin ETF issuers on tenterhooks after in-kind filing

- Calamos lists first capital-protected Bitcoin ETFs

- New Options, new benefits for CME's BFF

In-Kind Filing triggers new ETF Cliffhanger

Despite the deluge of crypto ETF applications landing at the SEC throughout January, one of the most consequential filings wasn’t a request for permission to launch a fund.

Nasdaq filed a proposed rule change seeking to create and redeem units of BlackRock’s iShares Bitcoin Trust ETF (IBIT) in-kind instead of in cash, the latter method being the way all crypto ETF creation and redemption units are currently structured.

If permitted, the transition would be highly consequential and obviously welcomed by issuers, and all other counterparties involved.

It’s because utilization of the in-kind mechanism for unit creation and redemption avoids inefficiencies and cost implications inherent in converting the underlying asset into and out of cash; which authorized participants are obliged to, when the cash methodology is applied.

A pivot would also be another embarrassment for the SEC, given the Commission’s officially unexplained, yet tacit conditioning of approval for spot Bitcoin, and subsequently, spot Ether ETFs, on the cash create/redeem mechanism.

There are numerous theories as to why the SEC favoured ‘in cash’, vs., in-kind. They’re less central now; though you can find more context in our CFB Compact piece on the same topic linked below.

More importantly, if approved, the potential for additional impetus to allocations is obvious. Particularly from the removal of friction faced by all institutional participants. They currently need to explain to clients why crypto ETP redemptions differ from those for just about any other funds they advise on.

On a common sense basis alone (which of course is seldom the sole consideration) approval ought to be favoured.

It's a sentiment echoed by Marco Santori, who was Chief Legal Officer of Kraken for several years, and has now transitioned to an advisory role at the group, amid reports he's in the running to be the next CFTC chair.

In the clip below, from a recent episode of the CFB Talks Digital Assets, Santori notes there are no sound operational reasons why cash create/redeem was prescribed for crypto ETFs, in the face of the widely shared view that it's the sub-optimal option.

The wait

Given the discretionary nature of approval probabilities, as usual, caution is advised. And whilst the SEC’s typical maximum 45-day initial review period is now widely known, it’s worth noting reviews officially begin after publication of proposed rule changes in the Federal Register. As of the time of writing, it does not appear the submission has been published in the register. At best, this delays any switch to in-kind for several more weeks yet.

Click below to catch the full episode of our podcast featuring Marco Santori on YouTube, or go here for other platform options.

Calamos Launches BRRNY-based Downside Protected ETFs

As we've noted several times over the years, one way to assess the maturity of digital asset markets and products, from an institutional perspective at least, is the degree to which facilities available to institutional and capital market participants in traditional asset classes can be matched by those available to crypto participants.

As such, the launch of several Bitcoin capital-protected exchange traded products by Calamos in recent weeks is a case in point:

- Calamos Bitcoin Structured Alt Protection ETF (CBOJ)

- Calamos Bitcoin 90 Series Structured Alt Protection ETF (CBXJ)

- Calamos Bitcoin 80 Series Structured Alt Protection ETF (CBTJ)

Billed as the first ever downside-protected Bitcoin ETFs, the suite also represents the first launch of digital asset products by Calamos, which reported some $40 billion in assets under management (AuM) at the end of 2024.

Calamos's BTC funds join a broader suite of products that include mutual, closed-ended, UCITS and other structures.

Still, the 50-plus year old group is best known for its deep bench of structured protection ETFs, and its new crypto funds are based on the same framework.

CBOJ, CBXJ and CBTJ provide a sliding scale of combined downside protection vs. rising upside caps, excluding fees, respectively: 100%/11.65%, 90%/29.15%, and 80%/51.50%.

These ETFs integrate our regulated CME CF Bitcoin Reference Rate - New York Variant (BRRNY) as their BTC reference price.

In common with Calamos’s other structured products, its Bitcoin ETFs are designed to capture returns to a pre-defined cap, whilst protecting against a given level of losses – so long as the ETFs are held for one year.

As such, for the first time, the funds provide a vital facility for a broad cohort of risk-averse investors looking for ways to gain exposure to Bitcoin returns via an exchange traded product, yet unwilling, as yet, to countenance Bitcoin’s intermittently enhanced drawdown risk.

Familiar structure

Again, these ETFs utilize capital protection structures that would be recognizable to anyone familiar with typical downside protected products.

The majority of Calamos's downside protected fund assets comprise of U.S. Treasurys.

For their Bitcoin products, the fixed income holdings are combined with returns from a bull call spread in Cboe Mini Bitcoin US ETF Index Options (MBTX).

Example

- Calamos Bitcoin Structured Alt Protection ETF – January (CBOJ) achieves its one-year principal protection with the purchase of 52-week U.S. T-Bills equating to 96% of assets

- The remaining percentage and discount rate are deployed on a bull call spread:

- Buy ATM MBTX calls (+25% of AuM)

- Sell lower-delta (higher strike) MBTX calls (-21% of AuM)

- Objective: profit from any moderate rise in the underlying, with max loss limited to net premium, and profit capped at the difference between strikes

Strategies like these may look like complex financial engineering – and of course in themselves, they're certainly sophisticated - but relative to the kind of tools available to participants in traditional capital markets, they’re bread and butter.

So, Calamos’ structured protection Bitcoin ETFs represent a further integration of crypto into mainstream markets.

CME's BFF Options Launch coincides with Robinhood Rollout

Following on from CME Group’s Bitcoin Friday futures (BFF) launch last year, and Robinhood Markets’ plans to offer BFF, plus other CME crypto products to retail clients, the world’s largest derivatives venue operator now confirms access will start rolling out to eligible Robinhood customers in coming weeks.

Bitcoin Friday futures are the first CME Bitcoin contract to settle to our CME CF Bitcoin Reference Rate – New York Variant (BRRNY), referencing Bitcoin’s 4 PM New York Time price, as opposed to all other CME BTC options and futures, which settle to BTC’s 4 PM London Time price, AKA BRR.

Further notable developments are embedded in CME’s plans for February.

Pending regulatory approval, CME also announced that options on BFF would become available to trade towards the end of February.

In another apparent convergence to retail-oriented characteristics aligned with the Robinhood rollout, the new options will also be the first financially settled (essentially, 'cash-settled') CME crypto contracts, with expiries available on each business day.

CME Bitcoin, Ether, Micro Bitcoin (MBT) and Micro Ether options and futures, primarily aimed at capital markets-scale traders, are all physically settled.

Still, CME executives suggest BFF would be attractive to a broad range of trading capacities, noting the smaller size of BFF (1/50th BTC vs. 5 BTC for regular CME BTC, and 1/10th for MBT) weekly flexibility, and now, the ability to manage risk with daily expiring BFF options.

"Building on the success of our Bitcoin Friday futures, the smaller size of these contracts, along with daily expiries, offer market participants a capital-efficient toolset to effectively adjust their bitcoin exposure."

Giovanni Vicioso, CME Group Global Head of Cryptocurrency Products

Meanwhile, with 775,000 BFF contracts traded since their launch on September 29th, 2024, and an average daily volume approaching 10,000, BFF continues to look like the CME’s most successful crypto product launch ever.

The upcoming addition of Robinhood traders to the BRR liquidity complex implies increasing benefits will continue to accrue for all users.

Particularly now that the complex includes around 60% of all U.S. Bitcoin ETF assets under reference, equating to the key issuers striking NAV to BRRNY.

All told, participants can expect increasing stability, transparency and choice around the orderbook spread, underpinning replicability, and, in turn, near-perfect tracking for product providers, plus minimal slippage for traders.

CFB Talks Digital Assets Episode 36: Goodbye to ‘Random Walks’: How CF Benchmarks built a robust Factor Model for Digital Assets

The potential for factor-based investing to one day be applied to digital assets has long been a tantalizing prospect. But it's not been possible - till now.

CF Benchmarks’ recent report ‘A Factor Model for Digital Assets’ has now demonstrated the existence of ‘classic’ factors, like Momentum, Liquidity, Value and others, within the crypto asset class, beyond any reasonable doubt.

For the clearest possible exploration of our research, the CFB podcast team were stoked to welcome back CF Benchmarks quant and product manager Cristian Isac.

Listen in to their chat to 5x your understanding of Crypto Factors!

Key points discussed include ....

- Why the pace of institutional participation means the time for a digital asset factor model is now

- How classic models like CAPM and Fama-French were adapted for crypto’s unique dynamics

- How our researchers surmounted the data quality challenge, with observations across rebalances, universes, and monetary regimes

- Impressive results, for example: the risk premium for 'Size' was ~9% annualized, with a Sharpe Ratio of 0.5. For 'Growth', the premium was ~25%, with a Sharpe of 1.5.

All in all, this episode should be essential listening for quants, portfolio managers, and investment professionals in general; anyone, in fact, serious about the evolution of digital asset investing.

Listen on Spotify

Listen on Apple Podcasts

Watch on YouTube (Audio)

Listen on Amazon Music

Excerpts from our research team's monthly market report follow below.

Policy Tailwinds Usher in New Highs as Fed Pauses

By Mark Pilipczuk - Research Analyst, and Gabe Selby, CFA - Head of Research

- Regulatory Tailwinds Drive Bitcoin to New Highs: Digital assets kicked off the new year on a positive note. President Trump issued an executive order on digital financial technology, establishing a new Presidential Working Group to develop comprehensive federal regulatory frameworks for digital assets. This coincided with the SEC's strategic moves to ease cryptocurrency regulations, including the repeal of SAB 121 and formation of a dedicated Crypto Task Force under Commissioner Peirce's leadership. The cryptocurrency market reflected this favorable regulatory change, with Bitcoin reaching a new high, breaking above $109,000 on the CME CF Bitcoin Real-Time Index. Meanwhile, the Federal Reserve maintained its cautious stance, holding rates at 4.25-4.50% amid ongoing inflation risks considerations.

- Large-Caps Outperform as Digital Culture Index Lags: Our CF Ultra Cap 5 Index led market performance, rising 11.12%, reflecting strong large-cap crypto resilience. The CF Free-Float Broad Cap Index and CF Smart Contract Platforms Index followed, increasing 10.28% and 5.86%, respectively, benefiting from positive investor sentiment. Conversely, the CF Digital Culture Index and CF Blockchain Infrastructure Index lagged, declining 6.24% and 2.68%, indicating weaker investor sentiment in niche digital assets. Meanwhile, the CF DeFi Index finished the month mostly unchanged, closing 0.82% higher.

- Bitcoin Dominates Fund Flows, Ether Sees Outflows: Fund flows into digital assets continued in January, with investors allocating over $4.5 billion. Bitcoin captured the majority of inflows, exceeding $4.4 billion, while Ether experienced a slight outflow of -$82 million.

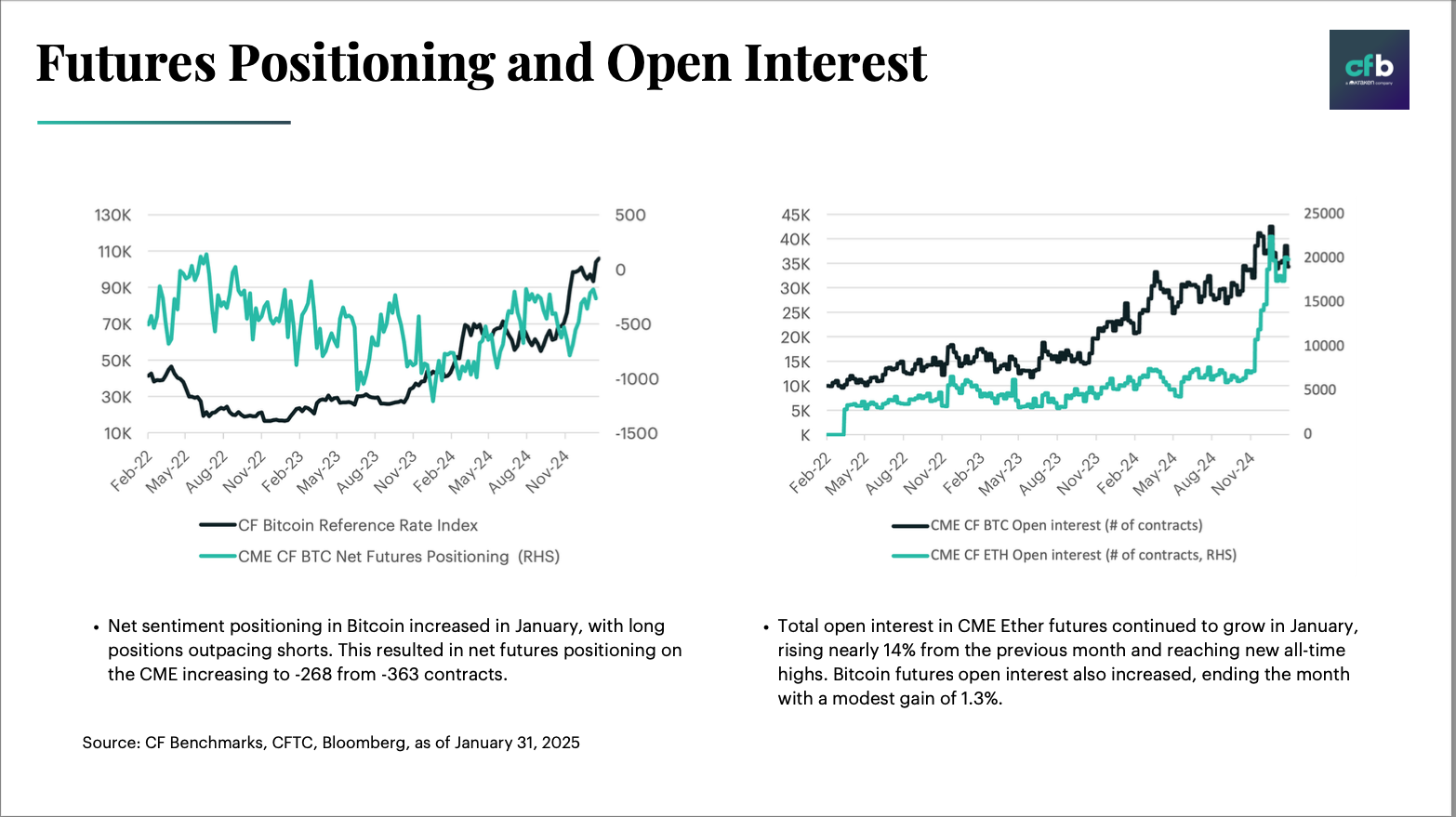

- CME Ether Futures Open Interest Continues to Hit Record Highs: Total open interest in CME Ether futures continued to grow in January, rising nearly 14% from the previous month and reaching new all-time highs. Bitcoin futures open interest also increased, ending the month with a modest gain of 1.3%.

CME Ether Open Interest growth still outpacing BTC's

To read the complete report, click here, or click below to download a PDF copy.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.