CF Benchmarks Newsletter - Issue 62

Although PayPal’s move is widely recognized as a potentially important inflection point for broad-scale adoption, for more informed digital asset participants, it’s seen as somewhat less remarkable, in context.

- Paxos looms large in PayPal USD

- Ether Futures ETF filings proliferate

- So it begins: first BTC ETF review extension

PaxPal

PayPal’s launch of a dollar-pegged stablecoin instantly becomes one of the top adoption stories of the year - with provisos. PayPal USD (PYUSD) is best understood by understanding Paxos Trust Company, PayPal’s partner in all major digital asset initiatives this decade.

- It’s over Paxos’ infrastructure that PayPal has offered retail consumers access to a range of cryptocurrencies since October 2020

- Paxos has operated a U.S. dollar stablecoin, Paxos Standard, one of the first with any sort of regulatory oversight, since 2018

- Pax Gold, an LBMA-gold backed token written on Ethereum, was launched in 2019. CF Pax Gold-Dollar Settlement Price and CF Pax Gold-Dollar Spot Rate, are registered, regulated benchmarks, published by CFB since 2020

- Paxos-owned itBit exchange, established in 2012, is a long-standing CME CF Constituent Exchange for certain regulated benchmarks. This means its operations have been vetted and are regularly reviewed for conformance with several public criteria relating to market integrity, governance and regulatory compliance

- itBit received a virtual currency limited purpose trust company charter from the New York State Department of Financial Services (NYDFS) in 2015

- The Conditional BitLicense NYDFS granted to PayPal in partnership with Paxos in 2020 was converted to a full license a year ago

So, although PayPal’s move is widely recognized as a potentially important inflection point for broad-scale adoption, for more informed digital asset participants, it’s seen as somewhat less remarkable, in context.

Stable and siloed

Nor is PYUSD likely to be particularly expansive for existing and experienced cryptocurrency users. At launch, PYUSD will be restricted to the PayPal system itself, exclusively within the U.S.

There are also questions about whether or not PYUSD will be only a pegged creation/redemption token or not. In that case, there will be no discernible market pricing mechanism, reducing PYUSD’s appeal to digital asset market participants even further.

'Stablecoin' era

Regardless, media comparisons with Meta’s ham-fisted Libra efforts are still incongruous, largely because of PYUSD’s evident regulatory anchoring, which has paved the way to its existence. The opposite situation applied to the token project led by the group formerly called Facebook, ultimately preventing Libra from ever going live. (And was Libra ever referred to internally as a stablecoin, anyway?)

Overall, it seems the adoption effect of PYUSD will almost certainly be legit in the broadest sense. Even if we just go by further corporate token projects that are likely to come to fruition in the near term. News that Microsoft is partnering with Aptos, which operates the Aptos Labs Layer 1 blockchain, sent the APT token around 18% higher soon after the announcement. PayPal USD’s relatively friction- free launch suggests the corporate ‘stablecoin’ era is just beginning.

Less Curve

Thankfully, no further major twists have emerged from Curve, since our extensive post mortem last week. Recall that we said no changes were planned for any single asset DeFi benchmarks, nor Multi Asset Series indices, for reasons given in the article. That remains the case.

Meanwhile, hackers responded further to the ultimatum announced by the Curve community by returning more of the bilked sum that’s now estimated to have been between $61m to $73m. Reimbursed funds amounted to about $52m early this week, according to blockchain security firm Peckshield, up from about $13m a week earlier. Because all funds were not returned by 6th August though, a bounty – $1.85m – was issued as Curve had threatened.

Still, reimbursements of various kinds, including further collateral deposits from curve.fi’s founder, following OTC peer-to-peer CRV deals, continued to help underwrite his outstanding liabilities, keeping their cumulative value above the $0.36 per token level, below which the loan would be liquidated. The outstanding still accrues interest of course. And that's just one of the persisting risks from the debacle for a significant swathe of pools and major protocols, particularly AAVE.

More ETH ETF paperwork

At last count there are now 14 open filings for Ether Strategy ETFs. This compares with the 9 we tallied last week. (This CFTC article on BTC Futures ETFs is a good intro to both ETH and BTC ETFs, if needed).

As Bloomberg ETF analyst James Seyffart notes here, the first firm to submit such an application in the current batch did so about a fortnight ago. The significance of that timeline is that a pattern has been observed with ETH strategy ETF filings, of which there’ve been several over the last two years. The SEC has reportedly sent strong informal signals to applicants within a few days of their filings, that have resulted in applications being withdrawn. That hasn’t happened this time. Just like the SEC’s ‘interpretative regime’ with regard to spot Bitcoin ETF filings, which have also been in focus this summer, there’s no sure way to know whether its view of ETH futures-based funds has changed. (Possible clue here). As far as we can tell though, current Ether futures fund filings are preliminary. Many forms are not completely filled out. Formal reviews are unlikely to begin for several weeks.

SEC rewinds ARK 21Shares review

Speaking of crypto ETF reviews, the SEC has issued its first ‘delay notice’ for one of the spot Bitcoin ETF filings on its desk. It’s been widely noted that the fund proposed by a partnership of Cathie Woods’ ARK and prolific Swiss issuer 21Shares was at the head of the cue, given that an amendment in June of their initial filing, around two years before, kept that application first in line for consideration - at least in theory. It's also been widely suspected the SEC would follow the pattern its evinced for all spot crypto ETF filings. Meaning it would utilize all possible opportunities to extend its reviews of them. On that basis, this delay notice is set to be the first of many, given the raft of BTC ETF filings in recent weeks.

Macro Outlook

By Gabe Selby

The most recent U.S. Consumer Price Index (CPI) reading came in slightly below expectations, as the year-over-year figure stood at 3.2%, as opposed to the forecasted 3.3%. The headline figure, encompassing volatile components such as food and energy, exhibited a milder increase than anticipated. Instead, a significant driver in the monthly increase was found in shelter costs. Despite this rise in housing expenses, the Fed is likely to find comfort in the second consecutive month of subdued core inflation, which only saw a 0.2% increase. This puts the 3-month and 6-month annualized rates at 3.1% and 4.1%, respectively, which is now closing in on the central bank's core inflation target.

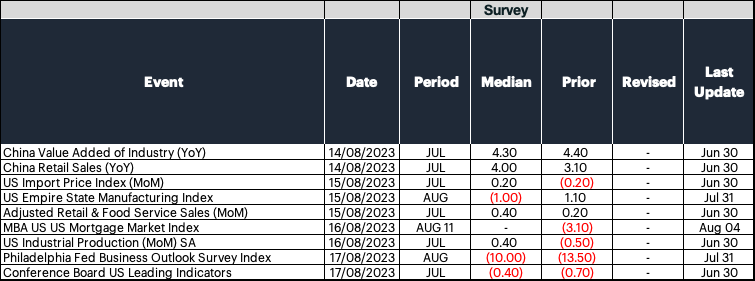

Next week's lineup of economic data is anticipated to be considerably less eventful. Investors should direct their attention towards July's Retail Sales data, as it will provide insight into whether financial challenges are gaining momentum, potentially leading to decreased demand. Regarding pricing trends, the most recent import price statistics are expected to exhibit a slight uptick, following a sequence of downside surprises. This prompts the question: are these disinflationary trends enduring? With the consensus forming that the Federal Reserve's battle against inflation might be in its final innings, the possibility of inflationary surprises cannot be dismissed as we move through the remainder of the year.

Featured utility: CF Digital Asset Classification Structure

VIDEO: CFB Talks Digital Assets 16: Cloudwall pioneers crypto risk analytics - with CEO Kyle Downey

Here at CF Benchmarks, we don’t downplay the fact that crypto is potentially one of the riskiest asset classes around.

Thinking more constructively though, how can those risks be managed?

In fact, because digital assets are so dissimilar to traditional assets in terms of technological complexity, their mode of economic participation and more, how do we even determine and measure such risks?

These are the kinds of questions our guest on the latest episode of CFB Talks Digital Assets, Kyle Downey, has been grappling with for years.

Kyle is co-founder and CEO of crypto risk analytics firm Cloudwall, and he quickly realised that although risk management is fundamental to any market activity, Cloudwall finds itself among the relatively few companies researching and constructing cogent models to credibly address that need.

We think the stimulating conversation between Kyle, Gabe Selby, CFA and Ken Odeluga, will be as educational for you as it was for us.

Highlights:

- Why the ‘four quadrants of risk’ - market, liquidity, operational and credit - require radically different ‘weightings’ for digital assets than for traditional assets

- How Cloudwall surmounts crypto-specific data challenges like the relatively short historical horizon and data quality

- Key features of the Serenity Portfolio Risk System, including the first commercial grade factor risk model for cryptoassets

- Potential integration of our CF Digital Asset Classification Structure (CF DACS), the first standardised universe of eligible cryptoassets, into Cloudwall models, to enable accurate attribution of digital asset category and sub-category risks

The next CF Benchmarks Newsletter will be out in September.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.