CF Benchmarks Newsletter - Issue 73

Just over a month after Bitcoin Friday futures (BFF) became the latest addition to the CME Group’s suite of regulated crypto products, a potentially significant distribution partner has emerged for BFF and CME digital asset products as a whole.

- Robinhood rolls out range of CME crypto futures to "active traders"

- Guest Post by FalconX's David Lawant: spot ETF flows & BTC prices

- From our research team: The Bitcoin Friday futures advantage

Recalibrating

Listening in to digital asset discussion on social and crypto media, a kind of ‘Trump Trade’ redux, and that blithely bandied about catch-all, ‘Uptober’, are both in the air. Still, these are likely to turn out to be relatively marginal drivers of the price updraft seen in recent weeks.

More cogently, we draw attention back to the emergence of the new monetary cycle identified by the CF Benchmarks Research Team, and detailed in their inaugural market outlook report (for Q4, 2024).

Amid the ‘material constraints’ of higher deficit spending and the spectre of lingering inflation, it makes sense that long-term hedges, pre-eminently Bitcoin, are set to remain in favour, thereby also training the spotlight on digital assets more broadly.

Melt and fade

BTC’s latest melt-up towards $70k fits the narrative. Front-month CME Bitcoin Futures, that settle to our CME CF Bitcoin Reference Rate (BRR) ended the prior week at $68,785, their highest since late-July. The backdrop includes markedly reaccelerating flows into Bitcoin ETFs which have been trading since January, but which saw their umpteenth seismic weekly influx of more than $500m in the week ending 18th October; this time of some $1.8bn, according to Bloomberg data.

Risky assets got off to the current week on a less certain footing, though, with shades of a mini bond ‘protest’ emerging. BRR pared back to as low as the $66k handle before recouping by the time of publication.

With the expected extent of the Fed’s next policy easing crystallising ever more on the 25bp option, yields and the dollar have been underpinned, sending the 10-year Treasury yield to 4.2% for most of this week, its highest since July.

On the case

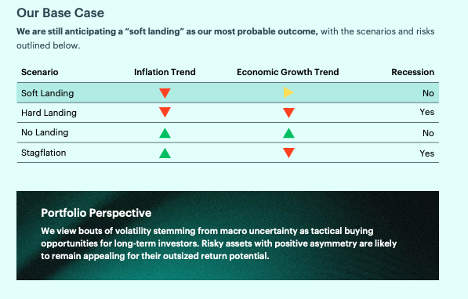

This hint of tightening conditions reflects recent macro readings that have landed on the ‘benign’ side of near-term implications for U.S. economic performance. As such, incoming data continue to veer towards the CFB research team’s 'soft-landing’ base case; with constructive overall implications for “Risky assets with positive asymmetry”, as clipped below.

Download the complete CF Benchmarks Q4 market outlook report, ‘Recalibrating for the New Monetary Cycle’, here.

Click below for a summary.

It’s also worth keeping an eye on our Research and Insights page as our analysts, led by Gabe Selby, CFA, and Mark Pilipczuk continually assess the macro outlook in light of ongoing data.

Better yet, subscribe to CF Benchmarks content by clicking this link.

In the meantime, we continue to spotlight progression of recently announced initiatives furthering adoption, including those in which our high integrity benchmarks play an integral part.

- Chief among these covered in this edition, CME Group’s first weekly expiring digital asset contract, Bitcoin Friday futures (BFF) securing an influential ‘BFF’ of their own, weeks after debut, with Robinhood Markets, Inc. rolling out a slew CME crypto derivatives, all settled by CF Benchmarks indices.

- We also take the opportunity to show case our research team’s BFF analysis; looking at what the advent of accessible CFTC-regulated digital asset futures means for the ‘perp’-dominated retail crypto landscape.

- As well, we’re delighted and honoured to republish an analysis by Falcon X’s Head of Research, David Lawant, from earlier in the month. It explores U.S. spot Bitcoin ETF flows, and what they may reveal about the BTC price outlook.

- Meanwhile, note that Sydney’s Monochrome Asset Management, listed its second crypto ETF in four months, this time Australia’s first to offer a direct entitlement to Ether. Like Monochrome's spot Bitcoin fund, listed in June, Monochrome’s Ethereum ETF (IETH) strikes net asset value (NAV) to a regulated CF Benchmarks reference rate, in this case, the CME CF Ether-Dollar Reference Rate - Asia Pacific Variant (ETHUSD_AP).

Read Monochrome's announcement here

- More coverage from Coindesk, here

Bitcoin Friday futures set for Robinhood rollout

Virtually all CME crypto contracts will soon be tradeable on Robinhood

Just over a month after Bitcoin Friday futures (BFF) became the latest addition to the CME Group’s suite of regulated crypto products, a potentially significant distribution partner has emerged for BFF and CME digital asset products as a whole.

Robinhood Markets, Inc., best known for online trading (across around 12 million monthly active accounts, +9% year-on-year, according to its Q2 results) announced an expansion of its existing crypto offering to cover most CME cryptocurrency futures contracts, including BFF.

The news came amid a wider rollout of new products and services centering on the release of Robinhood Legend, a revamped, more customisable desktop platform, aimed at “active traders”.

CME crypto confirmed

At the same time, confirming speculation that emerged a few months ago, Robinhood told The Block, it will offer CME Bitcoin Futures, Micro Bitcoin Futures, Ether Futures and Micro Ether Futures contracts, as well as the CME's new weekly expiring contract, Bitcoin Friday futures.

All CME Group cryptocurrency derivatives and related products (e.g., Bitcoin Basis Trade on Index close) settle to regulated CF Benchmarks reference rates. Chiefly, the CME CF Bitcoin Reference Rate (BRR) and CME CF Ether-Dollar Reference Rate (ETHUSD RR).

Bitcoin Friday futures are notably the CME’s only Bitcoin derivative contracts settling to our CME CF Bitcoin Reference Rate – New York Variant (BRRNY). This references the price of Bitcoin at the traditional U.S. market close of 4 PM New York Time, instead of 4 PM London Time, per BRR.

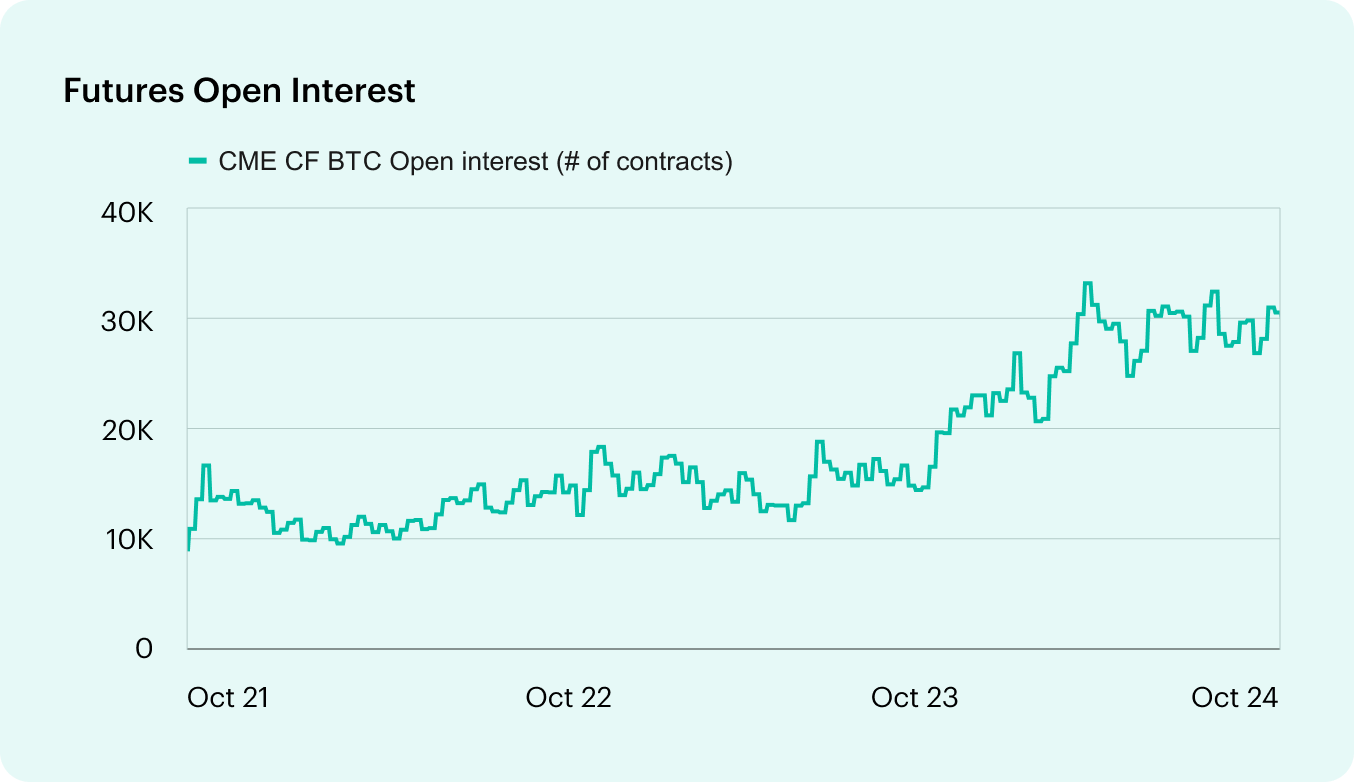

In the previous CF Benchmarks Newsletter, we talked through some of the key emergent liquidity advantages, for BFF, from utilisation of the same benchmark as six of the U.S. spot Bitcoin ETFs that began trading in January, and which have consistently accounted for a majority of the fresh net asset value (NAV) and flows in this product class ever since.

Simple access to Liquidity Complex

Now, the upcoming entrance of Robinhood users to the CME’s crypto derivatives marketplace is set to broaden the BRR Liquidity Complex – and its mutual benefits for all participants – even further.

Just as importantly, BFF going live on the fast-growing Robinhood trading environment (which famously prioritises accessibility over account size, i.e., "no account minimums") solidifies BFF as the path of wider access to CME's Bitcoin derivatives market.

BFF now offers the only way smaller scale traders can access the primary, CFTC-regulated Bitcoin futures market.

Robinhood’s average account size was reportedly around $4,000 at end Q2 2023, compared to, for instance, an average $130k account size at E*TRADE.

BFF's retail benefits

Given its higher density of so-called retail traders, Robinhood users are also primed to benefit from BFF’s weekly expiries.

As CF Benchmarks CEO, Sui Chung pointed out in a recent Coindesk piece, their compact term makes BFF better-suited for use in event-based trading:

"Unlike monthly contracts, which are influenced by a wide range of events over four weeks, the weekly contracts allow investors to better express views on Bitcoin's reaction to specific events, such as U.S. macro data releases.”

Likewise, Chung added, BFF’s shorter duration relative to other CME Bitcoin futures will almost certainly equate to them exhibiting higher basis compression.

"The reduced time horizon of the weekly contracts generally results in a low basis compared to their monthly counterparts, simplifying analysis for retail traders.”

All told, Robinhood’s onboarding of Bitcoin Friday futures, as well as other CME crypto contracts, adds to the range of significant adoption steps seen over the past year, bringing wider access to regulated crypto trading, supported by the integrity and reliability of CF Benchmarks prices.

Featured Benchmark: CME CF Bitcoin Reference Rate - New York Variant (BRRNY)

The CF Benchmarks research team, led Gabe Selby, CFA and Mark Pilipczuk, have published a thorough analysis of CME Bitcoin Friday futures.

The team's specific focus is the potential for BFF to provide a reliable, efficient, alternative to perps, which are currently the most prevalent model available for individual participants seeking to trade Bitcoin futures.

Selby's and Pilipczuk's detailed examination includes:

- Key BFF advantages: smaller contract size, lower margin requirements, and transparent, reliable pricing, from our CME CF BRRNY index

- An explanation of how BFF avoids the need for the 'double-edged sword' of perpetual futures: funding rates

- Why BFF contracts are optimal for short-term trading

Check out the excerpt from the post below - then click the link to read the complete analysis.

Democratizing Institutional-Grade Derivatives through Bitcoin Friday Futures

By Gabriel Selby, CFA and Mark Pilipczuk

The successful launch of CME's Bitcoin Friday futures (BFF) marks the introduction of a groundbreaking instrument, offering a unique combination of retail accessibility and institutional-grade pricing within a regulated framework—something the market has never seen before. As the leading crypto index provider, CF Benchmarks stands at the forefront of this development, with our Bitcoin Reference Rate - New York variant (BRRNY) playing a crucial role in the pricing of the latest Bitcoin financial products.

In this analysis, we'll explore why BFF, underpinned by a robust benchmark like the BRRNY, represents a novel and viable alternative when compared to traditional perpetual futures. We'll delve into the intricacies of both products, highlighting how BFF addresses the limitations of perpetual futures and paves the way for a more mature, efficient, and accessible Bitcoin derivatives market.

Understanding the Retail Derivatives Landscape: BFF & Perpetual Futures

Before we dive into the specifics of BFF and perpetual futures, it's crucial to understand the context of the Bitcoin derivatives market. The demand for regulated bitcoin derivatives has grown exponentially in recent years, offering traders and investors various ways to gain exposure to Bitcoin price movements without necessarily owning the underlying asset. These instruments have played a significant role in increasing market liquidity, improving price discovery, and providing hedging opportunities. However, not all derivatives are created equal, and the introduction of BFF marks another leap forward in the evolution of these financial products.

Guest Post by David Lawant, Head of Research at FalconX

We're delighted to publish an excerpt from a post by David Lawant, Head of Research at FalconX.

FalconX is the largest institutional crypto prime brokerage, and has served global institutions participating in the digital asset market since the firm was founded in 2018.

A CFTC-registered swap dealer, FalconX offers OTC contracts settled against CF Benchmarks' CME CF Bitcoin Reference Rate, CME CF Ether-Dollar Reference Rate, and other CFB regulated single asset reference rates. This enables FalconX clients to gain transparent, high-integrity exposure to a range of cryptocurrencies.

Latterly, the group has played an integral part in the provision of various services to key investment management and capital markets participants involved in the spot Bitcoin and Ether ETFs that listed in the U.S. this year.

As an accredited veteran of high-profile digital asset-focused institutions, with previous roles at Bitwise and Hashdex, among other firms, David Lawant deploys his unique vantage point at Falcon X to publish a continuing stream of exclusive, qualified insights into market structure, the macro backdrop, and of course, the market outlook, with a particular (though not exclusive) focus on digital assets.

Below, we publish an excerpt from a post by Lawant, from earlier in October:

In this analysis, Lawant undertakes a series of statistical tests on some ten months of U.S. spot crypto ETF market data, drawing tentative, but objectively reliable conclusions about the interplay between net ETF flows and Bitcoin prices.

For anyone seeking "meaningful context for interpreting market trends and potential directional movements," which can impact crypto ETFs, and their underlying digital assets alike, Lawant's analysis is well worth reading and absorbing.

Please read the excerpt, then click the link below to read the rest.

We're grateful to David Lawant and FalconX for their permission to republish this content!

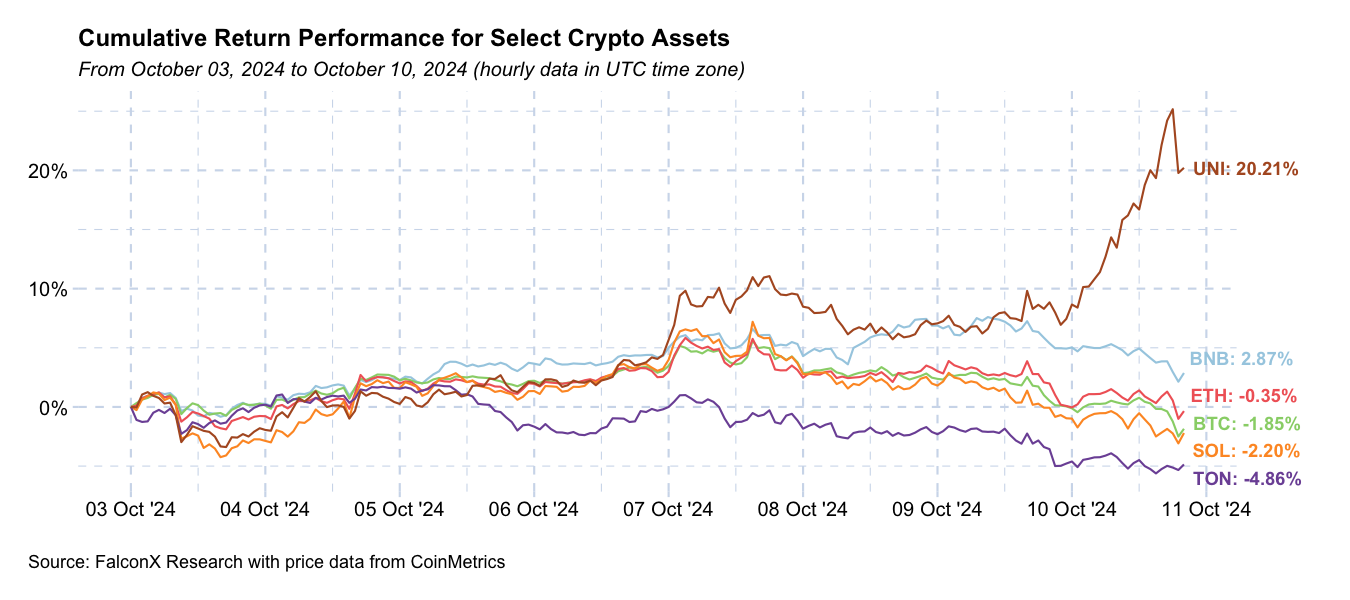

The anticipated "Uptober" bull run has failed to materialize in the first ten days of the month. The uncertainty surrounding China's market-boosting policies, further exacerbated by a mixed September CPI report, brought in some bearishness. However, calls for a successful soft landing engineered by the Fed brought some excitement toward the end of the week.

As a result, BTC has dipped below $60,000 for the first time since September 18, but it recovered to positive territory like most of the market. The notable exception among cryptocurrencies with a market cap exceeding $1 billion was UNI, which saw gains following Uniswap Labs' announcement of Unichain, a DeFi-specific Ethereum L2.

In the coming months, we expect greater clarity on two key factors currently preventing the market from establishing a clearer directional trend: the outcome of the U.S. 2024 elections and the outlook for global liquidity conditions. For those interested in our detailed analysis of these topics, please refer to our previous reports (here, here, and here).

As uncertainty surrounding these factors diminishes, ETF flows may reemerge as a more significant driver of price action.

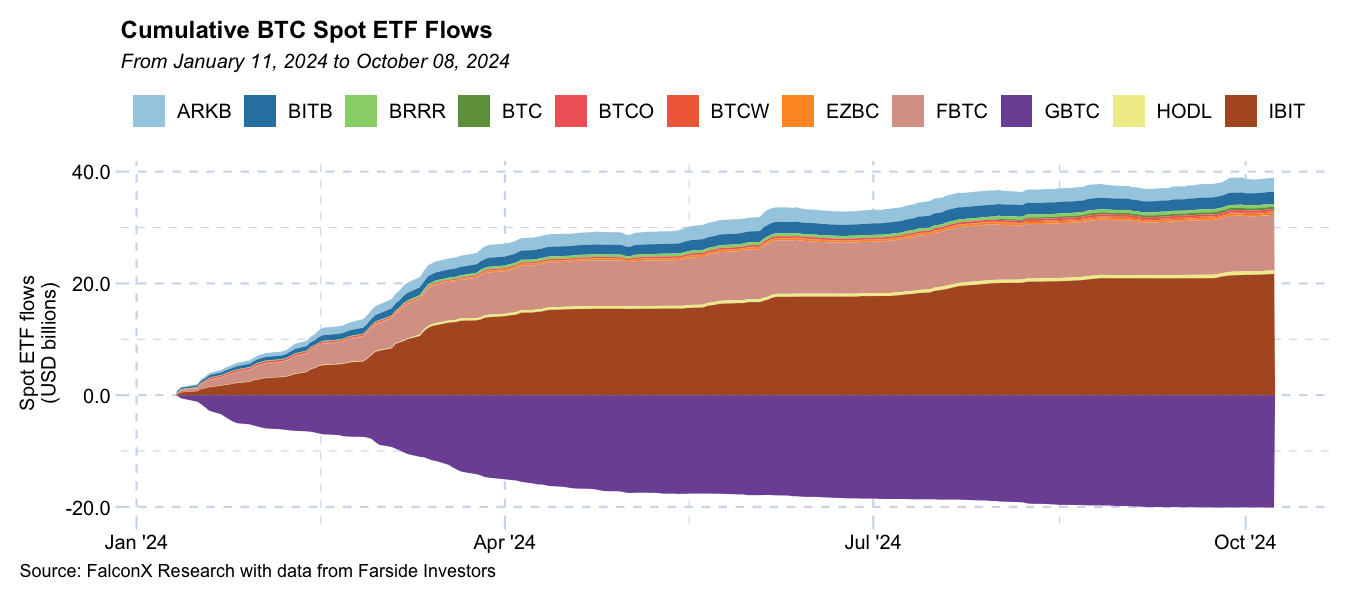

Since their launch on January 11, U.S. BTC spot ETFs have accumulated $18.6 billion in net flows. Excluding GBTC outflows, total net inflows now approach $40 billion. While 70% of these non-GBTC inflows occurred between January and March, a remarkable $11.8 billion entered during the relatively flat market period after April. This sustained interest, even in a stagnant market, underscores the growing importance of ETFs as the main source of new capital to the market.

Unsurprisingly, total net inflows have been stronger during months with positive price performance. Over the past six months, Bitcoin posted gains in May, July, and September. During these months, ETF net flows were substantial: $2.1 billion, $3.2 billion, and $1.3 billion, respectively.

The interplay between U.S. spot ETF net flows and Bitcoin prices has been largely unexplored until now. With ten months of daily data available and the market potentially approaching a more defined direction in the coming months, this is an opportune time to delve deeper into understanding this relationship.

We’ll get a bit wonky on the stats side, but bear with me because the conclusions are potentially interesting.

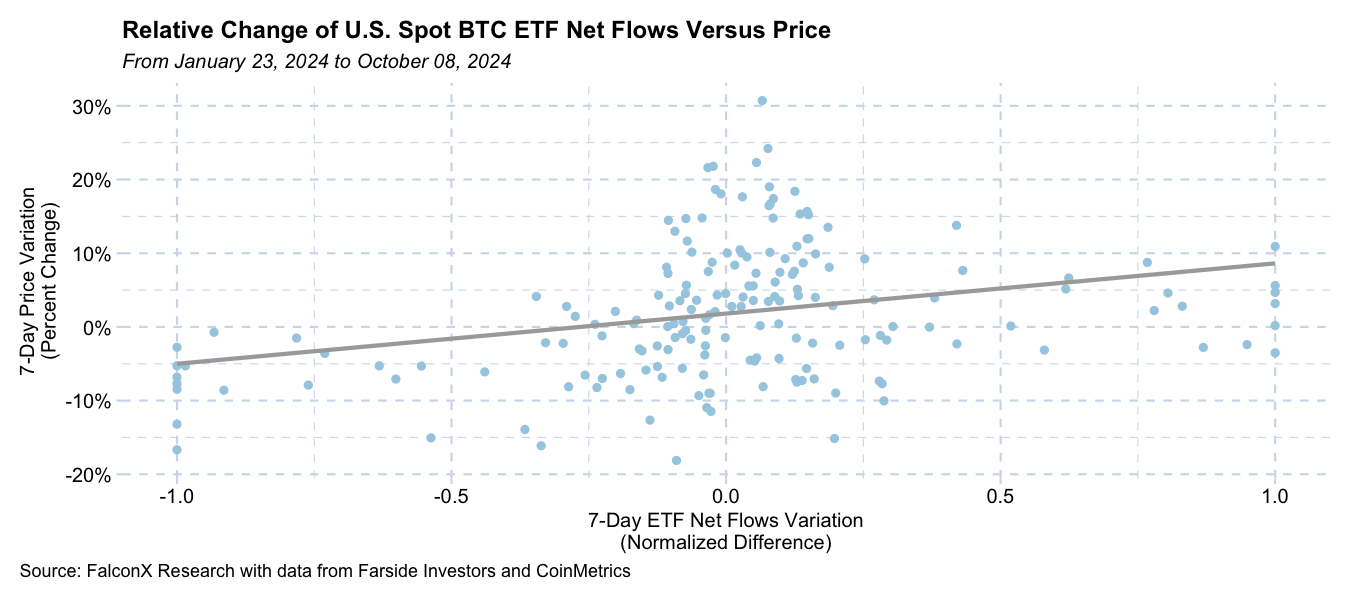

The chart below compares two metrics: Change in daily BTC prices versus the variation in U.S. spot ETF flows. Both are computed over 7-day periods to reduce short-term noise. Notably, ETF flows variations are calculated using the normalized difference method, which better accounts for its constant shifts between positive and negative values.

There is a statistically significant relationship between changes in ETF flows and prices, but it’s not a strong one. The correlation coefficient is 0.30, which means that less than 10% of the change in prices can be explained by the change in net flows.

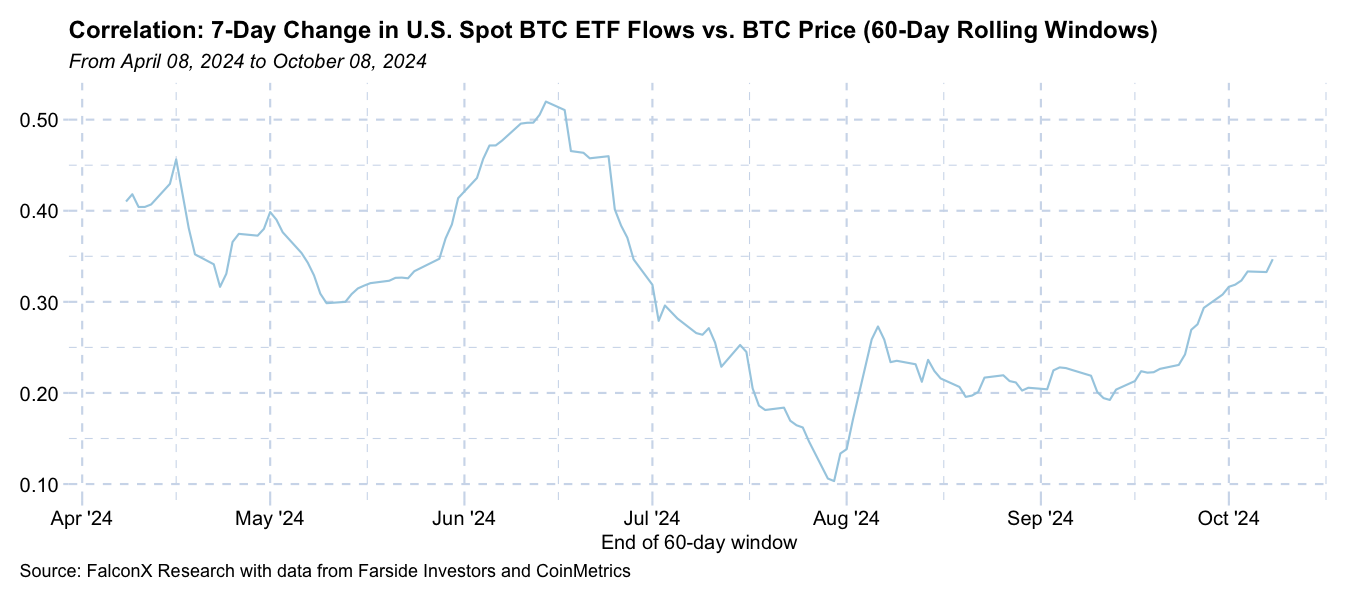

This relationship, however, is far from constant. The chart below shows the correlation coefficient between the variation in ETF flows and prices on a rolling 60-day basis. This figure has ranged from 0.10 to just north of 0.50 over the past ten months.

The relationship between ETF flows and Bitcoin prices has been strengthening in recent weeks. Given that ETFs have been the primary source of new capital into the crypto market in 2024, this correlation may continue to intensify if the market finds a sustainable direction.

The critical question for most investors, however, is whether ETF flows provide meaningful context for interpreting the trajectory of prices.

One way to address this question is what is known as the Granger causality test, which helps determine if one time series is useful in forecasting another. In this case, we're examining how helpful changes in ETF flows are for predicting the BTC price.

This test’s results (f-statistic of 8.4767 with a p-value of 0.00406) indicate that there’s a strong relationship between these two variables at a statistically significant level considering the most common thresholds of 0.05 and 0.01.

Importantly, Granger causality doesn't prove actual causation. It merely indicates that one variable (ETF flows) contains information that precedes and helps predict changes in another variable (Bitcoin price).

But in practical terms, these results suggest that ETF flows do indeed provide valuable context for understanding Bitcoin price movements beyond what we could predict using past price data alone.

To deepen our understanding of the relationship between ETF flows and Bitcoin price changes, we employed a Vector Autoregression (VAR) model in conjunction with an Orthogonal Impulse Response Function analysis. These tools are particularly useful for examining the dynamic interactions between multiple time series variables.

Our analysis reveals intriguing dynamics between Bitcoin ETF flows and price movements.

Watch our podcast episode with David Lawant from earlier this year

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.