ASIC greenlights crypto ETFs with CF Benchmarks-based “good practices”

The key to ASIC’s more sure-footed approach is proposals on exchange traded crypto products that point to the adoption of the essence of CF Benchmarks policies and guidelines

ASIC opens Aussie market for crypto ETFs supported by CF Benchmarks pricing guidelines and methodologies

ASIC nears crypto ETF endgame

The widely-awaited approval of a U.S. cryptocurrency exchange traded fund and the subsequent launch of the first last month, ProShares Bitcoin Strategy ETF (BITO), had long been expected to represent a significant milestone for ‘normalisation’ of the digital asset class that could also accelerate institutional adoption.

Still, there’s been one key development in the wake of BITO that is in fact the culmination of a momentum that was gathering pace independently of laborious moves towards an ETF in the U.S.

As we noted in September, the Australian Securities & Investments Commission (ASIC) has been signalling for months that it intends Aussie markets to be among those in the fast lane with regards to exchange traded crypto products.

The key to ASIC’s more sure-footed approach is proposals on exchange traded crypto products that point to the adoption of the essence of CF Benchmarks policies and guidelines. It’s worth noting that the commission’s consultation document published in June contained several instances of similar and sometimes verbatim terminology to that used within public CF Benchmarks policy or methodology documents.

(See our post ‘Australia’s ASIC prepares ground for crypto ETFs with CF Benchmarks-like policies’ for several examples.)

Having received several submissions to its call for public comment, the commission has now issued a thorough response. Choice excerpts include the one below:

“We consider that ETPs and other investment products that provide exposure to crypto-assets have unique and novel features and risks that must be considered and addressed in light of these functions. On that basis, we have implemented our proposals to help facilitate ETPs and other investment products that reference crypto-assets”

ASIC goes on to outline its approach to fulfilling that implementation including “modification in light of feedback received”, and by publication of “good practices” for issuers of both cryptoassets and exchange traded products.

Policy points to CF Benchmarks

In a more specific document, “Exchange traded products: Admission guidelines”, ASIC details a set of protocols that are consistent with the proposals published earlier in the year.

As expected, the confirmed prescriptions are cogent with global securities standards, a point made by ASIC’s advice to exchanges deciding on principles of ‘underlying pricing’ for crypto products.

"Licensed exchanges should verify where necessary that their arrangements with the benchmark/index administrator comply with recognised benchmark selection principles such as the International Organization of Securities Commissions (IOSCO)"

ASIC also goes a moderate but significant step further: it notes that “EU Benchmarks Regulation or other internationally recognised benchmark selection principles” may be among the frameworks exchanges can adopt for ensuring sound governance, quality, methodology and accountability of pricing benchmarks.

So, following implicit initial signals from the regulator earlier in the year that echoed CF Benchmarks guidelines, methodologies and principles, ASIC has now officially included the EU Benchmark Regulation regime among approvable benchmark selection principles.

As a UK FCA authorised Benchmark Administrator, CF Benchmarks was the first cryptocurrency index provider to be recognized as a Benchmark Administrator under European Benchmarks Regulation (EU BMR).

Such principles will only serve as guidelines in the Australian jurisdiction. However, the regulator’s endorsement of them, and CF Benchmarks’ unique status, suggests that its methodologies and policies can be relied upon to satisfy the obligation for “robust and transparent pricing mechanisms... (for cryptoassets) both throughout the trading day and to strike a NAV price”.

Signs of pent-up Aussie BTC demand

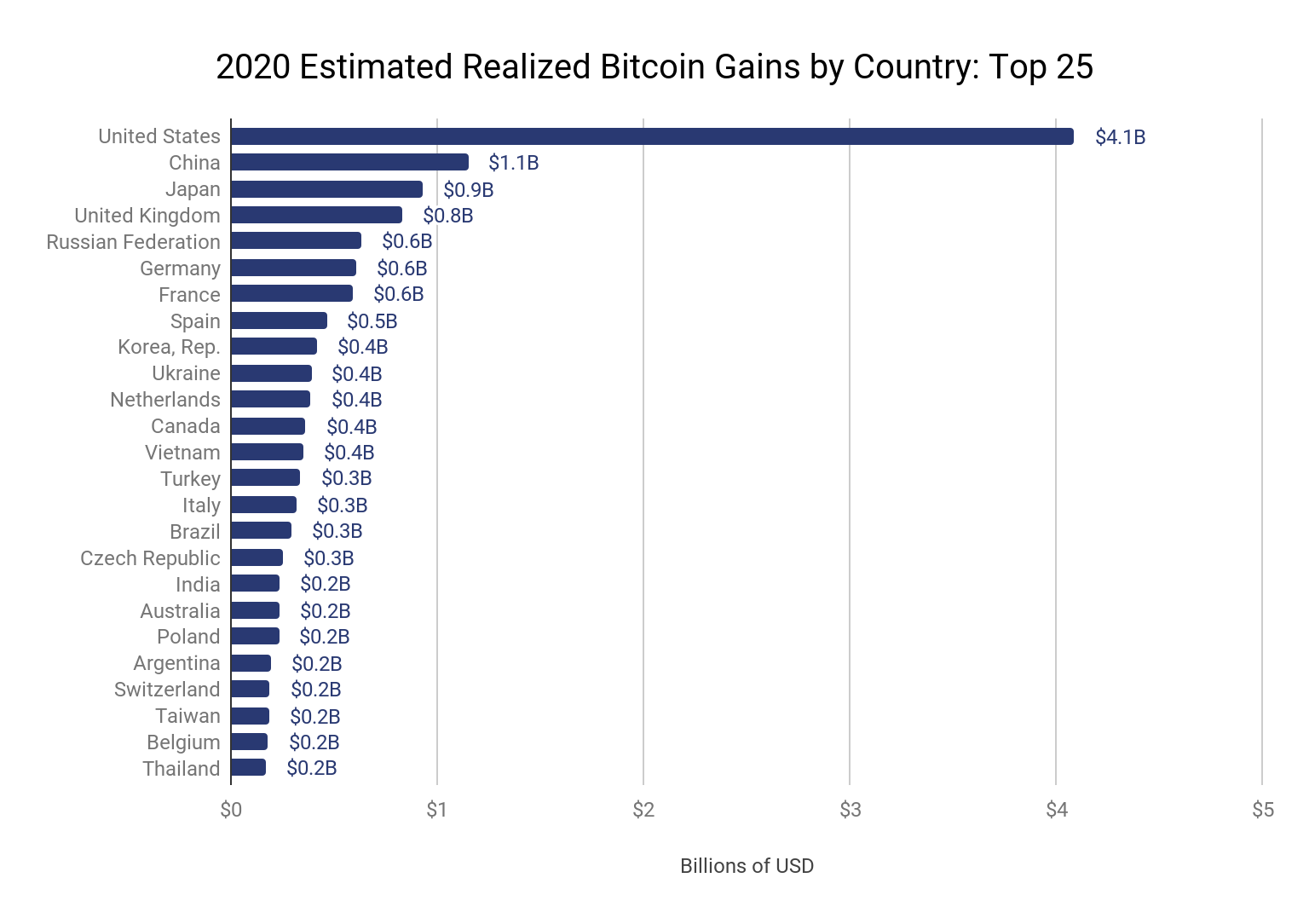

Bearing in mind that Australia’s A$102 billion in ETF AuM as of March 2021, ranks it as one of the smallest ETF markets among developed economies—compare it to Japan for instance, which had AuM of about $450bn as of October 2020—crypto adoption down under appears to punch above the country’s weight. The graphic below, published by Chainalysis in February, shows estimated realised Bitcoin gains by country for 2020, with Australia well within the Top 25 at approximately US$0.2bn.

The market for crypto ETFs is likely to be mostly derived from investors who are more averse to buying Bitcoin, Ethereum and other coins directly. Assuming that the Chainalysis research implies similar pent-up demand in Australia for crypto in an ETF wrapper to that seen for ProShares Bitcoin Strategy ETF, the Aussie market reception for a crypto ETF ought to be solid.

Meanwhile, ASIC has taken steps to ensure that the most trusted pricing methodologies and policies underpin crypto exchange traded assets when they come to Australia’s market, in the relatively near future.

Understand our regulated CME CF Bitcoin Reference Rate (BRR) and CME CF Ether-Dollar Reference Rate benchmarks in less than 10 minutes with these videos:

CME CF Bitcoin Reference Rate - Integrity Defined

CME CF Ether Dollar Reference Rate - Integrity Defined

Read ASIC’s finalised guidance on crypto investment products here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.