CF Benchmarks Newsletter - Issue 67

The ‘main case’ remains, from our perspective, that Ether ETFs are on track for full approval and listing – relatively imminently.

- What's behind the Ether ETF delays?

- Get ready: Our research team's Ethereum primer - summarised

- The Bitcoin Basis: the definitive take by CF Benchmarks Research

Scare

Apart from a fresh outbreak of public uncertainty—looking at social and crypto media—the SEC’s enforcement action against Consensys looks immaterial for the ‘main case’, right now. (The lack of a discernible Ether price reaction also seems to back the ‘immaterial’ conclusion).

And that ‘main case’ remains, from our perspective, that Ether ETFs are on track for full approval and listing – relatively imminently.

Admittedly, the emphasis is rather more uncomfortably on ‘relatively’ than anyone wants. And venturing just marginally into the realms of speculation, it’s easy to envisage how events like the Consensys suit, and others similar to it, may have contributed to this indeterminately extended ‘final review phase’.

Backstory

Firstly though, understand how the rationale for low-grade panic pivots on MetaMask. Developed by Consensys Software Inc., it is the most popular (in usage terms) and best established wallet for interacting with the Ethereum ecosystem. (55% jump in Monthly Active Users in the quarter ending January 2024).

MetaMask is at the heart of the Commission’s complaint:

The Securities and Exchange Commission today charged Consensys Software Inc. with engaging in the unregistered offer and sale of securities through a service it calls MetaMask Staking and with operating as an unregistered broker through MetaMask Staking and another service it calls MetaMask Swaps.

Close observers will recognise these charges haven’t dropped out of the blue. In late-April, the firm disclosed receipt of a Wells notice with a focus on MetaMask. Even closer observers, especially those embedded for longer and more deeply in crypto, might note Consensys’ storied origins. Founded by an initial co-developer of Ethereum, firm and personnel are not unfamiliar to the U.S. securities regulator.

Consensys subsequently filed an injunction; essentially seeking confirmation the Commission lacks legal authority over Ethereum, and the DApps, ERC-20s, and layer 2s it hosts.

Causally or not, the investigation was apparently ‘closed’ last month; an event misinterpreted in some quarters, including apparently by Consensys itself, as signifying the end of the affair. Then came the charges.

The connection

So, it seems the scare is simply based on the adjacency of MetaMask to Ethereum. Cumulative nerves from the trickle of similar notices, suits and settlements over the last several months – against TradeStation, ShapeShift, Uniswap and others – are also worth noting.

Indeed, the SEC’s complaint also mentions liquid staking platforms Lido and RocketPool, accessible via MetaMask itself.

Meanwhile, beforehand, Consensys had inadvertently helped solidify notions of a deleterious connection between a potential SEC enforcement action and upcoming Ether ETFs. From the same June 18th blog post cited above:

On June 7, we sent a letter asking the SEC to confirm that the ETH ETF approvals in May, which were predicated on ether being a commodity, meant the agency would close its Ethereum 2.0 investigation.

'Smoothly'

In the end though, the Commission, and its chair Gary Gensler, have adhered to public commentary, conveyed over the last several weeks, indicating firm intent to complete the final stage of approval of all the current spot ETH funds.

And as we’ve repeatedly noted, the SEC’s approval order for the exchanges that will list Ether ETFs (19b-4s) cited CF Benchmarks’ analyses, and data; seeming to align the Commission with our view of the extant regulatory status of Ether as a commodity asset.

There’s been no outright confirmation from the Commission. Nor outright denial. All the while, Gensler has contributed forward looking statements—running quite concurrently with enforcement actions—offering a rough timeline to complete approval.

Furthermore, no U.S. spot Ether filing proposes to include staking. In fact, within the rafts of S1 amendments over the last several weeks, ‘staking’ has been tantamount to Kryptonite. Even the mention of it in filings has been avoided as much as possible.

Still, in light of this most recent ‘query’ by the SEC, on how issuers intend to interact with the Ethereum blockchain, it’s conceivable ongoing S1 reviews and amendments have gone through further iterations, to ensure they’re future-proofed against any conceivable form of proscribed participation down the line.

Below we feature summaries and excerpts from reports produced by the CF Benchmarks Research Team Gabriel Selby, CFA and Mark Pilipczuk.

Featured Benchmarks:

- CME CF Ether-Dollar Reference Rate - New York Variant (ETHUSD_NY)

- CME CF Ether-Dollar Reference Rate (ETHUSD_RR)

ETHER: A Strategic Asset for the Decentralized Economy

Background

In anticipation of the upcoming final approval and listing of Ether ETFs, CF Benchmarks Research has prepared a comprehensive report that's intended to serve as an in-depth primer on Ethereum as an investment asset.

Although it will take some time before Ether ETFs are made available to the clients of RIAs and other intermediaries, and onboarded on to investment platforms, post approval, this is an inevitability.

At that point, the considerably greater complexities and facilities of the Ethereum blockchain as compared to Bitcoin may become a challenge for those unfamiliar with the second-largest digital asset, in market capitalisation terms. Still, it's one that can be remediated pretty quickly by the tremendous amount of resources available to Ethereum newcomers, especially this CF Benchmarks introductory white paper.

Summary

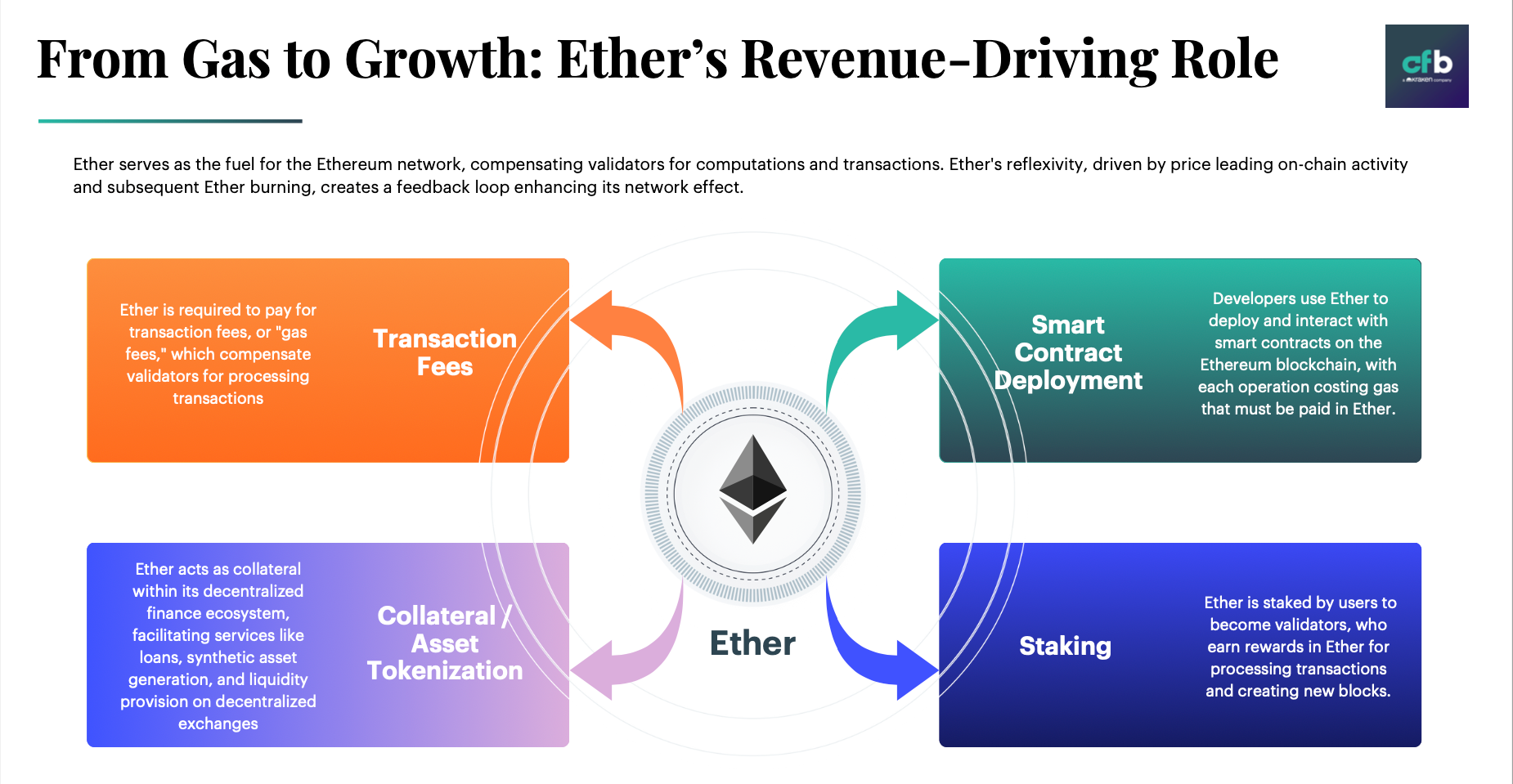

The paper explores Ethereum's basis as the foundational network for smart contract platform functionality – partly driven by the interoperability of layer-2 blockchains based on Ethereum; its ‘tokenomics’, AKA the blockchain economic model pertaining to this specific network; and the fundamental rationales that provide Ethereum with undeniable intrinsic value.

Read the excerpted sections 'What is Ethereum?' and 'From Gas to Growth: Ether’s Revenue-Driving Role' below, then click the button to download the full report.

Ken Odeluga

Excerpted from a report by Gabriel Selby, CFA and Mark Pilipczuk

Featured Benchmarks:

- CME CF Bitcoin Reference Rate - New York Variant (BRRNY)

- CME CF Bitcoin Reference Rate (BRR)

Exploring Bitcoin Basis Trades: How Price Singularity in ETFs and Futures is Bolstering Market Activity

Excerpts from an article by Gabriel Selby, CFA and Mark Pilipczuk

The alignment of price benchmarks between spot Bitcoin ETFs and CME futures contracts plays a crucial role in enabling precise arbitrage opportunities. Six of the spot Bitcoin ETFs utilize the CME CF Bitcoin Reference Rate - New York Variant (BRRNY) to determine the Net Asset Value (NAV) for creation and redemption. Simultaneously, CME futures contracts settle using the same reference rate. This synchronization ensures that both instruments are inherently linked to the same price benchmark, facilitating more efficient basis trades.

Understanding the Fundamentals of Basis Trades

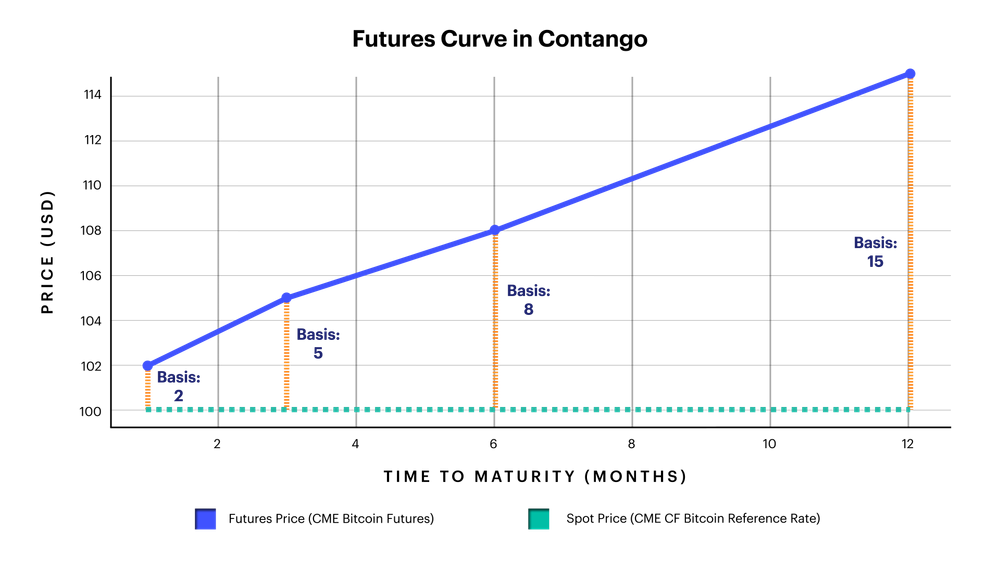

At its core, a basis trade involves simultaneously taking positions in the spot market and the futures market for the same asset. The objective is to profit from the convergence of the spot and futures prices at the expiration of the futures contract. When the futures price is higher than the spot price (known as a positive basis), traders typically buy the underlying asset and sell the corresponding futures contract. Conversely, when the futures price is lower than the spot price (a negative basis), traders sell the asset and buy the futures contract.

The success of a basis trade hinges on the expectation that the futures price will converge towards the spot price as the contract approaches maturity. This convergence allows traders to lock in the price difference as profit, while hedging against potential price fluctuations in the underlying asset.

Institutional Involvement in Basis Trades

Basis trades are primarily executed by institutional investors, such as hedge funds, proprietary trading firms, and large financial institutions. These entities leverage their substantial capital and sophisticated trading tools to identify and exploit market inefficiencies. Market makers and arbitrageurs also engage in basis trades, employing advanced strategies to profit from the convergence of futures and spot prices.

The participation of institutional investors in basis trades contributes to improved market efficiency and liquidity. By actively trading on price discrepancies, these entities help to narrow the gap between spot and futures prices, promoting more accurate price discovery and reducing market fragmentation.

The Interplay of Spot Bitcoin ETFs and Futures Markets

The recent launch of spot Bitcoin exchange-traded funds (ETFs) has had a significant impact on the dynamics of basis trades in the cryptocurrency market. These ETFs provide institutional investors with a more accessible and regulated avenue to gain exposure to spot Bitcoin, enabling them to capitalize on positive basis opportunities.

Click below to read the full article

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.