CF Benchmarks Monthly Market Recap

Here's the December edition of a monthly compilation of digital asset market data, analysis and insights by CF Benchmarks' Lead Research Analyst Gabe Selby.

This report has been designed to help you see at a glance which blockchain economic categories have been driving recent crypto market performance, get a sense of where institutional investors are allocating capital earmarked for digital assets, and understand how crypto fits into, impacts and is influenced by the broader market picture.

Hawkish Fed kills early price gains

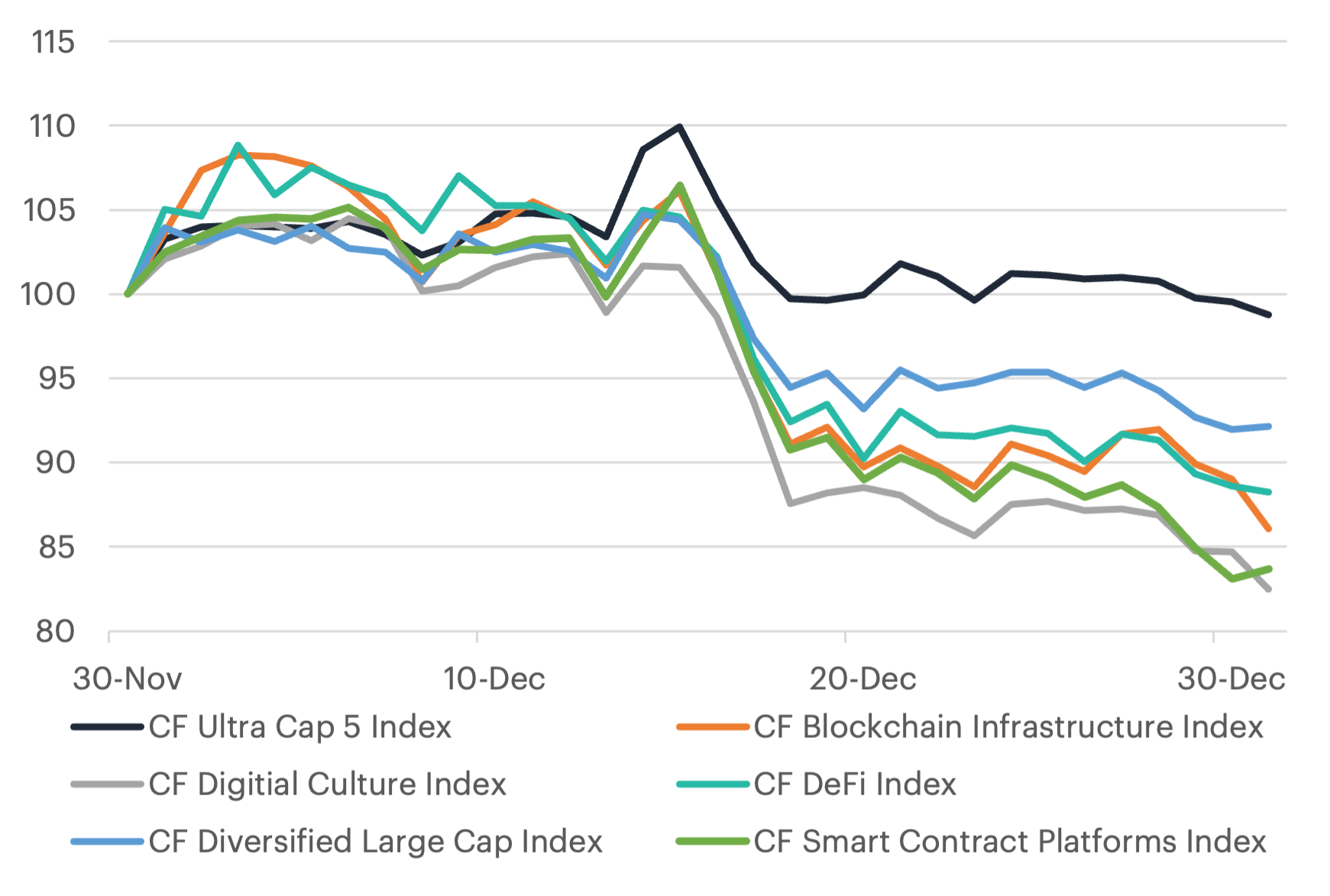

- Our portfolio indices erased their early December gains after the Federal Reserve doubled down on their fight to tame inflationary pressures.

- Blue-chip tokens remained relatively resilient with our Ultra Cap 5 Index finishing the month just 1.3% lower and our Diversified Large Cap Index (-7.9%) outperforming the remaining cohort.

- The CF Digital Culture Index finished the month as the worst performer (falling over 17%) and edging out last month’s laggard, the CF Smart Contract Platforms Index (-16.3%).

Monthly Index Performance

Major Crypto-Pairs (USD)

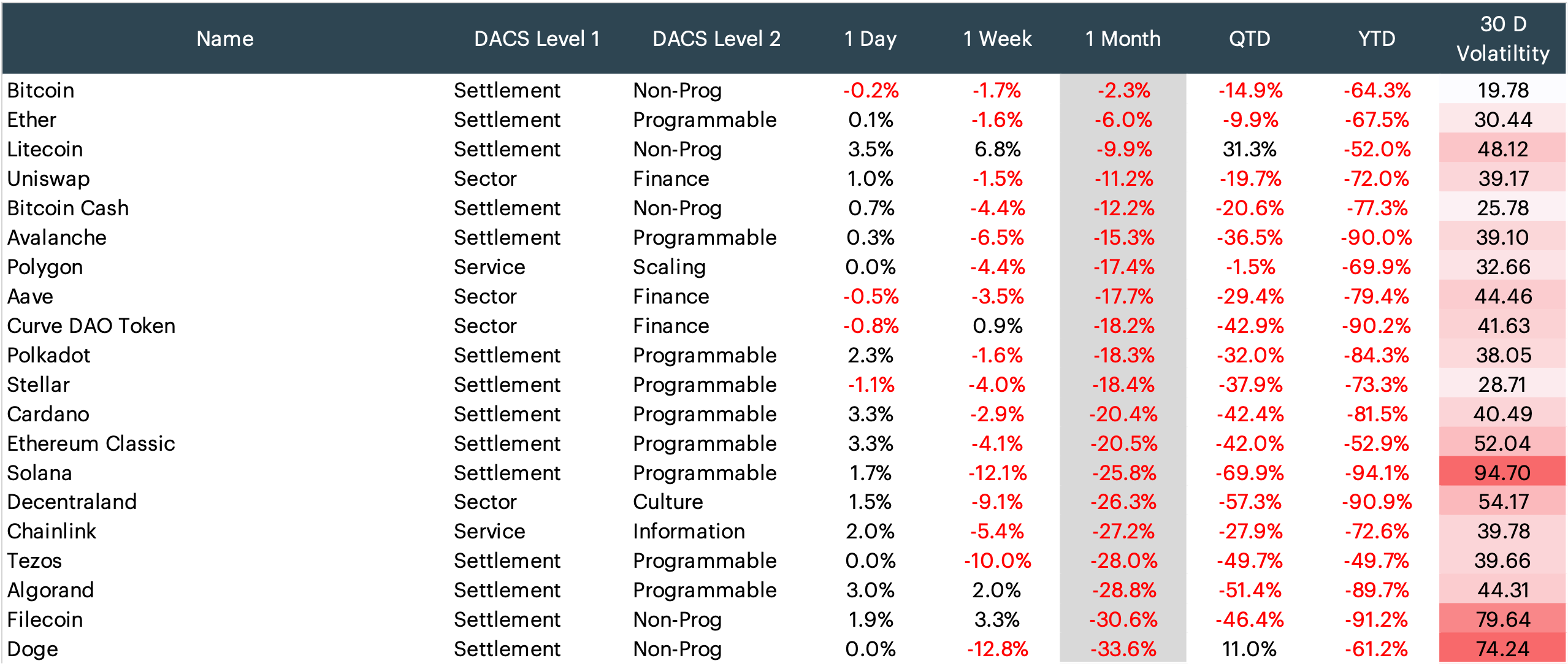

- The two mega-cap tokens, Bitcoin and Ether, performed relative defensively, falling only 2.3% and 6.0% (respectively).

- Doge finished the month as the worst performer, falling over 33% as the popular meme coin continued to pair its post-Twitter takeover rally.

Trailing Risk-Adjusted Returns

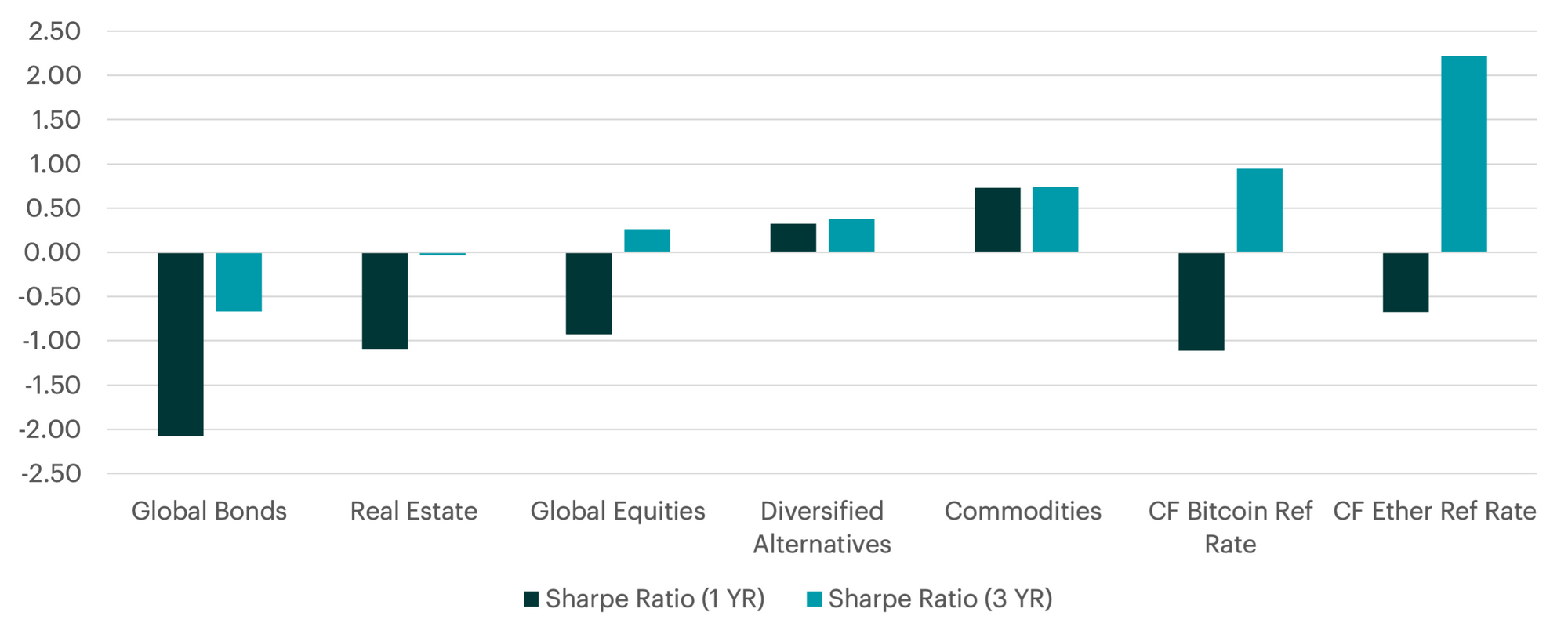

- When compared to traditional asset classes, Bitcoin and Ether continue to provide the best risk-adjusted performance over a longer-time horizon.

Currency of Flows

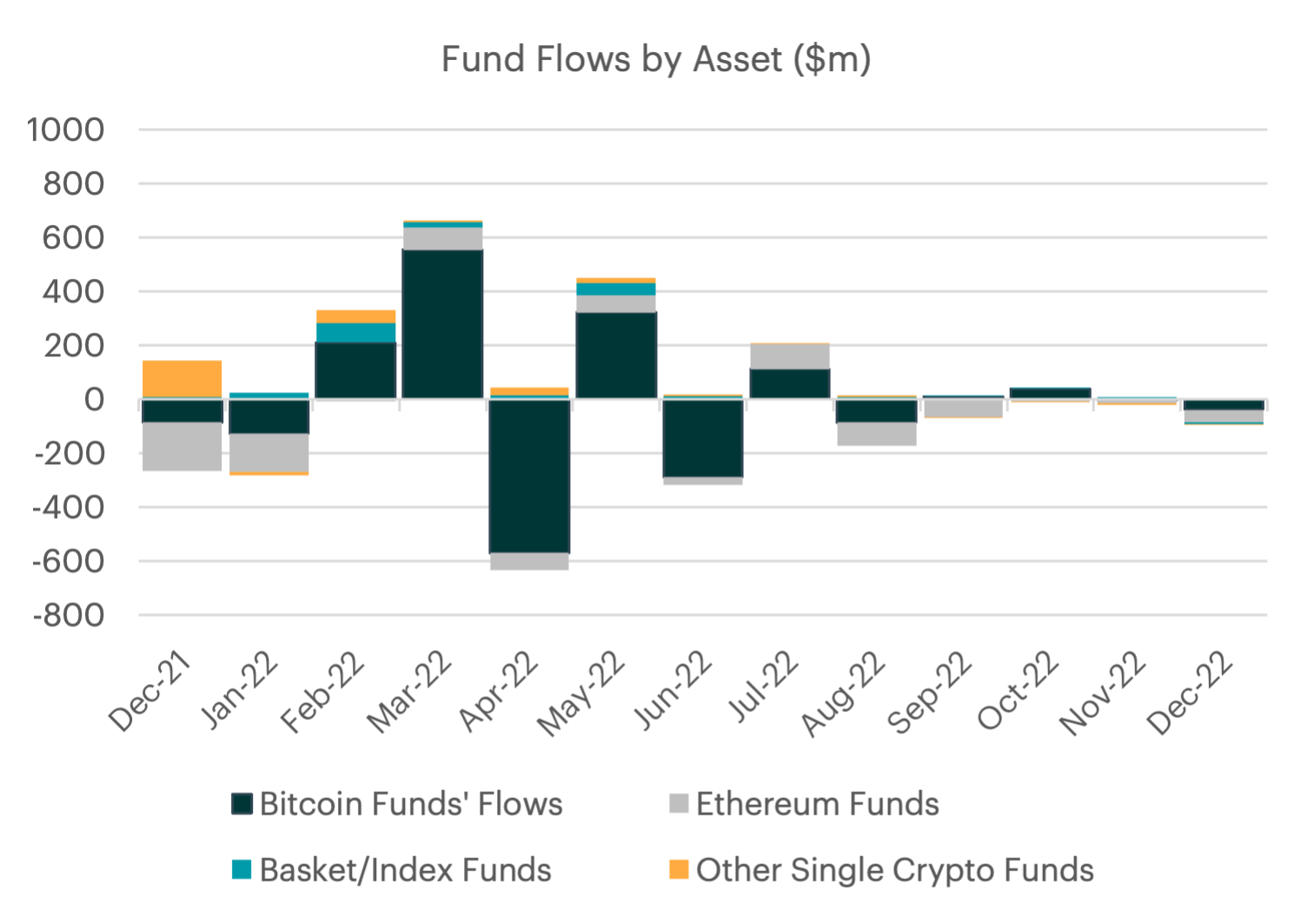

- Fund flows by asset-type remained broadly negative, falling -$96m with most of the decrease concentrated in ETH funds.

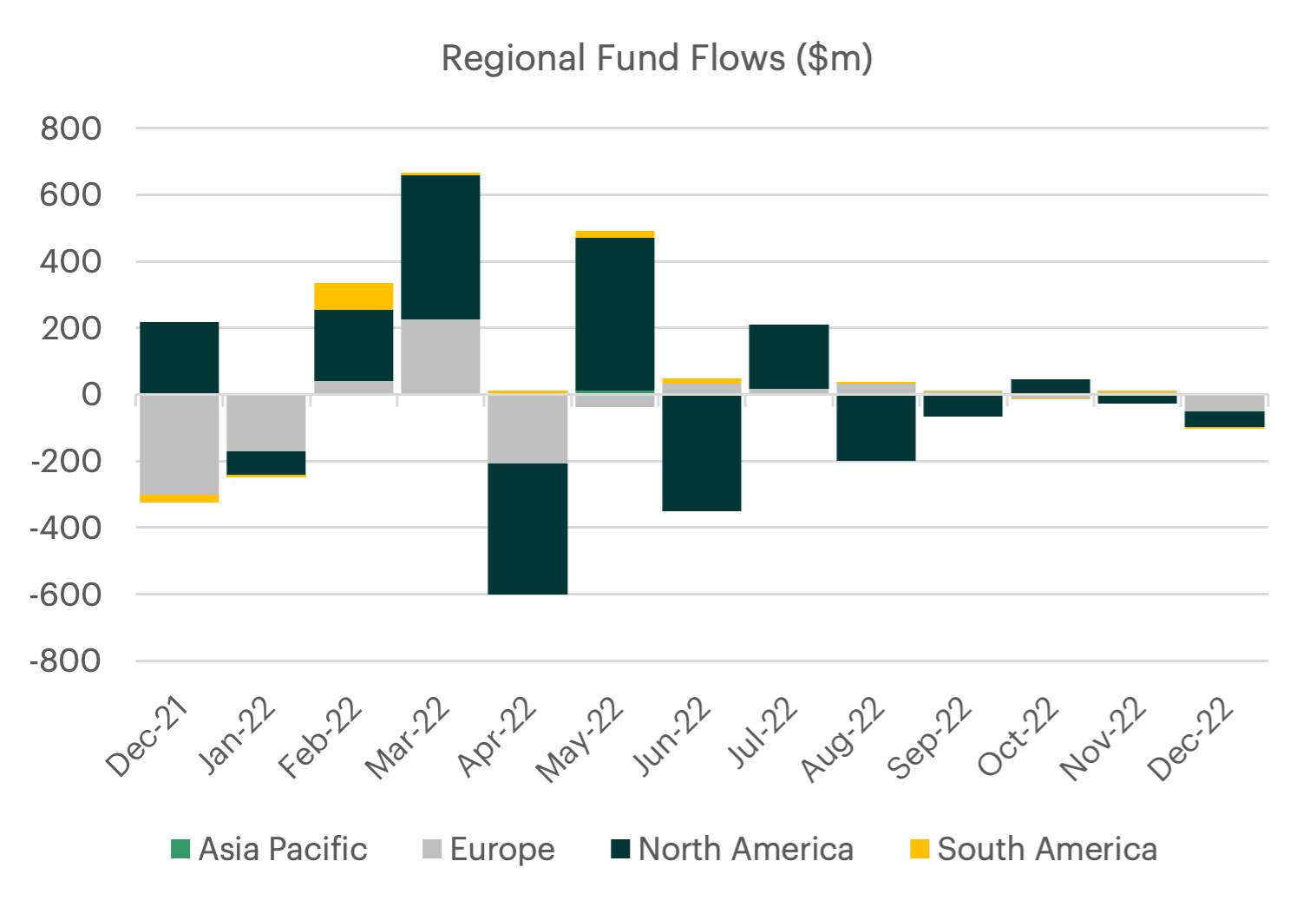

- From a regional perspective, Europe and North America saw almost $100M in fund outflows as the Asia Pacific region edged a slight gain (+500K).

Futures Positioning and Open Interest

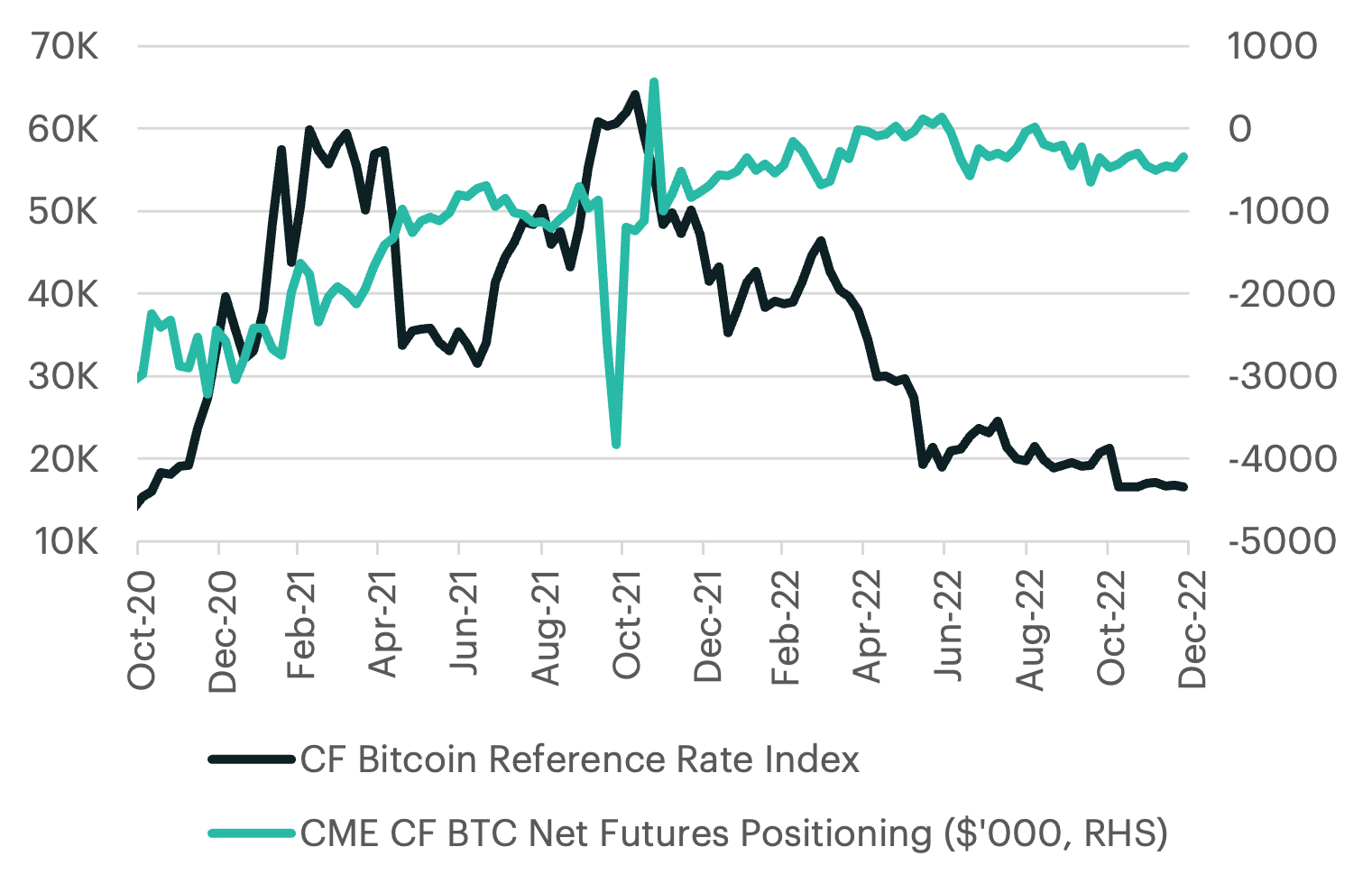

- Bitcoin futures positioning remained slightly bearish in December, with net positioning rising from -456 to -346 contracts.

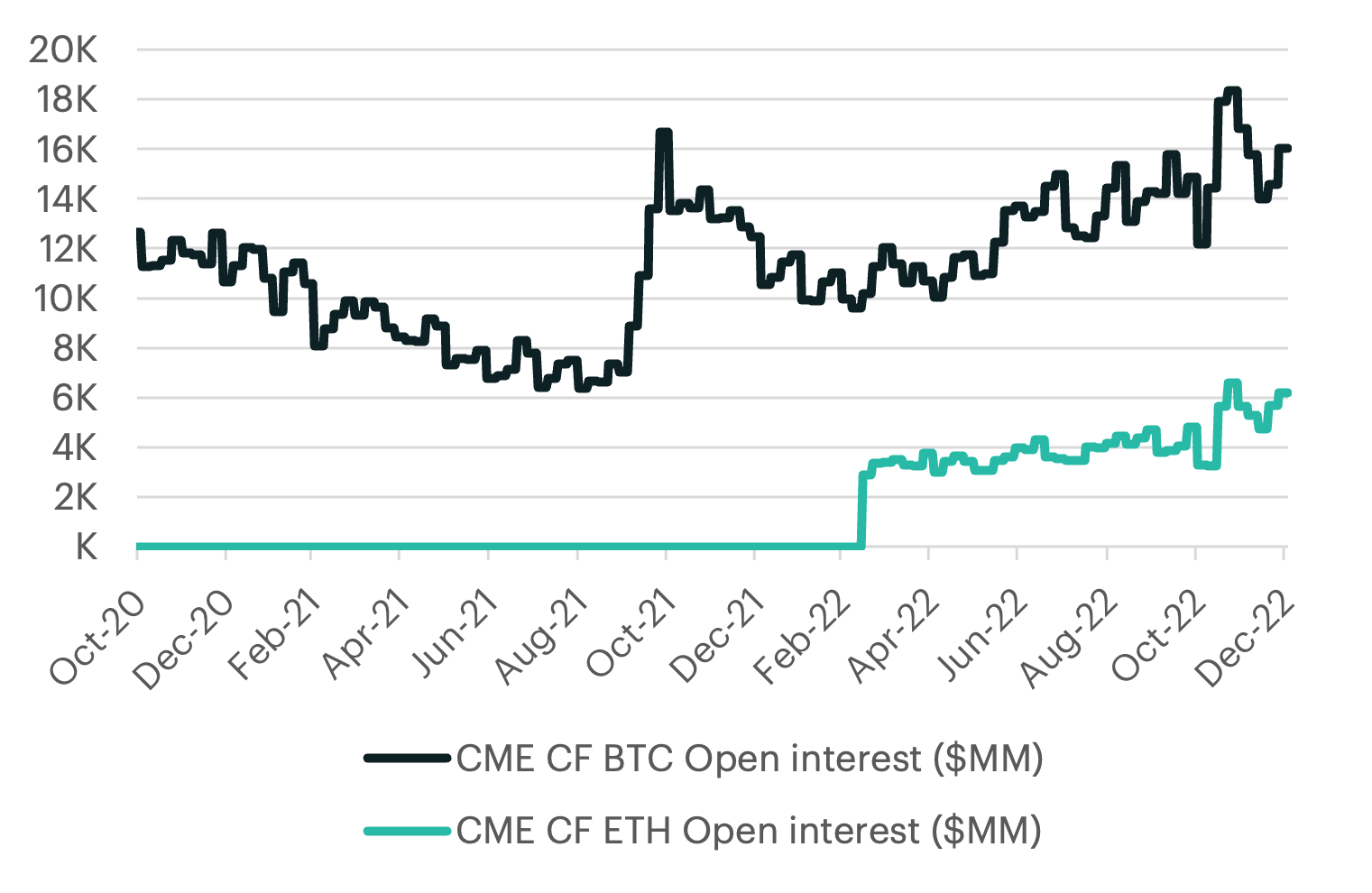

- Open interest trends for Bitcoin and ETH futures was mixed, with Bitcoin futures edging slightly lower as ETH continued to climb higher.

On-chain updates: Total Value Locked (TVL) in DeFi protocols

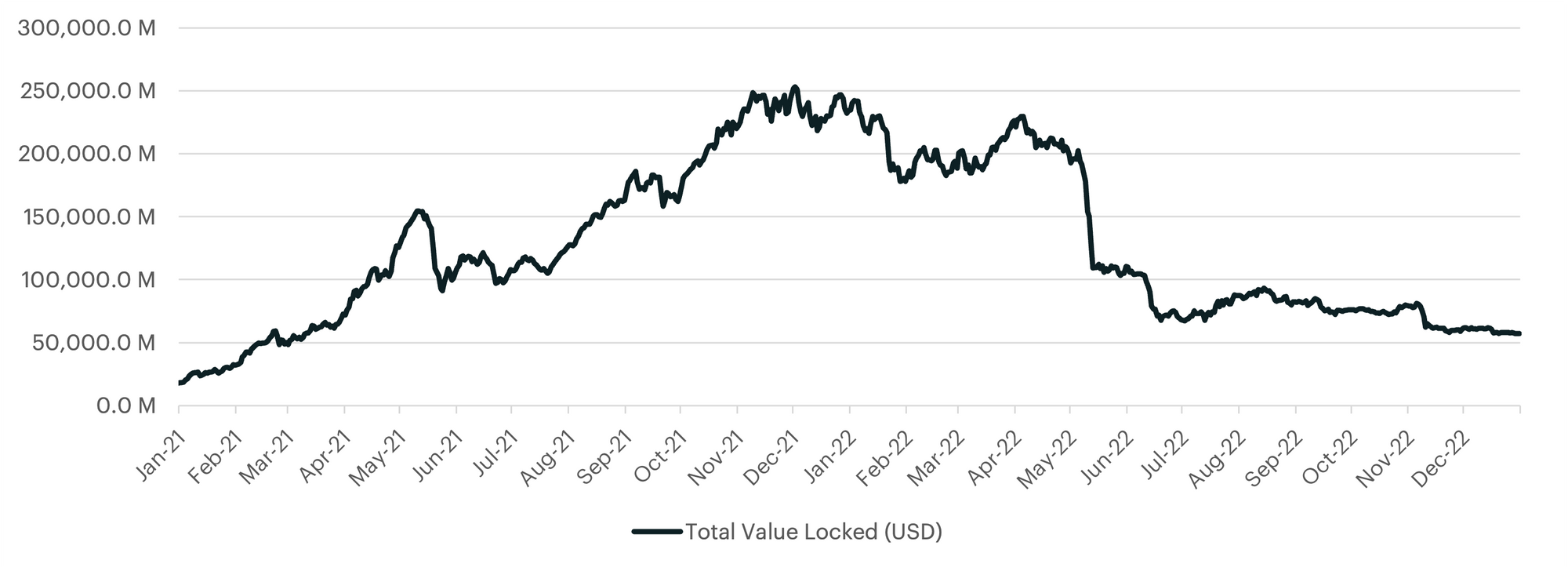

- Total Valued Locked (TVL) in DeFi Protocols edged lower in the month of December (falling from $60bn to $57bn). This proxy for gauging the size of DeFi has stabilized in the $55bn to $65bn range since the FTX / Alameda collapse in November.

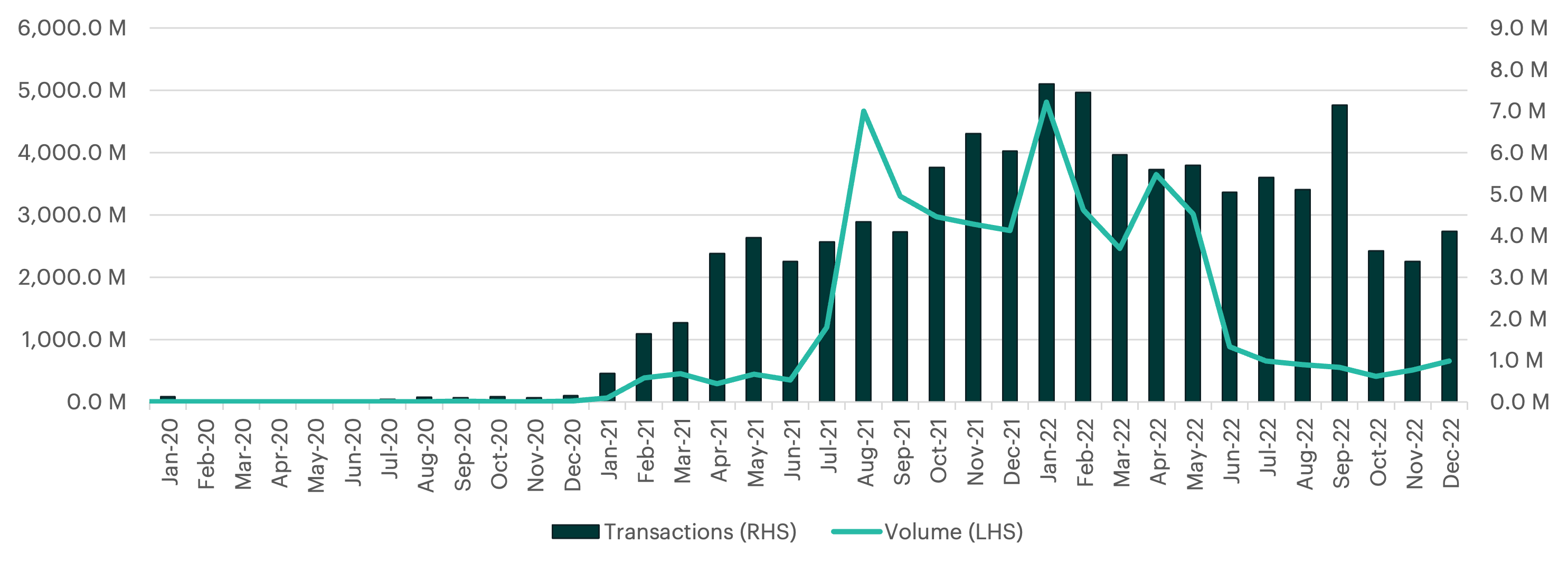

NFT Transactions and Volumes

- Activity for NFTs rebounded in December, with both total transaction increasing over 20% and prices (or volumes) rising almost 30%.

Download The CF Benchmarks Monthly Market Recap here (PDF file)

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.