CF Benchmarks Newsletter - Issue 60

Record open interest in CME crypto contracts both BTC and ETH, futures and options...argue against the notion of retreating participation.

- Why is Bitcoin so quiet right now?

- Crypto/Wall St prices de-couple again - what are the drivers?

- VIDEO: How one odd acronym - 'SSA' - could unlock crypto ETFs

The Final Boss

The thinning out of crypto market participation, possibly seasonal, that we noted last week continues, drawing into sharper focus the longer-term conundrum of how narrowly distributed even the largest cryptoassets by market capitalization are.

For an immediate term measure, we’ve added the Bollinger Band Width (BB Width) analysis to Bitcoin’s chart in the Market’s section. Even at a glance, you can see that the indicator, which, broadly speaking, gauges a market’s realised volatility (i.e., not its options-derived implied vol.) is meandering close to its lowest for a month. In fact, when you get there, the second chart will reveal an even more significant milestone.

Record Open Interest, quiet trading

Most likely of course, is that we’re just in the midst of a short-lived, low volume pullback; which is plausible amid the re-emergence of covariance between crypto, particularly Bitcoin, and traditional risky market assets. On the negative side a thoroughgoing re-correlation, If such a regime took hold, could be yet another headwind for the digital asset class.

Still, as CF Benchmarks’ Lead Research Analyst Gabe Selby notes in his recent blog post From Macro to Micro: Can Narrative Shifts Spark the 'Decoupling'?, there are promising indications that the opposite model, i.e., low-to-no correlation between liquid risky assets and crypto, might be reasserting itself, at least for the near term. (Scroll down to read an excerpt of Gabe’s article.)

Record open interest in CME crypto contracts—so both BTC futures and options, and ETH futures and options—booked by ‘large traders’ in Q2 also broadly argue against the notion of retreating participation.

(Read the CME’s quarterly crypto recap here).

A key worry though is that, precipitated by the numerous counterparty implosions of 2022, and maybe exacerbated by the more recent exit under regulatory pressure, of the largest provider in the U.S., Binance, we suspect a sizeable cohort of retail participants has been removed and that we might be witnessing a new baseline of retail crypto interest and participation that could pose speed bumps in the evolution of adoption.

Low investment tide

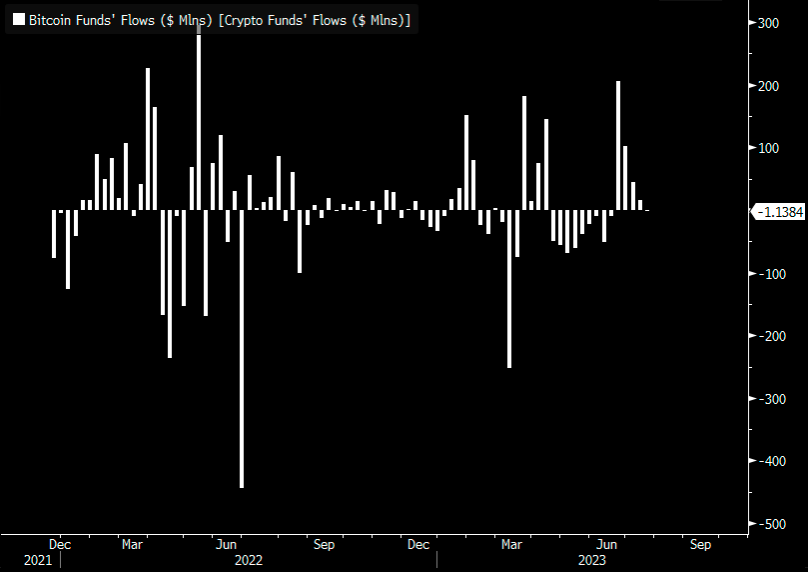

Meanwhile, the health of investment interest is also starting to suggest as irking a picture as the pulse of speculative interest. Fund flows, graphed below, provide hints that institutional participation may also have reached a sub-cycle limit in step with the end of Bitcoin’s latest up-leg.

Bloomberg’s weekly listed fund tallies had recently staged a run of respectable inflows underpinned by the optimistic market and institutional response to June’s ETF filings. However, allocations have latterly reverted back towards the neutral threshold with a marginal net outflow recorded in the past week.

So, weak trader volition and fair-weather active investor favour. It’s just a snapshot, albeit worth keeping tabs on. Still the question of the relevance and utility of an asset class that meets frequent challenges of distribution and participation is one for which cogent answers are needed.

Deleterious prospects like these help explain why conquering the challenge of getting a crypto ETF listed in the U.S. is widely regarded as the 'final boss to be defeated' before mass adoption.

As CF Benchmarks CEO Sui Chung stated in the latest episode of CFB Talks Digital Assets:

We’re very proud to be able to facilitate in our small way, adoption…through the regulated financial products channel, through a channel that many investors are more familiar with and more comfortable with, than you know, creating a self-hosted wallet and onboarding with cryptocurrency exchanges. There’s nothing wrong with that, but…we have to accept that certain investors are not comfortable with that route to cryptocurrency exposure. And CF Benchmarks is very proud to have facilitated other routes that can be taken to gain cryptocurrency exposure and further adoption of the asset class.

Teaser and link to the podcast below.

And in case you missed it, catch-up on the 8 'live' U.S. Bitcoin ETF applications - 4 powered by our CME CF Bitcoin Reference Rate New York Variant (BRRNY) - here.

Markets: BTC's sub-$30k snooze

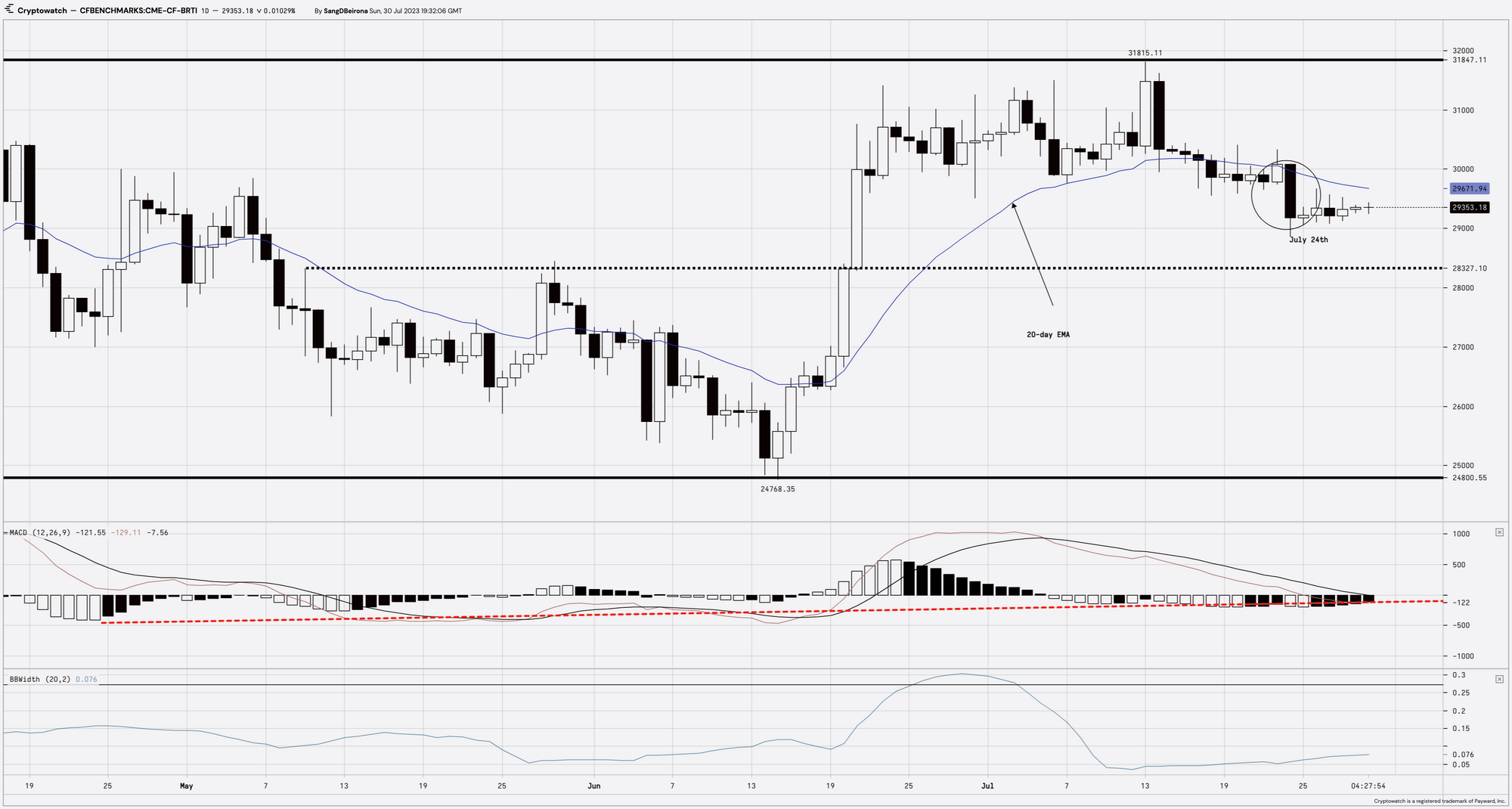

For active Bitcoin traders, the current tone of market sentiment is all too predictable. As shown by the chart below of the asset’s main institutional live price, CME CF Bitcoin Real Time Index, having reached the region of approximately $30k - $31k in the latter half of June, BTC has studiously shied away from crossing it ever since; the definition of what technical chartists call 'resistance'. The other point to subtract from the scorecard, as we’ve also observed in recent weeks: disinclination to surf near-term momentum gauges, like the one we’ve included, the 20-day exponential moving average (EMA).

Many traders will maintain a negative bias – which in practice might mean selling upticks and minor rallies – whilst an asset’s price is weaker than such intermediate trends. The preceding week has seen prices setting consecutive higher highs on a closing basis, which generally would be interpreted as positive. The inevitable ‘however’ is that the relatively narrow daily ranges (candle lengths) have been unconvincing. As well as signally surpassing the EMA, traders would also expect BTC to escape the range of the sharp downdraft on July 24th (circled) – between $28,861 and $30,097 – before adjusting any basic stance on short-term direction.

As implied at the top of the newsletter, the wait could also require improved signs of life in the market as a whole. As the Bollinger Bandwidth indicator (BB Width; bottom panel) reveals, the realised volatility range is snaking along almost at the lowest bound of the analysis.

Narrow band

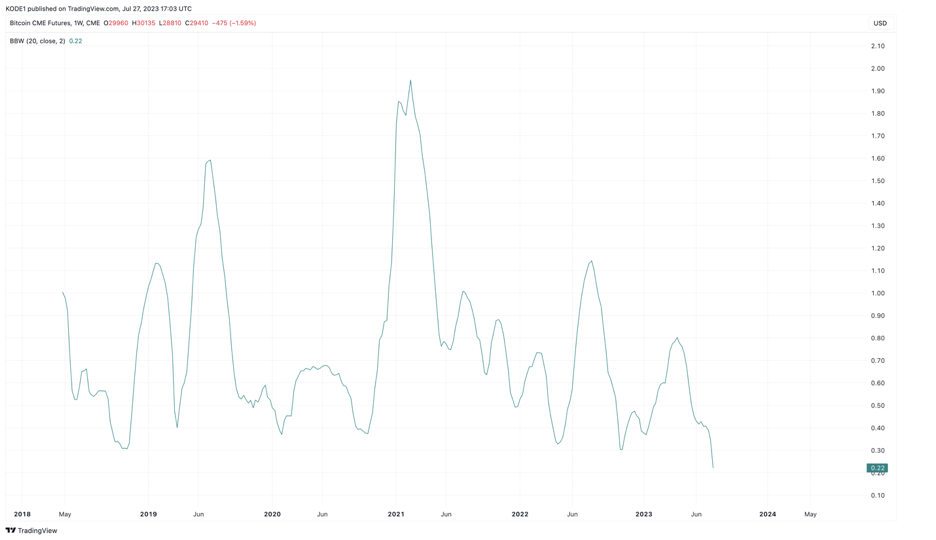

And in fact, the collapse of realised volatility appears to be at a more significant milestone than that. The chart below removes the underlying price and is dedicated to the Bollinger Bandwidth alone, though this time it is derived from a continuous series of weekly sequential CME Bitcoin Futures contract prices.

From the chart, it is clear the that the breadth of volatility has dipped to its lowest since CME Bitcoin Futures became available to trade. On this basis, the outlook for variability to revert to previous norms would therefore be binary, though of course unpredictable.

DOGE jumps but alts fade

Speculative attention has, unsurprisingly, focused more strongly on smaller cap assets (AKA altcoins) amid the somnambulant period for large caps. Dogecoin stood out last week with a 10% surge early on taking its fortnightly gain to around 25% - according to our regulated CF Dogecoin-Dollar Spot Rate.

The response seemed to be premised on the supposed intention of DOGE's occasional promoter Elon Musk, to place DOGE at the heart of plans for expanded services and facilities available from X/Twitter.

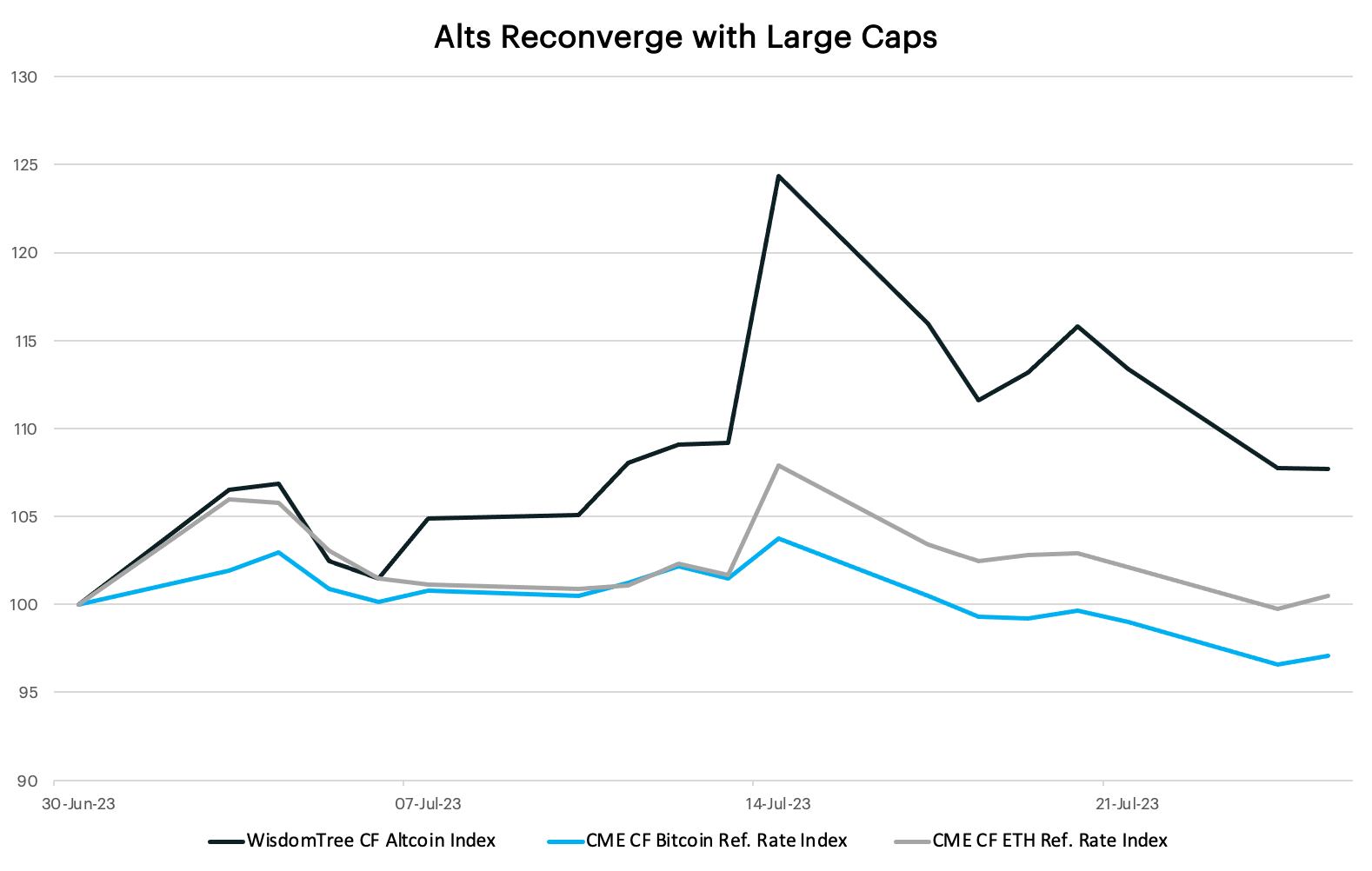

For most alts though, recent effervescence is beginning to look fleeting, with the group as a whole now on course to drift lower as the boost from the partial Ripple Ruling in mid-July, which partially exonerated many tokens from being cast as securities, continues to fade. The normalised chart below shows the WisdomTree Alt Coin Index (for which CF Benchmarks designed the methodology and is Calculation Agent) against CME CF Bitcoin Reference Rate (BRR) and CME CF Ether Dollar Reference Rate. Superior beta for altcoins from the ‘Ripple Rip’ hasn’t been maintained at initial levels as relative outperformance also subsides.

Macro Outlook

By Gabe Selby

The Fed decided not to surprise the interest rate markets, going ahead with the fulfilment of the widely expected 25 bps rate increase, leaving the benchmark rate in the 5.25% - 5.5% range. Changes to the official statement were relatively limited, with the overall message of remaining 'data dependent' still emphasized. It appears that whilst Fed policymakers have acknowledged progress in both their policy stance and subsequent economic data, they still want to keep future options open.

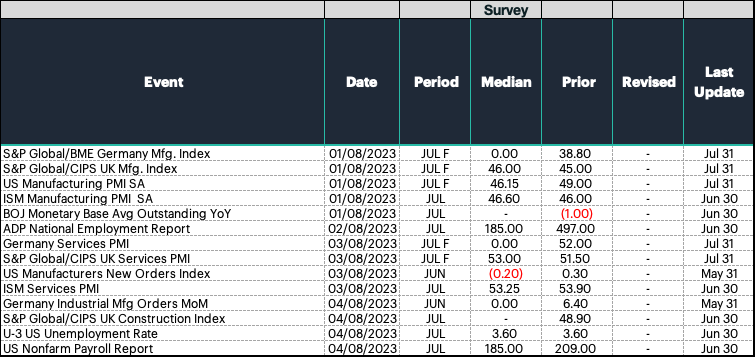

Next week's headline economic event will likely be July's payroll report on Friday August 4th. Forecasters anticipate that the labor market is set to show further signs of cooling, with the median estimate for monthly job creation at 185K. Investors will also take note of the latest manufacturing and services gauges across the U.S. and Europe. Economic activity has been dramatically diverging between these two regions since the start of the second quarter, leaving data-dependent macroeconomic investors with plenty of variables to consider.

Featured benchmark: CF Broad Cap Index (Free Float Market Cap Weight) - London - Spot Rate

From Macro to Micro: Can Narrative Shifts Spark the 'Decoupling'?

By Gabe Selby

"There is no such thing as a free lunch"

Renowned Nobel laureate Harry Markowitz once said that diversification is the only "free lunch" in the world of investing. This is because the benefits of a properly diversified portfolio with various asset classes can allow an investor to drastically reduce the overall risk of their portfolio, without materially reducing the portfolio's return potential. To put it simply, diversification is a powerful strategy that enables investors to potentially optimize their gains while safeguarding against unnecessary risks.

In investing, practitioners can use a correlation statistic to measure the association between different financial assets. Correlations range from -1 to 1, with a positive correlation signifying that both assets move together, no correlation meaning there is no relationship, and a negative correlation indicating movement in opposite directions. Investors use it to diversify portfolios and manage risk effectively by selecting assets with low or negative correlations.

In the early days, one of the key advantages of investing in cryptocurrencies like Bitcoin was its close-to-zero correlation to traditional markets. The illustration below depicts the rolling 20-day correlation of our CF Floating Broad Cap Index with the Nasdaq 100 Index over the past decade (note: I'm using 20 periods since there are typically 5 business days in a week). Prior to 2020, digital assets maintained an average correlation of just 0.04 with the tech-centric equity market index. Many practitioners consider any correlation near zero as an indicator of an uncorrelated asset.

Read the rest of Gabe Selby's article on our website

Featured benchmark: CME CF Bitcoin Reference Rate - New York Variant

VIDEO: CFB Talks Digital Assets Ep 15: CEO Sui Chung on spot Bitcoin ETF filings and why this time might be different

Ever since BlackRock’s surprise filing to list a spot #Bitcoin #ETF, powered by our regulated CME CF Bitcoin Reference Rate - NY Variant, it's been a top talking point among institutional investors.

But given CF Benchmarks' participation in more crypto ETF filings than any other provider, we have a uniquely informed perspective on what’s likely to work and what definitely won’t.

That means it’s no exaggeration to say CFB’s CEO, Sui Chung is a true insider to BlackRock’s filing, and the applications by 3 other issuers using our benchmark.

With the SEC now officially reviewing all filings, listen in to the latest episode of the CFB Talks Digital Assets podcast with Sui as our guest, for exclusive insights:

- Why this time really might be different

- Why Surveillance Sharing Agreements are the ‘silver bullet’

- Why a U.S. spot BTC ETF would be a “paradigm shift”

Featured utility: CF Digital Asset Classification Structure

VIDEO: What is Crypto?

It's been 12 years since Bitcoin was created, but by far the most questions we get asked by investors are:

"What is crypto? What gives crypto value? And what backs crypto?"

For the answers to these questions and others, watch Sui Chung's video where he discusses all of the above.

Click below to watch

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.