Bitcoin buyers break little sweat as $12,000 breached

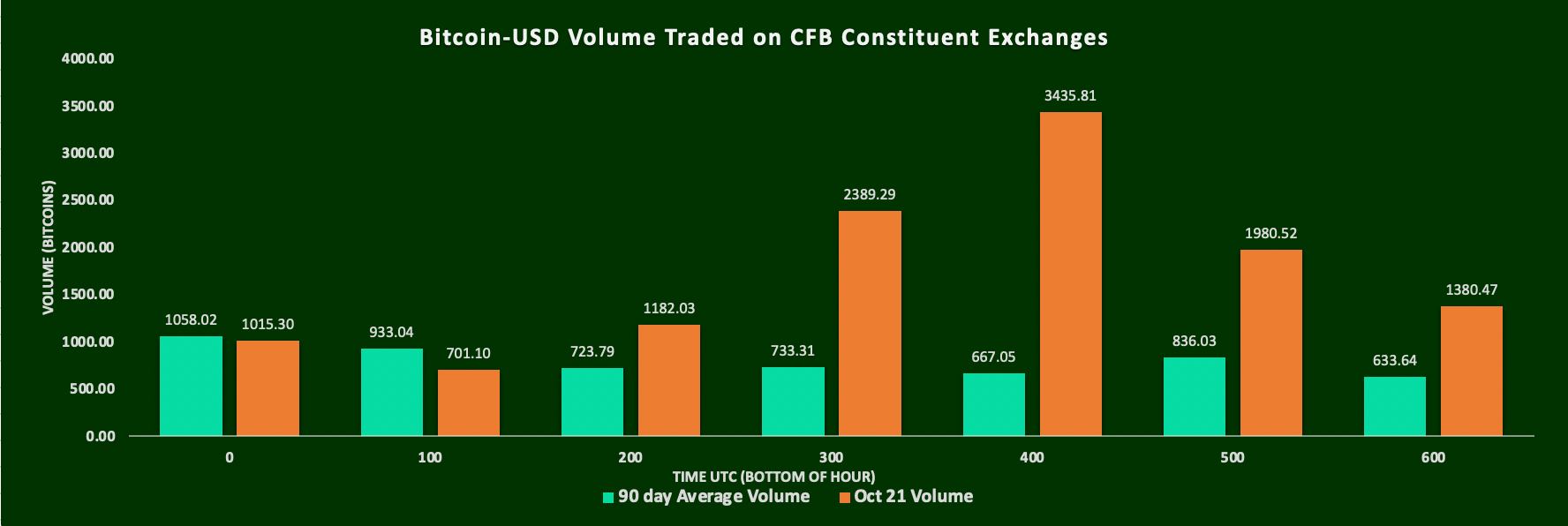

In fact, the breach of $12,000 itself was not accompanied by particularly remarkable volumes. These were not seen till a few hours later, when turnover accelerated to as much as five times the 90-day average as of 04:00 UTC.

Buyers took their time to back a third move above the $12,000 mark within three months

Strike three

The third time’s a charm, perhaps Few things get traders talking as much as when the price of an asset hits a nice, round, ‘psychological’ number. With Bitcoin’s infamous disconnect, quite by design, from the type of ‘fundamentals’ that encumber traditional markets, excitement and celebration (if the milestone is an upside one) can be even more intense than for mainstream assets.

So, make no mistake, though 2020 has seemingly been crammed with major cryptocurrency happenings, Bitcoin crossing the $12,000 mark—for the third time this year and for the second in two months—is still quite big.

As is typical for such moves, circumstantial triggers have been abundant. Still, considering the proximity of news surrounding MicroStrategy, Square, Stone Ridge, not forgetting Grayscale’s latest achievements, followed this week by PayPal outlining its crypto offering, and maybe including UK fintech Mode’s relatively minor news—the corporate adoption story looks like a compelling corollary; even if resurgent mainstream ‘risk appetite’ once again appears to have played a part. As ever, though, attempting to draw definitive conclusions is as difficult as is unwise.

Buyers becalmed

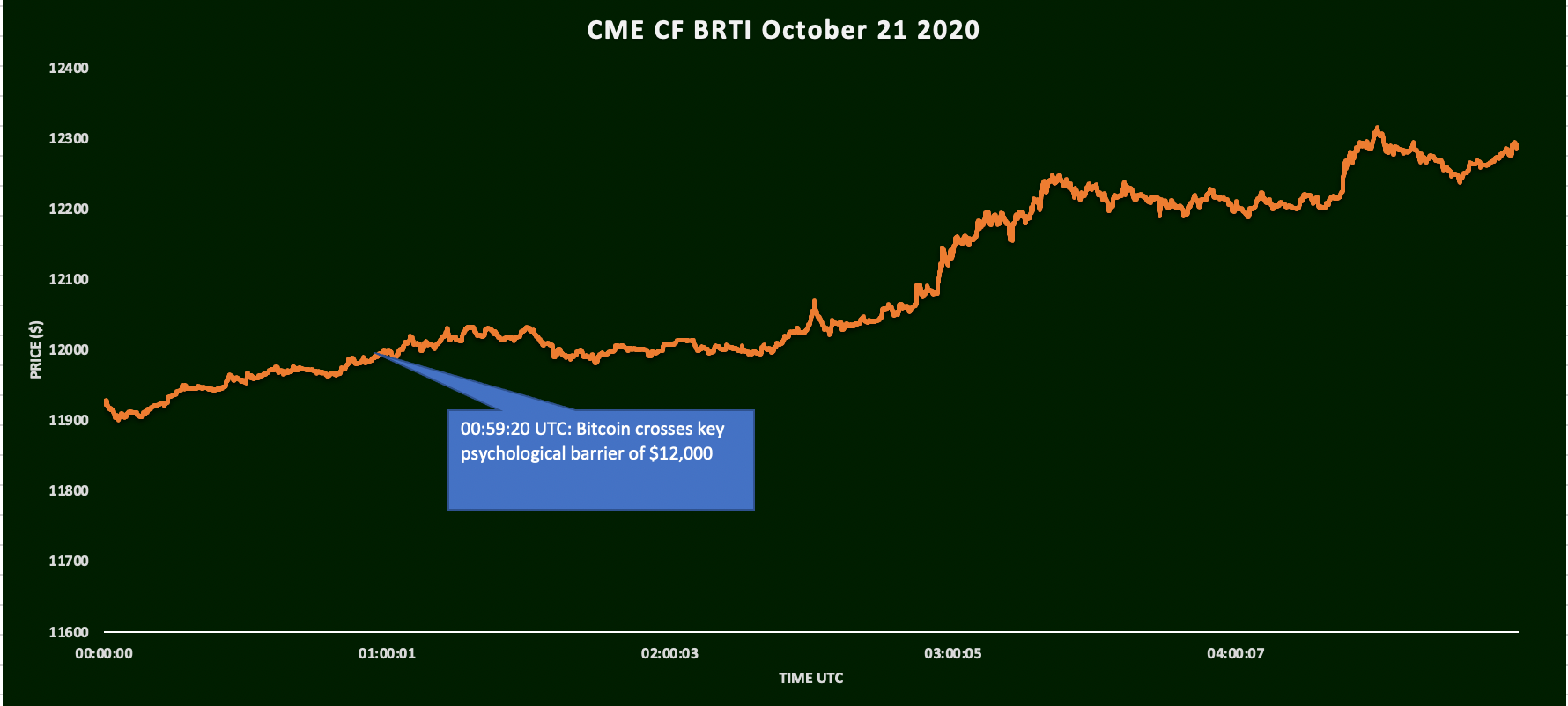

Utilising, CF Benchmarks’ uniquely empirical Bitcoin price data set, what we can say for sure is that Bitcoin/USD’s third crossing of the $12,000 barrier in 2020 (the others having occurred in July and August) is that market participants did not seem to be immediately fussed with the precise milestone on this occasion.

CME CF Bitcoin Real Time Rate (BRTI) is constituted of price data from 5 rigorously screened exchanges. The data are then subjected to multiple computations and tests to eliminate anomalies and potential manipulation before admitted to the index. The methodology is an obligation enforced by CF Benchmarks’ authorisation as an official Benchmark Administrator from the FCA. In other words, BRTI price and volume data really are standard benchmarks for crypto markets.

CME CF Bitcoin Real Time Index – 00:00-04:00 UTC 21-10-2020 Source: CF Benchmarks

Source: CF Benchmarks

Note the time at which BTC/USD crossed the threshold; just slightly before 1 in the morning, UTC, on Wednesday 21st October.

Bearing that time in mind, now look at the chart below depicting volumes the index printed across the same stretch as in the chart above.

Bitcoin-USD trading volumes - 00:00-04:00 UTC 21-10-2020 Source: CF Benchmarks

Source: CF Benchmarks

Delayed reaction

In fact, the breach of $12,000 itself was not accompanied by particularly remarkable volumes. These were not seen till a few hours later, when turnover accelerated to as much as five times the 90-day average as of 04:00 UTC.

No doubt some combination of algorithmic and ‘human’ delayed reaction to the price print was in play, a pattern often seen when price events like the one in question occur. With this being the third print on the $12k handle in a matter of weeks, it’s probable that the both ‘psychological’ and hard order flow pressure were lower relative to the instances when, preceded by natural market anticipation, the price was marked in late July and August.

Groundwork

Nevertheless, the attraction of an increased number of participants to Bitcoin trading venues in the wake of the price event was as plain as the eye can see, according to CF Benchmarks data. At the very least, it is clear that the groundwork, in terms of sentiment, for Bitcoin to hold above $12,000 and then perhaps to approach and possibly take, even more eye-catching milestones in the months ahead, has begun.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.