CF Benchmarks launches CF Rolling CME Bitcoin Futures Index

The index is able to negate the effects of roll yield significantly, providing strong replication of the physical bitcoin price and mitigating any operational risks in the replication process.

CF Benchmarks launches CF Rolling Bitcoin Futures Index, enabling replication of continuous investment in the most liquid CFTC-regulated Bitcoin Futures Contract

Responding to the need of institutional investors that require constant investment in the most liquid CFTC-regulated BTC futures contracts, CF Benchmarks has launched the first BMR compliant benchmark that replicates serial investment in CME Bitcoin Futures, the CF Rolling CME Bitcoin Futures Index.

The CF Rolling CME Bitcoin Futures Index (Excess Return) is calculated once a day and published at 15:15 US Central Time.

The index has been developed to measure the returns that a passive strategy of holding CME Bitcoin Futures contracts would generate. It is thereby a means of replicating exposure to Bitcoin through holdings of CME Bitcoin Futures contracts settled in U.S. dollars. Furthermore, through an index construction that spreads allocation across both the front and second months of the contract as well as rolling the contracts during the most liquid days in the run up to expiry, the index is able to negate the effects of roll yield significantly, providing strong replication of the physical bitcoin price and mitigating any operational risks in the replication process.

With CF Rolling CME Bitcoin Futures Index (Excess Return), investors have the ability to go both long and short of the Bitcoin price through price discovery facilitated by the GLOBEX central limit order book system. Therein, transactions are centrally cleared, and all activity is conducted under the regulatory oversight of the US CFTC. (Link to CME GLOBEX Reference Guide).

These features enable CF Rolling CME Bitcoin Futures Index to maintain the unique end-to-end regulated nature of participation in the CME Bitcoin Futures market.

CF Benchmarks is a registered Benchmarks Administrator regulated under EU Benchmarks Regulation (BMR) and also regulated by the UK FCA. Both CME CF Bitcoin Reference Rate (BRR), against which CME Bitcoin Futures are settled, and CF Rolling CME Bitcoin Futures Index itself, are regulated Benchmark Benchmarks under EU BMR.

The CF Rolling CME Bitcoin Futures Index is also a beneficiary and interface to the CME CF BRR Liquidity Complex, the ecosystem of financial products, venues and counterparties that utilize, contribute to, or directly reference the BRR. The CME CF BRR Liquidity Complex establishes a superior pool of liquidity around the regulated spot price of Bitcoin, CME CF BRR, mediating perfect tracking to products referencing it.

CF Rolling CME Bitcoin Futures Index is defined by a robust and transparent methodology that is designed to minimize roll costs.

The CF Rolling CME Bitcoin Futures Index was launched on June 20, 2022, with a base value of 1000 as of May 9, 2022. All index values prior to May 9, 2022, are backtested.

The index methodology is formally underpinned by the aim to provide a representative, replicable and efficient means of facilitating the creation of financial products, like exchange traded funds (ETFs), mutual funds, derivatives contracts and other financial instruments.

Read the Methodology Guide for CF Rolling CME Bitcoin Futures Index (Excess Return)

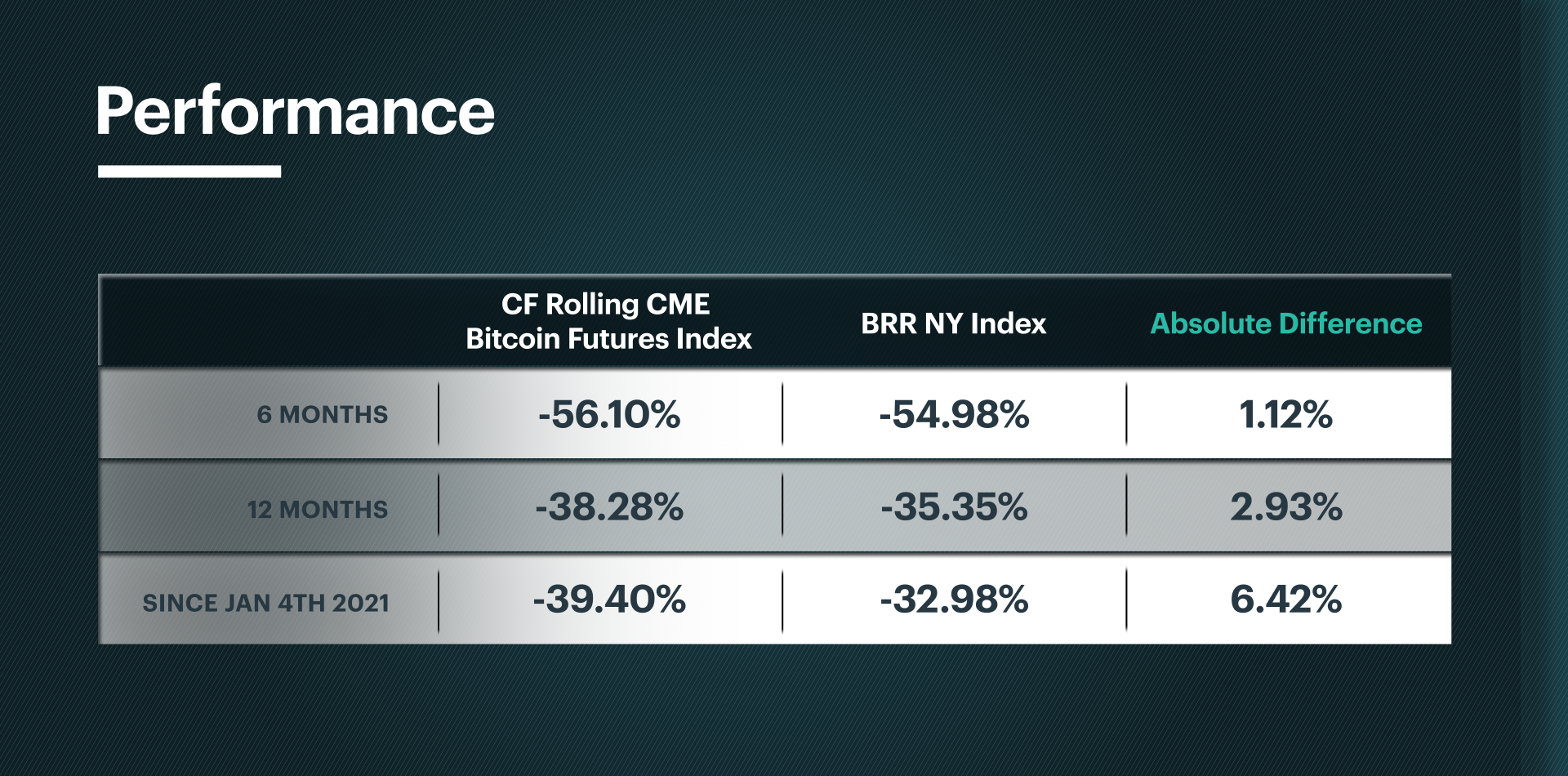

For a quick look at how CF Rolling CME Bitcoin Futures Index captures exposure to CME Bitcoin Futures on a 6- and 12-month basis, as well as to a holding of the contract between January 14th, 2021, to June 21st, 2022, click below to watch a short animation.

The historical performance described above is broken out in the still shot below.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.