CF Benchmarks launches the regulated CF ETH Staking Reward Rate

As a regulated benchmark under the UK Benchmarks Regulation (BMR) framework, compatible with the EU BMR, the CF ETH Staking Reward Rate is designed to promote replicability, representativeness and manipulation resistance, for financial product providers engaging in non-custodial staking.

The first indices in our new CF Staking Series are the ideal solution for institutional ETH staking participants

Institutional ETH staking grows fast

Responding to the rising demand for a credible, trustworthy, daily, realized Ether staking reward rate, CF Benchmarks is launching the CF ETH Staking Reward Rate (ETH_SRR), the inaugural benchmark of our CF Staking Series, providing an accurate measure of the economic incentives associated with Ethereum, a Proof of Stake (PoS) blockchain.

These incentives, which are also known as staking rewards, are derived principally from three sources: the consensus layer, (from block rewards and attestation rewards) the execution layer (from transaction fees) and the Maximal Extractable Value (MEV). Some rewards are associated with penalties, known as ‘slashing’, levied against validators that have broken the blockchain rules.

With ETH dominance of PoS protocols rising to 79% in the third quarter of 2023, from 68% in Q3 2022, coupled with a steady PoS market share of the overall crypto asset market capitalization in Q3 2023 (source: Staked.US), the ongoing expansion of the institutional cohort in ETH adoption is evident.

Risks for institutions

However, large scale participants, seeking to reap the considerable benefits of staking ETH, face risks related to an unavoidable dependence on third-party data, with ample scope for concerns about data reliability, accuracy and representativeness.

Single source risk

Conventional reward rate solutions often rely on a singular data source, creating a palpable risk of yielding unrepresentative returns. The ETH_SRR employs a multi-contributor methodology, supported by institutional Staking Service Providers that are verified to meet stringent Benchmarks Regulation standards. This effectively mitigates the potential risk of inadequate market representation.

Meanwhile, unlike some published reward rates, the ETH_SRR does not utilize the gross network reward rate. Unfiltered network reward values, which include retail staking, are not always appropriate for institutional participants, for several reasons, including the potential inclusion of data from ‘slashed’ contributors, which can have adverse impacts on reward rate performance.

DeFi risks lurk in the pool

Staking options in the form of DeFi protocols, particularly liquidity staking pools, offer a variety of choices for inferred staking reward rates. However, this approach also introduces potential downsides.

Elevated contract risk:

- Relying on blockchain contracts exposes participants to inherent risks such as bugs or exploits, amplifying the foundational blockchain risk. The potential impact of an exploit can significantly influence the inferred reward rate

KYC/AML non-compliance:

- Some protocols may not be fully compliant with KYC/AML regulations, thereby increasing overall risk exposure when inferring a staking reward rate from DeFi protocols

The Regulated Solution

The CF ETH Staking Reward Rate strongly mitigates all the potential reward data risks described above, and others, by design.

As a regulated benchmark under the UK Benchmarks Regulation (BMR) framework, compatible with the EU BMR, the CF ETH Staking Reward Rate is designed to promote replicability, representativeness and manipulation resistance, for financial product providers engaging in non-custodial staking on the Ethereum blockchain, with institutional-grade Constituent Staking Service Providers (SSPs).

In order to maintain the inherent standards of market integrity, data reliability and accuracy of a regulated benchmark, the CF ETH Staking Reward Rate only observes a carefully selected subset of eligible professional validators, excluding validators that have not consistently maintained the requisite standards.

Superior Staking Service Providers

To ensure the CF Staking Series serves as a transparent and representative indicator of daily realized rewards associated with the proof-of-stake protocols, CF Benchmarks selects a diverse group of Constituent Staking Service Providers (SSPs) which conform to the stringent eligibility criteria laid out in our publicly available CF Constituent Staking Provider Criteria policy, in line with the requirements of the Benchmarks Regulation framework.

CF Staking Series indices are therefore the first regulated benchmarks for PoS protocols that only source input data from eligible Constituent Staking Service Providers, that are professional non-custodial node operators.

High representation

As well as having been selected on the basis that they conform to the eligibility criteria, it’s equally important to note that the SSPs were also chosen due to each providing a significant representation of the total ETH reward rate market.

There are four initial SSP contributors to the CF ETH Staking Reward Rate: Kiln, Staked, Figment, and Blockdaemon.

Each one meets the criteria outlined above. In aggregate, the four represent approximately 145,000 validators and around 16.5% of the entire staked ETH capitalization.

Find out more key details on the initial four SSP contributors to the CF ETH Staking Reward Rate by clicking on their logos below.

(Information sources: CF Benchmarks and SSPs)

Staked.US

Kiln

Figment

Blockdaemon

(Information sources: stakingrewards.com and SSPs)

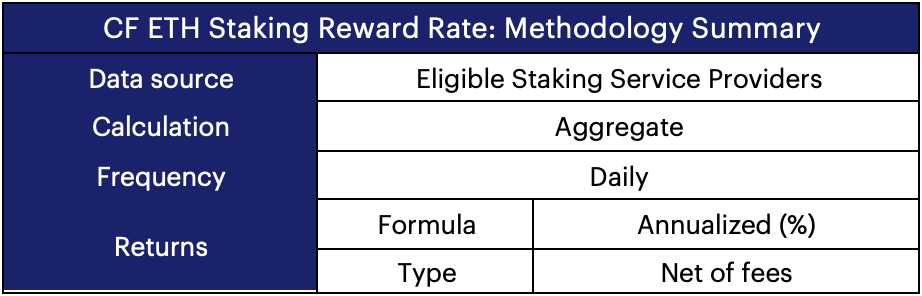

CF ETH Staking Reward Rates Methodology

The Basics

- The CF ETH Staking Reward Rate is calculated daily, aiming to represent the reward rate obtained when staking ETH on its native blockchain (Ethereum). The rate is formulated in annualized percentage form

- Reward rate data are sourced from eligible Constituent Staking Service Providers (SSPs) that contribute rates offered to validators, net of fees

- Note that such rewards are derived not only from staking, but also from participating in all core validator activities on the Ethereum blockchain, including the consensus layer, the execution layer, and Maximal Extractable Value (MEV), where applicable

- Reward tokens must be in the form of the digital asset that’s native to the blockchain (for ETH_SRR, that is Ether) thereby remaining fungible after the blockchain’s un-staking period

- The CF ETH Staking Reward Rate is the aggregate of SSP reward rate contributions

The methodology is summarized even more concisely below.

Multipart Flexibility

The CF Staking Series is comprised of three sub-series, providing increased flexibility in how the Staking Reward Rate can be utilized by institutions seeking to create financial products from these indices and in turn by their clients.

- CF Staking Reward Rate Series

- CF Staked Return Index Series

- CF Staked Return Index Blends Series

This demarcation denotes several supplementary CF ETH Staking indices, in addition to the CF ETH Staking Reward Rate.

The complete set of CF ETH Staking indices includes the benchmarks listed below, together with their respective key characteristics:

- CF ETH Staked Return Index (ETH_SRI):

Represents the sum of ETH’s daily performance and daily reward rate. There are two variants: (1) simple interest mechanism (2) daily compounded interest mechanism.

- CF ETH Staked Return Index Blends Series:

Consists of several variants and each represents the portfolio performance of a specific ‘blend’ of non-staked assets and staked assets, of fixed weight, rebalanced quarterly. Each variant is a different balance of non-staked assets and staked assets

New institutional deployment options

The flexibility afforded by the suite of ETH Staking Reward Rate indices, together with their transparency, accuracy and high standards of market integrity, opens a wide range of institutional deployment options, that were problematic to execute, or even non-existent, before inception of these benchmarks.

- Uses can range from internal performance benchmarking for managers of ETH holdings as a component of ETH products offered to clients, or by capital markets participants, such as market makers, providing liquidity in staked ETH

- Likewise, investment managers can devise funds that track the CF ETH Staked Return Index, or one of the CF ETH Staked Return Index Blends, secure in the knowledge that the benchmarks represent the most accurate pricing possible of staked ETH returns

- Market makers may deploy the CF ETH Staking Reward Rate when acting as the direct contract counterparty in swap contracts

- Staking Service Providers may utilize ETH Staking Reward Rate indices as market benchmarks, for balance sheet management, internal risk, or reporting purposes, among others

Conclusion

In summary, our new CF ETH Staking Reward Rate and its supplementary sub-series benchmarks, the CF ETH Staked Return Index and the CF ETH Staked Return Index Blends, introduce a higher standard of trustworthiness, flexibility and price integrity for what is arguably the most important aspect of staking for institutional participants, the reward rate itself.

More information

- CF Constituent Staking Provider Criteria

- CF Staking Series Methodology Guide

- CF ETH Staking Reward Rate Factsheet

- CF Staking Series Product Page

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.