CF Benchmarks Newsletter - Issue 65

The chief beneficiary of shifting spot Bitcoin fund allocations is BlackRock’s iShares Bitcoin Trust ETF, the biggest member of our ‘BRRNY Six', in assets under management (AuM) terms.

- First Hong Kong spot Bitcoin ETF filing is powered by CME CF BRR Asia Pacific

- New U.S. BTC funds still growing

- Read the BlackRock paper: 'Bitcoin ETFs: A new era of access'

Next

Crypto press and social media comment decrying spot crypto ETF fatigue may have a point…within the confines of the ‘crypto echo chamber’, that is.

From the inside looking out though, it’s axiomatic that for the broader sweep of institutional investors, the advent of the first U.S. exchange traded funds investing directly in Bitcoin is an inarguable watershed, and is likely to remain a novel concept, to say the least, for far longer.

Meanwhile, a sizeable cohort of market participants is likely to be still none the wiser – or just nonplussed.

As such we’re continuing our focus on the ‘CFB Six’ – the key providers using our regulated benchmark to calculate their spot Bitcoin ETF net asset value. Scroll down to read the latest.

Hong Kong

In fact, the theme of increased access to the digital asset class via the ETF wrapper, which more conventional-minded investors are more comfortable with due to its tried and trusted structure, is now widening beyond the formerly preeminent ‘holdout’ region of the U.S.

Recent days have seen fresh progress from well-telegraphed efforts by Hong Kong authorities, over the last several months, to position the region as a regulated hub for digital asset market access.

Following the rollout of its virtual asset regulatory framework in June (concise summary by PwC here) Hong Kong’s Securities and Futures Commission (SFC), working closely with the Hong Kong Monetary Authority (HKMA), signalled final readiness to consider applications for spot crypto ETF applications in December.

Harvest in view

Meanwhile, key institutions began to signpost their intent to utilize the new crypto framework almost as soon as it was in place.

CF Benchmarks’ launch, in November, of the CF Meta Lab GameFi Index, coincided with the announcement of a new partnership with Meta Lab HK. Meta Lab is the Hong Kong-based digital assets unit of Harvest Global Investments, one of China's longest-established licensed investment management firms, which discloses some $121B in AuM, according to its EU facing website.

As Meta Lab’s Chief Product Officer, Yubao Flora Lou, notes in this clip, from our CFB Talks Digital Assets podcast, Harvest has long been keen to embark on a similar path to that taken by high-profile U.S. institutions that were, at the time, about to precipitate a historic paradigm shift by listing the first spot Bitcoin ETFs in that market.

These include BlackRock, who’s iShares Bitcoin Trust (IBIT) strikes net asset value (NAV) using our CME CF Bitcoin Reference Rate – New York Variant (BRRNY) , and five other members of ‘The BRRNY Six’, whose funds participated in last month’s watershed moment.

Meet the CME CF BRRAP

Furthermore, Hong Kong issuers’ goal of offering regulated Bitcoin exposure in their own region, is similarly facilitated by a CF Benchmarks index that’s identical to the BRRNY (and to its flagship variant, BRR) in all but one respect.

Following our launch of the CME CF Bitcoin Reference Rate – Asia Pacific Variant (BRRAP) last year, the same qualities of ample institutional liquidity, accuracy, reliability and integrity, that have long been established and demonstrated in BRR and BRRNY, are now available to participants utilizing this newest Bitcoin benchmark, which references the traditional Hong Kong market Closing Time of 1600 HKT.

With the long official and institutional choreography now culminating in Harvest filing the first application to list a spot Bitcoin ETF in Hong Kong, it makes sense that the group selected our regulated CME CF BRRAP as the benchmark.

BTC in HK

It’s worth noting that potential spot crypto ETFs in HK are emerging against a backdrop of additional incremental regulatory developments there, sending an unequivocal message that bodes well for the growth of the asset class in the region.

As well as a handful of modestly capitalized crypto futures ETFs trading on HKSE since late 2022, one firm, VSFG, named in reports as considering a spot Bitcoin ETF filing to rival Harvest’s, even says it will submit an application for a spot Ether ETF, possibly within weeks.

Meanwhile, plans are in motion for a stablecoin ‘regulatory sandbox’. Tokenization is another focus, with certain restrictions preventing retail participation lifted within the SFC’s latest guidance.

Neither the SFC nor Harvest Global Investments have commented publicly in response to the reports mentioed above, though the regulator has indicated it will accept feedback on proposals for its new stablecoin licensing regime till the end of February.

New BTC funds keep growing

Although the most recent flows and volumes for the cohort of spot Bitcoin ETFs that were launched last month have understandably moderated since the stunning initial rates of their first few weeks, the overall trend and direction appears largely in line with the first blush we outlined in our previous newsletter.

This helps vindicate the view that the appetite among mainstream investors for exposure to the largest capitalized cryptocurrency remains significant.

Logically, this demand should become more quantifiable over time, as the infrastructure required to facilitate the mediation of this new product class to investment managers is installed.

This will be followed, where necessary, by information and education programmes for advisors, so they in turn can begin to offer that access to clients.

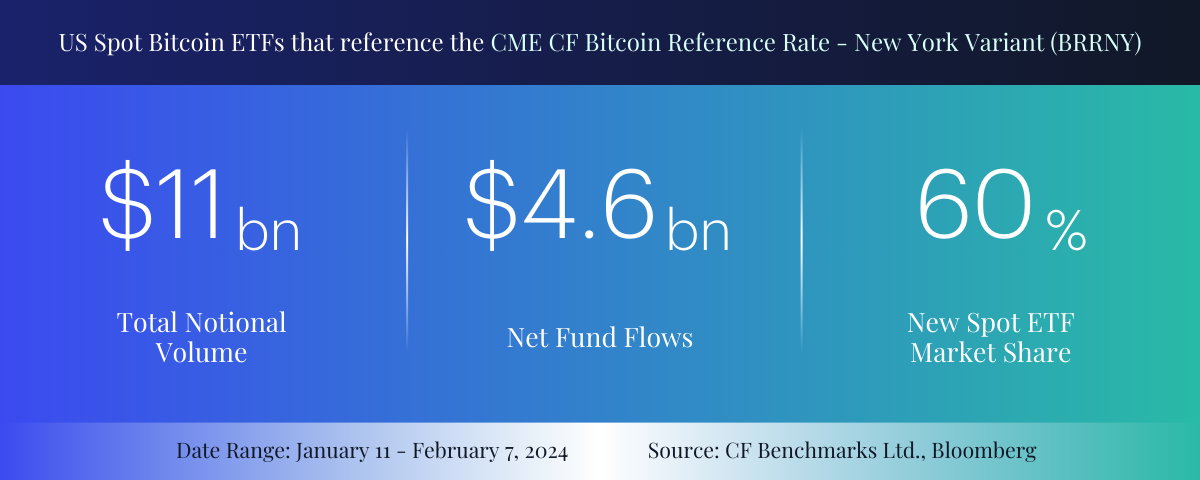

For now, the most recent data continue to show that on aggregate, the six high profile firms using our CME CF BRRNY index as their benchmark continue to win the lion's share of spot Bitcoin ETF inflows.

Amply allowing for T+2 effects – therefore tallying data up to February 5th – the most corroborable information available at the time of writing, indicate that the CME CF BRRNY's share of new spot Bitcoin ETF assets under reference holds steady at approximately 60%, as shown below.

One direction

All indications show the direction of travel of these flows continues to be overwhelmingly (at least) moving away from Grayscale’s converted GBTC fund, and towards its rivals – particularly those run by the largest issuers. Even so, the pace of GBTC attrition slowed markedly into the end of January.

Proactive Investors cites readings from market data platform Fineqia International indicating a GBTC outflow as low as $255m on Friday January 26th, the least punishing outflow since the erstwhile OTC Bitcoin fund behemoth converted to an ETF on January 11th. Daily outflows had peaked around $500m following GBTC’s listing.

The chief beneficiary of these shifting spot Bitcoin fund allocations is BlackRock’s iShares Bitcoin Trust ETF, the biggest member of our ‘BRRNY Six', in assets under management (AuM) terms. AuM stood at about $3.3bn at the time of publication, based on disclosures, more than double the circa $1.4bn AuM we reported at the time of our previous newsletter, on January 22nd.

It's worth noting that with some $20.27bn in AuM still sitting at GBTC at the time of writing (down from roughly $27bn pre-ETF status, looking at data from Bloomberg and fund specialist Fintel) GBTC outflows may have quite a way to run, assuming the disinvestment rationale in the spotlight at the time spot Bitcoin ETFs launched still applies. (Most likely, it does: GBTC’s management fees are still sharply higher than those of its rivals.)

Below, CF Benchmarks is pleased to host an excerpt from BlackRock’s thought leadership piece ‘Bitcoin ETFs: A new era of access’.

It covers several aspects of the factors driving the emergence of spot Bitcoin ETFs and their likely impact, plus the key points to watch for this new product class going forward.

To read or download the complete paper, please click the link provided at the end of the excerpt.

Executive summary

The investing industry has arrived at an historic moment: the introduction of spot bitcoin exchange traded funds in the U.S. This development has enabled increased mainstream access to bitcoin, a notable evolution from its beginnings as a niche internet-native form of money.

In this paper, we explore the significant shifts in investor interest, industry infrastructure, and the regulatory environment that have brought us to this moment, and the implications ahead for investors.

Key takeaways

- The launch of spot bitcoin ETFs in the U.S. represents a scalable bridge from traditional finance into bitcoin, helping to broaden access to bitcoin for mainstream investors.

- Bitcoin’s characteristics as a store of value and its potential to reimagine payment methods, even while exhibiting volatility, have helped it become the most widely adopted cryptoasset and the first form of internet-native money to gain broad global adoption.

- Three shifts have taken place to create the conditions for this moment:

- Global forces have accelerated interest

- Bitcoin’s ecosystem infrastructure has developed

- The regulatory atmosphere has evolved as policymakers in numerous jurisdictions enact or consider regulatory and other policy changes to more directly address aspects of the digital asset ecosystem.

- These shifts have helped enable the launch of spot bitcoin ETFs in the U.S. We believe that for many investor types, the ETF could represent the preferred holding vehicle for bitcoin and this launch represents a new era that will be characterized by more choice and convenience.

- Bitcoin’s exact path is unknown, but we believe this enhanced access, catalyzed by the convenience of U.S. ETFs, may further boost bitcoin’s adoption as a potential store of value by a wider investing audience.

Introduction

Bitcoin’s story has been one of innovation and growth. The world’s leading cryptoasset has been on a journey since its launch 15 years ago, rising in terms of access, use cases, and market value, to become the most widely adopted digital asset, holding over 50% of the $1.7 trillion market.1

Now, with the launch of spot bitcoin exchange-traded funds in the U.S., mainstream access across more investor archetypes is opening up to an asset that was once considered a niche financial technology. We believe that these increased access points via the convenience and utility of ETFs give more choice to investors, and, potentially, bolster bitcoin’s place in the future financial system as an alternative store of value. Bitcoin has been culturally relevant for years, giving rise to memes and attracting, at first, a fringe investor base, often made up of younger adopters, who are comfortable transacting their lives in an increasingly digital way. The world’s population, in many parts, is skewing younger, and the Millennial and Gen Z generations are now an increasingly significant part of the workforce and more predominant in the investing world, as both self-directed and institutional investors. As investors and adopters, they are increasingly interested in bitcoin.

At the same time, there has been an acceleration of growth in the digital asset ecosystem, leading to more adoption by a broader group of investors. This widening group includes institutional investors.

The industry now stands at this historic moment. Access to bitcoin is broadening through the introduction of spot bitcoin exchange-traded funds (ETFs), which are helping to bridge traditional finance with bitcoin. This is quite an evolution from bitcoin’s beginnings as a niche technology. But how did we get to this point? What has changed in bitcoin and the traditional finance world to enable access to bitcoin in the ETF wrapper? And what does this mean for bitcoin and investors?

1CoinGecko, as of Dec. 31, 2023. Bitcoin predominance based on its market cap of $860 billion, which accounts for 51% of the $1.7 trillion total market cap of all cryptoassets, excluding stablecoins.

Click here to read or download the full paper.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.