CF Benchmarks Newsletter - Issue 69

The top end of new Ether funds, represented by BlackRock’s iShares Ethereum Trust ETF (ETHA), and Bitwise’s Ethereum ETF (ETHW), comfortably join the echelons of ETFs evincing a faster-than-historical-average pace of asset gathering.

- BlackRock’s ETHA is among 2024's top ETFs as ETH fund flows go positive

- The rise and fall of crypto volatility

- Ripple fine slashed as CME and CFB launch XRP-USD benchmark

Swing

Good old-fashioned, market-destabilising volatility has finally reasserted itself among preeminent focus points for risky asset classes, including crypto, in recent weeks; triggered, as long threatened, by an unusually diverse brace of global macroeconomic circumstances.

In keeping with that complexity though, the most salient influences continued along their ambivalent path around publication time, as resurgent U.S. employment concerns, stoked by startlingly weaker than expected payrolls a week prior, were moderated by the fastest drop of weekly employment benefit claims for almost a year.

To that point, check this tweet by our Head of Research, Gabe Selby, CFA - @gxselby:

Fears of a #recession, fueled by the #SahmRule, are giving way to a new understanding: labor supply dynamics may be a more significant factor than weakening demand. For now, a soft landing remains a viable possibility. https://t.co/9RbuZSyVjA

— Gabe Selby (@gxselby) August 8, 2024

Sahm ruled-out

It’s worth noting that despite the Sahm Rule recession indicator being widely invoked in recent days, the author who devised it, Claudia Sahm, has pushed back. She says current data don’t support the conditions her theory suggests will very probably precede a recession.

As well, the sudden strengthening of U.S. Treasurys in the wake of the Bank of Japan’s signal tightening of borrowing costs, the first in 15 years, wasn’t so scary following the BoJ’s later, more ameliorative commentary, apparently in response to the week-long tantrum across global markets.

With these factors reducing prospects for continued price pressure, risky assets like oil, stocks and yes, crypto, won some breathing space in the most recent sessions.

Scroll down now to read Gabe Selby, CFA's, exclusive, detailed analysis of resurgent Bitcoin volatility.

Also, for a concise catch-up on markets in July as the basis of the latest moves, you can grab an excerpt of our research team’s Monthly Market Recap, and navigate to the full report.

BlackRock's ETHA Excels

Regardless of how sustained it may turn out to be, the outbreak of volatility has provided something of a natural bookend to a several months long chain of constructive drivers of digital asset prices; including a continuation of headline institutional adoption trends. These arguably continue to edge the resumption of ‘normal markets service’ as the more material theme of the year.

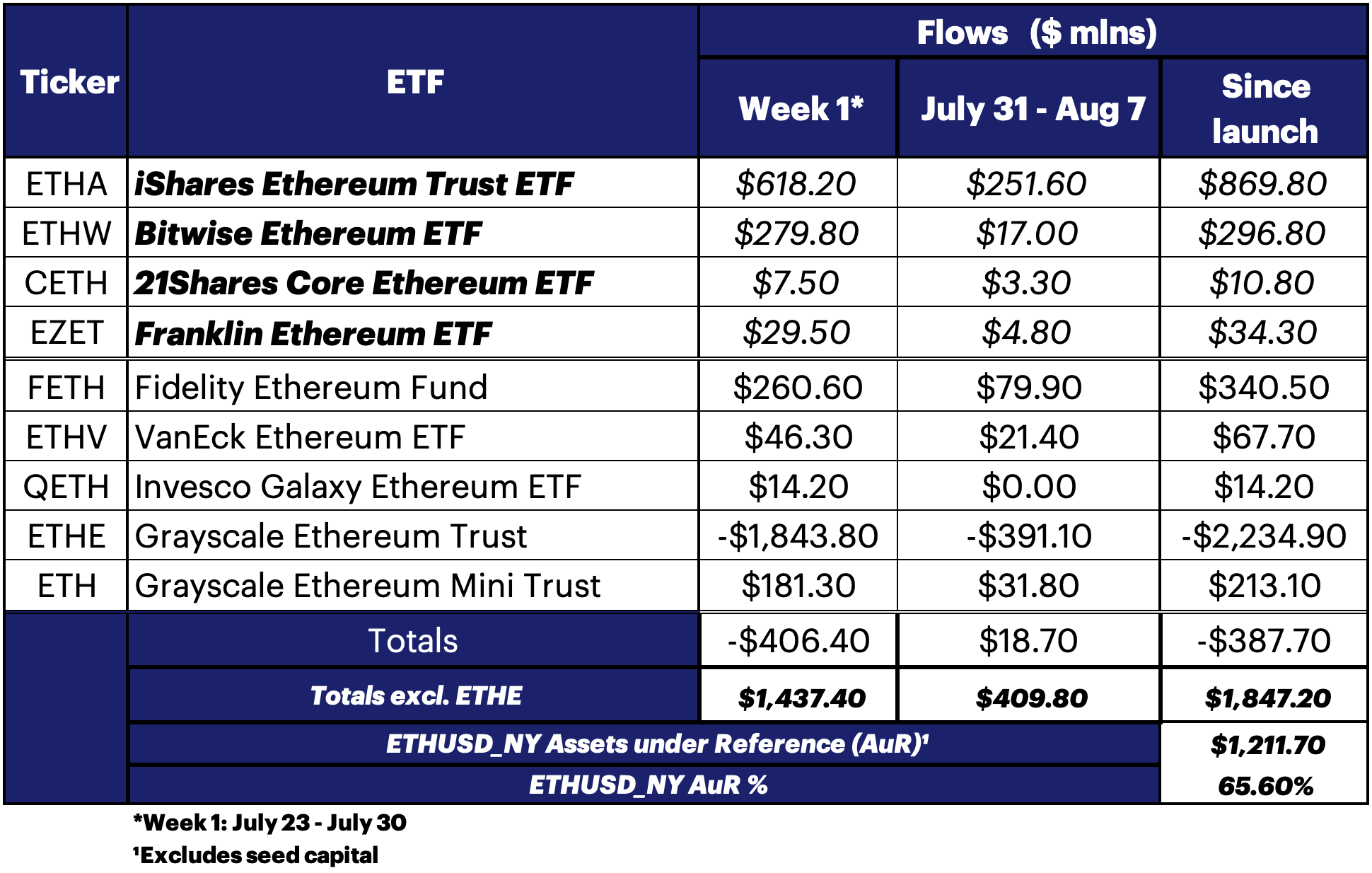

Gross spot Ether ETF demand, to the extent that can be assumed from ongoing flows, has largely maintained the profile established in their first few days of trading.

The underlying picture is even more promising when the confounding effect of Grayscale’s legacy fund conversion is removed, as shown below.

Positive week

Still, even the unabated torrent of capital exiting Grayscale Ethereum Trust (ETHE), the firm’s primary Ether vehicle alongside its newer Grayscale Ethereum Mini Trust, hasn’t been enough to prevent weekly net flows from a probable swing into moderately positive.

This underscores, again, that whilst the Wall Street debut by the second largest cryptoasset remains more modest in scale relative to Bitcoin’s record-breaking TradFi transition, the top end of new Ether funds, represented by BlackRock’s iShares Ethereum Trust ETF (ETHA), and Bitwise’s Ethereum ETF (ETHW), comfortably join the echelons of ETFs evincing a faster-than-historical-average pace of asset gathering.

Meanwhile, ETHA’s almost $900m in assets since launch, places it among 2024’s top six ETFs by that measure, even after the impact of the market mayhem of preceding days.

Our market share

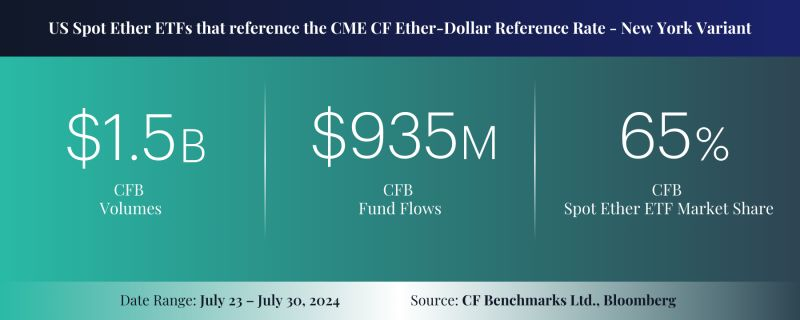

Likewise, CF Benchmarks’ share of U.S. spot Ether Assets under Reference (AuR) – the metric denoting how much spot Ether is priced by our CME CF Ether-Dollar Reference Rate (ETHUSD_NY) – is, like overall ETH ETF outcomes, better than even our quietly optimistic expectations.

Strictly speaking, it’s worth noting there's only been one confirmed complete week of trading in these funds at the time of writing, bearing in mind T+1.

Still, there are decent grounds to assume ETHUSD_NY’s 65% AuR for part of week two’s trading, will prevail for the remainder.

In fact, that’s in line with the AuR pattern swiftly established by Ether ETFs in their first complete market week, per below.

Flows outlook

Meanwhile, the same provisos applicable to longer-term preconditions for Bitcoin ETF flow growth and general demand are clearly in the frame for Ether ETFs too.

Chiefly, there is almost certainly no client advisory onboarding, and little or no intermediary onboarding of the latter funds, as yet; whilst the progression of these funds to self-managed platforms will take even longer.

That said, data showing robust net inflows for all brand-new ETH ETFs, point to bids among institutional participants to build inventory, among other purposes.

In turn, that suggests these guys and, by extension, potentially some of their client cohort; from whom much impetus may emanate, are chomping at the bit.

Overall, it bodes well for a successful roll-out of broader access, when the necessary education and infrastructure work are done.

Get informed

In case of remaining dissonant expectations – more specifically the view that Ether’s lower-key ETF launch potentially points to weaker asset growth over time – there are several high profile proponents of the more informed outlook.

It’s predicated on 1., Ethereum’s Number Two status in market cap terms, which has historically tended to meter its expansion, in many respects, not just for asset growth. More importantly 2., Ethereum’s already dominant network ubiquity must also be considered, as that casts it as the ‘proto-industrial’ blockchain, with a fast-growing ‘real-world’ footprint, that tips adoption risks to the upside over time.

These are points CF Benchmarks CEO Sui Chung made succinctly during media interviews on the first day of Ether ETF trading, like the one clipped below.

Morgan Stanley BTC ETF clients onboard

Speaking of ‘onboarding’, though winding back to the year’s earlier digital asset watershed, one significant instance of gathering of momentum emerged in recent days.

Morgan Stanley, 19th largest U.S. Bank by total assets, but which punches above its weight due to the sustained leading position of its private wealth management franchise, is reportedly set to give the greenlight for its 15,000 financial advisors to offer clients access to spot Bitcoin ETFs.

If accurately reported, this would represent the first known instance of a ‘bulge bracket’ bank unlocking spot crypto investing within the ETF wrapper.

Solicited

Furthermore, the group appears to have permissioned the terms of any such offers as being on a solicited basis for eligible clients, as opposed to a self-referred basis.

The distinction is important as investment solicitation is recognized as implying a higher degree of regulatory risk for the vendor. For MS to be willing to shoulder that theoretical risk indicates the bank's greater certainty of the offer's viability.

That’s promising for the broader process of Bitcoin ETF subscriptions by advisors' clients, which is expected to ramp up over the next several months.

Meanwhile, new Morgan Stanley BTC ETF investors will have access to the largest BTC vehicle that debuted in January, BlackRock’s iShares Bitcoin Trust (IBIT), the net asset value (NAV) of which is struck against our CME CF Bitcoin Reference Rate – New York Variant (BRRNY).

This helps ensure the highest possible end-to-end standards for incoming crypto ETF investors.

ETHA options incoming

BlackRock looms large elsewhere in pivotal developments for U.S. exchange traded crypto, this time with regards to its counterpart Ethereum fund, iShares Ethereum Trust ETF (ETHA), which is also underpinned by CF Benchmarks’ regulated benchmark methodology, in this case ETHUSD_NY.

Together with the Nasdaq, venue of the fund’s primary listing, BlackRock has filed a proposed rule change, that would enable the listing of options on that issue.

The advent of an option on an existing security is generally recognised as offering wider flexibility for position and risk management in the underlying, and also tends to precipitate increased activity, and ultimately, potentially increased liquidity in both the derivative and in this case, the ETP.

Meanwhile, approval, if granted, would inevitably be the first of several similar proposed rule changes to be filed. ETHA options would also of course signal yet another incremental step in the maturation of crypto as a mainstream asset.

Ripple’s Revival

The order by a Federal judge that Ripple Labs should pay just a fraction of the civil penalty demanded by the SEC, is worth a second look.

That’s because it coincides with potential optics suggested by the recent transition of CF Benchmarks’ existing regulated XRP-USD indices, to the CME CF Cryptocurrency index family.

The recent regulatory approval of Ether ETFs has buttressed the validity of CF Benchmarks’ long held view that a CFTC regulated futures market is among critical conditions that must be satisfied for a digital asset to be deemed eligible for sale within an exchange traded fund.

Still, the conversion of our XRP benchmarks to the CME CF Family does not mean that a CME XRP futures contract is near - or even on the cards.

This suggests assertions (including by Ripple’s CEO) that an XRP ETF may be approaching imminence, are probably wide of the mark.

The launch of CME CF Ripple-Dollar Reference Rate (XRPUSD_RR) and CME CF Ripple-Dollar Real Time Index (XRPUSD_RTI) may now follow the same playbook as several other cryptocurrency indices that have resided in the CME CF family, sometimes for years.

These serve only as cryptocurrency pricing sources of the highest possible integrity, publicly available to anyone for free.

About the Ruling

As for the ruling, what’s patently true is that the order that Ripple must pay just $125m, vs. the $2bn fine proposed by the SEC, limits all sorts of exposures the firm faced, as well as removing the negative overhang faced by the group since the Commission’s initial prosecution in 2020.

Our XRPUSD_RTI index marked the token around 25% higher in reaction to the news on Thursday. Still, it’s worth noting the token is largely flat for the year, and some 77% below a peak from April 2021.

The news does represent a further incremental positive for Ripple Labs as well as XRP, after last year’s partial ruling in the group’s favour by the same judge.

At that time, the court concluded that securities law, including the so-called Howey Test, applied solely to historical sales of the XRP token to institutional investors, and not to the much more widespread distribution of XRP to individual buyers in the secondary market.

Neither is Ripple required to disgorge proceeds, calculated by the SEC to be above $876 million. And the firm was not found to have acted fraudulently.

Loose ends

Ripple was, however, injuncted from committing further securities laws violations and, as the Commission noted, the judge indirectly admonished Ripple for showing a “willingness to push the boundaries” of her previous ruling.

Meanwhile, the ruling skirts several issues that might have clarified obligations and freedoms of the myriad firms operating businesses similar to Ripple’s.

The injunction means no new XRP can be issued, unless Ripple registers the token as a security, which would be surreal, if it occurred.

Meanwhile, Ripple is likely to continue regular sales from the proportion of the XRP it has on hand of the around 100 billion tokens already in circulation.

As for the possibility of an appeal, whilst the SEC has remained noncommittal, the number of outstanding legal loose threads at least indicate the basis of an opinion that could motivate such a move.

Markets

Bitcoin's Volatility Headfake: Options Traders Position for Further Upside

The cryptocurrency market recently experienced a phenomenon dubbed the "Volmagedon headfake," characterized by a sharp spike in Bitcoin volatility followed by a swift recovery. This analysis delves into the market dynamics using sophisticated technical indicators and trader sentiment.

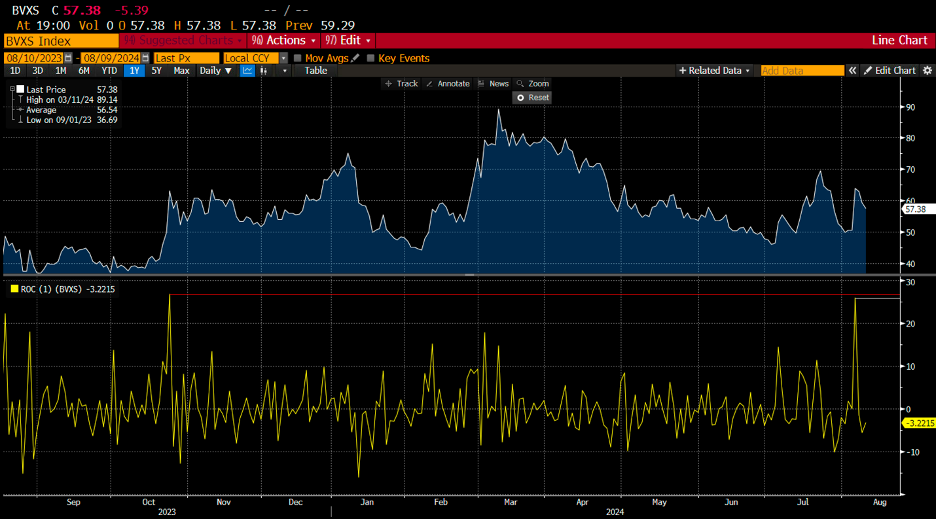

BVX: The Swiss Army Knife of Crypto Volatility CF Bitcoin Volatility Real Time Index (BVX)

The BVX is a cutting-edge benchmark for Bitcoin's implied volatility, offering:

- Second-by-second updates

- A forward-looking, 30-day constant maturity measure

- Foundation in CFTC-regulated Bitcoin option contracts traded on the CME

This index serves as a multifaceted tool for market practitioners, providing:

1. A diversifying tail risk hedge during risk-off periods

2. A barometer for long/short volatility strategies

3. Opportunities for option premium yield harvesting

4. Insights for term structure trading

Weekend Tremors...

The cryptocurrency market witnessed a significant sell-off over the prior weekend, with Bitcoin prices falling from $62,000 to below $50,000 triggering a pronounced reaction in the BVX:

- Over 20% jump from the previous Friday's close

- The highest single-day rise since October 2023

Bouncing Back: Market Resilience and Trader Sentiment

Bitcoin's price rebounded sharply from a key support level, surprising traders who had positioned for further downside. This strong upward movement gained further momentum, propelling the cryptocurrency past the psychologically significant $60,000 threshold.

The recent recovery in Bitcoin's price reflects the market's resilience and aligns with options traders' positioning. This recovery is evident in today's upward movement in Bitcoin prices, suggesting that the "Volmagedon headfake" may indeed have been a temporary phenomenon.

As #Bitcoin crosses the $60K threshold today, we are likely to continue seeing strong risk appetite for $BTC options on @CMEGroup. Yesterday's print of our @CFBenchmarks #volatility surface shows how traders were positioned for this. pic.twitter.com/fVwrLUR1bK

— Gabe Selby (@gxselby) August 9, 2024

Market Recap: Crypto Stabilizes with Robust ETF Demand & Public Policy Spotlight

Compiled and written by CF Benchmarks Head of Research, Gabriel Selby, CFA

This is an excerpt of the complete report, originally published on August 2nd, 2024. Click the link at the end of the excerpt to navigate to the complete article.

Key takeaways for the month:

- ETF Demand, Political Endorsements, and Macro Signals: Robust demand was observed for the anticipated launch of spot Ether ETFs, with over $1 billion in fund flows accumulating into the newly launched products. Concurrently, U.S. presidential candidates and policymakers have publicly advocated for Bitcoin to be adopted as a strategic reserve asset for the U.S. Treasury, reflecting the growing focus on digital assets in public policy. Meanwhile, cooling inflation and labor market data, coupled with recent Fed commentary, indicate potential interest rate cuts starting as early as September.

- Index Gains and Sectoral Shifts: Last month's portfolio index performance was broadly positive. The CF Free-Float Broad Cap Index, our broadest gauge of the institutionally investible market, recorded a 6.1% gain. Mega-cap tokens, represented by the CF Ultra Cap 5 Index, emerged as top performers, rising by 6.7%. The CF Diversified Large Cap Index led the pack with a 7.7% increase. In contrast, the CF Digital Culture Index continued to face challenges, declining by 6.7%, while the CF Blockchain Infrastructure Index lagged the rest with an 8.3% decline.

- July's Crypto Movers and Shakers: Ripple's XRP token (+31.6%) and Solana's SOL token (+17.3%) were the top performers in July. XRP surged on settlement hopes with the SEC after an amendment was filed in the SEC’s case against Binance. Solana saw record on-chain activity, surpassing Ethereum in daily fee revenue for the first time in late July. Fantom's FTM token (-28.2%) and Uniswap's UNI token (-21.8%) were the month's bottom performers. The Fantom foundation announced that it would be committing 200M FTM tokens, valued at $120M to fund strategic grants to developers creating apps on Fantom.

- Bitcoin's Dominance and Spot Ether Debut: Net monthly inflows continued in July, with Bitcoin accounting for $3,426 million in inflows. Following the launch of the spot ETFs, Ether saw $334 million in outflows. From a regional perspective, the majority of the inflows were concentrated in North America (+$3,021 million).

- Bitcoin's Mining Difficulty Hits All-Time-High: Bitcoin's network hash grew significantly in the past month, gaining 20.7% to reach 495 exahashes per second. The mining difficulty, which measures how hard it is to find a new block and thus adjusts to maintain a consistent block creation time, increased by 4.5% during the month. The next difficulty adjustment will likely be in the second week of August and is trending towards a 2.0% increase.

- Ethereum Fee Fluctuations and Network Activity: The Ethereum network saw total fees paid decrease 49% from the prior month to $66.2M. The average fee per interaction with the Ethereum network fell by 27.5% over the period, indicating that overall transaction volumes were down for the month.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.