B2C2’s Bitcoin NDF set to be institutional first choice

It’s the integration of the CME CF BRR as reference price that distinguishes the Bitcoin NDF deal executed by B2C2 from any such deals that would be executed without the BRR as reference price.

A combination of crypto demand and crypto caution make NDFs with CME CF BRR as reference price, like B2C2’s, a logical choice for institutions

B2C2’s execution of the first confirmed non-deliverable forward (NDF) last month, with Bitcoin as the underlying asset, epitomises a key use case of the CME CF Bitcoin Reference Rate (BRR) Liquidity Complex, as outlined in our whitepaper ‘How the CME CF BRR Liquidity Complex can be utilised for the creation and management of structured products’.

The NDF, which integrated BRR as its reference rate, is now among 2021’s crypto watershed moments, and essentially marks the opening of a new derivative class, in which increasing trading volume is now likely to be seen.

As such, an overview of the benefits of crypto NDF transactions, from our unique perspective as a Benchmark Administrator, is in order.

It's what you think it is

First, for the avoidance of doubt, it’s worth confirming that a Bitcoin NDF is identical in principle to a fiat currency NDF.

Just like in traditional currency markets, in situations when it is undesirable or prohibited for a forward transaction to be settled in a particular currency–indicating when a regular forward contract cannot be used, but one settled in U.S. dollars, for example, (i.e., a non-deliverable forward) may be used instead—a Bitcoin NDF also avoids the need for a counterparty to receive the non-convertible currency.

Therefore, a crypto NDF, is simply like a fiat currency NDF transaction but with a crypto non-convertible currency instead of a fiat one. Likewise, the use cases in which B2C2’s Bitcoin NDF facility would be deployable are also readily apparent.

Hands off

Participating in the crypto market by means of a crypto NDF can be useful for any participant that is not permitted by regulations to handle spot crypto or seeks to eliminate counterparty risk (including ‘C-Score’ intermediaries) or wants to avoid the potential inefficiencies and administrative costs of handling spot crypto, chiefly custodial costs.

Some basic examples:

- Cryptocurrency activities are not permissible for several types of banks, often as a consequence of regulations that precede crypto. An NDF with Bitcoin as the underlying asset, for instance, enables banks to offer BTC exposure to clients whilst remaining compliant

- Asset managers of all kinds are able to access more capital efficient exposure to cryptos via structured products like NDFs

- Likewise, on the other side of capital market transactions, margin brokers and other types of liquidity providers can offer capital efficient crypto exposure, that can be back-to-back risk managed more cost effectively than if physical exposure were offered

As with all hypothetical scenarios, it’s worth bearing in mind that they are only outlines, excluding specific details like transaction fees and rates.

Still, the final basic example brings us neatly back to the B2C2 NDF executed for QCP Capital.

We don’t know whether the position was placed on a prop basis with regard to QCP, or on behalf of a QCP client.

But given QCP’s position as the leading OTC spot cryptocurrency liquidity provider to institutions in Southeast Asia, we can reasonably safely assume the trade was in the hundreds of thousands or millions of dollars.

Either way, the advantages outlined above would apply to the principal amount in the trade.

The CME CF BRR Liquidity Complex advantage

It’s the integration of the CME CF BRR as reference price that distinguishes the Bitcoin NDF deal executed by B2C2 from any such deals that would be executed without the BRR as reference price.

As a regulated Bitcoin benchmark, the BRR’s methodology is by definition transparent, with Constituent Exchanges subject to stringent selection standards, continuous monitoring and review.

Above and beyond that, the BRR methodology is unique in having been independently audited, whilst it’s also the only FCA-authorised Benchmark for which manipulation resistance, market representation and replicability have been demonstrated by academic-standard research.

The latter two factors are chiefly a consequence of the superior liquidity of the CME CF BRR’s benchmark price. Beginning with the use of BRR as settlement price for CME Bitcoin Futures, and eventually Micro Bitcoin Futures, some $400bn-plus in regulated futures have been settled by BRR since inception of CME BTC Futures in December 2017.

More broadly, BRR assets under reference have steadily risen since then to stand at approximately $5.2bn as of Q4 2021.

As noted in the CME CF BRR Liquidity Complex whitepaper:

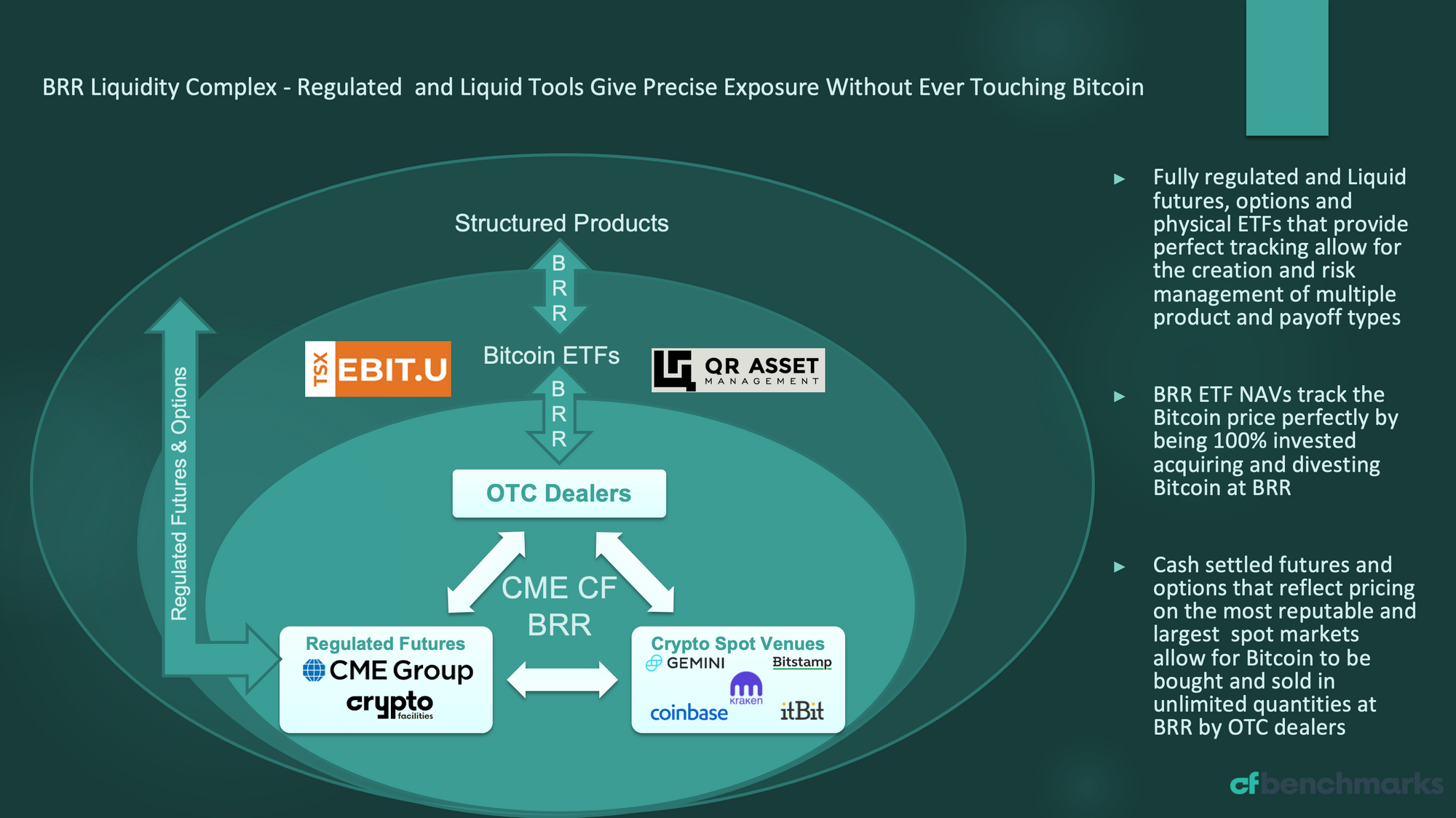

“The expansion of regulated financial products utilizing the CME CF Bitcoin Reference Rate (BRR) has established an interlocking system, comprising primary impacts and secondary effects that are beneficial to the ecosystem of products underpinned by the BRR…We have designated this system as the CME CF BRR Liquidity Complex.”

How and why the Liquidity Complex works is shown in the illustration below, including major products referencing the BRR that contribute to the complex.

CME CF BRR liquidity benefits thereby place it in pole position to integrate another asset class into its Liquidity Complex, namely structured products, including NDFs.

Meanwhile, capital markets demand for structured crypto products continues to build.

A report called 'Cryptocurrencies: The Road Ahead May Not Be Cryptic Anymore', was published by Coalition Greenwich, a division of S&P Global, a week before the B2C2 NDF was executed. It was based on a survey of more than 100 market participants from banks, brokerages, exchanges, and fintech.

On crypto NDFs, Coalition Greenwich concludes:

“Given their OTC nature, NDFs are much easier to manage (e.g., there are no margin issues with exchanges), and the technology and risk-management philosophy is extremely well embedded into the current setup across all banks. All study participants expressed deep familiarity with the instrument…Beyond this, the product provides flexible access 24 hours a day and has the ability for contracts to expire on bespoke days, which further contribute to its attractiveness.”

As for our own conclusion, we expect that the same prudent caution that is driving structured exposure to BTC through products like NDFs, will also zero in on the quality of components within those structured products, including reference pricing.

As such, given regulatory and liquidity pricing risks that the CME CF BRR eliminate, Bitcoin NDFs that settle to BRR, like the one offered by B2C2, are the most cogent choice for institutions.

CME CF BRR Liquidity Complex summarised

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.