Alpha in the Aftermath: Moving Beyond the 60/40

Regulatory clarity is poised to support digital assets despite macro headwinds. The GENIUS Act greenlights USD stablecoins, while the SEC moves to fast-track multi-token spot ETFs. Corporate treasuries may add ETH and SOL, as tokenized equities lift block demand and staking yields.

Regulatory catalysts are set to unlock fresh demand even as macro frictions linger. The GENIUS Act is expected to be signed by late July, establishing federal oversight for USD-backed stablecoins and allowing banks to launch products as early as Q4 2025. By September, the SEC is likely to introduce uniform listing standards for spot-crypto ETFs, including multi-token baskets, accelerating approvals and widening market access. This could act as a catalyst to bring ETF flows to $50 billion this year, with altcoins capturing a growing share of inflows. We anticipate corporate treasurers will follow suit, with the number of companies holding ETH or SOL rising ten-fold over the next year. Meanwhile, tokenized equities on layer-1 networks should lift block-space demand, enhancing staking yields and fee burn for Ethereum and Solana. These themes position large-cap tokens for relative outperformance through year-end despite headwinds from tariffs, elevated rates, and a slowing U.S. economy.

Market Summary: Trade Tensions, Fed Vigilance, and Stablecoin Momentum

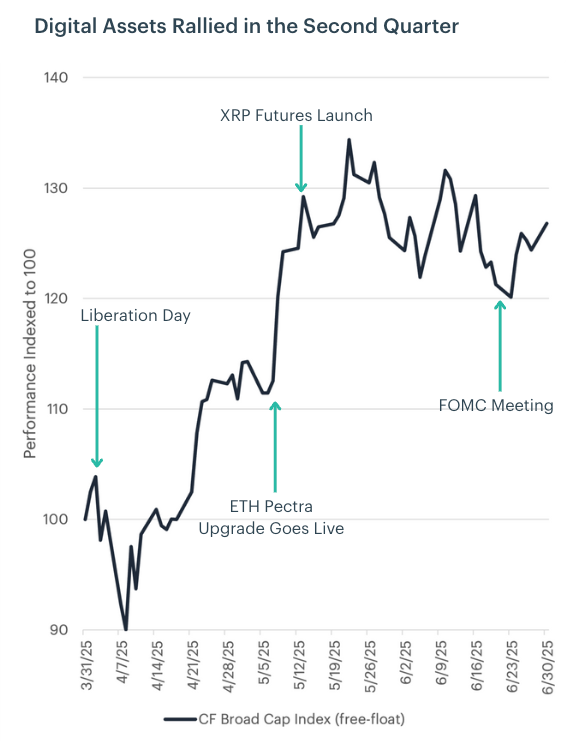

Digital assets weathered a turbulent second quarter, buffeted first by protectionist headlines and later by shifting monetary expectations. In April, President Trump’s tariff announcement lifted effective U.S. import duties above 20 percent, sending the S&P 500 and Nasdaq briefly into bear-market territory and pushing the 10-year Treasury yield higher. Risk aversion initially spilled into crypto; nevertheless, spot-Bitcoin ETFs attracted $2.2 billion of inflows, underscoring demand for hedges against policy uncertainty and monetary debasement.

Momentum strengthened in May. Easing trade rhetoric and robust ETF demand propelled Bitcoin to a record $112,000 on the BRTI, while crypto funds added another $6.7 billion. Institutional engagement broadened as the CME listed regulated XRP futures, expanding access beyond BTC and ETH. Still, investors contended with policy cross-currents: a large House tax-and-spend package rekindled deficit concerns, and tariff negotiations with China remained fluid, tempering the month’s risk-on tone.

June brought a period of consolidation. The Federal Reserve held rates at 4.25–4.50 percent and reiterated vigilance on persistent inflation, reinforcing a higher-for-longer stance. Bitcoin steadied around the six-figure mark, while total crypto-fund inflows topped $6.1 billion, led by renewed demand for Ethereum products and record open interest in CME ETH futures. Regulatory clarity also advanced: the GENIUS stablecoin bill cleared the Senate, and the SEC approved filings for a staking-enabled Solana ETF while reviewing multi-token baskets. These developments, together with continued institutional allocations, left digital assets better anchored heading into the third quarter, with regulatory progress helping to offset lingering macro and geopolitical headwinds.

Measuring Growth: A Slower Start Deepens as Tariffs Take Hold and Real Demand Softens

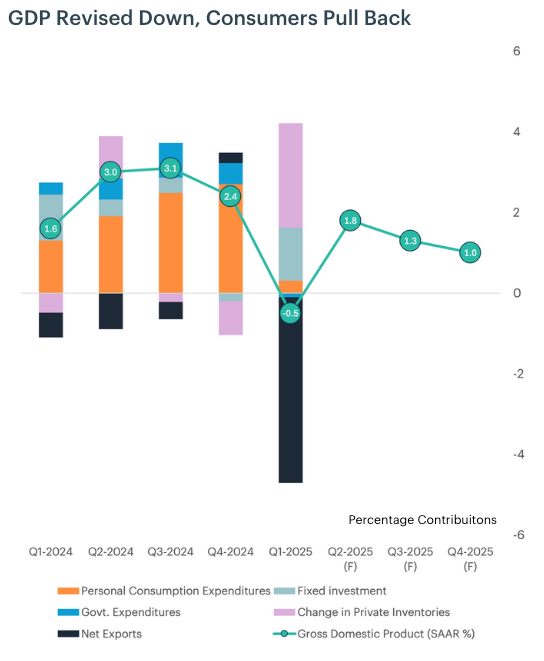

The U.S. economy enters Q3 2025 facing deeper headwinds than anticipated. Initial optimism following the election and expected rate cuts has been replaced by a weakening macro environment. Although the full implementation of the “Liberation Day” tariff package was ultimately postponed, the implementation of the 10 percent universal import tax and targeted reciprocal measures has already introduced significant trade frictions. The effective tariff rate may still exceed 20 percent on impacted goods, and the effects on consumption, investment, and trade are becoming increasingly apparent as input costs rise and financial conditions tighten.

Policy Risks Add to Fragility

Labor market conditions are deteriorating, and the Federal Reserve has revised its unemployment rate projections higher. While the Department of Government Efficiency (DOGE) has largely unwound its initial mandate, lingering fiscal austerity measures continue to weigh on public sector demand, compounding weakness in the private sector. Although corporate tax relief and deregulation may offer modest support later in the year, they are unlikely to fully offset the near-term drag. Business confidence remains fragile, and capital formation continues to slow.

The clearest risk to the U.S. outlook in 2H 2025 is the weakening consumer. Real consumption has slowed meaningfully, with Q1 spending revised to just 0.5% and another decline in May. While tariff pass-through has been limited so far, sticky inflation, rising interest costs, and labor market strain are weighing on households. Inventory and trade distortions may temporarily lift GDP, but underlying demand is soft. With housing and business investment still under pressure, the trajectory of consumer spending will be critical. If it continues to falter, a broader slowdown may unfold before policy support arrives.

Portfolio Perspective: We maintain a structurally cautious stance on U.S. growth in 2025. The combination of weak consumption and tariff-related distortions could place further pressure on earnings and delay the recovery. With real GDP growth tracking below 2 percent, our outlook presents downside risk to consensus forecasts. While long-term opportunities in innovation remain compelling, the near-term environment calls for a more tactical (or opportunistic) portfolio tilts. Assets like Bitcoin may benefit from heightened inflation risk, uncertainty around policy direction, and ongoing concerns about the value of the U.S. dollar. A selective and liquidity-aware positioning approach remains critical.

Measuring Inflation: Core and Headline Divergence

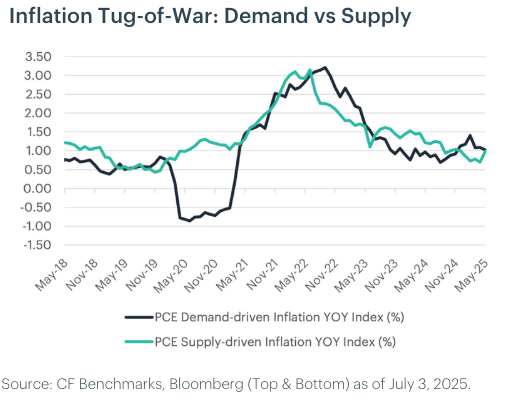

Pricing pressure dynamics remain mixed, with inflation accelerating slightly in May, but core inflation, particularly super-core services less housing, remaining subdued. Recent readings show core PCE reflected continued disinflation in services like shelter and medical care. AI-driven productivity gains are expected to reinforce this trend in services, while tariff pass-throughs could lift prices in goods categories. These forces may offset, keeping underlying inflation on a gradual cooling path even as top-line figures drift higher.

Tariff Impacts Are Still Taking Shape

The inflationary impulse from the first wave of “Liberation Day” tariffs is still emerging. While select goods categories tied to China, like apparel and auto parts, have seen some price pressure, the overall passthrough to consumers remains muted. Businesses appear to be absorbing higher input costs by compressing margins and drawing down inventory. This dynamic may not hold if demand picks up or if a second wave of tariffs materializes. We see material risk that cost pressures broaden in late Q3 or early Q4, especially if tariff implementation accelerates.

Inflation Forecasts Remain Anchored

Despite recent headline volatility, our baseline forecast anticipates average CPI inflation to settle just under 3.0% in 2025. However, upside risks stemming from tariffs and commodity shocks could briefly push inflation above the 3.0% mark later this year. We view this as a transitory move, driven by base effects and temporary supply frictions rather than a structural shift. Core services inflation, particularly in housing, is expected to continue moderating, supporting the broader disinflationary trend toward the Fed’s 2% target.

Portfolio Perspective: Our outlook remains nuanced. While disinflation is still progressing, tariffs have reintroduced upside risks. Investors should be prepared for volatility in rate expectations and inflation-sensitive assets. Real assets, quality equities with pricing power, and alternative stores of value such as Bitcoin and gold may benefit in scenarios where Fed policy turns more reactive. With political pressures rising and the Fed’s path to normalization still unclear, portfolio flexibility remains key.

Measuring the Fed: Tariff Uncertainty and a Softening Labor Market

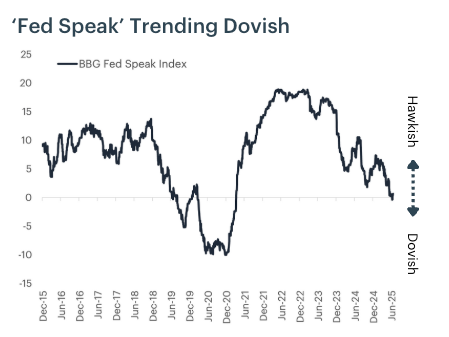

The Federal Reserve enters the third quarter navigating a more complex and politically charged policy environment. The introduction of trade tariffs has triggered renewed cost-push inflation concerns just as labor market conditions begin to weaken. This combination of rising input costs and slowing demand is complicating the Fed’s decision-making. While our baseline scenario still assumes 75 basis points of rate cuts in 2025, divisions within the FOMC have widened, and market confidence in that trajectory is starting to fade, likely delaying any policy action until later in the year.

A “Shadow Chair” to Take the Stage

Amid this uncertainty, the political spotlight on the Fed is intensifying. We expect President Trump to name a preferred successor to Chair Powell well before his term expires in May 2026, effectively installing a “shadow Fed chair” who will shape policy expectations from the sidelines. This nominee is likely to promote a more dovish stance, calling for aggressive rate cuts and easier financial conditions. Even without formal authority, a shadow chair’s public signaling may shift sentiment and increase pressure on the Fed to act, especially if inflation begins to reaccelerate. Should such a figure emerge, we expect Fed speak to flip decisively dovish in the second half of 2025.

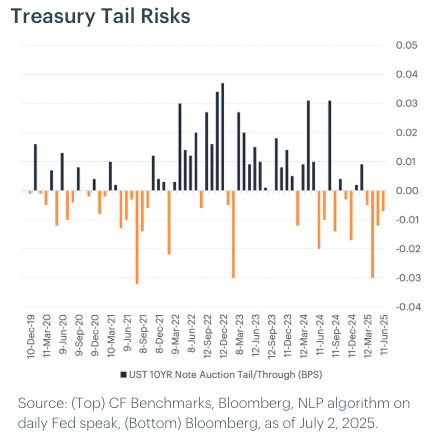

Portfolio Perspective: The monetary backdrop has become more complicated. While the growth outlook is weakening, inflation risks amplified by tariffs are keeping the Fed cautious. Interest rate volatility is likely to remain elevated, particularly if rising Treasury issuance and softening demand drive yields higher. If auction tails persist, especially following a potential surge in debt issuance tied to a post-election tax and spend bill, the Fed may be forced to consider unconventional tools, including a slower balance sheet runoff or some form of yield curve management.

However, any such actions would face heightened political scrutiny and occur against a backdrop of elevated inflation expectations. The emergence of a shadow Fed chair introduces a new channel of policy signaling risk. While not officially leading the committee, this figure could meaningfully influence market expectations for a more accommodative regime, which may erode confidence in the dollar and reinforce demand for real assets. In this environment, investors may favor inflation-resilient strategies and alternative stores of value, particularly gold and digital assets like Bitcoin, which tend to benefit from declining real yields and dovish policy shifts.

Measuring the Regulatory Environment: Genius Act Set to Pass Ahead of August Recess

With the Senate’s decisive 68-30 passage of the GENIUS Act on 17 June, the first federal framework for payment stablecoins now moves to the House. Chairman French Hill has confirmed his goal of sending a unified stablecoin bill to the President before the August recess. The GENUIS act requires 1-to-1 cash-and-Treasury reserves, two-day redemption, PCAOB-audited disclosures and tailored oversight that allows sub-$10 billion issuers to remain state-supervised. Floor amendments in the House are expected to soften the Big-Tech issuance ban and adjust the state-federal supervisory balance, but core guardrails are likely to survive. With the White House urging swift action, we expect the GENIUS Act to be signed into law by the end of July 2025.

SEC to Revamp Digital Asset ETF Listing

On July 1, 2025, the SEC issued comprehensive guidance for crypto ETP issuers, clarifying NAV calculations, custody practices, benchmarks, and conflict-of-interest disclosures. We anticipate that by the end of September the SEC will roll out universal listing procedures for spot crypto ETFs in partnership with national stock exchanges. Under the draft standards, eligible tokens must satisfy exchange listing, liquidity, and turnover requirements. This initiative, which precedes the CLARITY Act, will streamline approvals and coincide with the first U.S. authorizations of multi-token ETFs in Q3.

CLARITY Act On Track to Pass in Early 2026

The CLARITY Act that came out of the financial services committee will establish the comprehensive regulatory guardrails sought by investors and operators. By delineating the SEC’s role over tokenized securities and the CFTC’s jurisdiction over digital commodities, the bill will remove the uncertainty that has deterred advisors, endowments, and other institutions from allocating meaningful capital to crypto markets. Registration guidelines for exchanges and intermediaries, coupled with explicit DeFi provisions and standardized disclosure requirements, will create an on-ramp for traditional financial firms to engage with digital assets under familiar compliance frameworks . With these guidelines in place, we expect a wave of new product launches and capital formation in 2026. We believe the CLARITY Act’s will pass the house or the senate in late 2025 and will mark the inflection point at which capital begins rotating out of Bitcoin into the broader altcoin market.

Portfolio Perspective: Regulatory clarity is likely to provide a significant tailwind for tokens beyond the majors. We anticipate that the CF Broad Cap will outperform other indices with greater large-cap weightings.

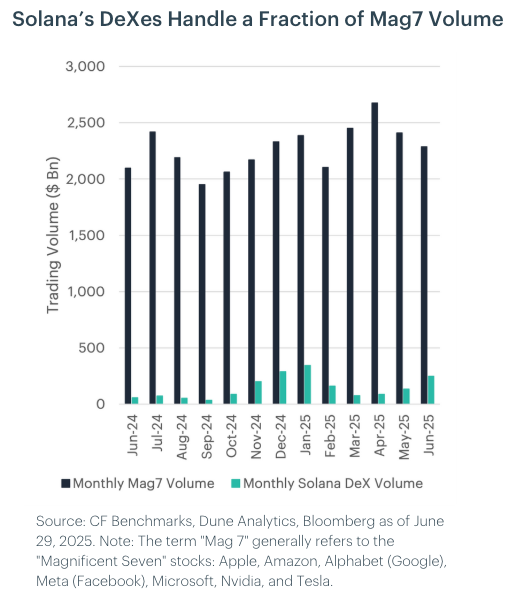

Measuring Network Scalability: Stocks to Test Scalability

The recent introduction of tokenized equities on layer-1 blockchains represents a significant opportunity for altcoin valuations. Decentralized exchanges (DEXs) on networks such as Solana handle substantial annual trading volumes, in Solana's case, approximately $1.8 trillion, yet these figures remain modest compared to the $27.4 trillion turnover generated by just the seven most liquid U.S. equities. Capturing even a small fraction of traditional equity exchange volumes through tokenization could significantly increase demand for block space and network resources across various layer-1 platforms.

Equity Trading has the Potential to Lead to Layer-1 Congestion

Increased transaction activity driven by tokenized stocks would heighten competition for block inclusion, effectively driving up transaction fees. Historical congestion events already demonstrate how sensitive layer-1 fee markets can be; priority fees have spiked considerably during periods of high demand. Higher transaction fees would enhance tokenomics across layer-1 platforms such as Ethereum and Solana through increased staking yields and accelerated token burns, creating a new source of demand for their native tokens.

Scaling to accommodate such growth will not be without challenges. Previous stress events have increased transaction failure rates, highlighting potential bottlenecks under sustained high-volume conditions. Planned and ongoing network upgrades, such as Solana's Firedancer, aim to significantly enhance throughput capacity, thereby addressing these scalability constraints.

We believe that tokenized equities is another crypto use case that will find product market fit over the next 12 months; strengthening the fundamentals for programmable layer-1s. Should these networks successfully navigate scalability hurdles, there could be significant upside in their tokens over the next 12 months.

Portfolio Perspective: Regulatory clarity is likely to provide a significant tailwind for tokens beyond the majors. We anticipate that the CF Broad Cap will outperform other indices with greater large-cap weightings.

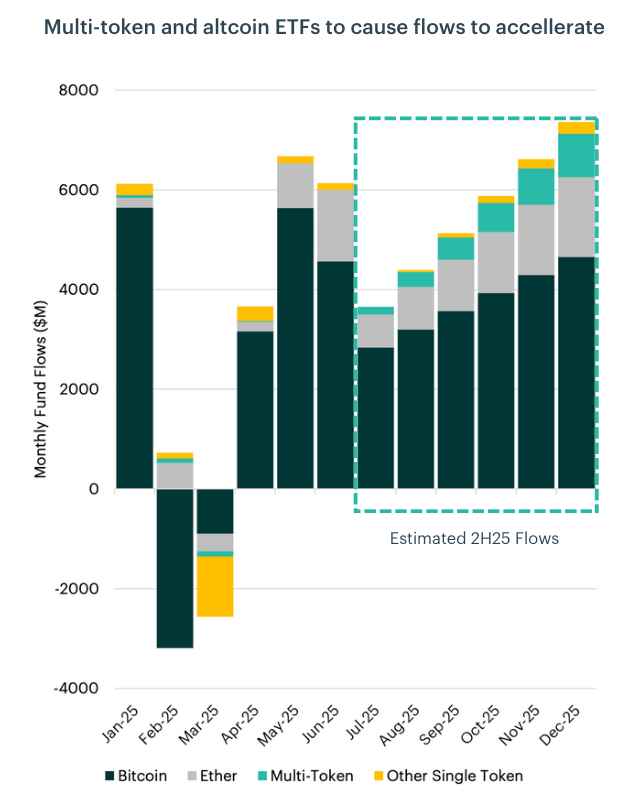

Measuring Institutional Adoption: ETF Flows to top $50B in 2025

We anticipate crypto-ETF inflows to accelerate in the second half of 2025, lifting year-to-date subscriptions from $17.5 billion today to roughly $50 billion by December. While we think Bitcoin will remain a significant portion of the flows, investor demand for exposure to other digital assets will be key in driving that growth. Our projections point to cumulative Bitcoin inflows reaching $37 billion in 2025, while Ether products gather close to $10 billion. We think multi-token portfolios could see flows reach $3 billion this year as basket ETFs get regulatory approval. There is also a wide array of single-asset funds on the horizon, we anticipate these will attract close to $1 billion in flows as retail investors look to branch out. Taken together, these flows should create a strong tailwind for an altcoin catch-up, led by large-cap assets that capture the lion’s share of ETF allocations. These inflows are likely to narrow the altcoin performance gap with Bitcoin going into 2026.

Staked SOL ETFs to Provide Insight into Demand for Staking

The launch of the first U.S. Solana‑staking ETF provides an early barometer of demand for yield‑bearing crypto funds. Ether ETFs have attracted muted inflows so far, a shortfall that may owe to the absence of staking rewards. We expect Ether staking to debut in spot ETFs in 2025, accelerating YTD Ether ETF inflows by adding an additional $5–7 billion in the second half of the year. Staking not only offers investors the underlying asset’s full return stream; it also promotes institutional‑grade validator infrastructure, strengthening security, attracting enterprise usage, and enhancing overall decentralization.

Portfolio Perspective: The launch of multi-token ETFs in 2025 will provide a significant tailwind for large-cap altcoins. Passive inflows into these diversified vehicles should directly benefit tokens in the CF Large Cap Index, as allocators seek exposure to established digital assets. We anticipate that, in H2 2025, large-cap assets will capture the majority of ETF-driven demand, narrowing their performance gaps with Bitcoin.

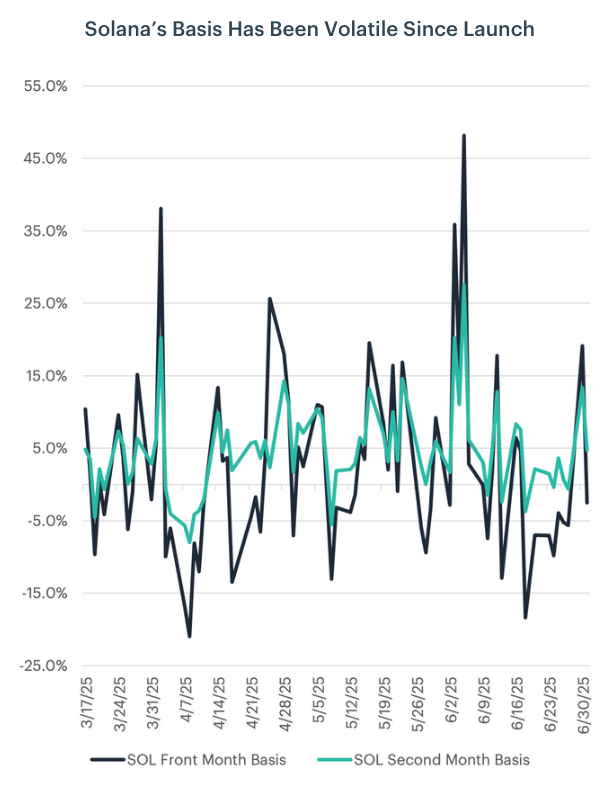

Measuring Basis Activity: New CME Contracts and ETFs to Boost Basis Trading

The launch of the first U.S. spot‑Solana ETF on July 2, 2025, in addition to the launch of CME Solana futures earlier in the year unlocks a basis‑trading opportunity that should attract sophisticated traders in the second half of the year. With an ETF that uses the same benchmark as the CME futures now tradable, arbitrageurs can capture the spread between spot and derivatives markets. While this type of trading is market‑neutral, the capital committed to monetize the basis will boost two‑way liquidity in both venues, tightening bid‑ask spreads and enhancing price efficiency for SOL.

Basis Trades to Remain Hot

We anticipate that this new arbitrage demand will drive significant inflows into spot‑Solana ETFs over the next 12 months. Concurrently, futures activity on the CME will expand, with daily volumes and open interest rising. Evidence of should manifest in upcoming 13F filings, where a growing hedge‑fund footprint in SOL ETFs will be apparent, and in the CFTC’s Commitment of Traders report, where leveraged funds are likely to transition into a net‑short stance, reflecting the short side of the basis trade.

Looking ahead, similar basis-trading setups may emerge for other liquid tokens like XRP, which began CME futures trading in May and is backed by pending spot-ETF filings. Crypto’s inherent volatility is likely to keep spot–futures dislocations wide, making an elevated basis a persistent structural feature. Consequently, we expect active basis-trading flows and the liquidity benefits they bring to remain a durable fixture of digital asset markets well into the future.

Portfolio Perspective: The increased volume from basis trading is poised to deepen order books, compress spreads, and sharpen price discovery for SOL and XRP. This improved liquidity will make these assets more likely to attract institutional investors over the coming year.

Measuring Corporate Adoption: A Balance Sheet Unlock

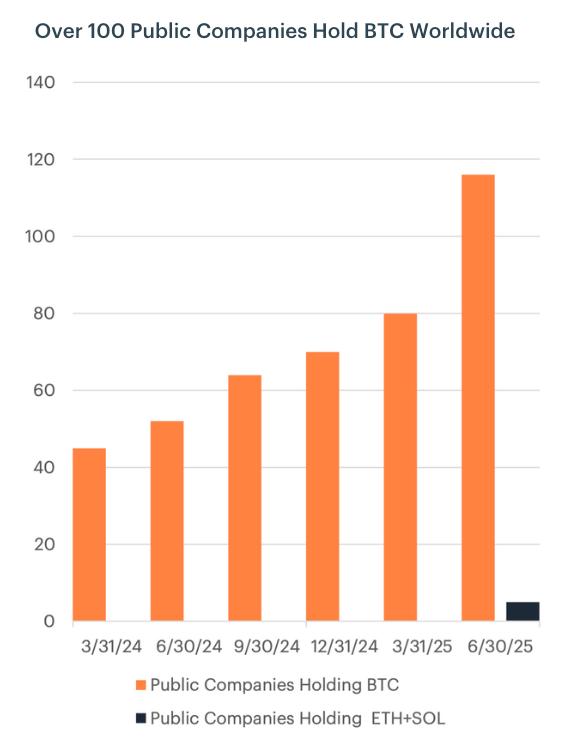

In 2025 we have seen rapid corporate adoption of Bitcoin as a treasury asset. Currently, 116 public firms report direct BTC holdings, up from 52 a year earlier. Two archetypes have emerged: purpose-built treasury companies that raise capital expressly to buy Bitcoin, and operating companies that keep smaller allocations alongside cash for diversification. The dedicated model has delivered outsized equity returns and is increasingly viewed as a template that can migrate to digital assets beyond Bitcoin.

Treasury companies to provide a steady bid

Ether is poised to follow a similar trajectory. Stablecoins are going mainstream, and every on-chain transfer consumes native gas. Visa already lets merchant acquirers settle USDC on Solana, while the bulk of stable-coin activity occurs on Ethereum. Companies that use these rails must hold ETH or SOL in treasury to fund fees, a requirement that will place these assets on more corporate balance sheets. We are also seeing firms raise capital specifically to operate ETH and SOL treasuries. Both assets offer native staking yield and can be used as collateral in DeFi protocols, allowing companies to earn additional yield while enhancing protocol liquidity and security.

We anticipate more firms will follow the Bitcoin-treasurer playbook by issuing equity or convertibles to buy tokens. We also expect many payment gateways, remitters, and e-commerce platforms to accumulate balances as an operational necessity. The combined effect of these forces should increase the number of public companies exposed to ETH and SOL from five to fifty, roughly a ten-fold rise, over the next 12 months.

Portfolio Perspective: The tokens in the CF Ultra Cap 5 Index are positioned to benefit as corporate treasuries continue to adopt 3 of the 5 assets in the index. Companies will continue to issue equity and debt to accumulate BTC, ETH, and SOL, while operating firms integrate on-chain payment rails and stablecoin settlement, creating another source of demand.

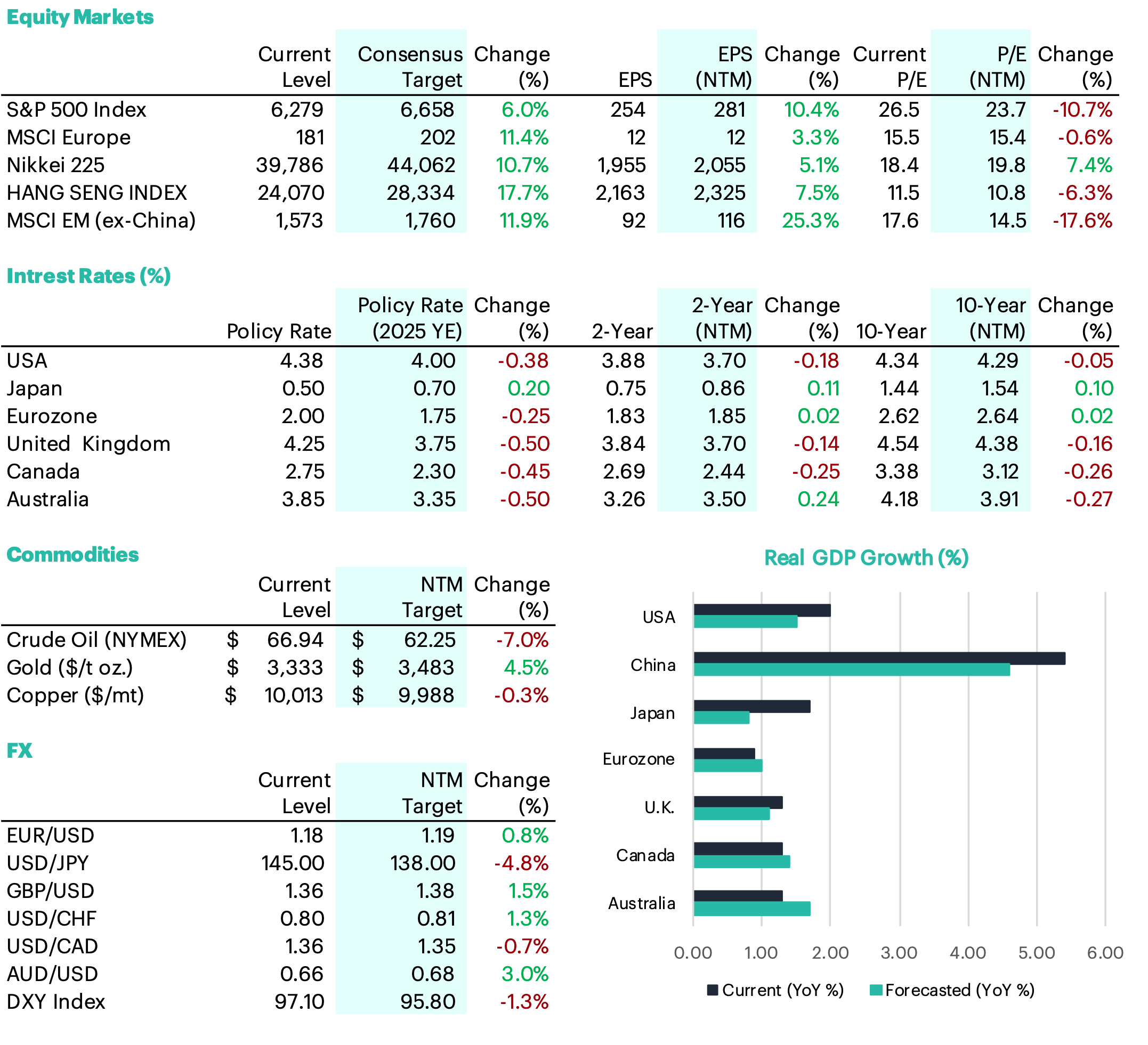

Measuring the Crowd: Consensus Forecasts

Equities: Analysts maintain a broadly positive outlook for equities, with Hong Kong (+17.7%) and Japan (+10.7%) leading major market forecasts. Emerging markets ex-China (+11.9%) and European equities (+11.4%) are also expected to perform well. U.S. equities are forecast to rise 6.0%, with S&P 500 earnings per share projected to grow by 10.8%. Despite ongoing valuation compression, particularly in the U.S. and emerging markets, earnings growth remains a key support, especially in Japan and EM.

Interest Rates: Markets are pricing in broad rate cuts across developed markets, with Australia (-0.50%), Canada (-0.45%), and the U.K. (-0.50%) expected to deliver the most easing. The U.S. policy rate is projected to decline by 0.38% to 4.00%, while Japan is expected to hike modestly (+0.20%). Changes in 2- and 10-year yields remain modest, suggesting limited conviction in an aggressive easing cycle.

Commodities: Gold is forecast to gain 4.5%, reflecting investor demand for real assets amid macro uncertainty. Crude oil is expected to decline by 7.0%, likely reflecting weaker demand expectations. Copper remains broadly flat with a slight decline of 0.3%, suggesting muted industrial momentum.

FX: The U.S. dollar is expected to weaken slightly, with the DXY Index down 1.3%. The yen is projected to gain 4.8% on policy normalization, while modest appreciation is expected in the euro (+0.8%), pound (+1.5%), Swiss franc (+1.3%), and Australian dollar (+3.0%). USD/CAD is forecast to edge lower by 0.7%.

GDP Growth: Growth forecasts show continued regional divergence. China is expected to lead with growth near 5%, while the U.S. is forecast to grow around 2.5%. Australia and Canada are projected near 2.0%, while Japan, the Eurozone, and the U.K. are forecast to expand more modestly between 1.0% and 1.5%.

To read the our full market outlook report, please click here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.