CF Benchmarks Newsletter - Issue 64

Even a cursory examination of volume and flow data shuts down suggestions that the establishment of this new investment product class happened with anything short of demand that was quantifiably above historical norms. (AKA, it was a crushing success.)

- Make no mistake: Spot Bitcoin ETF launch metrics crushed norms

- Should we be worried about the Bitcoin price?

- Hold your spot ETH ETF horses

No doubts

Inevitably, market participant and media attention, and even the scrutiny of that most prized public cohort, active investors (institutional and individual) has shifted on to gauges of the ‘quality’ of the spot Bitcoin ETF launch.

To the extent ‘quality’ can be unpacked, and credibly quantified, there are several unequivocal data points to lean on, with at least one complete week of trading in the bag (there'll be another following this week, once T+2 uncertainties expire).

For majority of our readers in the institutional investment management sphere, who have not pored over every spot Bitcoin ETF detail in the run-up, and in the wake of their listing (unlike us) we’d like to be crystal clear.

Even a cursory examination of volume and flow data shuts down suggestions that the establishment of this new investment product class happened with anything short of demand that was quantifiably above historical norms. (In other words, it was a crushing success.)

Metrics of scale

- Total trade volume across all 10 successfully launched funds on day one amounted to about $4.6bn. True, this was an atypical product class initiation (all in a day), but turnover was inarguably atypical too. And total volumes rose to around $10bn by day two. Again, many observers have noted that second-consecutive trading days following ETF debuts seldom, if ever, match first days in terms of gross activity

- For a better grasp of performance relative to individual historical ETF listings though, consider the below:

- BlackRock’s iShares Bitcoin Trust (IBIT) saw day one turnover of more than $1bn. Meanwhile, first-day inflows into the Bitwise Bitcoin ETF (BITB) were $240m.

- These respective metrics place both funds – whose NAVs are powered by our CME CF Bitcoin Reference Rate – New York Variant (BRRNY) – in the top 5 best first days of ETF trading ever

- As for asset gathering speed, maybe unsurprisingly, IBIT and Fidelity Wise Origin Bitcoin Fund, paced the $1 billion in AuM mark by Monday, January 22nd’s close, among the first of so-called ‘New Born Nine’ to do so. That was some days slower than the fastest ever ETF to reach $1bn in AuM, ProShares Bitcoin Strategy ETF (BITO), but still among only a handful of such funds to do so in that many days

- Meanwhile, whilst a realistic attitude to initial demand is cogent, several metrics helped quantify the widespread notion that this was no ordinary set of listings. For instance, just days after the emergence of the new product class, the spot Bitcoin ETF category had paced silver to become the second-largest ETF commodity in the U.S.

The Grayscale Legacy

And then there’s Grayscale Bitcoin Trust (GBTC).

It was the first publicly purchasable spot-based Bitcoin fund of any note. Its legacy now includes facilitation of an entire product class, following its protracted but ultimately successful legal fight with the SEC.

For GBTC alone, on the basis of raw flows, it was a genuinely impressive day one, justly warranting the term ‘historic’. As the key corporate conversion into an ETF (it’s last day of trading as an OTC product was the January 10th) its pre-installed infrastructure enabled it to lay claim to “the first spot Bitcoin ETF to trade in the United States”, with pre-market orders in NY from 04:00 on Thursday 11th.

GBTC was, hands-down, The Most Actively Traded ETF Debut Ever, with $2.32bn turning over on NYSE Arca. Liquidity on the day was decent, according to Grayscale, with a 6 basis point average bid-ask spread maintained throughout the session.

Curiously though, Grayscale's launch-day email gave no hint of the direction of that volume.

For what appears to have been all sessions of its existence as an ETF, the direction of travel of GBTC investors has been towards the exit.

The graphic below, tweeted by Eric Balchunas, of Bloomberg Intelligence’s ever-reliable ETF team (including colleague, James Seyffart) covers days 1-5 of trading (ending January 18th; January 15th was a market holiday).

Exit only

The clear indication is that institutional holders, likely constituting more than 90% of GBTC’s external ownership, were in reduce-only mode in the vehicle’s, first full week as a fully public fund. When most recent readings can be confirmed, there are more than decent chances that any holders inclined to transact will continue to be overwhelmingly doing so to close out.

Also, check out these ownership data compiled by financial data specialist Fintel. They’re based on Q3 disclosure and recent 13Fs. It’s a given that accumulation occurred under GBTC’s years-long phase as an OTC-traded closed-end fund, during which well-aired restrictions all but compelled many holders to stand pat. Therefore, the opening of the “Exit Door” metaphor is apt, as pent up sell pressure was finally released.

Further reasons

There are two other key motivations that may account for a share of ongoing GBTC outflows (Eric Balchunas estimates 13% of GBTC’s roughly $27bn pre-ETF AuM was drained by Tuesday 23rd January).

These additional motivations are relatively marginal in comparison to the cessation of the structural lock-up, but they’re worth noting as they also spotlight the rationale for certain GBTC holders to remain invested.

- Expense optimization: Though Grayscale slashed GBTC’s management fee in step with the sudden outbreak of pre-launch fee compression* (see below) across all 10 successfully launched ETFs, the cost to own GBTC – 1.5% - is still sharply higher than for rivals – even after a 50 basis point cut.

- (For example, the Bitwise Bitcoin ETF headline fee is currently stated as 0.20%; for Franklin Bitcoin ETF, it's 0.19%)

- Grayscale also stood aside from a wave of fee waivers (typically scheduled for 6 months and/or a multiple of initial AuM)

- As for (speculation about) Grayscale’s rationale: investors intent on transferring to lower expense vehicles face a potential taxation event upon realisation of gains. For some holders the calculus will argue against disposal, for now at least

- Agnostic arbitrage: The best chance to capitalize on what could turn out to be the biggest Bitcoin-related price dislocation in the asset’s history, has now passed. GBTC’s discount to NAV stood at 0.27% on Friday January 19th, vs. 8.52% as recently as December 28th, 2023

All told, the Grayscale Bitcoin Trust continues to loom large over the whole endeavour, even as it ironically bleeds asset value to rivals whose it existence it helped facilitate.

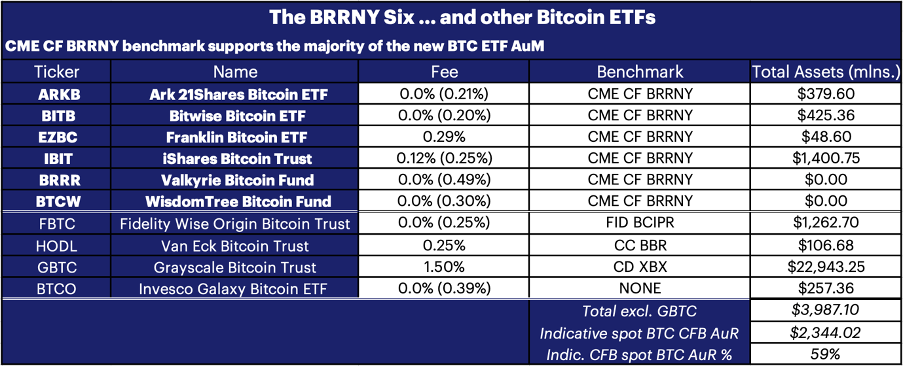

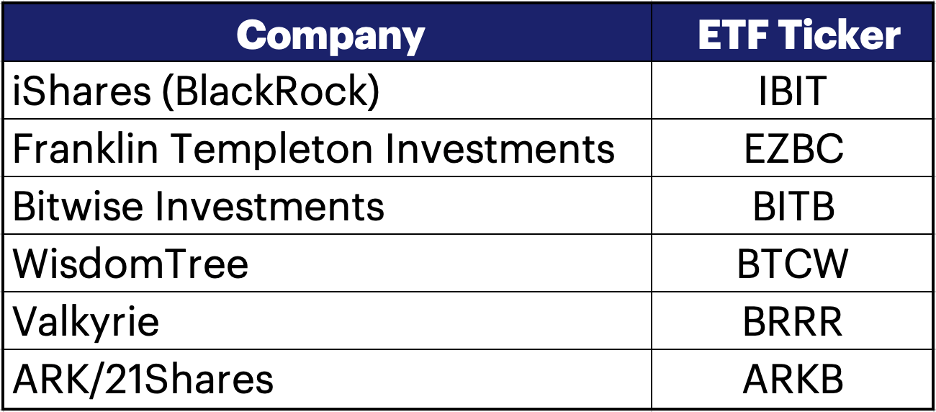

The BRRNY Six

Meanwhile, the destination of all that asset travel is also clear.

In the event, successfully launched funds were whittled down to 10, from the initial 11 expected. So, with six issuers having opted for the longest established and most road-tested institutional Bitcoin price, BRRNY, it is axiomatic that the majority of newly invested assets into these products, so far, reference our benchmark.

Markets: BTC pressure

The sheer weight of the GBTC exodus helps account for Bitcoin’s disappointing price decline relative to expectations in the wake of the ETF listings.

Still, beyond recent broad-market ambivalence, from which Bitcoin remains, at best, only partially decorrelated, additional rationales – many of which are also ETF-related, and product-neutral factors – add to the view that the post-launch retreat should be classed as a 'routine retracement'.

- With all spot Bitcoin ETFs utilizing cash creation and redemption, after strong guidance from the SEC, Authorized Participants are widely speculated to have accumulated significant spot positions in anticipation of approval. Now, post-approval, we're seeing a degree of unwinding

- Meanwhile, as Bitwise CIO, Matt Hougan points out in the podcast clip below, the most substantive inflows expected from investors newly furnished with the ability to invest in BTC via funds like Bitwise Bitcoin ETF (BITB), are likely to be several months away.

Catch the whole episode by clicking the links below:

Listen on Spotify

Watch on YouTube

- Also partially ETF-related, there have been numerous reports in recent days of large disposals of bitcoins and/or GBTC shares, by major holders, (e.g., FTX)

- As ever, price-centric expectations play a part in sentiment, with BTC/USD traversing several ‘technical’ and ‘psychological’ levels of late. The image below depicts a ‘continuation chart ’, configured from daily price intervals of the most actively traded CME Bitcoin Futures contracts, spanning March 2023, to the time of writing

(CME Bitcoin futures and options contracts have settled to our CME CF Bitcoin Reference Rate (BRR) since December 2016.)

- Bitcoin’s breakout uptrend clearly kicked-off around October 12th, 2023. BTC then traded within a reasonably clear range channel right up till - you guessed it - January 11th, at which point price broke down and out of the channel, indicating the loss of the support that had maintained the uptrend for almost 3 months to the day

- The implication is that assumptions providing session-to-session momentum have been relinquished. As well, medium-term trend following was also nixed following the ETF launches, symbolized by the break below the popular 21-day exponential moving average

- There’s nothing fatal in there though, or even particularly alarming. An asset price above its 200-day moving average is generally considered to be maintaining healthy market support. Therefore, the market is unlikely to begin to look truly skittish whilst BTC remains well above $32k

- For grave liquidation levels, we have to scan all the way down to ~$24.7k, where kickback buying emerged last June, and again, nearby, on September 11th and 12th

- So, for Bitcoin’s most liquid institutional derivative (CME Bitcoin Futures), at least, price action remains constructive. Still, active traders are on the look-out for the reestablishment of an outright positive stance in the near term, particularly as the Stochastic Relative Strength Index hints at ‘oversold’ conditions during what is widely assumed to be an uptrend

The ETF launch: in our words and theirs

Well covered

Press coverage understandably went into overdrive with the launch of spot Bitcoin ETFs, with both crypto and ‘mainstream’ media having long recognized CFB’s pivotal role at the heart of the endeavour. The key positive outcome of that awareness has, fortunately, been the reams of largely accurate and informed takes across acres of print.

Still, inevitably a few salient (often intriguing) points, which could have done with more emphasis were somewhat obscured in the shuffle. Additionally, select quirkier takes deserve more of an airing. Plus, we think it’s important for CF Benchmarks’ own key contextualization to anchor the telling for posterity.

We present a selection below.

Alongside the manic running commentary of almost all outlets, Blockworks managed to compile a compact round-up, including original Bitcoin ETF protagonists.

Tyler Winklevoss claimed: “Bitcoin won”. Meanwhile, Cameron Winklevoss chose the moment to echo one of the most commonly heard admonishments of the SEC: “Just remember, the [SEC] didn’t approve Bitcoin ETFs because they wanted to, they approved them because they had to.” That could be read as a warning, as institutional discussion swiftly moves on to the possibility that further cryptoassets could now be offered within the ETF wrapper.

(For more about, ETH ETF prospects, see 'Et Tu ETH', below)

Just as pointedly, there was Ripple Labs CEO, Brad Garlinghouse’s endorsement of widely held expectations that the event will prove to be “yet another catalyst for institutional investment/adoption.” The comment comes ahead of a trial, scheduled for April, that will decide on the last remaining aspects of the SEC’s complaint against Ripple, the root of which is that the XRP token is an unregistered security.

All judgements in the case so far have gone against the regulator, adding to the SEC’s spate of legal failures last year, including Grayscale’s successful appeal against the SEC’s rejection of its GBTC conversion request.

Just as importantly, Blockworks quotes CFB CEO Sui, Chung, underlining one potentially overlooked role of the ETFs: the regeneration of liquidity levels after they were significantly dampened by last year’s negative counterparty and market events.

“The ETF will most likely create more demand which will therefore lead market makers to assign more capital to support that liquidity. Crypto market liquidity still hasn’t fully recovered from the FTX crash in November 2022.”

Read the full article on Blockworks:

‘The crypto world reacts to day one of bitcoin spot ETF trading’

Elsewhere, TradFi and institutionally oriented City of London news site, Financial News, spotlighted the possibility of increased take up of the only regulated Bitcoin benchmark available for potential further issuers down the line. Six of the current 10 U.S. spot Bitcoin ETF providers have opted to use our CME CF Bitcoin Reference Rate – New York Variant (BRRNY)

“There are roughly 50 firms currently in talks with us for our index services for their spot bitcoin ETFs”, Sui Chung told FN, noting that only half of new prospective clients are U.S.-based.

Read the full article on Financial News:

Kraken’s UK subsidiary in talks with 50 firms to provide bitcoin ETF pricing

Sui Chung also sought to underline key takeaways from a separate Financial News article, decrying a UK regulatory stance towards digital assets that leaves itself open to accusations of being out of step with key financial centres like New York, Hong Kong and Singapore.

“I don't expect regulators and government to endorse and promote crypto, or indeed any other asset class, I do expect them to be aware of how any given asset class is treated by regulatory jurisdictions of equivalent standing”, Chung wrote in a LinkedIn post.

Read the article on Financial News:

The Fintech Files: A UK firm might be the real winner from the US bitcoin ETF approval

One of the most meme-laden takes came in Arthur Hayes’ Crypto Trader Digest blog, featuring SEC Chair Gary Gensler, and fellow crypto skeptic, Senator Elizabeth Warren.

In a typically, wide-ranging post, the former BitMEX CEO (who is completing the final year of a probationary sentence for AML failures at BitMEX) name-checked CF Benchmarks 10 times.

Still, the post was well on-message for the blog, hinting at pragmatic arbitrage opportunities inherent in our UK and EU Benchmarks Regulation (BMR) compliant, and UK FCA regulated CME CF BRRNY index, which accounts for the majority of incoming spot Bitcoin ETF NAV.

Hayes tacitly acknowledged stringent standards required of CME CF Constituent Exchanges contributing to the benchmark, Bitstamp, Coinbase, itBit, Kraken, Gemini, and LMAX. In turn, these BMR-codified protocols have long excluded venues like Binance, OKX, and several others venues, due to their structural inability to meet our Constituent Exchange Criteria, which are rooted in market integrity.

“For the first time in a long time, the Bitcoin markets will have a predictable and long-lasting arbitrage opportunity”, Hayes wrote.

Read the full post on Crypto Trader Digest:

ETF Wif Hat

Finally, our own take.

We’ve included historical context that rightly places CF Benchmarks at the heart of the entire endeavour to bring about the listing of a product that was recognized from the very beginning (as in 2013) to be transformational.

Not just for crypto, but for the fundamental activity of investment and wealth management as a whole.

Read an excerpt of our launch article on January 11th, 2024, below

New Era of Investing Starts Today, with Six CF Benchmarks-powered Spot Bitcoin ETFs

The six spot bitcoin ETFs that strike net asset value (NAV) against the CME CF Bitcoin Reference Rate – New York Variant (BRRNY) are set to be listed today

Not a normal day, even for crypto

Although, there is certainly no shortage of hyperbole in the crypto space about many things, it is difficult for anyone to argue that this is anything less than a remarkable watershed for Bitcoin, digital assets, and perhaps most importantly, the broader, mainstream sphere of investment management.

Accessibility

As we and others have highlighted several times over the last few years, whilst the exact extent and timing is as yet unknown, the impact of the new ‘skill’ that is about to be unlocked (Bitcoin exposure) for U.S. fiduciaries of several kinds, including RIAs and consultants, can only be mechanically seismic.

Persistence

The moment of course also represents the culmination of the collective, individual, and corporate efforts of tens of thousands of people who are committed both to cryptocurrencies, as well as to the painstaking regulatory standards and principles required for Bitcoin to become an exchange traded investment. It goes without saying that today is their ‘victory lap’.

CF Benchmarks' contribution

That done, this is also a fitting point to outline CF Benchmark’s own important participation as a member of all the above cohorts, and at virtually every stage of the process of getting a spot bitcoin ETF listed (something which was often dismissed, even in quite recent years, as impossible.)

Read the rest of this article on our website

Et Tu, ETH?

Institutions are now chomping at the bit to list spot Ether ETFs, but doing so may take longer than expected

Now let's do ETH

One of the most striking turns of events post spot Bitcoin ETF launches wasn’t about Bitcoin at all.

As described above, BlackRock’s iShares Bitcoin Trust (IBIT) has rapidly become the largest ETF of the new group, in terms of AuM (and the biggest contributor to spot Bitcoin Assets under Reference (AuR) for our CME CF BRRNY benchmark).

Almost simultaneous with that explosive acceleration right out of the gate, BlackRock’s CEO was embarking on a round of media interviews designed to maximize momentum.

But one of Fink's most conspicuous talking points was the potential that the advent of the first widely accessible, regulated crypto product could help pave the wave for another, perhaps in short order.

“I see value in having an Ethereum ETF,” said Fink.

Click here to watch a clip from CNBC’s interview of Larry Fink on X

Already on it

As we know, there are few truly off-the-cuff the remarks at this level, therefore, Fink's comment and candid underlying intent, were widely interpreted as firing the starting gun on plans to follow-up on the successful campaign to manifest IBIT, with another, to bring about the same success with an Ether ETF.

However, though the swiftness with which Larry Fink appeared to progress the agenda was surprising for some, it was quite in line with a long chain of adoption developments that have been clearly flagged over the last several months.

BlackRock’s iShares Ethereum Trust S-1 was filed in November, joining a list of applicants that includes several familiar names, relative to spot Bitcoin ETF issuers. These include Ark 21Shares, which filed its Ark 21Shares Ethereum ETF application in September.

Both the iShares ETH ETF and Ark21Shares’ cite our CME CF Ether–Dollar Reference Rate – New York Variant (ETHUSD_NY) as their benchmark, and for NAV calculation.

The six other major filings for such products currently sitting on the SEC’s desk, together with a spate of Ether futures ETFs already trading in relatively modest volumes, underline that Fink’s thoughts were quite likely to have been tacitly shared by other less forthcoming investment leaders.

'Fight me'

Meanwhile, the same rationale that downed the SEC’s opposition to ‘physical’ Bitcoin products appears, on the surface at least, applicable to possible ETH ETFs. Regulated futures market? Check.

CME ETH Futures and options settle to our CME CF Ether-Dollar Reference Rate (ETHUSD_RR), the initial variant of ETHUSD_NY.

ETHUSD_RR references the ETH price at 4PM London Time. ETHUSD_NY references the price at 4PM New York Time.

All the above said, as far as signals from the SEC go, its chair has flagged his continued opposition to seeing an ETH ETF appear on his watch quite clearly. In the curious ‘Statement on the Approval of Spot Bitcoin Exchange-Traded Products’, published a day before these began trading, he stated the below.

“Importantly, today’s Commission action is cabined to ETPs holding one non-security commodity, bitcoin. It should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities. Nor does the approval signal anything about the Commission’s views as to the status of other crypto assets under the federal securities laws…”

SEC Chair, Gary Gensler, January 10th, 2024

The implication is that the chair is not inclined to elaborate to Ethereum the logic of the successful appeal ruling that enabled Grayscale to convert GBTC to an ETF. At least not without a similar legal fight.

Here we go again...

Indeed, recent days have seen a raft of preliminary ETH ETF paperwork receiving the same treatment that the SEC dealt out to Bitcoin ETF applications for years.

Déjà vu, much?

- SEC delays decision on Grayscale's proposal for spot Ethereum ETF again, with order to institute proceedings and seek public comment – The Block

- US SEC delays decision on Grayscale, BlackRock's spot Ethereum ETFs – Reuters

About that yield

Meanwhile, notions of a clear path for Ether into the ETF wrapper are also complicated by ETH’s clearest dissonance versus Bitcoin: its direct lineage to traditional assets from its facility to offer a (staking) yield. Naturally, this has been latched on to by the U.S. regulator as another criterion that should classify Ethereum as a security.

Beyond regulatory opinion, another implied dampener on the quick appearance of ETH ETFs is a more practical one.

Said CF Benchmarks CEO, Sui Chung, here:

“You’ve already sold bitcoin by going down the diversification route; someone’s already stuck 1.5% or 2% of bitcoin into their portfolio.”

All told, by default or design, expectations for a quick one-two, with ETH ETFs being the ‘two’, might need to be curbed a bit.

Visit the CME CF Ether Dollar Reference Rate – New York Variant index page

Learn More

For institutional investment management professionals of all kinds, even the briefest of glances at events of recent weeks should make clear that the sphere is now confirmed as being on the way to changing significantly, chiefly due to the introduction of the new asset class of crypto to traditional trading venues, within the familiar and straightforward structure of ETFs.

In other words, regardless of what one’s attitude to digital assets is, their growth, both in terms of market value and public awareness, has now progressed to such a point that the assets themselves and investor demand for them can no longer be ignored.

One major challenge that immediately presents itself following this watershed though, perhaps particularly for professionals who’ve hitherto focused on traditional asset classes, is the perception of a steep learning curve to be surmounted in order to catch up.

To be sure, as in all things, starting from scratch on digital assets, will require some effort. However, backed by CF Benchmarks’ years-long track record as an institutional crypto services provider, and our approach that will focus first on the essentials, beginning to get a grasp of crypto shouldn’t require inordinately prolonged study, and will pay dividends almost immediately.

To kick things off, for those who require it, a quick infographic showing how spot Bitcoin ETFs actually work in practice, can be found by clicking the image below.

Next, we present content that will move newcomers exponentially up the learning curve, our comprehensive but straightforward Bitcoin primer, Bitcoin: A Universal Store of Value for the Digital Age, written by CF Benchmarks’ Lead Research Analyst, Gabe Selby, CFA.

An excerpt follows below.

Bitcoin: A Universal Store of Value for the Digital Age

By Gabe Selby, CFA

Bitcoin is a revolutionary form of digital currency first proposed in 2008 by a person or group of people known as Satoshi Nakamoto. Unlike traditional currencies, Bitcoin is a digital asset, and does not depend on central banks or governments. Instead, it operates as a completely decentralized system and stores activity on a digital database called the Bitcoin ledger. This decentralization means that no single company or government can make decisions about how the currency works or how people can use it.

Since its inception, Bitcoin has exploded onto the financial scene as a groundbreaking new form of digital collateral. As the first ever cryptocurrency, Bitcoin represents a monumental shift in how we conceptualize and transfer value in the digital age. In this paper, we will explain what makes Bitcoin so revolutionary and why it may deserve a place in your investment portfolio.

The Case for Adding Bitcoin to your Investment Portfolio

Although volatile on a standalone basis, even small 1-5% Bitcoin allocations have boosted portfolio returns while only marginally adding to long-term risk. Historical data showing Bitcoin's effects on portfolio performance presents a strong case that it warrants investment consideration. For example, our study found that a 3% Bitcoin allocation over the past 5 years would have increased the Sharpe Ratio of a traditional 60/40 portfolio from 0.60 to 0.75, or a 25% boost in risk-adjusted returns from a small tactical Bitcoin position.

Major benefits of Bitcoin in a portfolio context include:

- Diversification - Bitcoin's returns have exhibited low correlations with traditional assets.

- Asymmetric return profile - Small allocations have had an outsized impact.

- Inflation hedge - Due to its fixed supply, Bitcoin is engineered to maintain its purchasing power over time.

- Network effects - Bitcoin's growing network of users continues to enhance liquidity, acceptance, and network security.

Click here to read, or download the full report

Meet us at Exchange 2024!

CF Benchmarks will again be attending what’s rapidly become the most essential annual symposium for the U.S. institutional investment management world, particularly focusing on Registered Investment Advisors (RIAs) and the issuers of listed investment products, chiefly ETFs.

Though Exchange doesn’t prescribe a specific focus on crypto, and in fact places only a moderate emphasis on ‘alternative’ investment assets of all kinds, right from the inaugural gathering in 2021, up to the forthcoming meet this February, organizers have taken a farsighted approach to counterparties and service providers that demonstrably seek to inculcate the highest standards of professionalism and market integrity across institutional investment management as a whole.

Hence, as a regulated Benchmark Administrator right from its establishment as a separate company, CF Benchmarks has fitted right in.

Now more than ever, issuers of investment products looking to ensure they keep pace with investor demand, by enabling simple and secure access to crypto, are likely to seek the surest track to the market as well as the demonstrable peace of mind that derives from regulated services providers.

Be sure to connect with our team at Exchange, on February 11th - 14th, 2024.

Find out more at exchangeetf.com

Follow Exchange on LinkedIn for updates

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.