CF Benchmarks Newsletter - Issue 66

The launch of spot Ether ETFs in the U.S. remains locked-on.

- U.S. spot Ether ETFs may be imminent

- Recapping a global glut of CFB-supported crypto ETFs

- Meet BVXS - the only CME BTC implied volatility index

Exemptive

After a metamorphic launch at the start of the year, roughly coincident with another up-wave of the current bull market, growth of the 6-month old U.S. spot Bitcoin ETF product class has settled into a less parabolic, but still impressive trajectory.

Meanwhile, the stunning success of ETFs investing directly in Bitcoin fortified sentiment in crypto markets and encouraged issuers to push for what’s widely regarded as the next most important step in institutional adoption - spot Ether ETFs.

A surprisingly benign outcome followed, though complete resolution is progressing at a somewhat decelerated pace.

Price and flow

JPMorgan earlier in the month estimated spot Bitcoin ETF net inflows alone for the year to date, had amounted to $16bn, accounting for the majority of a surge in digital asset inflows overall. The bank, somewhat superfluously, concluded that it was 'sceptical' net inflows would continue unabated at such a rate.

The pace of inflows has certainly moderated since the first few months of the year, which is entirely normative. Spot Bitcoin ETFs, the newest category of such funds, have swiftly become the fastest growing ever, based on several metrics.

The key positive is that inflows, the best gauge of interest in U.S. exchange traded Bitcoin products, continues to track the market vector well.

Looking at the most liquid institutional proxy, CME Bitcoin Futures (overlooking typical volatility for the sake of measurement), a synthetic continuation contract indicates a price return of around 55% since January 2nd.

Approval path

The most visible impact on institutional demand from the arrival of U.S. crypto ETFs has clearly been an increase in momentum - in many senses.

Beyond the incredible expansion of flows, digital asset programmes at existing providers have widened, and new ones have entered the fray.

And as we've seen, ETH was correctly deemed as the highest-probability, low-hanging fruit, in terms of the asset expected to see ETF approval next.

(It's not the only asset in the frame. Read 'Solana's dimmer ETF chances' below.)

Most of America’s successful new crypto ETF issuers and even some that stood aside from the BTC drive, scrambled to tack filings for Ether ETFs on to perceived momentum from the prior win.

The switch

Trepidation about the prospect of a clear path to success was widespread though. SEC chair Gary Gensler had beaten the drum for years about his view (and therefore, the Commission's collective view) that Ether was an unregistered security.

Rejection was widely thought to be the most likely outcome. At best, issuers hoped success might come several months, or perhaps years later; in the event that a new SEC chair might be installed, new legislation might be passed, enabling approval; or even that the Commission might suffer another embarrassing legal defeat. Like the one meted out by Grayscale, which essentially swept away SEC opposition to Bitcoin.

Then suddenly such fears evaporated, literally overnight.

One week in early May, still around a month from the date expected to mark the SEC’s ultimate conclusion, the flow of major firms heard making unofficial visits to the SEC's Washington HQ became too numerous to ignore.

After Bloomberg’s ETF team abruptly hiked their estimate of the probability of approval from 25% – close to where it had been for months – to 75%, the game was clearly up.

Things are taking a turn for the better on Spot #ethereum ETF approvals this week. Upping our odds to 75%. https://t.co/3WJ8kx9d8k

— James Seyffart (@JSeyff) May 20, 2024

Exemptive, delegated, but approved

In fact, while we speak of ‘approval’ (and we mean Ether ETFs really have been granted approval) the outcome is as unexpected as it’s nuanced, and at the time of publication, strictly speaking, still incomplete.

Recall, so far, that authorisation has only been granted to the proposed exchanges that will list these shares, i.e., that the SEC has accepted their proposals as set out on forms 19b-4.

Approval is a two-pronged process though, requiring regulatory approval of both trading venue and issuer applications, the latter are usually submitted on forms S1 and variants.

For an insight into the unusual split in the typical approval choreography, we can look at the ‘exemptive’ basis of the exchange approvals. Exemptive approval is a pathway the regulator set aside decades ago for select ETFs to diverge from certain requirements of the Exchange Act, ‘in the public interest’, provided they’re consistent with investor protection.

It has also been noted the approvals were done on the basis of another arcane principle: 'delegated authority'. This enables a single senior staff member of the Commission's Market Regulation division to issue exemptive approval. The most important distinction relative to 'ordinary authority' is that decisions made under delegated authority are not subject to a public Commissioner vote, and can be challenged internally.

Snag potential

The exemptive aspect may simply reflect the original intention of the procedure: a device to enable otherwise compliant investment vehicles to be authorised, despite certain divergences from the norm, thereby avoiding the need for excessively categorical rule making, or even new legislation.

Likewise, delegation might have been nothing more than a convenience to expedite completion at a time when resources (i.e., people) were stretched.

Some mutterings suggest the measures may tacitly provide a back door for 'snags' that could eventually cause further delays, or even roadblocks. We'll probably never know for sure. But the apparent momentum with which the Commission is moving towards full closure suggests otherwise.

Gensler folds (and holds)

On a similar note, we have concluded the “rationale that Ether has been officially categorised as a commodity is now incontrovertible, following the SEC’s approval” (again, read our cogent rationale at the link above, for the details).

Commission chair Gensler seems keen to keep uncertainty alive, though.

He has doubled down on equivocation over the status of Ether - whilst at the same time, remaining clear that U.S. spot ETH ETFs will be listed before too long.

The chair noted a few days ago S1 reviews were “going smoothly”. This follows on from his reply to a question on when approval would be complete at a budgetary hearing earlier this month:

“I would envision sometime over the course of the summer…”

This week, sources for a Reuters report indicated final approval could occur even sooner.

In sum, uncertainty itself should also be viewed as 'only partial' - pertaining solely to Ether's regulatory definition.

(Note that in our view, Ether's status as a commodity is now effectively settled. Gensler’s counterpart at the CFTC, Rostin Benham, who also attended the hearing, publicly agrees.)

Either way, the launch of spot Ether ETFs in the U.S. remains locked-on.

Why the pivot?

As we noted soon after approval news began to emerge:

"The SEC's opaque decision-making process means all rationalisations [about its motivations] are purely speculative".

This is a massive vindication of CF Benchmarks' index methodology, our market integrity, and our collective professional capability.

Click below to read the full account of the part CF Benchmarks played in this latest inflection point.

Solana's dimmer ETF chances

Perhaps unsurprisingly, some institutions have now begun to look beyond even the second-largest crypto in market capitalisation terms, Ether, for further potential assets for which ETF approval might be forthcoming.

VanEck is the first major firm to put its head above the parapet.

Whilst the logic of this prospective progression is cogent, the timing may turn out to be premature.

CF Benchmarks added the CME CF Solana-Dollar Reference Rate (SOLUSD_RR) to our range of regulated benchmarks around two years ago. It is based on the same tried and trusted Benchmarks Regulation (BMR) compliant methodology as our other FCA regulated crypto indices, including others we have launched over the years in partnership with the CME Group. (Note the names of these benchmarks are pre-fixed by 'CME CF').

Still, the launch of such indices is just the first step in the process of establishing a liquid institutional crypto market, underpinned by regulation.

The playbook followed by the CME Group to date has been typically to make derivatives contracts in a digital asset available for trade sometime after the inception of our benchmarks.

There are currently no CME CF Solana-Dollar contracts available for trade on the CME.

Absent such markets, critical components that the SEC has stated must exist for ETF listing exchanges to carry out their obligations under the Securities and Exchange Act, are missing.

For instance, as we've seen, the SEC has demonstrated its agreement with CF Benchmarks' analysis that one of the key determinants of an asset's regulatory status as a commodity, is the existence of a Designated Contract Market in the asset (chiefly the CME Group's) and Designated Clearing Organisations, both overseen by the CFTC.

Without these, prospects for a Solana ETF are weaker than Bitcoin's and Ether's were.

Hopes chiefly appear to hang on potential legislative changes. The timing of these is obviously tough to determine, though arguably could be brought forward in the event that an administration more accommodating to crypto wins the U.S. Election in November.

Click below to read our recent research report showing how the regulated CME CF Solana-Dollar Reference Rate meets the requirements of a benchmark for regulated products.

Markets

Ether looms large

As our Head of Research, Gabe Selby, CFA, notes in his recent Quarterly Attribution Report (QAR) for our June 2024 rebalancing period, though digital assets overall were buffeted by a wide array of disparate factors, the “surprising shift in the U.S. regulatory stance, with the Securities and Exchange Commission's approval of a spot Ether ETF signalling a potential thaw in its relationship with cryptocurrencies”, was among the major upside drivers.

Furthermore, “Ether edged out Bitcoin in terms of market gains” over the rebalancing period, Selby notes after the SEC’s decision to approve exchange application filings for spot Ether ETFs.

Bitcoin options check-in, by CFB Research

For an approximate gauge of the price outlook for the largest digital asset by market capitalisation, Bitcoin, at the time of writing late in June, CF Benchmarks Research this week noted signs that capital market participants are increasingly positioning for potential surges in short-term Bitcoin implied volatility.

That outlook is moderated by relatively muted demand for longer-dated out of the money (OTM) call options, according to CF Benchmarks Research, as cited by The Block.

Referencing our recently launched CF Bitcoin Volatility Index (BVXS), the only available direct gauge of CME Bitcoin options implied volatility, the analysts noted "a larger increase in IV for short-dated puts, compared to calls, suggesting an increase in appetite for tactical hedging."

Still the lack of a significant bid for OTM strikes relatively far into the future "suggests traders are continuing to look for longer-term bitcoin price exposure to the upside, with the short-dated IV appearing to be a sentiment shift for the short-term", the CF Benchmarks analysts concluded.

Read the full article at The Block.

Scroll down to read an excerpt of our CF Bitcoin Volatility Index launch article, or click here for the whole post.

CF Benchmarks Quarterly Attribution Report: March - June 2024

The best possible summaries of crypto market performance over any quarter are presented within our Quarterly Attribution Reports (QAR).

To formulate our QAR methodology, CF Benchmarks has adapted MPT-based analysis frameworks in combination with our proprietary CF Digital Asset Classification Structure, the only transparent taxonomy of investible cryptoassets published by a regulated Benchmark Administrator.

This has resulted in a unique series of comprehensive reports, packed with analyses of the major drivers of digital asset market performance from one quarter to the next, and produced to the same exacting standards as those required by institutions managing traditional asset portfolios.

Scroll down for excerpts from the most recent QAR, then click the link to read a longer summary or download the reports.

Key takeaways:

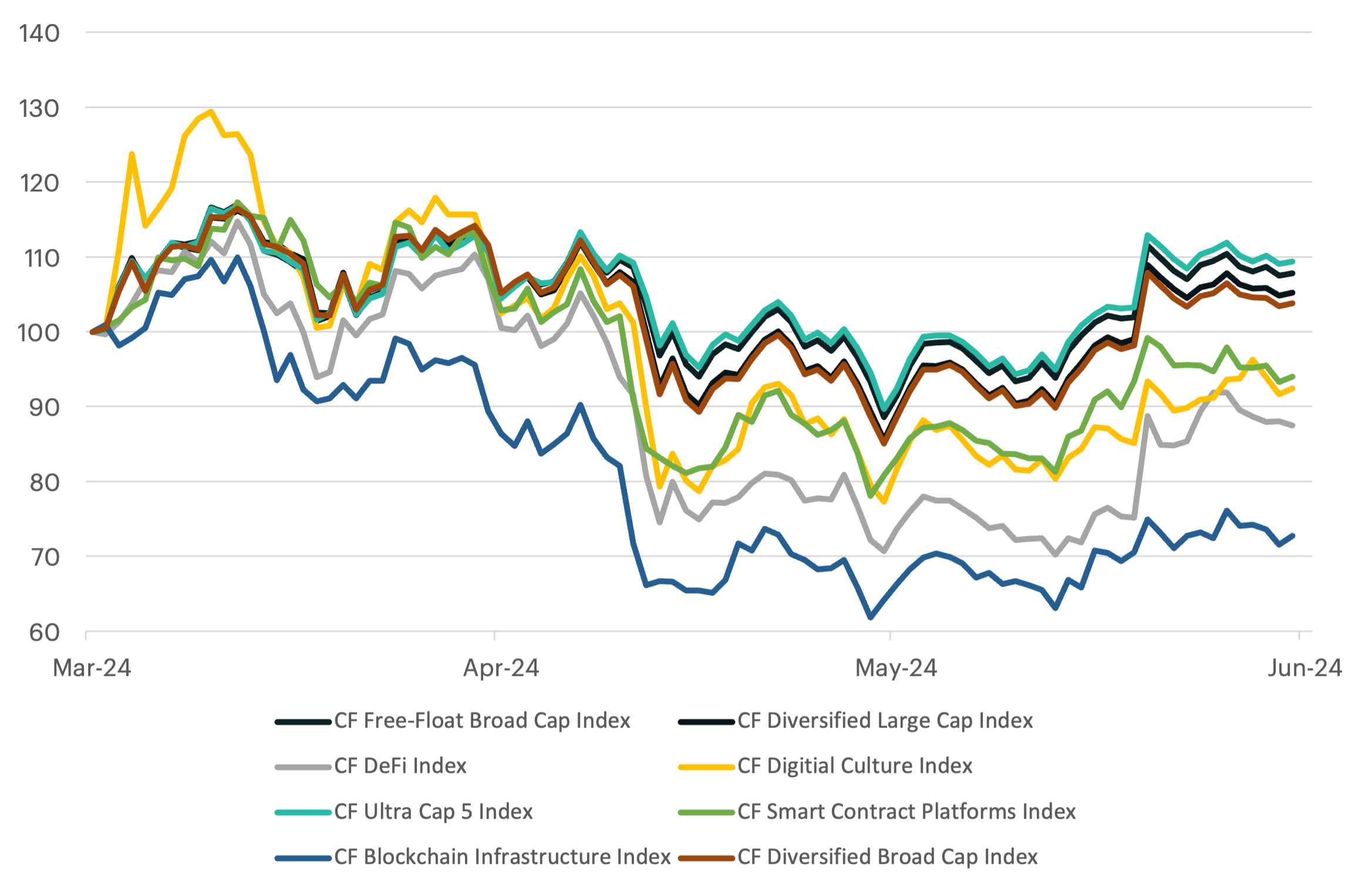

Ultra Caps Lead as Blockchain Infrastructure Lags in Mixed Market

- Digital assets have mostly remained in a period of consolidation, resulting in sideways price action for the broader crypto market during the latest rebalance period.

- Excitement around the Bitcoin halving and regulatory wins, such as the approval of spot Ether ETFs, has supported the market, while concerns about rising interest rates and their impact on risky assets have tempered enthusiasm.

- The CF Cryptocurrency Ultra Cap 5 Index led all portfolio indices, rising over 9% and nearing its November 2021 record high levels, followed by the CF Free-Float Broad Cap Index (+8.0%), while the CF Blockchain Infrastructure Index (-26.4%) and CF DeFi Composite Index (-13.5%) lagged due to regulatory uncertainty.

By Gabe Selby, CFA

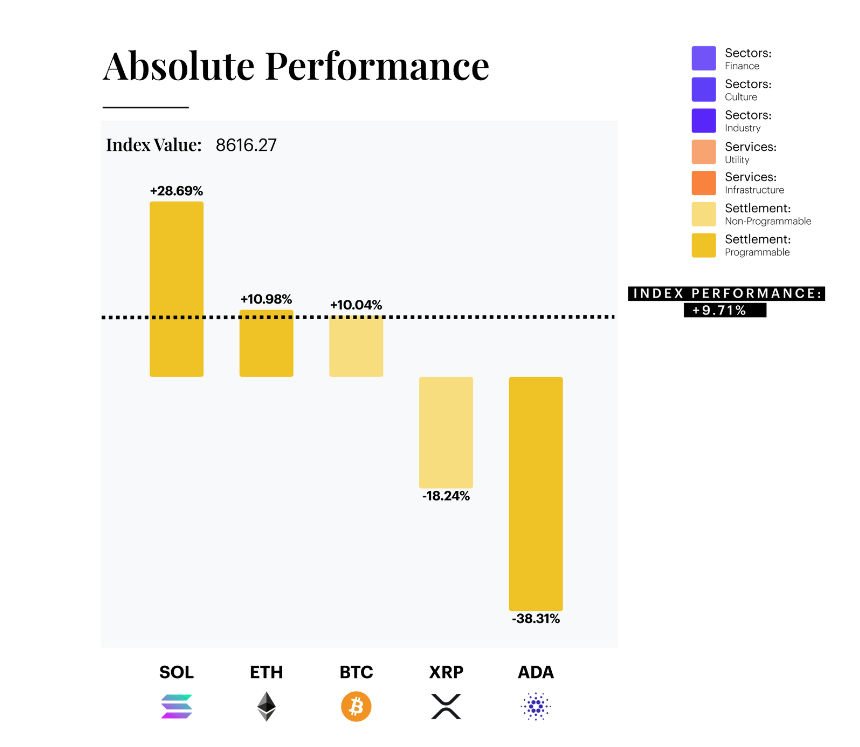

CF Ultra Cap 5 Index: SOL Outperforms, ETH and BTC Follow

The overall positive market performance for our CF Ultra Cap 5 Index was predominantly driven by Solana, Bitcoin, and Ether. Ether edged out Bitcoin in terms of market gains, following a surprising decision by the SEC to approve the 19b-4 forms for all spot Ether ETF applications. In contrast, Ripple's XRP and Cardano's ADA ended in negative territory, with declines of 18% and 38%, respectively.

Solana's SOL outperformed its blue-chip peers for the third consecutive quarterly rebalance, surging over 26%. This impressive performance propelled Solana's market cap to a new all-time high, with the SOL price surpassing $200. The surge was fueled by growing interest in memecoins and airdrops, positioning Solana as the preferred platform for these assets.

Furthermore, Solana secured a significant deal with PayPal to support its stablecoin, expanding PYUSD from Ethereum to Solana. This strategic move aims to tap into the $2.6 trillion payments market, further bolstering Solana's market position and appeal.

By Gabe Selby, CFA

To read the full summary and download all QAR reports click here.

Click below to watch our latest QAR podcast.

CFB News

SEC cites CF Benchmarks in ETH ETF Pivot

The SEC leaned extensively on CF Benchmarks’ data and reasoning as the basis of its ETH ETF approval, as seen in a section of the approval order below.

An excerpt of our explainer following these events follows below.

Persuading the SEC

Not only does the SEC take the unusual step of naming CF Benchmarks, it also cites the market data and arguments we submitted in our Comment Letter supporting our clients’ ETF filings.

Comment Letters are a typical part of the review procedure for securities filings.

What is highly atypical, is for the Commission to quote the assertions of a commercial entity to make its case for a regulatory ruling.

We believe this is an unprecedented acknowledgement of the veracity of our regulated benchmark methodology and the safeguards we’ve incorporated into it, to ensure the reliability, accuracy and market integrity of our pricing benchmarks.

So, why was our analysis evidently compelling enough for the regulator to adopt it wholesale?

The Argument

The purpose of the Comment Letter was to demonstrate that according to regulatory precedent set by the SEC itself, conditions required for Ether ETF listing exchanges to carry out their obligations under the Securities and Exchange Act, are already in place.

Given the weight placed by the Commission in previous statements on the need for the existence of a regulated market of “significant size” (for Ether, that would be the CME’s Ether Futures market) and the necessity for that market’s returns to be highly correlated with returns on Ether spot markets, we included our own correlation analysis.

We also provided the source code utilised for the calculation, so the Commission, or anyone else, could verify our results and conclusions for themselves.

Our main points are summarised below:

- The SEC's order approving spot Bitcoin ETFs is “the best guide" of the standards required for Ether ETF approval under the Securities and Exchange Act, 1934

- Regulatory precedent establishes ETH as a commodity. Chiefly, this is due to the existence of a Designated Contract Market (primarily the one operated by the CME Group) – cleared by Designated Clearing Organisations (DCOs) as commodity futures and options contracts, under the regulatory oversight of the CFTC. Again, as per Bitcoin, this strongly argues for the "designation of the proposed (Ether) ETP shares as commodity trust shares"

- We determined that Ether ETF exchanges can meet key standards of the Securities and Exchange Act, 1934, by noting that two critical conditions are met:

- The existence of surveillance sharing agreements between listing exchanges and the ETH "market of significant size" - the CME's Ether Futures market

- Demonstration, through correlation analysis, that major spot ETH exchange returns and CME ETH Futures returns are highly correlated

We concluded that proposals by ETH ETF clients are correctly classified as the listing of commodity trust shares.

Evidently, the SEC agrees.

All HK crypto ETFs are priced by CFB

The unprecedented growth of the digital asset ETF product class over the last several months has not been limited to the U.S.

Hong Kong raced ahead of other major financial jurisdictions by completing a years-long roadmap to list spot crypto exchange traded products.

There were numerous surprises. These included HK becoming the first regulatory region to green light products in two assets, Bitcoin and Ether, simultaneously. Meanwhile all three firms exclusively utilise our CME CF BRAAP (BRRAP) and CME CF ETHAP (ETHUSD_AP) to calculate the NAV of their Bitcoin and ETH ETFs.

Monochrome's pure-play Bitcoin ETF

One of CF Benchmarks earliest clients, Sydney-based Monochrome Asset Management, listed Monochrome Bitcoin ETF (IBTC) on the Cboe Australia exchange earlier this month.

One of the first ETFs to strike net asset value (NAV) against the Asia Pacific closing time variant of our flagship CME CF Bitcoin Reference Rate, IBTC is also notable for being Australia's only ETF fully authorised to invest in Bitcoin directly, by virtue of full adherence to the country's cryptoasset licensing framework.

All other Aussie ETFs skirt their lack of full authorisation by utilising structures that enable them to offer less than direct exposure, for instance 'feeder funds' investing in third-party Bitcoin vehicles.

We were lucky enough to grab half an hour with Monochrome's busy Head of ETF Operations, Grayson McLeod, just ahead of IBTC's listing, for an informative episode of CFB Talks Digital Assets.

Click below to watch.

ETC's Tri-NAV Bitcoin ETP spans three time zones

For around half a decade, Europe's spot crypto exchange traded product (ETP) market has quietly pre-existed the one that launched with much fanfare in the States this year.

Now, the firm that operates the largest and most liquid listed BTC fund in Europe, ETC Group, has doubled down on demand with a new fund, ETC Group Core Bitcoin ETP (ticker: BTC1).

BTC1 offers increased flexibility on when institutional participants can transact the vehicle, with its unique Tri-NAV structure, based on all three CME CF BRR variants.

Watch the podcast featuring ETC's Head of Product, Chanchal Samadder, CFA, by clicking below.

CF Benchmarks launches CF Bitcoin Volatility Index, first direct measure of CME Bitcoin implied volatility

The CF Bitcoin Volatility Index enables expanded institutional participation within the only primary CFTC-regulated Bitcoin options market

An excerpt of our launch article follows.

One measure, two variants

Responding to the need for a singular, comprehensive gauge of volatility, based solely on the CME’s CFTC-regulated Bitcoin options market—and therefore specifically designed to complement it—CF Benchmarks is launching the CF Bitcoin Volatility Index, the first comprehensive benchmark of CME Bitcoin Options implied volatility.

The index is comprised of two variants:

- CF Bitcoin Volatility Index Settlement Rate (BVXS) – derived from published BVX data and calculated daily at 16:00 London Time

- CF Bitcoin Volatility Real Time Index (BVX) – a real-time measure calculated and published every second between 07:00 to 16:00, U.S. Central Time, on all CME Trading Days

Daily settlement, or real-time values

Technically speaking, the index represents a 30-day constant-maturity measure of implied volatility in the CME Bitcoin Options market. In other words, BVX and BVXS, respectively, represent interpolated real-time and daily rates of CME CF Bitcoin implied volatility.

As such, BVX and BVXS represent the first streamlined and accurate gauges of implied volatility for CME Bitcoin Options, the only CFTC regulated primary Bitcoin options market.

Streamlined

As we’ll explain in more detail below, these facilities open the way to several previously unavailable deployment opportunities, avoiding the inefficiencies and risks of strategies that try to synthesise CME Bitcoin implied volatility over time.

Meanwhile, institutional participants that elect to trade CME Bitcoin Options, at least partly due to the market integrity engendered by CFTC oversight, can now extend participation with instruments specifically designed for the CME Bitcoin options market.

Click below to read the full article.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.